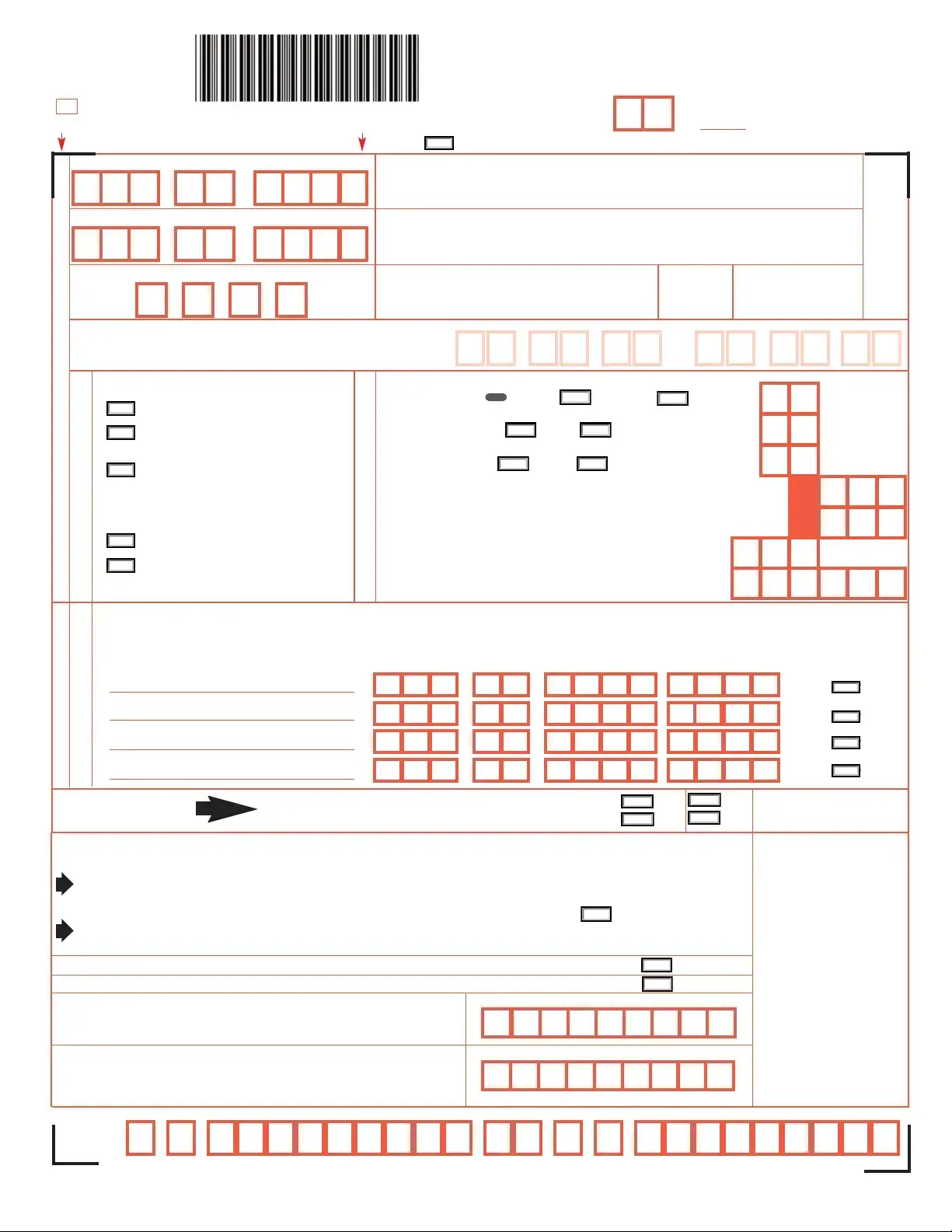

Fill Out a Valid Nj 1040 Template

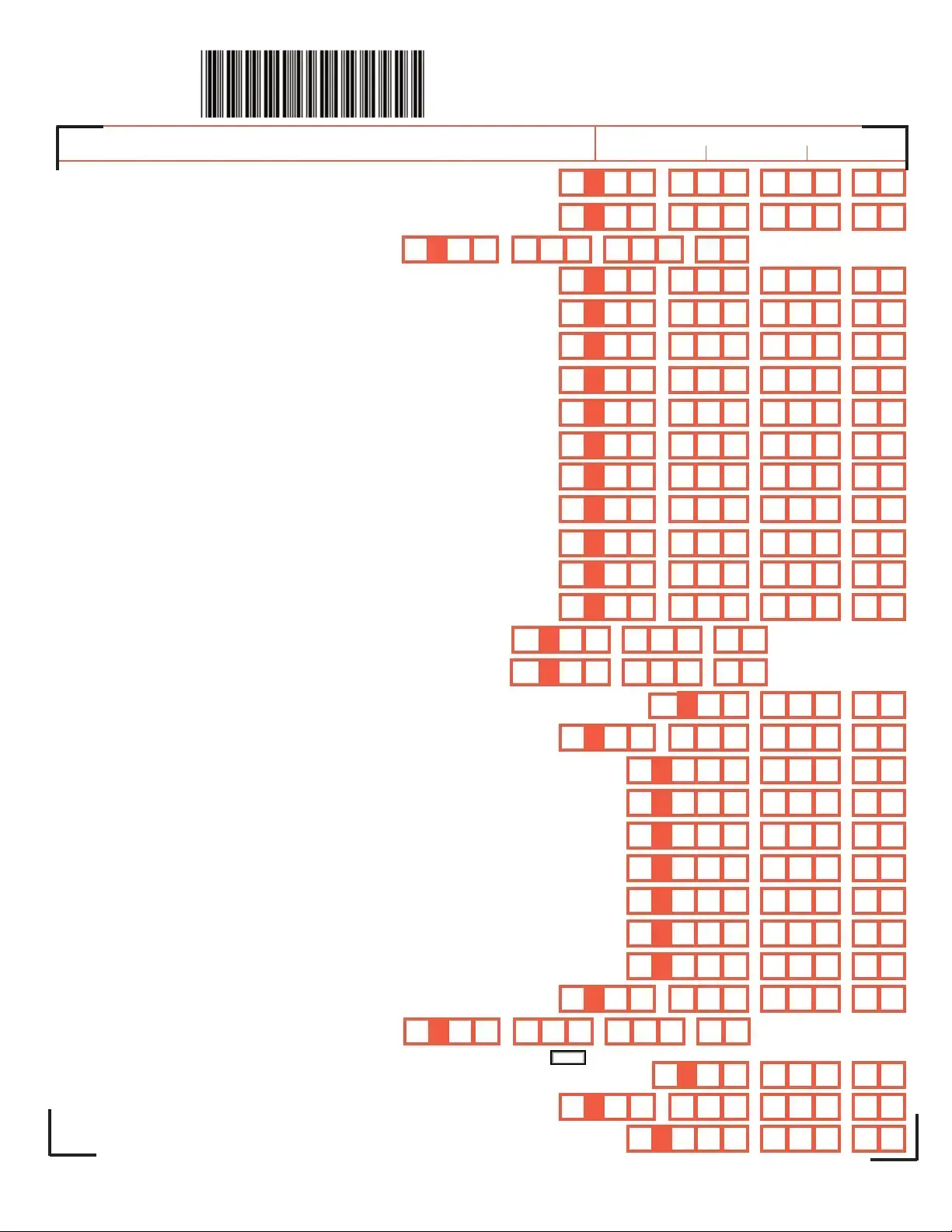

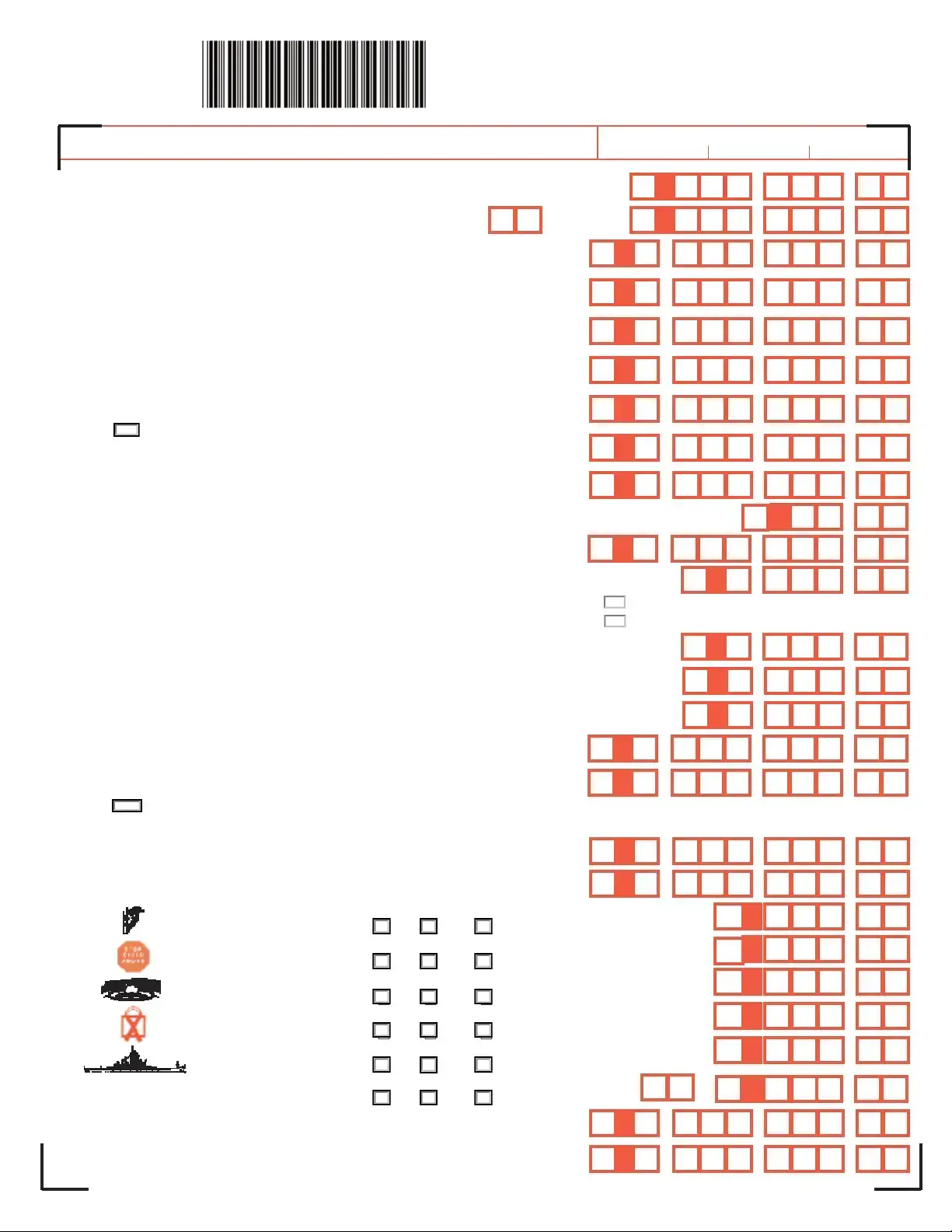

The NJ-1040 form represents an essential document for residents of New Jersey who need to file their state income tax returns. Covering the 2012 tax year, this form is designed for both individuals and joint filers to report their annual income, calculate taxes owed, or determine the refunds due. It accommodates various financial scenarios through sections for wages, interest income, dividends, business profits, property gains, pensions, annuities, and more, demonstrating its comprehensive nature to encompass a wide range of fiscal activities. Filers must provide personal details, including Social Security numbers and residency status, to ensure accurate processing and compliance with privacy regulations. The form’s structure also facilitates adjustments for exemptions, deductions, and credits, such as those for education, retirement income, medical expenses, and property taxes, allowing individuals to reduce their taxable income effectively. Furthermore, it incorporates provisions for those who wish to contribute to state funds, offering an opportunity to support causes like wildlife conservation, child abuse prevention, and cancer research directly through their filings. Finally, directives for payment or refund procedures underscore the state's efforts to streamline the tax filing process, highlighting options for electronic payments and specifying instructions for those expecting a refund or owing additional taxes. The inclusion of a gubernatorial elections fund contribution option further reflects New Jersey's engagement in fostering civic participation through tax filings.

