Fill Out a Valid New Jersey R 3 Template

In New Jersey, the importance of transparency and accountability in political campaign finance cannot be overstated. This principle is embodied in the detailed requirements set forth by the New Jersey Election Law Enforcement Commission (ELEC) through the R-3 form, officially titled "Receipts and Expenditures Quarterly Report." The R-3 form serves as a critical tool for committees to report their financial activities, ensuring that monetary transactions related to electoral campaigns are conducted within the boundaries of the law. It is meticulously designed to capture a comprehensive snapshot of a committee's financial status, including cash on hand, monetary receipts, expenditures, debts owed by and to the committee, and a net financial summary. Every quarter, committees are mandated to complete this form, which encompasses both the Depository Information and the Net Financial Summary, along with detailed schedules of receipts and expenditures, to maintain a transparent and accountable electoral process. Additionally, the form requires the certification of the treasurer, confirming the veracity of the information provided and compliance with legal contribution limits. The complexity of the form, inclusive of stringent reporting periods and an array of financial detail, reflects the commission's commitment to uphold integrity within New Jersey's election framework.

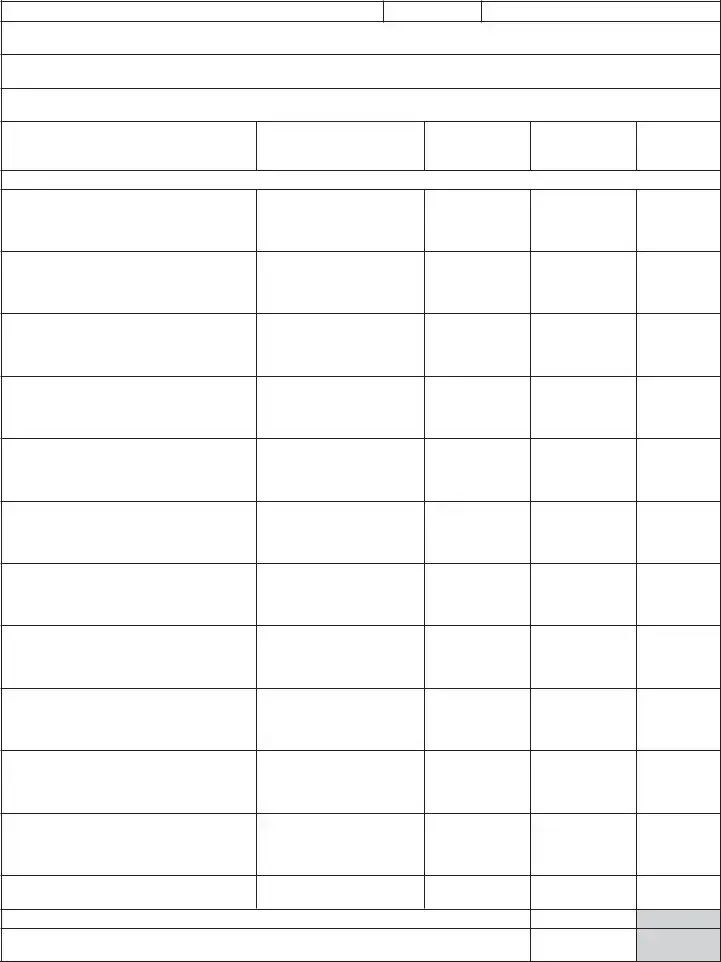

Sample - New Jersey R 3 Form

RECEIPTS AND EXPENDITURES QUARTERLY REPORT

NEW JERSEY ELECTION LAW ENFORCEMENT COMMISSION

P.O. Box 185, Trenton, NJ

(609)

PLEASE TYPE OR PRINT

FORM

FOR STATE USE ONLY

Committee Name or Approved Acronym

Address (Number and Street) Check if different than previously reported

City, State, Zip Code |

|

|

ELEC Identification Number |

|

|

|

|

Committee Type |

Check if: |

|

Report Quarter |

CPC PPC LLC |

Amendment |

First Report Filed |

Apr 15 Jul 15 Oct 15 Jan 15 Year_________ |

|

|

|

|

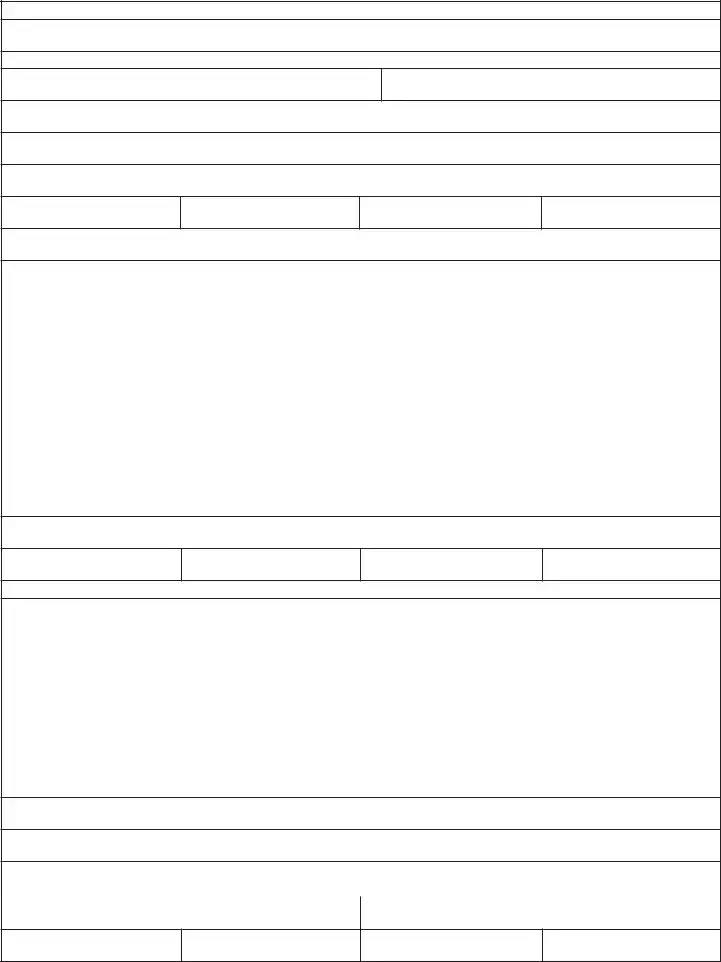

Do not attempt to complete the “Depository Information” or the “Net Financial Summary” until the appropriate schedules have been completed.

