Fill Out a Valid Nj 1040Nr Template

Filing tax returns can often feel like navigating a complex labyrinth, designed with challenge after challenge. For those who have spent time in New Jersey but aren't full-time residents, this journey involves a special map: the NJ-1040NR form. Knowing the intricacies of this document is crucial for nonresidents who have earned income from New Jersey sources during the 2021 tax year, running from January 1, 2021, to December 31, 2021, or another tax year beginning in 2021 and ending in 2022. From wages and salaries to dividends and even gambling winnings, this form encompasses a range of income types. It also covers various deductions and credits potentially available, such as the Pension/Retirement Exclusion and the Sheltered Workshop Tax Credit, aiming to provide an accurate picture of the tax responsibilities. Moreover, for those who need it, it includes the option to designate a portion of their taxes to funds like the N.J. Endangered Wildlife Fund. Whether submitting an original return, amending a previous submission, or accounting for taxes on gifts, the NJ-1040NR is a significant step in complying with New Jersey’s tax requirements, offering a pathway for nonresidents to fulfill their obligations systematically. Understanding each section, from personal exemptions to allocations of business income to New Jersey sources, ensures the process is completed efficiently and correctly.

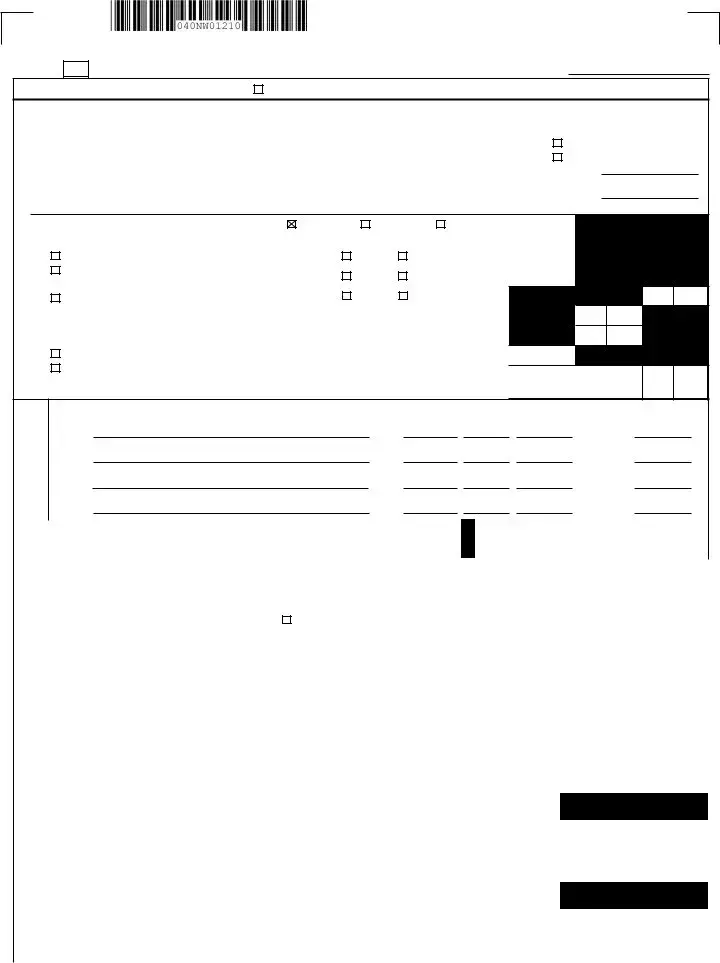

Sample - Nj 1040Nr Form

2021

New Jersey Nonresident For Tax Year January 1, 2021 – December 31, 2021

Income Tax Return |

Or Other Tax Year Beginning |

|

, 2021 |

|

|||

|

Ending |

|

, 2022 |

Check box |

|

if application for federal extension is attached or enter |

confirmation number

Check box if this is an amended return

INSTRUCTIONSSEE |

Your Social Security Number |

|

Last Name, First Name, and Initial (Joint filers enter first name and initial of each. |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