Sample - Nj 1040 Form

Document Specifications

| Fact Name | Description |

|---|---|

| Form Type | NJ-1040 is the Income Tax-Resident Return form for New Jersey. |

| Applicability | Used by New Jersey residents to file their state income tax return. |

| Tax Year | Applicable for the tax year Jan.-Dec. 31, 2012, or for other fiscal years beginning in 2012. |

| Requirement | Must enter Social Security Numbers for the taxpayer and spouse/CU partner, if applicable. |

| Filing Status Options | Includes Single, Married/CU Couple filing jointly, Married/CU Partner filing separately, Head of household, and Qualifying widow(er)/Surviving CU Partner. |

| Exemptions and Deductions | Offers various exemptions including age, blindness or disability, dependents, and deductions such as medical expenses and alimony payments. |

| Income Reporting | Requires reporting of wages, interests, dividends, business profits, and other income types. |

| Gubernatorial Elections Fund | Offers option to designate $1 of taxes to the New Jersey Gubernatorial Elections Fund. |

| Signature Requirement | Must be signed by the taxpayer and spouse/CU partner if filing jointly. Preparer's signature is required if prepared by someone other than the taxpayer. |

| Payment Options | Payments can be made by check, money order, e-check, or credit card. |

| Governing Law | Governed by New Jersey state law, specifically Title 54 of the New Jersey Statutes Annotated (N.J.S.A.). |

Detailed Steps for Using Nj 1040

Filling out the NJ-1040 form is a necessary step for residents of New Jersey to comply with state tax laws. It's essential to accurately report income and calculate the correct amount of tax owed or determine the refund due. The process can be straightforward if approached methodically. Below are step-by-step instructions to guide you through this process.

- Start by gathering all necessary documents, including W-2 forms, 1099 forms, records of any other income, and information on deductions and credits you plan to claim.

- Enter your Social Security number, and if you're filing jointly, include your spouse's/CU partner's Social Security number as well.

- Fill in your full name, and if filing jointly, include your spouse's/CU partner's first name and initial. If your last names are different, enter both.

- Type your complete home address, including the apartment number or rural route, if applicable.

- Locate and fill in the county/municipality code by referring to the table provided in the instructions.

- Indicate your New Jersey residency status by filling in the dates of residency if you were only a part-time resident.

- Select your filing status from the options provided and mark the appropriate oval.

- Claim any exemptions for yourself, your spouse/CU partner, dependents, including those attending college, by entering the necessary numbers in the boxes provided.

- Fill in the dependent information section if applicable, providing names, Social Security numbers, birth years, and marking the health insurance status.

- Decide if you wish to contribute to the gubernatorial elections fund and mark your (and your spouse's/CU partner's, if joint filing) decision.

- Go through your income meticulously, entering amounts for wages, taxable and tax-exempt interest, dividends, net profits from business, and other income sources on the corresponding lines.

- Calculate and enter any applicable deductions, including medical expenses, alimony payments, and any contributions to retirement plans.

- Determine your New Jersey taxable income, total exemption amount, and taxable income after deductions.

- Calculate your tax based on the New Jersey tax tables or rate schedules.

- Include information on any payments already made, such as New Jersey income tax withheld, estimated tax payments, and credits for taxes paid to other jurisdictions.

- If you have an overpayment, decide how much, if any, you would like to apply to next year's taxes or other designated contributions.

- Review your form for accuracy. Ensure all necessary information is included and calculations are correct.

- Sign and date the form. If you're filing jointly, make sure both you and your spouse/CU partner sign.

- If enclosing a payment, write your Social Security number(s) on your check or money order, make it payable as instructed, and mail it with your form to the address provided.

- If you're due a refund or have no payment due, mail your form to the separate address listed for refunds.

By following these instructions, you can complete the NJ-1040 form accurately and ensure compliance with New Jersey tax requirements. Take your time to double-check your work before submission to minimize errors.

Learn More on Nj 1040

What is the NJ-1040 form used for?

The NJ-1040 is the form used by residents of New Jersey to file their state income tax return. It's necessary for reporting all the income you've earned over the tax year, calculating how much tax you owe to the state or determining how much of a refund you are entitled to receive. This includes wages, salaries, dividends, and interest income, among other types of income.

Who needs to file an NJ-1040 form?

Any New Jersey resident who received income during the tax year and meets the filing thresholds set by the state needs to file an NJ-1040 form. This applies even if you were not a resident for the entire year but earned income during the time you were a resident. Individuals with varied filing statuses, such as single, married filing jointly, married filing separately, head of household, or qualifying widow(er), should use this form to file their state taxes.

What information do I need to fill out the NJ-1040?

- Your Social Security Number and, if filing jointly, your spouse's or civil union partner's Social Security Number.

- Income information, including wages, salaries, interest, dividends, and any other income earned during the tax year.

- Deductions and credits you are eligible for, such as property taxes paid, medical expenses, or education credits.

- Your filing status and number of dependents.

- Details about your residency status for the tax year.

Can I file the NJ-1040 form online?