DEPOSITORY INFORMATION |

|

Column A |

Column B |

||

|

|

|

|

|

|

|

|

From |

Through |

|

Calendar |

Period Covered |

|

|

This Report |

||

|

|

|

|

|

|

1. |

Cash on Hand, January 1, _______________ |

|

|

|

|

|

|

|

|

|

|

2. |

Cash on Hand, Beginning of Reporting Period |

|

|

|

|

|

|

|

|

|

|

3. |

Monetary Receipts |

(+) |

|

|

|

|

|

|

|

|

|

4. |

Subtotal |

|

|

|

|

|

|

|

|

|

|

5. |

Monetary Expenditures |

|

|

||

|

|

|

|

|

|

6. |

Cash on Hand, Close of Reporting Period |

|

|

|

|

|

|

|

|

|

|

NET FINANCIAL SUMMARY

7. |

Cash on Hand, Close of Reporting Period |

|

|

|

|

8. |

Debt owed to Committee |

(+) |

|

|

|

9. |

Subtotal |

|

|

|

|

10. |

Debt Owed by Committee |

|

|

|

|

11. |

Total (Net Worth) |

|

TREASURER CERTIFICATION

I certify that the statements on this document are true, and that the contribution amounts received conform with the limitations designated by law. I am aware that if any of the statements are willfully false, I may be subject to punishment.

_______________________ |

______________________________________ |

_____________________________________ |

DATE |

PRINT NAME |

SIGNATURE |

|

______________________________________ |

_____________________________________ |

|

ADDRESS |

*(AREA CODE) DAY TELEPHONE NUMBER |

|

______________________________________ |

_____________________________________ |

|

|

*(AREA CODE) EVENING TELEPHONE NUMBER |

|

|

|

New Jersey Election Law Enforcement Commission |

Form |

|

*Leave this field blank if your telephone number is unlisted. Pursuant to N.J.S.A.

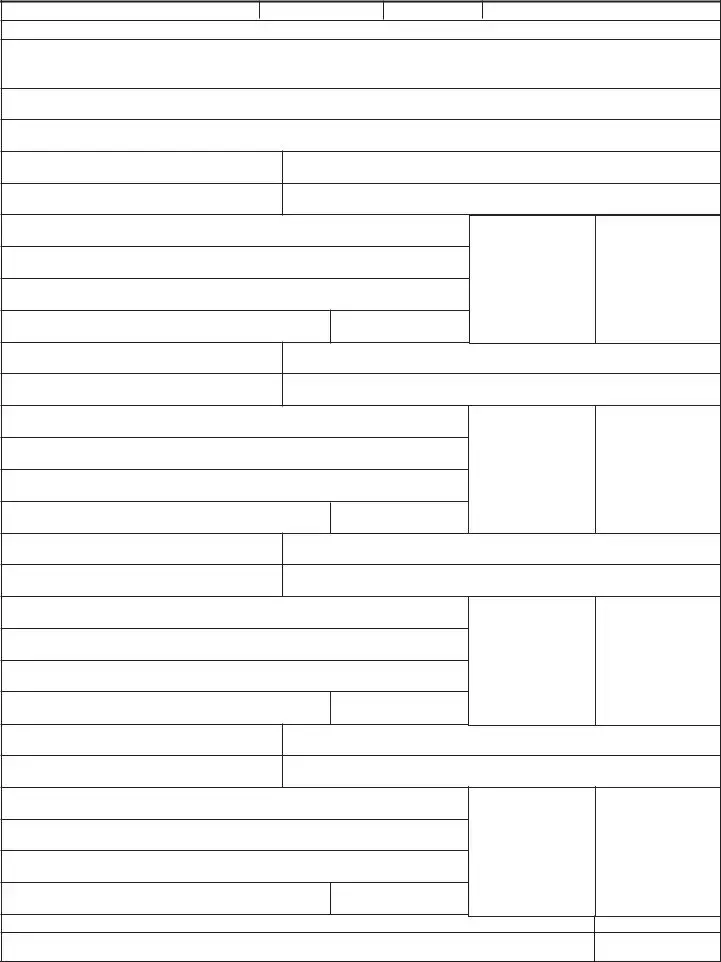

Do not attempt to complete Tables I and II until the appropriate schedules have been completed.