Enter spouse/CU partner last name only if different.) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/CU Partner’s Social Security Number |

|

Home Address (Number and Street, incl. apt. # or rural route) |

Change of address |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign address |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of Residency (outside NJ) |

|

City, Town, Post Office |

|

|

|

State |

ZIP Code |

|

|

|

||||||

NOTIFICATIONACTPRIVACY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status |

EXEMPTIONS |

6. Regular |

Yourself |

Spouse/ |

Domestic |

|

|

|

|||||||

|

|

|

|

CU Partner |

Partner |

6. |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

(Check only ONE box) |

|

|

|

|

|

|

||||||||

|

1. |

Single |

|

|

7. Age 65 or over |

Yourself |

Spouse/CU Partner |

7. |

|

|

|||||||

|

2. |

Married/CU Couple, |

|

|

8. Blind or Disabled |

Yourself |

Spouse/CU Partner |

8. |

|

|

|||||||

|

|

|

filing joint return |

|

|

|

|

||||||||||

|

3. |

|

|

9. Veteran Exemption |

Yourself |

Spouse/CU Partner |

|

|

|

||||||||

|

Married/CU Partner, |

|

|

|

|

|

|||||||||||

|

|

|

filing separate return |

|

|

10. Number of your qualified dependent children |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

11. Number of other dependents |

|

|

|

|

|

|||

|

|

|

Name and SSN of Spouse/CU Partner |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

4. |

Head of Household |

|

|

12. Dependents attending colleges (See Instructions) |

12. |

|

|

|||||||||

FOR |

5. |

Qualifying Widow(er)/ |

|

|

13. For line 13a – Add lines 6, 7, 8, and 12. For line 13b – Add |

|

|

|

|||||||||

|

|

Surviving CU Partner |

|

|

|

|

|

||||||||||

|

|

|

|

lines 10 and 11. For line 13c – Enter amount from line 9. |

13a. |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

NJ RESIDENCY STATUS If you were a New Jersey resident for ANY part of the tax year, give the period of New Jersey residency.

From

MONTH DAY YEAR

To

MONTH DAY YEAR

9.

10.

11.

12c

13b. |

13c. |

|

|

DEPENDENT INFORMATION

14.Dependent’s Last Name, First Name, Middle Initial a

b c d

Dependent’s Social Security Number |

Birth Year |

/ /

/ /

/ /

/ /

|

GUBERNATORIAL |

Do you want to designate $1 of your taxes for this fund? If joint |

|

Yes |

|

|

|

No |

|

Note: If you check the “Yes” box(es), it |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

will not increase your tax or reduce your |

|

|||||||||||||||||||||||||||

|

ELECTIONS FUND |

return, does your spouse/CU partner want to designate $1? |

|

Yes |

|

|

|

No |

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

refund. |

|

|

|

|

|

||||||||||||||||||||||||||

|

Driver’s License # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

(Column A) |

|

|

|

(Column B) |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of Gross Income |

Amount From New Jersey |

|

||||||||||||||

|

(Voluntary) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Everywhere) |

|

|

|

Sources |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Wages, salaries, tips, and other employee compensation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

Check box if you completed lines 68 through 74 |

15. |

|

|

|

|

|

|

|

15. |

|

|

|

|

|||||||||||||||||||||

|

16. |

Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

|

|

|

|

|

|

|

16. |

|

|

|

|

||||

|

17. |

Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

|

|

|

|

|

|

|

17. |

|

|

|

|

||||

|

18. |

Net profits from business (Schedule |

18. |

|

|

|

|

|

|

|

18. |

|

|

|

|

||||||||||||||||||||||

|

19. |

Net gains or income from disposition of property (From line 67) |

19. |

|

|

|

|

|

|

|

19. |

|

|

|

|

||||||||||||||||||||||

|

20. |

Net gains or income from rents, royalties, patents, and copyrights (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

20. |

|

|

|

|

|

|

|

20. |

|

|

|

|

||||||||||||||||||||||

|

21. |

Net gambling winnings (See Instructions) |

21. |

|

|

|

|

|

|

|

21. |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

22. Taxable pensions, annuities, and IRA distributions/withdrawals |

22. |

|

|

|

|

|

|

|

22 |

|

||||||||||||||||||||||||||

|

23. |

Distributive Share of Partnership Income (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