Yes, New Jersey allows residents to file their NJ-1040 form electronically through NJWebFile or through authorized electronic filing options available from various tax-preparation software providers. Filing online is recommended for faster processing, quicker refunds, and enhanced accuracy of tax return information.

What should I do if I need more time to file my NJ-1040?

If you need more time to gather your documents or for any other reason, you can request a federal extension, which also extends your state filing deadline. Remember to enclose the application for the extension or enter the confirmation number of your federal extension when you finally file your NJ-1040 form. However, it's important to note that an extension to file is not an extension to pay. If you owe taxes, you're expected to estimate and pay by the original due date to avoid possible penalties and interest for late payment.

Common mistakes

When completing the NJ 1040 form, individuals often encounter several pitfalls that can complicate the process or even result in errors. Understanding these common mistakes can help filers to avoid them and ensure their tax return is accurate. Here are six of the most common missteps:

- Incorrect Social Security Numbers: Providing wrong Social Security numbers for oneself, spouse, or dependents can cause significant processing delays and may affect tax calculations.

- Filing Status Errors: Choosing the wrong filing status can impact tax liability and the credits one is eligible for. It’s crucial to understand the criteria for each status.

- Income Reporting Missteps: Not reporting all taxable income, such as wages, dividends, or interest income, can result in incorrect tax calculations and potential penalties. Be sure to accurately report all income as required.

- Overlooking Credits and Deductions: Taxpayers often miss beneficial credits and deductions simply because they’re unaware of them. Thoroughly review which credits and deductions apply to ensure you’re not paying more tax than necessary.

- Mathematical Errors: Simple math mistakes can throw off your entire return. Double-check all calculations or consider using tax software to minimize errors.

- Incorrect Bank Account Information for Refunds: Entering wrong banking information for direct deposit refunds can delay access to your funds. Confirm all account details before submitting your return.

Avoiding these errors does not only speed up the processing of your return but also minimizes the chance of facing audits, penalties, and additional taxes due. Always review your tax return carefully before submission to ensure accuracy.

Documents used along the form

Filing the NJ-1040 form, which is the State of New Jersey Income Tax-Resident Return, is a comprehensive process that often requires additional documents and forms to accurately complete one's tax filing. These documents support or supplement the information provided in the NJ-1040 form, ensuring that taxpayers comply with the state's tax regulations and take advantage of eligible deductions and credits.

- W-2 Forms: Employers issue this form to report an employee's annual wages and the amount of taxes withheld from their paycheck. Taxpayers need this to fill out the wages, salaries, tips, and other compensations sections on their NJ-1040 form.

- Schedule NJ-BUS-1: This form is for reporting net profits from business operations. It’s particularly relevant for individuals who are self-employed or have income from business activities, as it helps detail the net profits or losses that need to be reported on the NJ-1040 form.

- Form NJ-2450: Used for claiming excess withholding of New Jersey Unemployment Insurance/Workforce Development Partnership Fund/Supplemental Workforce Fund, Disability Insurance, or Family Leave Insurance. This form is necessary if an individual has contributions in excess of the maximum yearly deduction.

- Schedule NJ-BUS-2: This schedule is for individuals who need to make adjustments to business income or losses reported on their tax return. It helps calculate the Alternative Business Calculation Adjustment for those who qualify, influencing the taxable income reported on the NJ-1040.

- Form 1099: This document reports miscellaneous income, such as income from self-employment, interest, dividends, rents, and fees. It's essential for accurately reporting various sources of income not covered by W-2 forms, which may affect the tax return.

The submission of the NJ-1040 form, along with the appropriate supplemental documents, is crucial for ensuring the accurate calculation of an individual's tax liability or refund. These documents serve as evidence of income, taxes paid, and eligibility for credits or deductions. It's important for taxpayers to carefully review their forms, schedules, and any additional required documentation to ensure compliance with New Jersey tax laws and to accurately determine their tax obligations or refunds. Proper completion and submission of these forms can significantly impact an individual's financial well-being.

Similar forms

The Federal IRS Form 1040 is similar to the NJ 1040 in that both are individual income tax return forms used to report annual income to the respective tax authority. While the NJ 1040 is specific to the state of New Jersey, capturing information about residents’ incomes, deductions, and credits that apply under state law, the IRS Form 1040 serves the same function at the federal level, collecting detailed income information and allowing for deductions and credits per federal guidelines. Both forms serve as the primary documents for individuals to calculate and report their income taxes, but for different jurisdictions.