TABLE I RECEIPTS |

|

Column A |

Column B |

|

|

|

|

|

|

|

|

|

|

Calendar |

Monetary Receipts |

|

This Report |

||

|

|

|

|

|

1. |

Contributions, $300 or less |

|

|

|

|

|

|

|

|

2. |

Contributions, more than $300 (Schedule A) |

|

|

|

|

|

|

|

|

2a. |

Currency Contributions (Schedule A) |

|

|

|

|

|

|

|

|

3. |

Total (Add lines 1, 2 and 2a) |

|

|

|

|

|

|

|

|

4. |

Refund of Contributions (Adjustment Schedule) |

|

|

|

|

|

|

|

|

5. |

Subtotal (Subtract line 4 from line 3) |

|

|

|

|

|

|

|

|

|

Other Receipts |

|

|

|

|

|

|

|

|

6. |

Reimbursements/Refunds (Schedule A) |

|

|

|

|

|

|

|

|

7. |

Dividends/Interest (Schedule A) |

|

|

|

|

|

|

|

|

8. |

Loans Received by Committee, $300 or Less |

|

|

|

|

|

|

|

|

9. |

Loans Received by Committee more than $300 and all |

|

|

|

|

Currency Loans (Schedule B) |

|

|

|

|

|

|

|

|

10. |

Total Monetary Receipts (Add lines 5 through 9) |

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

|

|

|

|

12. |

|

|

|

|

|

|

|

|

|

13. |

Gross Receipts (Add lines 10, 11 and 12) |

|

|

|

|

|

|

|

|

TABLE II EXPENDITURES |

|

|

|

|

|

|

|

|

|

14. |

Operating Disbursement (Schedule C) |

|

|

|

|

|

|

|

|

|

Contributions (from the Committee) to: |

|

|

|

|

|

|

|

|

15a. |

NJ Gubernatorial Candidates/Committees (Schedule D) |

|

|

|

|

|

|

|

|

15b. |

NJ Legislative Candidates/Committees (Schedule D) |

|

|

|

|

|

|

|

|

15c. |

All other Candidates/Committees (Schedule D) |

|

|

|

|

|

|

|

|

|

Expenditures Made on Behalf of: |

|

|

|

|

|

|

|

|

16a. |

NJ Gubernatorial Candidates/Committees (Schedule E) |

|

|

|

|

|

|

|

|

16b. |

NJ Legislative Candidates/Committees (Schedule E) |

|

|

|

|

|

|

|

|

16c. |

All other Candidates/Committees (Schedule E) |

|

|

|

|

|

|

|

|

16d. Independent Expenditures (Schedule E) |

|

|

|

|

|

|

|

|

|

17. |

Loan Payments (Schedule B) |

|

|

|

|

|

|

|

|

18. |

Total Monetary Expenditures (Add lines 14 through 17) |

|

|

|

|

|

|

|

|

19. |

|

|

|

|

|

|

|

|

|

20. |

|

|

|

|

|

|

|

|

|

21. |

Gross Expenditures (Add lines 18 through 20) |

|

|

|

|

|

|

|

|

New Jersey Election Law Enforcement Commission |

Form |

DEPOSITORY SUMMARY - PLEASE TYPE OR PRINT. PHOTOCOPIES MAY BE USED IF ADDITIONAL FORMS ARE NEEDED.

Committee Name:

BANK ACCOUNT INFORMATION

1. Name of Bank

(Area Code) Telephone Number

Mailing Address

City, State, Zip Code

Account Name

Opening Balance this Period

Deposits this Period

Disbursements this Period

Closing Balance this Period

If the committee has more than one bank account within the same bank, the name(s) of the additional account(s) must be provided.

Account Name

Opening Balance this Period |

Deposits this Period |

Disbursements this Period |

Closing Balance this Period |

|

|

|

|

|

|

2. Name of Bank |

|

|

(Area Code) Telephone Number |

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

City, State, Zip Code |

|

|

|

|

|

|

|

|

|

Account Name |

|

|

|

|

|

|

|

|

|

Opening Balance this Period |

Deposits this Period |

Disbursements this Period |

Closing Balance this Period |

|

|

|

|

|

|

If the committee has more than one bank account within the same bank, the name(s) of the additional account(s) must be provided.

Account Name

Opening Balance this Period

Deposits this Period

Disbursements this Period

Closing Balance this Period

OTHER ASSETS

Other than the bank account(s) listed above, does this committee hold any of the following (please X):

Investment Institution Money Market Account |

Bonds |

Certificate of Deposit (C.D.) |

Stocks |

Mutual Fund Account |

Real Property |

Other (please specify) _______________________________________________________________________________

For each item checked (“X”) above (other than real property), please complete the following information. If real property is held, a Real Property Schedule must be filed as part of the Form

1. Name of Depository or Issuer |

(Area Code) Telephone Number |

|

|

Mailing Address

City, State, Zip Code

Account Name

Type of Asset |

|

|

|

|

|

Money Market |

C.D. |

Mutual Fund |

Bonds |

Stocks |

Other (specify) ____________________ |

|

|

|

|||

Value of Asset at Purchase if Applicable |

|

Date of Maturity, if Applicable |

|||

Opening Balance this Period

Deposits this Period

Disbursements this Period

Closing Balance this Period

New Jersey Election Law Enforcement Commission |

Form |

ITEMIZED RECEIPTS (Other than Loans)

SCHEDULE A

Page No. |

of |

PLEASE TYPE OR PRINT. PHOTOCOPIES MAY BE USED IF ADDITIONAL FORMS ARE NEEDED.

Receipt Type (Use a separate “Schedule A” for each type and for each separate account.)

Currency |

All other Monetary Contributions |

|

Reimbursements/Refunds of Disbursements |

Dividends/Interest |

|

Committee Name

Account Name

Contributor Name

Contributor Address (Number and Street)

Occupation

City, State, Zip Code

Employer Name

Employer Address

Date(s) Received this Period

Amount(s) Received this Period

City, State, Zip Code

Receipt Description (If

Aggregate

Contributor Name

Contributor Address (Number and Street)

Occupation

City, State, Zip Code

Employer Name

Date(s) Received

Amount(s) Received

Employer Address

City, State, Zip Code

Receipt Description (If

Aggregate

Contributor Name

Contributor Address (Number and Street)

Occupation

City, State, Zip Code

Employer Name

Date(s) Received

Amount(s) Received

Employer Address

City, State, Zip Code

Receipt Description (If

Aggregate

Contributor Name

Contributor Address (Number and Street)

Occupation

City, State, Zip Code

Employer Name

Date(s) Received

Amount(s) Received

Employer Address

City, State, Zip Code

Receipt Description (If

Aggregate

1.SUBTOTAL (Add all receipts listed on this page.)

2.TOTAL RECEIPTS, THIS PERIOD (Complete this line on the last page used for each receipt type. Carry forward to applicable line on Page 2, Column A.)

