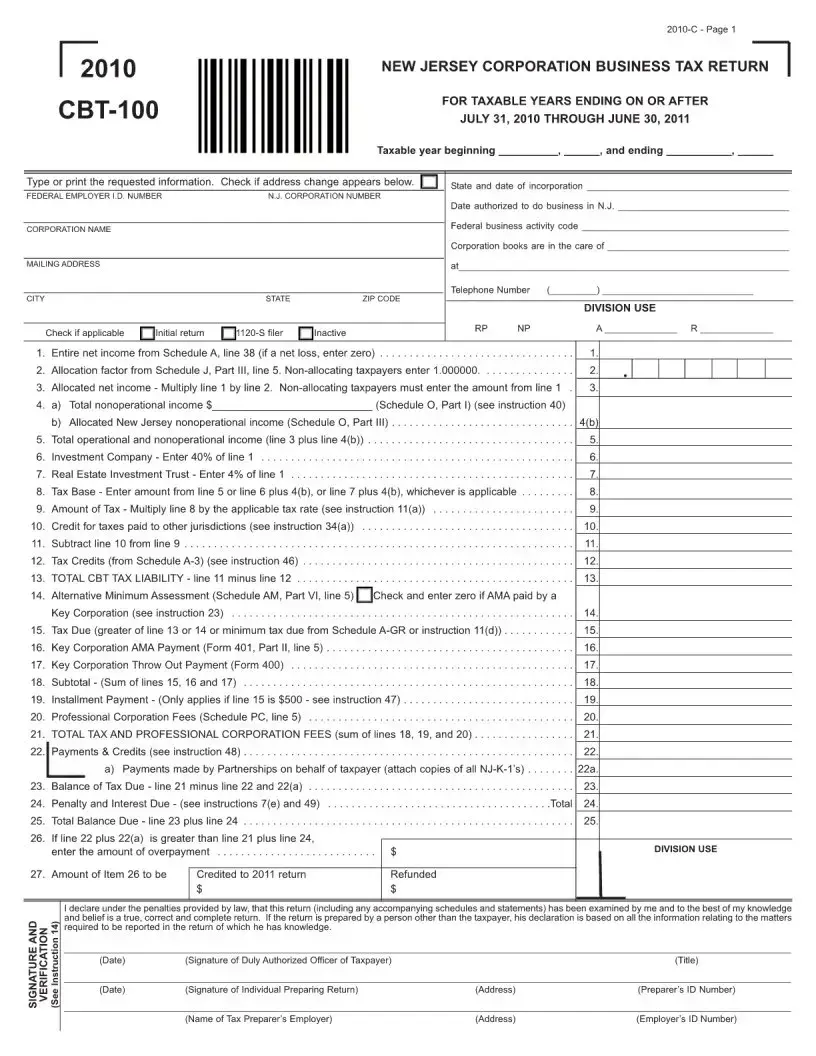

Fill Out a Valid New Jersey Cbt 100 Template

In New Jersey, all corporations that engage in business, employ capital, own or lease property, or maintain an office in the state are required to file the CBT-100 form. This document is integral to New Jersey's system of taxing businesses. A corporation's income, adjustments, credits, and business activities within the state must be accurately reported on this form. It serves as a key part of assessing the corporation's business tax obligations to New Jersey. The form's completion is crucial not only for compliance with state laws but also for ensuring the correct calculation of taxes owed, allowing businesses to take advantage of applicable deductions and credits. In preparing the CBT-100 form, taxpayers will need to provide detailed financial information, including federal income tax returns and schedules, adjustments made to income, and a description of activities conducted in New Jersey that create a taxable presence, often referred to as "nexus." The filing of this form each year by the appropriate deadline is mandatory for corporations to remain in good standing and avoid penalties.