Form W-2, Wage and Tax Statement, is another document that bears similarity to the NJ 1040, as it provides essential information required to fill out income tax returns, including the NJ 1040. Employers issue Form W-2 to employees detailing the annual wages paid and taxes withheld from their paycheck. This form is crucial for completing the NJ 1040 because it includes the state wages and tax information that taxpayers need to accurately report their income and calculate their tax liability or refund.

The NJ-1040-ES, Estimated Tax Voucher for Individuals, is related to the NJ 1040 in that it is used by individuals to pay estimated taxes on income not subject to withholding. This can include earnings from self-employment, interest, dividends, and other sources of income. Similar to the NJ 1040, which reconciles a taxpayer’s total annual income and tax liability, the NJ-1040-ES allows taxpayers to make payments towards their expected tax liability throughout the year.

Schedule NJ-BUS-1, Net Profits From Business, complements the NJ 1040 form by providing a detailed account of business income and expenses for individuals who operate a business or profession as a sole proprietorship or single-member LLC. This schedule is submitted along with the NJ 1040 and affects the total taxable income reported on the NJ 1040, highlighting their interconnectedness in reporting and calculating income derived from business operations.

The IRS Schedule C, Profit or Loss from Business, is akin to parts of the NJ 1040 that cater to self-employed individuals. Though Schedule C pertains to federal tax filings, it closely relates to NJ 1040 when a taxpayer needs to report income or loss from a business operated or a profession practiced as a sole proprietor. Both documents play integral roles in recording business operations’ financial outcomes, impacting the taxpayer’s income statement on both state and federal levels.

Form 1099, particularly the 1099-MISC and 1099-NEC, are documents that, like the W-2, provide vital income information necessary for completing the NJ 1040. These forms report miscellaneous income and non-employee compensation respectively, covering income sources such as freelance, contract work, and other income that’s not from an employer. Taxpayers use the information from these forms to accurately report their income on the NJ 1040, particularly in sections regarding additional income and business profits.

The NJ-2450, Employee’s Claim for Credit for Excess UI/WF/SWF, or Disability Insurance, resembles the NJ 1040 in its function to adjust a taxpayer’s liability based on specific contributions or taxes already paid. While the NJ 1040 reconciles annual income and calculates the taxpayer's liability or refund, Form NJ-2450 allows employees to claim a credit against their income tax for any overpayment of certain New Jersey workforce taxes, directly impacting the tax due or refund amount on their NJ 1040.

Schedule A (Form 1040), Itemized Deductions from the IRS, and the deduction sections within the NJ 1040 share similarities in purpose and process. Both allow taxpayers to subtract certain qualified expenses from their taxable income, potentially lowering the amount of tax owed. Though Schedule A impacts the federal tax return and the NJ 1040 influences state tax liability, each serves to facilitate the taxpayer’s ability to itemize deductions like medical expenses, charitable contributions, and taxes paid.

The Property Tax Credit Application (NJ-1040-H) is a specific document related to the NJ 1040, aimed at New Jersey residents who seek to claim a credit for property taxes paid on their principal residence. This form is directly related to a section on the NJ 1040 where taxpayers can reduce their tax liability through a property tax credit. Both the NJ 1040 and the NJ-1040-H engage directly in adjusting taxpayers' liability, reflecting their interconnected roles in ensuring tax advantages are properly applied.

The IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, shares a procedural similarity with the NJ 1040 in the context of tax filing deadlines. While Form 4868 pertains to extending the deadline for filing a federal tax return, the NJ 1040 includes options for taxpayers who have obtained a federal extension, thereby harmonizing the process across both federal and state levels. Taxpayers indicate on their NJ 1040 that a federal extension has been granted, affecting the submission timeline for their state income tax return.

Dos and Don'ts

When you're getting ready to fill out your NJ-1040 Form, there are some important do's and don'ts to keep in mind. These tips can save you time and help avoid common mistakes:

- Do verify your Social Security Number and any other SSNs on your form. Incorrect numbers can delay processing.

- Do make sure you accurately report all income, including wages, interest, and dividends, on the appropriate lines.

- Do take advantage of the deductions and credits you're eligible for to reduce your taxable income. Check the instructions for things like property tax deductions.

- Do choose direct deposit for your refund to receive it quicker.

- Don't forget to sign and date your return. If you're filing jointly, both spouses need to sign.