New Jersey Election Law Enforcement Commission |

Form |

LOANS RECEIVED |

|

|

|

SCHEDULE B |

Page No. |

|

of |

|||

|

|

|

|

|

|

|

|

|

|

|

PLEASE TYPE OR PRINT. PHOTOCOPIES MAY BE USED IF ADDITIONAL FORMS ARE NEEDED. |

|

|

||||||||

Use a separate “SCHEDULE B” for each separate account. |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Committee Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Lender |

|

Original Loan |

New Loan |

|

Total Amount of |

|

Outstanding Balance |

|||

|

|

Amount |

this Period |

|

Loan Plus Interest |

|

this Period |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments this Period |

Amount |

|

Check No(s) |

|

Date(s) |

|||

|

|

|

|

|

|

|

|

|

|

|

Occupation |

|

Terms: |

Date Incurred |

Date Due |

|

Annual Interest Rate |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Name and Address (Number, Street, City, State and Zip Code) |

|

|

|

Aggregate |

||||||

|

|

|

|

|

|

|

|

|

|

|

1. Name and Address of Guarantor |

|

|

|

|

|

|

Amount Outstanding |

|||

|

|

|

|

|

|

|

|

|

|

|

Occupation |

Employer Name and Address (Number, Street, City, State and Zip Code) |

|

Aggregate |

|||||||

|

|

|

|

|

|

|

|

|

|

|

2. Name and Address of Guarantor |

|

|

|

|

|

|

Amount Outstanding |

|||

|

|

|

|

|

|

|

|

|

|

|

Occupation |

Employer Name and Address (Number, Street, City, State and Zip Code) |

|

Aggregate |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Lender |

|

Original Loan |

New Loan |

|

Total Amount of |

|

Outstanding Balance |

|||

|

|

Amount |

this Period |

|

Loan Plus Interest |

|

this Period |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments this Period |

Amount |

|

Check No(s) |

|

Date(s) |

|||

|

|

|

|

|

|

|

|

|

|

|

Occupation |

|

Terms |

Date Incurred |

|

Date Due |

|

Annual Interest Rate |

|||

|

|

|

|

|

|

|

|

|

|

|

Employer Name and Address (Number, Street, City, State and Zip Code) |

|

|

|

Aggregate |

||||||

|

|

|

|

|

|

|

|

|

|

|

1. Name and Address of Guarantor |

|

|

|

|

|

|

Amount Outstanding |

|||

|

|

|

|

|

|

|

|

|

|

|

Occupation |

Employer Name and Address (Number, Street, City, State and Zip Code) |

|

Aggregate |

|||||||

|

|

|

|

|

|

|

|

|

|

|

2. Name and Address of Guarantor |

|

|

|

|

|

|

Amount Outstanding |

|||

|

|

|

|

|

|

|

|

|

|

|

Occupation |

Employer Name and Address (Number, Street, City, State and Zip Code) |

|

Aggregate |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. TOTAL NEW LOANS, THIS PERIOD (Complete this line on the last page used. |

|

|

|

|

|

|||||

Carry forward to Page 2, Line 9, Column A.) |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

2. TOTAL AMOUNT OF LOANS PLUS INTEREST, THIS PERIOD |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

3. TOTAL LOAN PAYMENTS, THIS PERIOD (Complete this line on the last page used. |

|

|

|

|

|

|||||

Carry forward to Page 2, Line 17, Column A.) |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

4. TOTAL OF ALL OUTSTANDING LOANS PLUS INTEREST (Complete this line on the |

|

|

|

|||||||

last page used. Carry back to Page 10, “Schedule F”, Line 1.) |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

New Jersey Election Law Enforcement Commission |

Form |

ADJUSTMENT SCHEDULE - REFUND OF CONTRIBUTIONS |

Page No. |

of |

|||

|

|

|

|

|

|

PLEASE TYPE OR PRINT. PHOTOCOPIES MAY BE USED IF ADDITIONAL FORMS ARE NEEDED. |

|

||||

Use a separate “ADJUSTMENT SCHEDULE” for each separate account. |

|

|

|||

|

|

|

|

|

|

Committee Name |

|

|

|

|

|

|

|

|

|

|

|

Account Name |

|

|

|

|

|

|

|

|

|

|

|

IF A MONETARY CONTRIBUTION IN EXCESS OF THE CONTRIBUTION LIMIT IS DEPOSITED, PLEASE REPORT |

|||||

THE REFUND OF THE EXCESS AMOUNT ON THIS ADJUSTMENT SCHEDULE. |

|

|

|||

|

|

|

|

|

|

Payment Date |

Check No. |

|

Payee Name and Address |

|

Refunded Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. TOTAL REFUND OF CONTRIBUTIONS, THIS PERIOD (Complete this line on the last page |

|

||||

used. Carry forward to Page 2, Line 4, Column A.) |

|

|

|

||

|

|

|

|

|

|

New Jersey Election Law Enforcement Commission |

Form |

ITEMIZED OPERATING DISBURSEMENTS

SCHEDULE C

Page No. |

of |

PLEASE TYPE OR PRINT. PHOTOCOPIES MAY BE USED IF ADDITIONAL FORMS ARE NEEDED. Use a separate “SCHEDULE C” for each separate account.

Committee Name

Account Name

Payee or Creditor Name, Address (Number, Street, State, City, State and Zip Code)

Purpose*

Amount(s)

Disbursed this

Period

Transaction Dates

Check No(s)

*Legislative Leadership Committees - See instructions concerning permissible uses of funds.

1.SUBTOTAL (Add all disbursements listed on this page.)

2.TOTAL DISBURSEMENTS, THIS PERIOD (Complete this line on the last page used. Carry forward to Page 2, Line 14, Column A.)