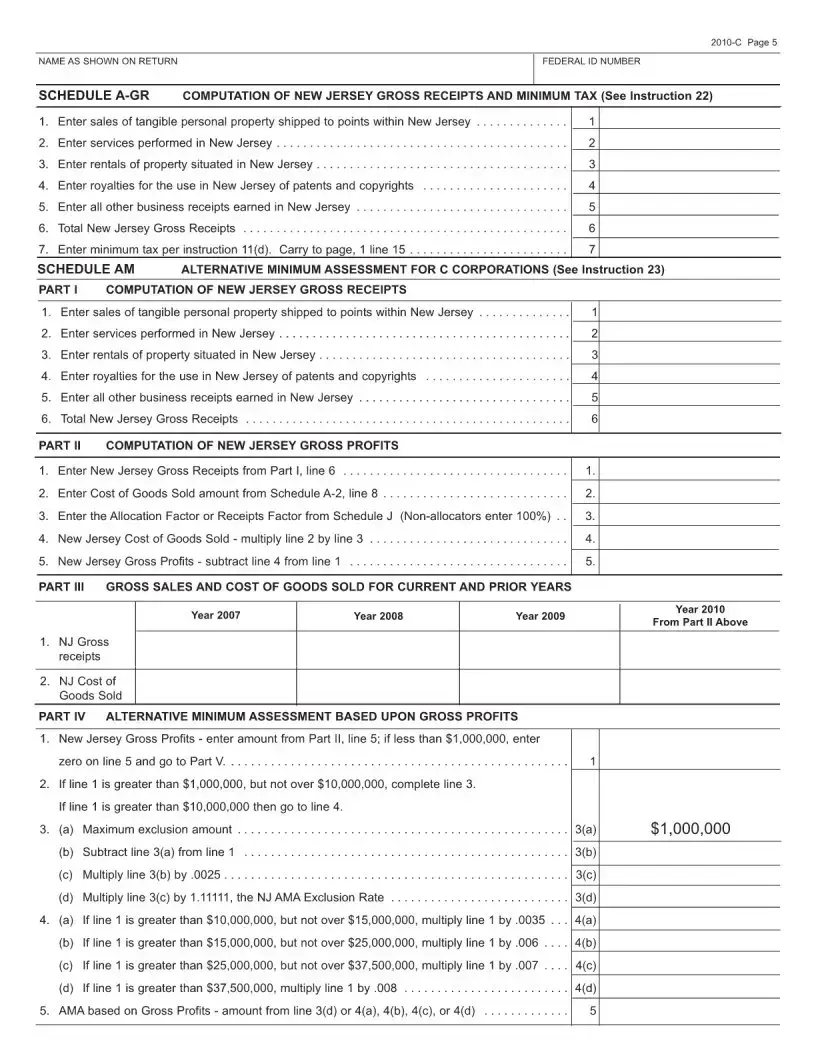

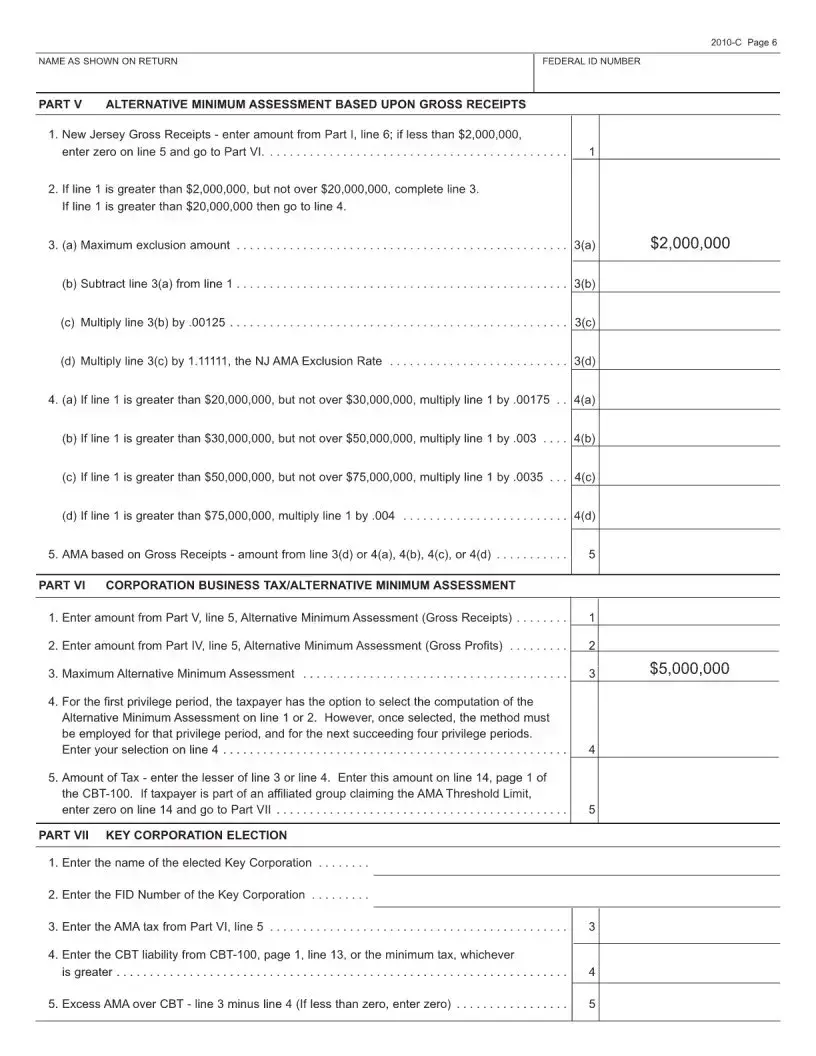

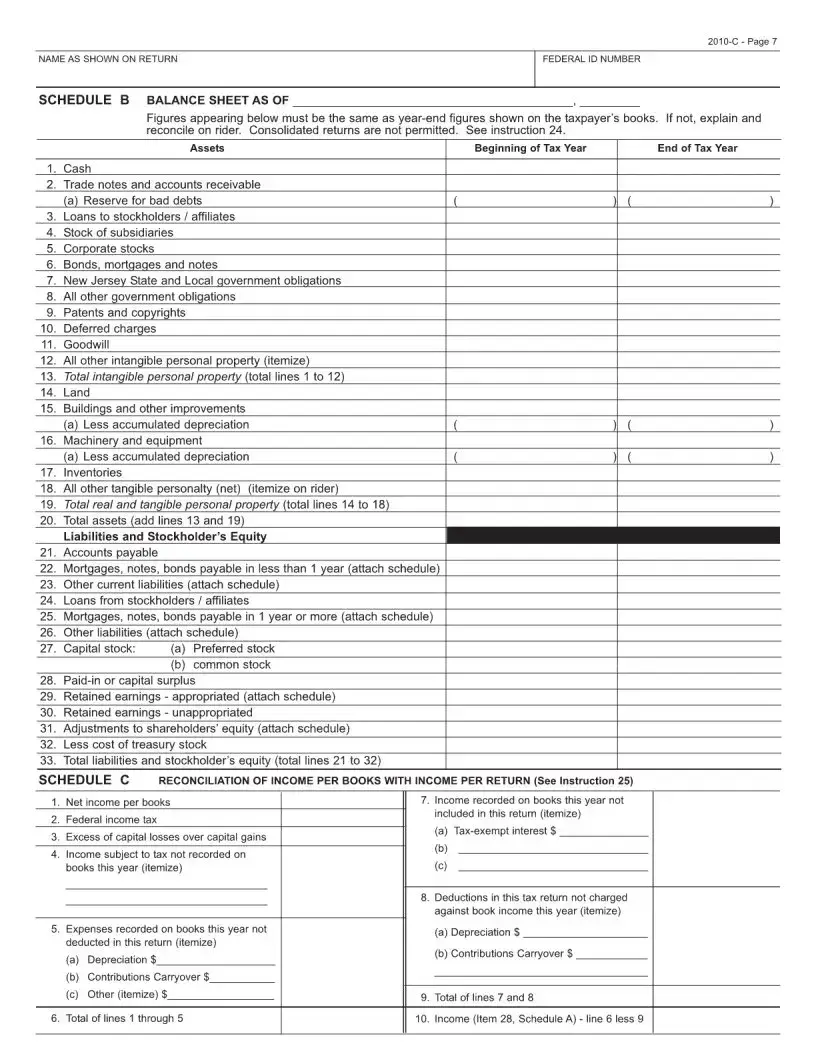

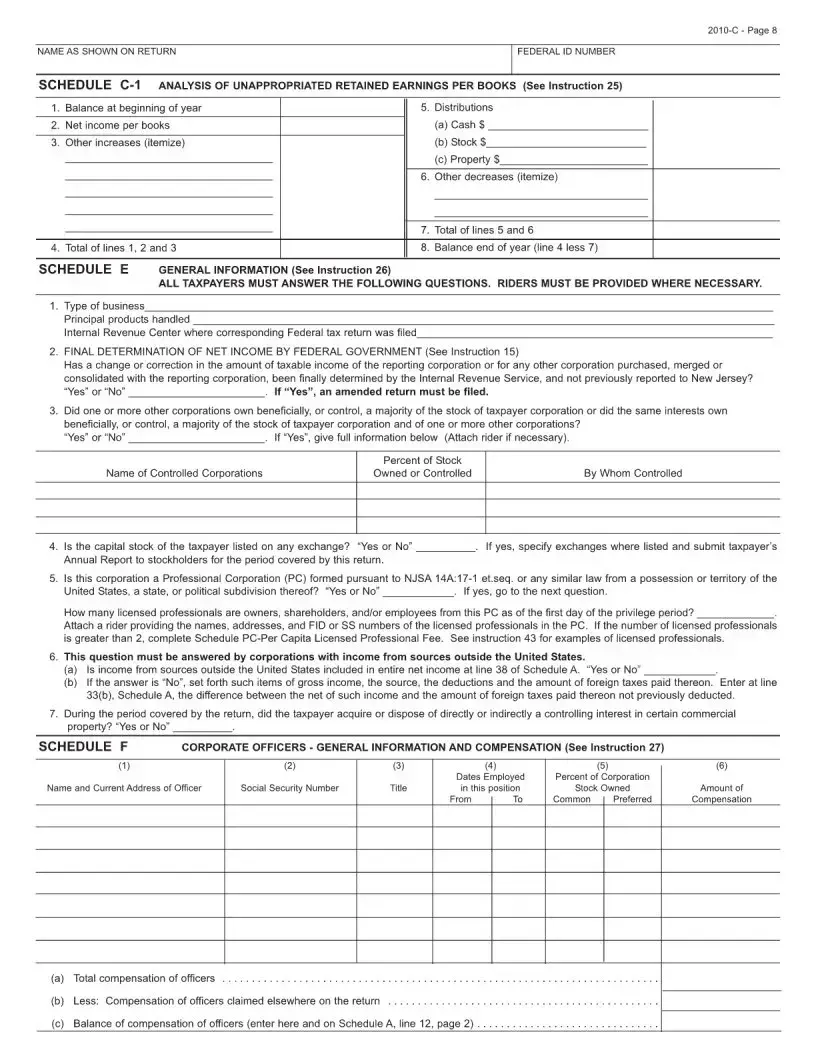

Sample - New Jersey Cbt 100 Form

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form | The New Jersey CBT-100 form is used for reporting Corporate Business Tax, which is applicable to corporations operating within New Jersey. |

| Applicable Law | This form is governed by the New Jersey Corporation Business Tax Act (NJSA 54:10A-1 et seq.). |

| Filing Requirement | All New Jersey corporations and foreign corporations with a presence in New Jersey must file the CBT-100, unless specifically exempt. |

| Due Date | The form is due on or before the 15th day of the fourth month following the end of the corporation’s fiscal or calendar year. |

| Minimum Tax | Most corporations are subject to a minimum tax ranging from $500 to $2,000, depending on New Jersey gross receipts. |

| Extension Availability | Corporations can request a six-month extension to file their CBT-100. |

| Electronic Filing | Electronic filing of the CBT-100 form is encouraged and, in some cases, required for certain corporations. |

| Payment Methods | Tax payments can be made online, by mail, or in person, though electronic payments are preferred. |

| Penalties for Late Filing | Failure to file by the due date may result in penalties and interest charges on the unpaid tax. |

| Amendments and Corrections | If a corporation needs to amend or correct information on a previously filed CBT-100, it must file a Form CBT-100, checking the "Amended Return" box. |

Detailed Steps for Using New Jersey Cbt 100

Filling out the New Jersey CBT-100 form is a critical step for corporations to comply with state tax obligations. This form is designed to report income and calculate the corporation business tax owed to the state of New Jersey. The process involves providing detailed financial information and requires careful attention to ensure accuracy and avoid potential penalties. Following a clear, step-by-step guide can simplify the task and help ensure it is completed correctly.

- Begin by gathering all necessary documents, including the federal income tax return, financial statements, and records of any New Jersey adjustments.

- Download the latest version of the New Jersey CBT-100 form from the New Jersey Division of Taxation website to ensure you are using the most current form.

- Fill out the General Information section at the top of the form, which includes the corporation's name, address, Federal Employer Identification Number (FEIN), and the beginning and ending dates of the reported tax year.