- Don't leave any relevant fields blank. If a particular situation doesn't apply to you, enter "0" or "not applicable".

- Don't neglect to attach all required documents, such as your W-2s, and any other schedules that support your entries.

- Don't miss the filing deadline. Late submissions can result in penalties and interest charges.

Remember, accuracy and attention to detail can save you from headaches down the road. Taking the time to review your NJ-1040 form thoroughly before submitting can help ensure a smoother process.

Misconceptions

Filing taxes can feel daunting, with forms like the NJ-1040 adding to the confusion. However, understanding the truth behind some common misconceptions can make the process smoother. Let's debunk a few myths about the NJ-1040 form.

- Myth #1: Only full-year residents need to file the NJ-1040. Actually, both full-year and part-year residents might need to file this form, depending on their income and residency status during the tax year.

- Myth #2: You can skip the SSN fields if you're worried about privacy. Your Social Security Number (SSN) is a mandatory field on the NJ-1040 form. This information is crucial for identity verification and tax processing purposes.

- Myth #3: Filing a joint return is always the best choice for married couples. While many married couples benefit from filing jointly, some find greater tax savings by filing separately, depending on their individual incomes and deductions.

- Myth #4: The "Gubernatorial Elections Fund" contribution increases your tax or reduces your refund. Opting to contribute $1 to this fund doesn't affect your tax owed or refund amount. It's simply a way to allocate a dollar of your already calculated taxes to this cause.

- Myth #5: You must manually calculate your NJ Taxable Income. While you should understand how your taxable income is determined, the form and accompanying instructions provide clear steps and worksheets to help you calculate this figure.

- Myth #6: Direct deposit is only for refunds. While the NJ-1040 form primarily discusses direct deposit in the context of refunds, taxpayers can also make payments via electronic funds transfer (EFT), though this is managed through separate processes, not directly on the NJ-1040.

- Myth #7: You can't make charitable contributions through your tax return. The NJ-1040 allows taxpayers to make contributions to several designated funds, thus enabling charitable giving directly through the tax return.

- Myth #8: Preparers must fill out the NJ-1040 by hand for it to be official. Many professional preparers use software that fills out the NJ-1040 electronically, improving accuracy and efficiency. Whether filled out by hand or electronically, the key is ensuring the return is complete and accurate.

By clearing up these misconceptions, taxpayers can approach their NJ-1040 forms with more confidence and understanding.

Key takeaways

When filling out and using the NJ-1040 form for state income tax filing in New Jersey, there are several key takeaways to consider:

- It is essential to correctly enter all Social Security Numbers (SSNs) on the form. This is crucial for both the taxpayer and, if applicable, the spouse or Civil Union (CU) partner. Accurate inclusion of these numbers ensures that the tax return is processed correctly and efficiently.

- The NJ-1040 form accommodates various filing statuses and exemptions. Taxpayers should carefully select their status — such as single, married/CU couple filing jointly, or head of household — and accurately claim exemptions for dependents, age, blindness, or disability to accurately determine their tax liability or refund.

- For residents who were only part-year residents of New Jersey, the form requires specific dates of residency. This information affects how income is taxed and what portion of the income is subject to New Jersey state taxes.

- The form includes sections for declaring all sources of income, including wages, taxable and tax-exempt interest, dividends, business profits, and more. Accurately reporting all income is necessary to comply with state tax laws and calculate the correct tax owed.

Moreover, the NJ-1040 form provides opportunities for taxpayers to claim deductions and credits which can reduce their taxable income or directly decrease their tax liability. These include deductions for medical expenses, property taxes, and exemptions for pensions, among others. Taxpayers should review all possible deductions and credits to which they are entitled to ensure they are not overpaying on their taxes.

Overall, accurate and thorough completion of the NJ-1040 form is critical to comply with New Jersey tax laws and to ensure the correct tax amount is paid or refunded. Taxpayers should carefully review all instructions associated with the form and consider consulting a tax professional if they have questions or need assistance.

Popular PDF Documents

Nj Sales and Use Tax Quarterly Return - The integration of payment and filing into one online platform simplifies the tax return process, saving time and reducing errors.

Nj Family Court Forms - This form also aids in filing cross-motions, allowing individuals to respond to motions filed against them in ongoing cases.

Can an S Corp Be an Llc - Provides a pathway for corporations to align past tax filings with the benefits of an S Corporation designation in New Jersey.