New Jersey Election Law Enforcement Commission |

Form |

ITEMIZED MONETARY CONTRIBUTIONS MADE TO CANDIDATES/COMMITTEES |

|

SCHEDULE D |

Page No. |

of |

|||||

|

|

|

|

|

|

|

|

||

PLEASE TYPE OR PRINT. PHOTOCOPIES MAY BE USED IF ADDITIONAL FORMS ARE NEEDED. |

|

||||||||

Use a separate “SCHEDULE D” for each separate account and each separate recipient type. |

|

|

|

|

|||||

|

|

|

|

|

|||||

New Jersey Gubernatorial Candidates/Committees |

New Jersey Legislative Candidates/Committees |

||||||||

All Other Candidates/Committees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committee Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recipient Name and Address |

Election Date |

|

|

Check |

|

|

|

Amount |

|

(Number and Street, City, State, Zip Code) |

District or County |

|

No(s) |

|

Date(s) |

|

of each |

||

|

or Municipality |

|

|

|

|

|

|

|

Contribution |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

1. SUBTOTAL (Add all contributions made to each recipient type listed on this page.) |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||

2. TOTAL, THIS RECIPIENT TYPE, THIS PERIOD (Complete this line on the last page used for |

|

|

|

|

|||||

each recipient type. Carry forward to Page 2, either Line 15a, Line 15b, or Line 15c, Column A.) |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

New Jersey Election Law Enforcement Commission |

Form |

ITEMIZED EXPENDITURES MADE AND INCURRED ON |

|

SCHEDULE E |

|

|

Page No. |

of |

|

|

|||||

BEHALF OF CANDIDATES/COMMITTEES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE TYPE OR PRINT. PHOTOCOPIES MAY BE USED IF ADDITIONAL FORMS ARE NEEDED. |

|

|

|

|

|

||||||||

Use a separate “SCHEDULE E” for each separate account and each separate recipient type. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

New Jersey Gubernatorial Candidates/Committees |

New Jersey Legislative Candidates/Committees |

|

|

||||||||||

All Other Candidates/Committees |

Independent Expenditures |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committee Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payee Name and Address |

|

Purpose |

|

Amount(s) this Period |

|

Transaction |

|

Check |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Number, Street, City, State and Zip Code) |

|

|

|

Incurred/Not Paid |

Disbursed |

|

Date(s) |

|

|

|

No(s) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOCATION OF EXPENDITURES BENEFITING CANDIDATE(S)/COMMITTEE(S) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Candidate/Committee Name |

|

|

Election |

|

District or County |

|

|

||||||

|

|

|

|

Date |

|

or Municipality |

|

|

|

Amount |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payee Name and Address |

|

Purpose |

|

Amount(s) this Period |

|

Transaction |

|

Check |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Number, Street, City, State and Zip Code) |

|

|

|

Incurred/Not Paid |

Disbursed |

|

Date(s) |

|

|

|

No(s) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOCATION OF EXPENDITURES BENEFITING CANDIDATE(S)/COMMITTEE(S) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Candidate/Committee Name |

|

|

Election |

|

District or County |

|

|

||||||

|

|

|

|

Date |

|

or Municipality |

|

|

|

Amount |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. SUBTOTAL (Add all disbursements made to each recipient type listed on this page.) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. TOTAL DISBURSEMENTS, THIS PERIOD (Complete this line on the last page used for |

|

|

|

|

|

|

|

|

|||||

each recipient type. Carry forward to Page 2, either Line 16a, Line 16b, or Line 16c, |

|

|

|

|

|

|

|

|

|||||

Column A.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. SUBTOTAL (Add all outstanding obligations incurred/not paid, listed on this page.) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. TOTAL OUTSTANDING OBLIGATIONS INCURRED/NOT PAID (Complete this line on |

|

|

|

|

|

|

|

|

|||||

the last page used. Carry back to Page 10, “Schedule F”, Line 2.) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey Election Law Enforcement Commission |

Form |

DEBTS AND OBLIGATIONS OWED BY COMMITTEE |

SCHEDULE F |

|

|

Page No. |

of |

|||

|

|

|

|

|

|

|

|

|

PLEASE TYPE OR PRINT. PHOTOCOPIES MAY BE USED IF ADDITIONAL FORMS ARE NEEDED. |

|

|||||||

Use a separate “SCHEDULE F” for each separate account. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committee Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Creditor Name and Address |

Outstanding |

|

|

Amount |

|

Payments |

Outstanding |

|

(Number, Street, City, State, and Zip Code) |

Beginning Balance |

|

Incurred |

|

this Period |

Balance this |

||

|

this Period |

|

|

this Period |

|

|

Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Purpose |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Purpose |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Purpose |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Purpose |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY OF DEBTS AND OBLIGATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. TOTAL OUTSTANDING LOANS PLUS INTEREST FROM SCHEDULE B, PAGE 5, |

|

|

|

|||||

LINE 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. TOTAL OUTSTANDING OBLIGATIONS INCURRED/NOT PAID ON BEHALF OF |

|

|

|

|||||

CANDIDATES/COMMITTEES FROM SCHEDULE E, PAGE 9, LINE 4 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

3. TOTAL OUTSTANDING OBLIGATIONS, SCHEDULE F |

|

|

|

|

|

|

|

|

(Complete this line on the last page used.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. TOTAL OUTSTANDING DEBTS/OBLIGATIONS OWED BY COMMITTEE |

|

|

|

|||||

(Add lines 1, 2 and 3. Carry forward to front page, Line 10.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey Election Law Enforcement Commission |

Form |

Document Specifications

| Fact Name | Detail |

|---|---|

| Form Purpose | Reporting quarterly receipts and expenditures for political committees in New Jersey. |

| Administering Body | New Jersey Election Law Enforcement Commission (NJ ELEC). |

| Key Components | Includes sections for depository information, net financial summary, and itemized receipts and expenditures. |

| Filing Deadlines | April 15, July 15, October 15, January 15 of each year. |

| Certification Requirement | Treasurers must certify that the information is true and in accordance with law. |

| Governing Law | N.J.S.A. 47:1A-1.1 regarding public records and confidentiality of unlisted telephone numbers. |

Detailed Steps for Using New Jersey R 3

Filling out the New Jersey R-3 form is a necessary step for tracking the financial activities of political committees. This document is vital for ensuring transparency and adhering to the state's Election Law Enforcement Commission's regulations. The process requires attention to detail and accurate reporting of all transactions within the specified period. By following the outlined steps, committees can maintain compliance and contribute to the integrity of the electoral process. Here are the steps to fill out the form effectively:

- Begin by typing or printing the committee's name or approved acronym and address, including city, state, and zip code. Mark the checkbox if the address has changed since previously reported.