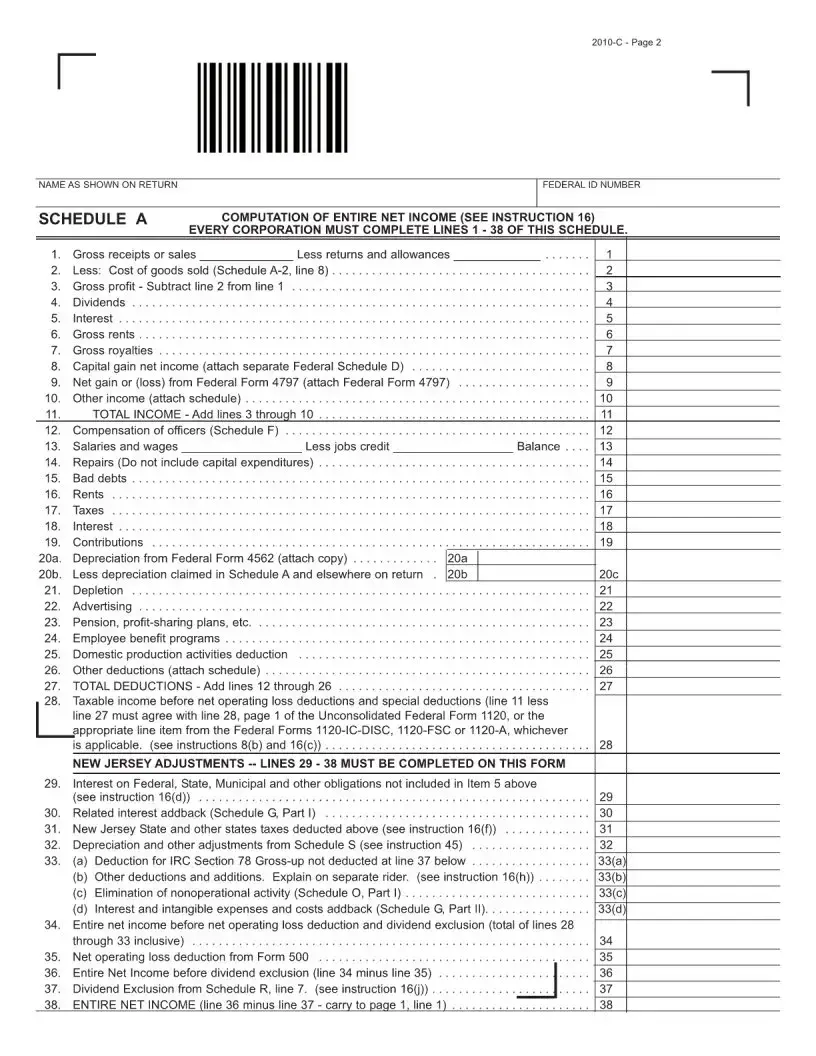

- Enter the corporation's income as reported on the federal income tax return in the income section. This includes gross income, dividends, interest, and any other sources of income.

- Adjust the reported income for New Jersey purposes, including any state-specific additions or subtractions, in the adjustments section.

- Calculate the corporation's net income or loss for New Jersey tax purposes using the adjusted income figure.

- Determine the corporation's tax liability based on the net income figure and the applicable New Jersey tax rates.

- Review the form for any applicable credits or deductions that the corporation may qualify for and apply these to reduce the tax liability.

- Sign and date the form. If a paid preparator completes the form, ensure they also sign and include their Preparer Tax Identification Number (PTIN).

- Attach all required documentation, including copies of the federal return, schedules, and any other relevant materials.

- Submit the completed form and attachments to the New Jersey Division of Taxation by the filing deadline to avoid penalties and interest.

After submitting the CBT-100 form, corporations should monitor their mail for any correspondence from the New Jersey Division of Taxation, which may include requests for additional information, notifications of tax due, or confirmation of tax payment. Timely response to any inquiries is important to maintain compliance with state tax regulations.

Learn More on New Jersey Cbt 100

What is the New Jersey CBT-100 Form?

The New Jersey CBT-100 Form, also known as the Corporation Business Tax Return, is a document that corporations operating in New Jersey must file annually. This form is used to calculate and report the corporation's business tax obligations to the New Jersey Division of Taxation.

Who needs to file the CBT-100 Form?

All corporations, including S corporations, that are incorporated, engaged in business, employing capital, owning or leasing property, or maintaining an office in New Jersey, are required to file the CBT-100 Form.

What information is required when filling out the CBT-100 Form?

When preparing the CBT-100 Form, corporations will need the following information:

- Federal Employer Identification Number (FEIN)

- Business name and address

- Principal business activity codes

- Accounting period information and fiscal year dates

- Total assets, liabilities, and equity

- Income, deductions, and tax computation details

- Payments and credits, if applicable

When is the deadline to file the CBT-100 Form?

The CBT-100 Form must be filed by the 15th day of the fourth month following the close of the taxable year. For corporations operating on a calendar year, the deadline is April 15th. For those on a fiscal year, the deadline varies accordingly.

Can the CBT-100 Form be filed electronically?

Yes, the State of New Jersey encourages corporations to file the CBT-100 Form electronically through the Division of Taxation's online system. Filing electronically is faster, more secure, and ensures prompt processing of the tax return.

What are the penalties for late filing or non-payment?

If a corporation fails to file the CBT-100 Form on time or does not pay the owed tax, it may face penalties. Late filing penalties are assessed at $100 per month, up to a maximum of 5 months. Late payment penalties are calculated at 5% of the unpaid tax per month, up to 25% of the unpaid amount. Additionally, interest is charged on both late payments and penalties.

Can I amend a previously filed CBT-100 Form?

Yes, if a corporation needs to make changes to a previously filed CBT-100 Form, it can file an amended return using the same form. It is important to check the box indicating that the submission is an amended return and to provide a detailed explanation of the changes.

Where can I get help with the CBT-100 Form?

Assistance with the CBT-100 Form is available through various resources, including:

- The New Jersey Division of Taxation website, which offers guides and contact information for direct support

- Professional tax preparers and accountants familiar with New Jersey tax laws

- Software programs designed to assist with business tax preparation, many of which support electronic filing

Common mistakes

When filling out the New Jersey CBT-100 form, which is a requirement for reporting corporate business tax in the state, individuals often encounter areas of complexity that can lead to errors. These mistakes not only cause delays in processing but may also result in penalties, making it crucial to approach this task with care and precision. Here’s an elaboration on some common mistakes to avoid:

Not Verifying the Tax Year: One of the fundamental errors occurs when filers do not double-check the tax year for the form they are submitting. It's essential to ensure that the document corresponds accurately to the fiscal year being reported to avoid filing under an incorrect period.