- Enter the ELEC identification number and select the committee type by checking the appropriate box: CPC, PPC, LLC, or indicate if the form is an amendment or the first report filed.

- Choose the report quarter by ticking the relevant box: Apr 15, Jul 15, Oct 15, or Jan 15, and enter the year.

- Do not fill in the "Depository Information" or "Net Financial Summary" sections until you have completed the necessary schedules.

- In the "Depository Information" section, fill out columns A and B, starting with the cash on hand at the beginning of the year and at the beginning of the reporting period. Add monetary receipts to calculate the subtotal, then deduct monetary expenditures to determine the cash on hand at the end of the reporting period.

- Complete the "Net Financial Summary" by entering the closing balance of cash on hand, debt owed to and by the committee, to calculate the total net worth.

- The treasurer must certify the report by signing and dating the form, printing their name, and providing their address and telephone number for both day and evening.

- For bank account information, write the name of the bank, telephone number, mailing address, city, state, zip code, and account details including opening balance, deposits, disbursements, and closing balance for the period. If there are multiple accounts within the same bank, list each separately.

- Mark any other assets held by the committee, such as investments or real property, and provide detailed information for each.

- For each section of itemized receipts (Schedule A), loans received (Schedule B), operating disbursements (Schedule C), and contributions made (Schedules D and E), fill in the specifics for each transaction, including names, addresses, amounts, and descriptions as applicable.

- Calculate and enter subtotals for receipts, loans received, and disbursements on the respective schedules and carry these figures forward to the main form as instructed.

- Review all entries for accuracy before submitting the form to the New Jersey Election Law Enforcement Commission at the address provided.

Once the form is completed and double-checked for accuracy, it should be submitted by the deadline to ensure compliance with New Jersey's election laws. This step is crucial in maintaining a transparent and fair electoral process by accurately reporting financial transactions.

Learn More on New Jersey R 3

What is the New Jersey R-3 Form?

The New Jersey R-3 Form, officially titled "Receipts and Expenditures Quarterly Report," is a document required by the New Jersey Election Law Enforcement Commission (ELEC). It's designed for committees to report their financial activities, including monetary receipts, expenditures, debts, and assets, for a specific reporting period. Committees such as Political Action Committees (PACs), Continuing Political Committees (CPCs), Legislative Leadership Committees (LLCs), and others involved in political campaigning or lobbying are required to file this form to maintain transparency and comply with state regulations.

How do I complete the Depository Information and Net Financial Summary sections?

To accurately fill out the Depository Information and Net Financial Summary sections of the R-3 Form, follow these steps:

- Depository Information: Start by reporting all of the committee's bank account details, including balances at the beginning and end of the reporting period, total deposits, and disbursements. If there are multiple accounts, each should be listed separately. Also, detail other assets like investments or real property owned by the committee.

- Net Financial Summary: This section is completed after tallying the figures in the appropriate schedules. You'll note the cash on hand at the end of the period, any outstanding debts owed to or by the committee, and calculate the total net worth. Ensure to include both the starting and ending cash balances, total monetary receipts and expenditures, and any adjustments for in-kind contributions or expenditures.

Who needs to sign the Form R-3 and why?

The treasurer of the committee is required to sign the Form R-3. This signifies that the treasurer certifies the accuracy and truthfulness of all the information provided in the document. The certification section includes a place for the treasurer's signature, printed name, contact information, and the date of signing. Signing the form is crucial because it holds the treasurer accountable for ensuring compliance with legal contribution limits and financial reporting requirements as set forth by the New Jersey Election Law Enforcement Commission. A willful submission of falsified information can lead to punitive action against the treasurer or the committee.

Where can I find more information or get assistance with completing the Form R-3?

For further guidance or assistance with the Form R-3, you can reach out to the New Jersey Election Law Enforcement Commission (ELEC) directly. Here are some resources:

- Phone: Call the ELEC at (609) 292-8700 or toll-free within New Jersey at 1-888-313-ELEC (3532) for direct assistance.

- Website: Visit the official ELEC website at www.elec.nj.gov for resources including detailed instructions, forms, and reporting guidelines.

- Mail: Correspondence can be sent to P.O. Box 185, Trenton, NJ 08625-0185 if you need to submit documents or have specific inquiries that require written communication.

Common mistakes

Filling out the New Jersey R-3 form, which pertains to receipts and expenditures for election-related activities, requires attentiveness to detail. Here are nine common mistakes that can lead to inaccuracies or even the rejection of the form:

- Not updating address and contact information - If your address or contact details have changed since the last report, failing to update this information can cause communication issues.

- Incorrect Reporting Period dates - Mixing up or mistyping the from and through dates for the reporting period can misrepresent your financial activity timeline.

- Overlooking the ‘Cash on Hand’ at the beginning of the reporting period - This can lead to an inaccurate current financial position.

- Errors in listing monetary receipts - Either by omission or incorrect amounts, which can affect the total financial intake reported.

- Misclassifying types of contributions - Not distinguishing between contributions of $300 or less and those more than $300 can lead to filing inaccuracies.

- Incorrectly reporting monetary expenditures - This includes both operational expenses and contributions made, which are crucial for a transparent financial report.

- Failure to accurately report loans received - This pertains to both disclosing the amounts and terms of loans accurately.

- Incomplete treasurer certification - The treasurer must sign the certification, ensuring that all reported information is true to the best of their knowledge.

- Not properly reporting other assets or bank accounts - Ignoring or incorrectly detailing these can misrepresent the committee’s financial status.

Steering clear of these mistakes not only ensures compliance with the New Jersey Election Law Enforcement Commission’s requirements but also promotes transparency and accountability in electoral finance. Taking the time to review and double-check the details before submission can save a lot of potential trouble down the line.

Documents used along the form

When managing political campaign finances in New Jersey, navigating the paperwork can be quite the task. The New Jersey Election Law Enforcement Commission's Form R-3, known for its role in reporting receipts and expenditures quarterly, is just the tip of the iceberg. There are numerous other forms and documents that often accompany the R-3, each serving a specific purpose in ensuring financial transparency and regulatory compliance. Let's take a closer look at some of these crucial documents.

- Form D-1: This is the statement of organization form. It's required for any committee that plans to receive contributions or make expenditures in New Jersey politics. It declares the committee's existence and provides essential contact and banking information.

- Schedule A: Attached to Form R-3 for detailing contributions more than $300, including currency contributions. It itemizes each receipt, providing a thorough record of financial backing.

- Schedule B: This accompanies Form R-3 to report on loans received by the committee. It lists each lender along with the terms and statuses of loans, ensuring full disclosure of financial obligations.

- Schedule C: Used for outlining operating disbursements. It's crucial for chronicling the committee's expenses in fine detail, from office supplies to campaign-related expenditures.

- Schedule D: Focuses on contributions made by the committee to other candidates or political entities within New Jersey. This maintains transparency in the flow of funds between political actors.

- Schedule E: Similar to Schedule D but specific to expenditures made on behalf of other candidates or committees, including independent expenditures. It ensures clarity in how funds are used to support political allies.

- Schedule F: This outlines all outstanding loans and their interest, providing a snapshot of the committee's financial health and obligations.

- Amendment Form: Utilized when information on a previously filed R-3 needs correction or update. This ensures all reported information remains accurate and current.

- Real Property Schedule: Required if the committee holds real property. It details property owned by the committee, adding another layer of financial disclosure.

- Bank Account Information Form: Although not a formal ELEC form, each committee must maintain accurate bank account records, showing the flow of funds across all accounts.

These documents, while requiring diligent attention to detail, promote a transparent and fair electoral process in New Jersey by ensuring that all financial activities are fully reported and open to public scrutiny. Together with the New Jersey R-3 form, they compose a comprehensive financial picture of a committee's activities, reflecting both the sources of its funding and the nature of its expenditures. Understanding and properly managing these forms are key responsibilities for those involved in the financial aspects of political campaigns in the Garden State.

Similar forms

The Federal Election Commission (FEC) Form 3 is a document that bears a resemblance to New Jersey's Form R-3 due to its function in tracking political contributions and expenditures. Like the R-3 form, the FEC Form 3 is designed for political committees to report the money they receive and spend. Both forms are essential for maintaining transparency in political finance and ensuring that committees adhere to legal financial limits and regulations. The FEC Form 3, like the New Jersey variant, includes sections for detailing receipts, disbursements, and debts, making it a crucial tool for campaign finance monitoring at the federal level.

The California Form 460 serves a purpose similar to that of New Jersey's Form R-3, as it is used by committees to record their financial activities related to elections. The forms share similarities in tracking the inflow and outflow of campaign money, including contributions, expenditures, and accrued debts. California's Form 460 is a detailed account that allows entities to report their financial standings, akin to the detail required by the R-3 form, thereby playing a pivotal role in the state's efforts to ensure electoral fairness and financial transparency.

New York's Periodic Financial Disclosure Report is another document that mirrors the function of New Jersey's Form R-3 by collecting data on political financial activities. This report is crucial for maintaining a transparent record of political funds, tracking all transactions to ensure compliance with state election laws. Like Form R-3, New York's report is designed to keep the electoral process clean by requiring detailed accounting of all receipts, disbursements, and liabilities by participating political entities.

Illinois' D-2 Quarterly Report is akin to the R-3 form in its purpose to provide a transparent overview of political campaign finance activities within the state. Both documents require detailed accounts of monetary transactions involved in election campaigns, including contributions received, expenditures made, and ongoing financial obligations. The D-2 Report emphasizes accountability in political financing, much like New Jersey's Form R-3, ensuring that all financial activities are thoroughly documented and publically accessible.

The Texas Ethics Commission's Campaign Finance Report shares objectives with New Jersey's Form R-3, as it is instrumental in documenting and disclosing financial transactions for political campaigns. Both forms serve to enforce campaign finance laws by requiring detailed reporting of contributions, expenditures, and financial positions. The Texas report, similar to the New Jersey form, aids in safeguarding the integrity of political processes by promoting financial transparency and accountability among political entities.

Florida's Campaign Treasurer's Report parallels New Jersey's Form R-3 in its requirement for political committees to report financial activities. It mandates the disclosure of detailed financial information, including the tracking of contributions and expenditures, to ensure compliance with state campaign finance laws. Both documents are vital in upholding the transparency of political funding and spending, offering regular insights into the financial dynamics of political campaigns.

Michigan's Campaign Statement is another document closely resembling New Jersey's Form R-3, as it is used to track and report financial transactions by political committees. Similar to the R-3 form, Michigan's Campaign Statement requires detailed financial reporting, including contributions, expenditures, and the financial status of political entities. This similarity underscores the universal goal of promoting transparency and legal compliance in political financing across different jurisdictions.

Ohio's Campaign Finance Report, akin to New Jersey's Form R-3, is designed to ensure transparency and accountability in political campaign financing within the state. The document requires detailed reporting of political contributions, expenditures, and debts, mirroring the objectives and functionalities of New Jersey's Form R-3. Through such reporting, Ohio seeks to preserve the integrity of its electoral processes by monitoring and disclosing the financial activities of political entities, a goal shared with New Jersey's campaign finance reporting requirements.