Incorrect or Incomplete Entity Information: Businesses sometimes overlook the importance of providing complete and accurate entity information, including the federal Employer Identification Number (EIN), the exact Legal Name, and the Principal Business Activity Code. Mistakes in this section can lead to misidentification and misprocessing of the form.

Failing to Report All Taxable Income: Companies may unintentionally or mistakenly omit sources of income that are taxable under New Jersey law. It is critical to carefully review all possible income streams to ensure full compliance with state taxation requirements.

Miscalculating Tax Due: The calculation of taxes payable is a complex task that requires attention to detail. Errors can occur due to misunderstanding the applicable tax rates, deductions, and credits. Incorrect calculations can lead to underpayment or overpayment of taxes.

Omitting Signatures or Dates: A surprisingly common oversight is the failure to sign and date the form. The signature and the date validate the form's accuracy and authenticity. Filing without these can render the submission invalid.

Ignoring Electronic Filing Requirements: New Jersey mandates electronic filing for certain businesses based on specific criteria such as the amount of tax owed or the type of entity. Not adhering to the electronic filing mandate when required can result in non-compliance with state laws.

Avoiding these errors involves a meticulous review of the form and all pertinent documents, as well as an understanding of the comprehensive tax codes applicable to the corporate entity in question. It's advisable for businesses to seek guidance from professionals familiar with New Jersey's corporate tax obligations to ensure accuracy and compliance.

Documents used along the form

When filing a New Jersey CBT-100 form, used for reporting Corporation Business Tax, several other documents may be required to fully comply with filing requirements and to provide a comprehensive overview of a company's financial and tax status for the year. These documents range from income and expense reports to declarations of estimated payments. Understanding each document's purpose is key to ensuring accurate and complete tax filing.

- CBT-100-V: This is a payment voucher for making tax payments associated with the CBT-100 form. It's used when payments are made via check or money order, helping to ensure the payment is correctly applied to the corporation's account.

- CBT-100S: Applicable for S Corporations in New Jersey, this form is used instead of the CBT-100 by businesses that have elected S Corporation status, detailing income, deductions, and tax liabilities in a manner suited to their tax structure.

- CBT-160-A: This form is a declaration of estimated tax for corporations, outlining estimated payments that need to be made over the fiscal year. It ensures corporations pre-pay a portion of their tax liability in advance.

- CBT-160-B: Used alongside CBT-160-A, this document is for underpayment of estimated tax by corporations. It helps calculate interest due if estimated tax payments were insufficient or late, ensuring compliance with pre-payment requirements.

- Form NJ-1065: Required for partnerships, this form reports income, deductions, and more for partnerships operating in New Jersey. While not for corporations, it's relevant for entities that are taxed differently but partake in business activities similar to corporations.