Dos and Don'ts

When filling out the New Jersey R-3 form, a comprehensive and accurate account of your committee's financial transactions is crucial for compliance with the New Jersey Election Law Enforcement Commission's regulations. The following is a list of nine dos and don'ts to guide you through the process:

- Do ensure all information is legible, whether typed or printed, to prevent misunderstandings or processing delays.

- Don't leave any required fields blank. If a section does not apply, indicate with “N/A” (not applicable) or “0” if it pertains to amounts.

- Do verify the accuracy of the committee's name, address, and ELEC Identification Number to ensure the report is correctly attributed.

- Don't forget to check the box if the report being filed is an amendment or the first report. This information is critical for record-keeping purposes.

- Do double-check the mathematical accuracy of your receipts, expenditures, and net financial summary to avoid discrepancies that could raise flags.

- Don't guess on amounts or dates. Use exact figures and double-check all entries for accuracy to maintain compliance and integrity of the report.

- Do list all bank accounts and other assets accurately, including name of bank, account numbers, and ending balances, to provide a comprehensive financial picture.

- Don't include sensitive information such as unlisted telephone numbers, per N.J.S.A. 47:1A-1.1, to protect privacy and comply with state law.

- Do sign and date the certification section, affirming the accuracy and truthfulness of the information provided. This is a legal attestation and must be taken seriously.

Compliance with these guidelines ensures your R-3 form submission is complete, accurate, and in accordance with the New Jersey Election Law Enforcement Commission's requirements. Remember, the accuracy of this document is paramount, as false statements may lead to penalties. For further assistance, you may contact the Commission directly.

Misconceptions

There are several common misconceptions about the New Jersey Election Law Enforcement Commission (ELEC) Form R-3, which is used for reporting quarterly receipts and expenditures by political committees. Understanding these misconceptions can help in accurately completing and submitting this form.

- Misconception 1: The Form R-3 is only for political candidates.

This is incorrect. The Form R-3 is also required for committees, such as Political Action Committees (PACs), Continuing Political Committees (CPCs), and Political Committee (PCs), to report their financial activities.

- Misconception 2: Electronic submissions are not allowed.

Contrary to this belief, the New Jersey ELEC does allow and even encourages electronic filing for reports, providing a convenient option for committees to submit their Form R-3 online through the ELEC’s website.

- Misconception 3: All receipts and expenditures need to be itemized regardless of the amount.

Not all transactions need to be itemized; there are thresholds that determine the necessity for itemization. Contributions and expenditures under certain amounts may be reported in aggregate form, not itemized individually.

- Misconception 4: The form is the same every year.

The Form R-3 can be updated or revised. It is crucial to use the most current form for each reporting period, as indicated by the revision date at the bottom of the form.

- Misconception 5: In-kind contributions do not need to be reported.

Both monetary and in-kind contributions must be reported on the Form R-3. In-kind contributions are goods or services provided instead of money and have specific lines for reporting on the form.

- Misconception 6: Personal loans to the committee do not need to be disclosed.

Personal loans, like any other financial transaction, need to be fully disclosed, including the terms of the loan and relationship to the lender, if applicable.

- Misconception 7: Only New Jersey residents’ contributions are to be reported.

All contributions, regardless of the contributor's residency, must be reported on the Form R-3, provided they meet the reporting criteria set by the ELEC.

- Misconception 8: Amendments to previously filed reports are discouraged.

Corrections or omissions to previously filed reports can and should be addressed through filing an amended Form R-3. The amendment box on the form should be checked when doing so.

- Misconception 9: The treasurer’s certification is not legally binding.

The treasurer’s certification is a legally binding statement attesting to the accuracy of the information on the form. Misrepresentations can result in penalties.

- Misconception 10: Deadline extensions are automatically granted upon request.

Extensions for filing are not automatically granted. Requests must be submitted and approved by the ELEC, and specific conditions must be met for an extension to be granted.

Understanding these common misconceptions about the New Jersey ELEC Form R-3 can help ensure accurate and compliant financial reporting by committees involved in the political process.

Key takeaways

When managing the New Jersey R 3 form, also known as the Receipts and Expenditures Quarterly Report, it's crucial to observe specific instructions and details to ensure accuracy and compliance. Here are key takeaways to guide you:

- Ensure to type or print information clearly on the form to avoid misunderstandings or processing delays. Accurate and legible entries promote smoother verification and review processes.

- The form should be used to report monetary transactions, including contributions, expenditures, loans, and other financial activities for a specified quarter. Being thorough with each transaction recorded guarantees that all financial activities are accounted for.

- Before filling out the Depository Information and the Net Financial Summary sections, complete the appropriate schedules first. This order helps in organizing information systematically, reducing errors.

- For contributions received and expenditures made, specific schedules (Schedule A for contributions, Schedule B for loans, and Schedule C for operating disbursements) must be completed. These schedules are designed to capture detailed information about each transaction type.

- It is mandatory to report the opening and closing balance of your committee's bank accounts, including any deposits and disbursements made during the reporting period. Accurate reporting of these balances ensures transparent tracking of funds.

- If the committee has multiple bank accounts, information for each must be provided separately within the form. This includes accounts within the same banking institution.

- Identify any other assets held by the committee, such as investments or real property, and provide detailed information as required. Transparent reporting of assets is vital for a comprehensive financial overview.

- The Treasurer's certification section is critical and must be signed, certifying the accuracy of the information provided on the form. This certification underscores the responsibility for truthful reporting and potential consequences for willful misrepresentation.

When completing and using the New Jersey R 3 form, attention to detail, thoroughness, and adherence to instructions play crucial roles in ensuring compliance with the New Jersey Election Law Enforcement Commission's requirements.

Popular PDF Documents

Ez Pass Veterans Discount Nj - The Njdmava 24P form stands as a gateway for veterans to access proper burial honors, detailing prerequisites for interment in a state cemetery.

1040es Tax Form - The bottom portion of the form, specifically designated for tax remittance, is directed to be forwarded to the New Jersey Revenue Processing Center post-closing.