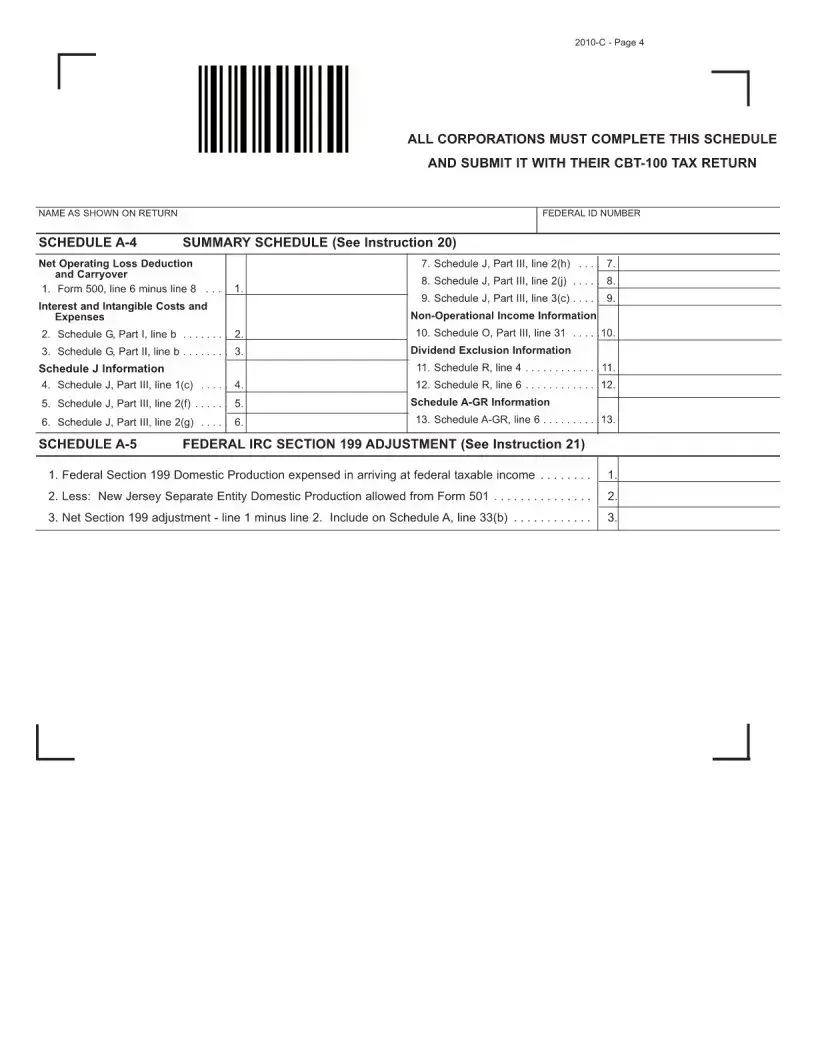

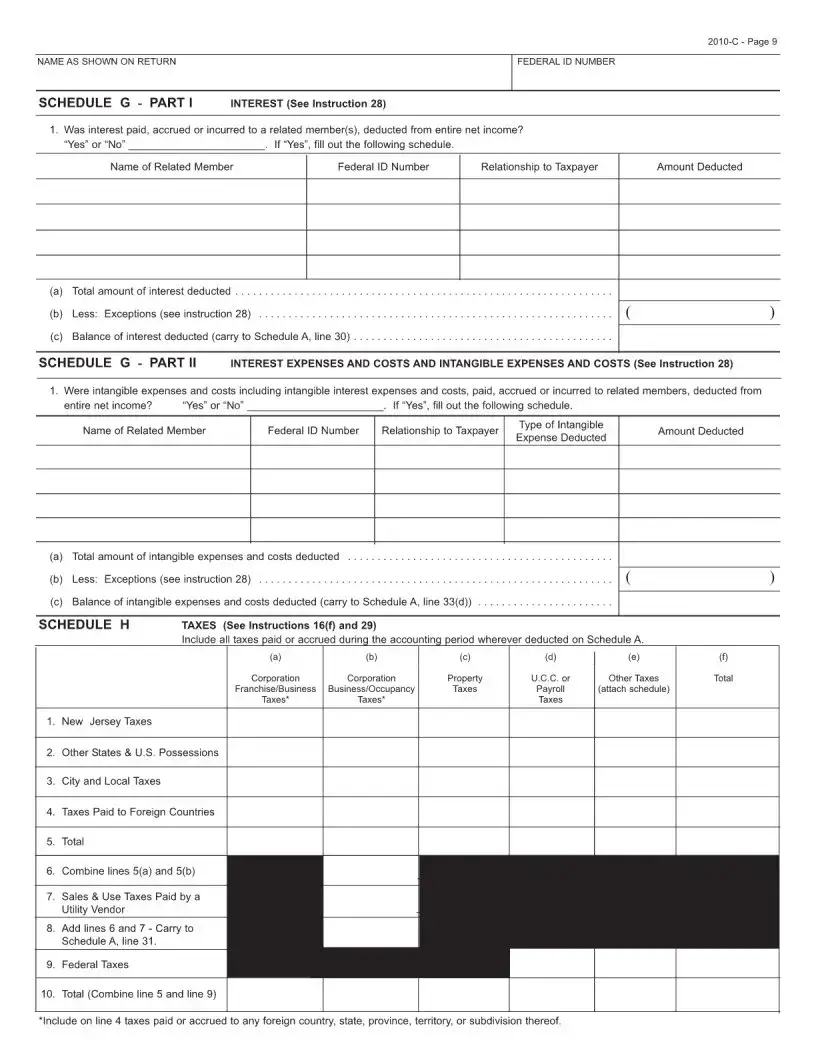

- Schedule J: This schedule is used to calculate and report the amount of tax on adjusted entire net income or alternative minimum taxable income, whichever is applicable, as part of the CBT-100 form filing process.

- Schedule K: A summary schedule for reporting dividends and exclusions within the CBT-100 form. It helps in detailing income from dividends that might be subject to adjustments or exemptions under New Jersey tax law.

- Schedule L: This is used to reconcile net income (loss) per books with entire net income as per the CBT-100 form. It is crucial for corporations to explain any differences between their book income and the income reported for tax purposes.

- Form NJ-REG: Needed by businesses to register for tax and employer purposes in New Jersey. Although not submitted annually like the CBT-100, it's essential for new businesses or those that have undergone changes affecting their tax status.

Together, these forms and documents support the New Jersey CBT-100 by providing detailed financial information, payments, and tax calculations specific to the corporation's operational nature and structure. Accurately completing and submitting these forms is critical for compliance with state tax laws, ensuring that corporations fulfill their fiscal responsibilities and avoid potential penalties for underpayment or late submission.

Similar forms

The New Jersey CBT-100 form, utilized for filing corporate business taxes, bears a resemblance to the Federal Form 1120. The Federal Form 1120 is designed for corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). Both forms serve as the primary tax reporting document for corporations within their respective jurisdictions, New Jersey state, and the federal government. They require similar information, such as the corporation's income, deductions, and tax computations, outlining a comprehensive view of the tax obligations at different government levels.

Similarly, the New Jersey CBT-100 form shares commonalities with the New York State CT-3 form, the Corporate Franchise Tax Return. Both are state-level corporate tax forms required by their respective states. They are designed to report a corporation's income, calculate owed taxes based on that income, and account for any adjustments or credits. By demanding detailed financial information, both forms help ensure the accurate calculation of the tax owed under each state's specific tax codes and regulations.

The California Form 100, for California Corporate Franchise or Income Tax Return, also parallels the New Jersey CBT-100 form. Each serves as a state-specific document for corporations to declare their income and determine tax liabilities according to the laws of New Jersey and California, respectively. While tailored to the unique regulations of their states, these forms cover similar grounds by necessitating information on total revenue, deductions, taxable income, and applicable tax credits, reflecting the corporation's fiscal responsibility to the state government.

Lastly, the New Jersey CBT-100 form is akin to the Texas Franchise Tax Report. Although Texas does not impose a traditional income tax on corporations, the Franchise Tax Report serves a similar purpose by assessing tax based on the corporation's margin. Both documents require businesses to disclose detailed financial information and compute tax obligations in accordance with state-specific formulas and guidelines. Despite different tax bases—net income for New Jersey and margin for Texas—each form plays a crucial role in the process of financial accountability and tax compliance for corporations operating within these states.

Dos and Don'ts

Preparing the New Jersey CBT-100 form, a crucial document for reporting corporation business tax, demands attention to detail and adherence to specific guidelines. Following the right steps not only simplifies the process but also helps avoid common pitfalls. Here are essential dos and don'ts when tackling this form:

- Do ensure that all the information provided is accurate. Double-check figures, spellings, and business details to prevent any errors that may lead to penalties or delays.

- Do utilize the official instructions provided by the New Jersey Division of Taxation. These guidelines are designed to help taxpayers understand each section and what is required.

- Do make use of electronic filing options if available. E-filing is not only faster but often more secure, reducing the risk of errors in data transmission.

- Don't overlook the importance of including all necessary schedules and attachments. Incomplete submissions can result in processing delays or assessments of additional tax.

- Don't ignore the filing deadline. Late filings can incur penalties and interest, adding to the overall tax liability.

- Don't hesitate to seek professional advice. If there are complexities in your business operations or tax situation, consulting with a tax professional can provide clarity and ensure compliance.

Filling out the New Jersey CBT-100 form accurately and on time plays a vital role in fulfilling your corporate tax obligations. By adhering to these guidelines, businesses can navigate the filing process more smoothly and avoid common mistakes that could impact their financial responsibilities to the state.

Misconceptions

Understanding the New Jersey CBT-100 form, which is used for Corporation Business Tax reporting, can sometimes be confusing. There are several misconceptions that can lead to mistakes or misunderstandings when filing. Below is a breakdown of these misconceptions to help clarify the process and ensure that businesses are better informed.

Only Large Corporations Need to File: A common misconception is that the CBT-100 form is only for large corporations. In reality, most corporations operating in New Jersey, regardless of size, are required to file this form. This includes S corporations, LLCs treated as corporations for federal tax purposes, and non-profit organizations that engage in unrelated business income activities.

It's the Same as the Federal Tax Return: While there are similarities between federal tax returns and the CBT-100, they are not the same. The CBT-100 form considers state-specific regulations and calculations that differ from federal tax requirements. It's essential for businesses to complete both federal and state forms accurately and according to each set of rules.

Financial Information Can Be Estimated: Accuracy is crucial when completing the CBT-100. All financial information must be precise and based on actual figures from the business’s financial statements. Estimations or rounding off to the nearest hundred or thousand can lead to discrepancies and might trigger an audit.

Filing Deadlines Are Flexible: The New Jersey Division of Taxation has strict deadlines for filing the CBT-100. Generally, the due date is on or before the 15th day of the fourth month following the end of the corporation's fiscal year. Extensions are available but must be requested using the proper form before the original due date. Assuming deadlines are flexible can lead to penalties for late filing.

Payment Is Only Required if Profitable: The requirement to file and potentially pay taxes does not solely depend on whether a corporation was profitable. New Jersey imposes a minimum tax liability on corporations, which is due regardless of profitability. Failure to understand this can result in unexpected tax liabilities.

All Businesses Pay the Same Rate: The tax rate applied in the CBT-100 form can vary based on several factors, including the corporation's business activities and income level. Believing that all businesses are taxed at a uniform rate can lead to incorrect calculations of tax liability.

Electronic Filing Is Optional: New Jersey has moved towards mandatory electronic filing for many of its tax forms, including the CBT-100. While there may be some exceptions, the general rule is that corporations must file electronically. This helps streamline the processing and ensures faster updates on the status of returns.

Amendments Are Unnecessary if Mistakes Are Minor: Any errors on the CBT-100, no matter how small, should be corrected through an amended return. Ignoring errors or assuming that the state will overlook minor mistakes can lead to penalties or interest on underpaid taxes.

Outside Assistance Is Not Needed: Due to the complexity of tax laws and the potential for significant financial implications, seeking professional advice is often a wise decision. Professionals can help ensure that the CBT-100, as well as other required documents, are completed accurately and in compliance with current laws and regulations. Assuming that it's easy to navigate without help can lead to costly errors.

Understanding these misconceptions can help corporations navigate the complexities of New Jersey's business tax system with more confidence and ensure compliance. It's always better to seek clarification on any points of confusion than to make assumptions that could lead to errors in tax filing and payment.

Key takeaways

The New Jersey CBT-100 form is instrumental for businesses to file their Corporation Business Tax Return accurately. Below are eight key takeaways to aid in effectively filling out and using this form. It's crucial for entities operating within the state to pay close attention to these points to ensure compliance and avoid common pitfalls.

Understanding the form's relevance is critical. The New Jersey CBT-100 form is designed for corporations to report their income and calculate the Corporation Business Tax owed to the state. This contributes to the financial obligations a corporation must fulfill annually.

Timeliness is essential. Corporations must file the CBT-100 form by the 15th day of the fourth month after the end of their fiscal year. An extension is available, but it must be applied for before the due date to avoid penalties.

Accuracy in reporting income is paramount. Corporations are required to report their entire net income as accurately as possible. This includes all revenues, less the cost of goods sold and other allowable deductions.

Document all deductions carefully. The form allows for various deductions, including expenses and allowances for depreciation. Ensuring these are accurately documented can reduce the tax liability but requires detailed record-keeping.

Take note of minimum tax requirements. There is a minimum tax that all corporations pay based on their New Jersey gross receipts. This emphasizes the need to understand the tax brackets and corresponding minimum tax amounts.

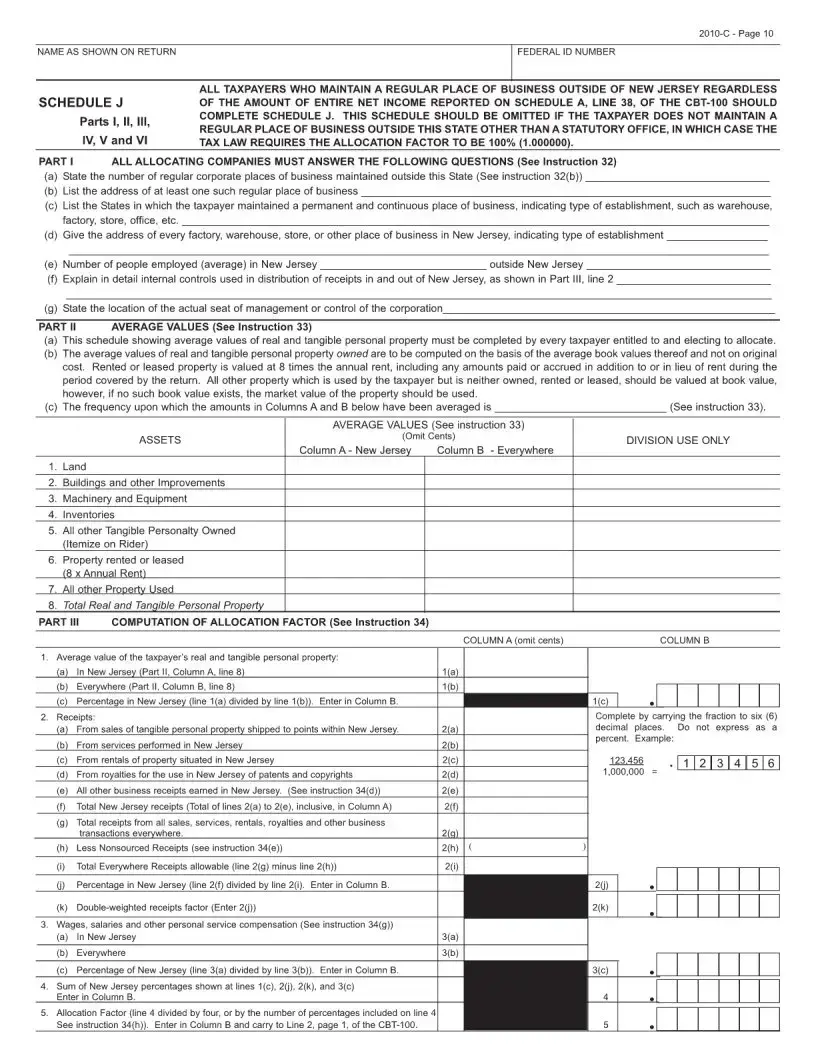

Consider the allocation formula. Corporations operating both within and outside New Jersey must use the allocation formula provided in the CBT-100 instructions to determine the portion of income subject to New Jersey taxes.

Filing amendments if needed. If a mistake is discovered after submission, the corporation can file an amended return using the same form. It's crucial to rectify any filing errors as soon as they are identified to avoid potential fines.

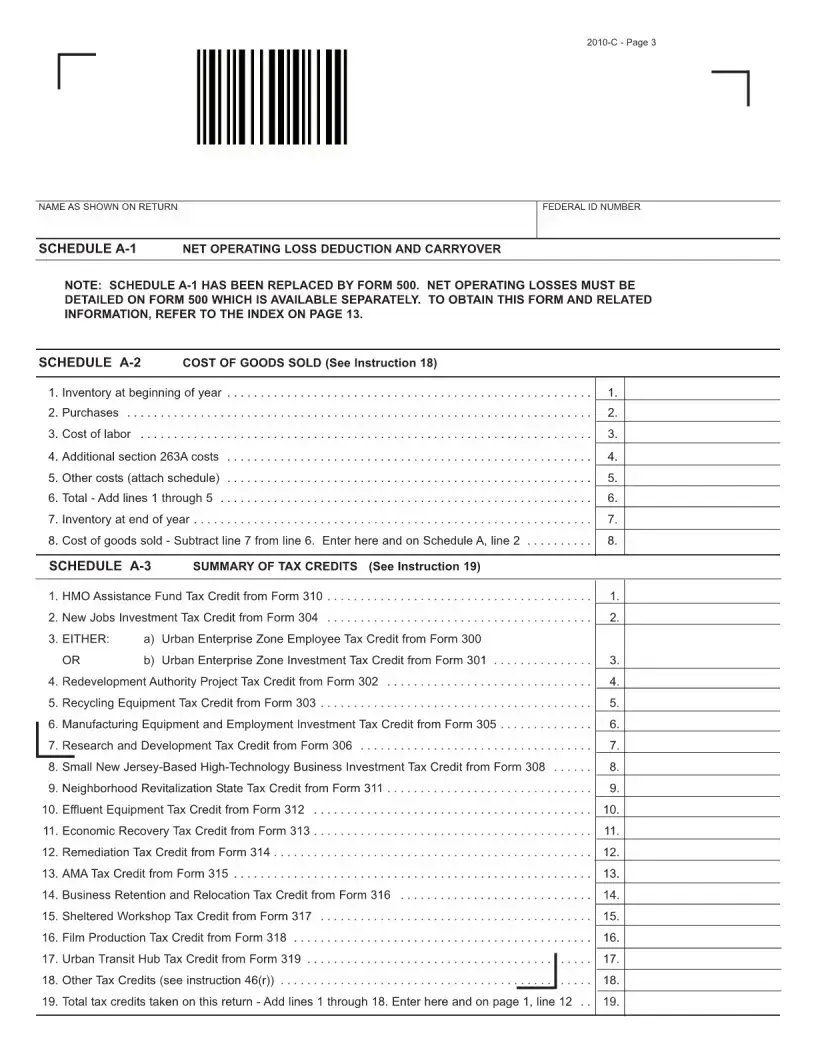

Take advantage of available credits. The CBT-100 form allows corporations to claim various tax credits, such as those for investments in urban enterprise zones or for research and development activities. Carefully reviewing eligible credits can significantly reduce the total tax liability.

It's imperative for businesses to approach the New Jersey CBT-100 form with diligence and care. Proper planning, accurate reporting, and awareness of deadlines and available benefits can aid in a smoother filing process and potentially lead to beneficial tax treatments.

Popular PDF Documents

New Jersey D 3 - Reflects New Jersey’s commitment to upholding the integrity of its political financing system through rigorous enforcement of election laws.

Nj Petit Juror Questionnaire - It requires the total number and capacity of regulated underground storage tanks, enhancing state oversight and environmental safety.

Update Nj Business Registration - The Reg C Ea form is used by New Jersey business entities to officially amend their business records.