Part III, line 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

|

|

|

|

|

|

|

23. |

|

|

|

|

|||

|

24. |

Net pro rata share of S Corporation Income (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

line 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. |

|

|

|

|

|

|

|

24. |

|

|

|

|

|||

|

25. Alimony and separate maintenance payments received |

25. |

|

|

|

|

|

|

|

25 |

|

||||||||||||||||||||||||||

|

26. |

Other – State Nature and Source |

..................... |

26. |

|

|

|

|

|

|

|

26. |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

Total Income (Add lines 15 through 26) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

27. |

27. |

|

|

|

|

|

|

|

27. |

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

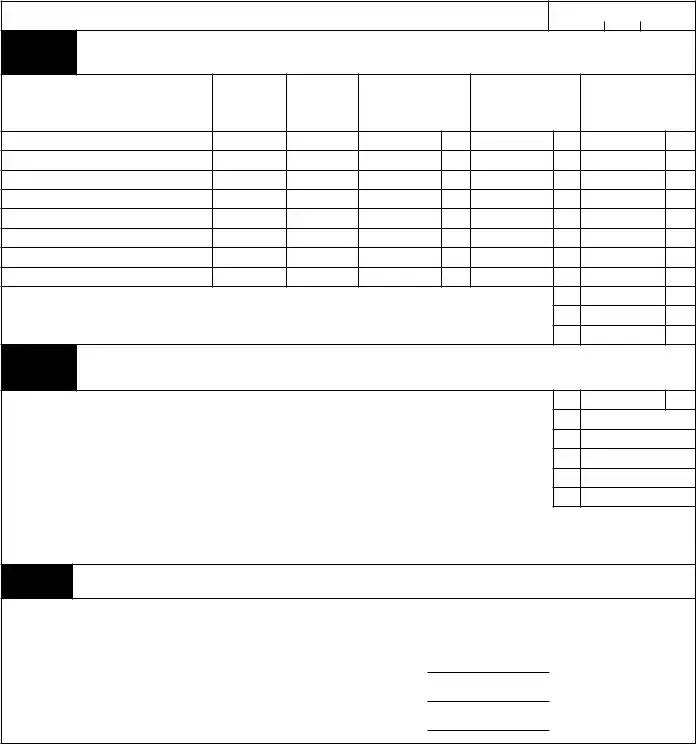

Name(s) as shown on Form |

Your Social Security Number |

|

28a. |

.............................................Pension/Retirement Exclusion (See Instructions) |

|

|

|

|

28a. |

|

|

|

|

|

|

|

|

||||||

|

28b. |

Other Retirement Income Exclusion (See Worksheet and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Instructions) |

|

|

|

|

|

|

|

|

28b. |

|

|

|

28b. |

|

|

|

|

|

|

28c. Total Exclusion Amount (Add line 28a and line 28b) |

|

|

|

|

28c. |

|

|

|

28c. |

|

|

|

|

|||||||

|

29. |

Gross Income (Subtract line 28c from line 27) |

|

|

|

|

|

|

|

29. |

|

|

|

29. |

|

|

|

|

|||

|

30. |

Total Exemption Amount (See Instructions) |

|

|

|

|

|

|

|

30. |

|

|

|

|

|

|

|

|

|||

|

31. |

Medical Expenses (See Worksheet and Instructions) |

|

|

|

|

31. |

|

|

|

|

|

|

|

|

||||||

|

32. Alimony and separate maintenance payments |

................................................. |

|

|

|

|

|

|

32. |

|

|

|

|

|

|

|

|

||||

|

33. |

Qualified Conservation Contribution |

|

|

|

|

|

|

|

33. |

|

|

|

|

|

|

|

|

|||

|

34. |

Health Enterprise Zone Deduction |

|

|

|

|

|

|

|

34. |

|

|

|

|

|

|

|

|

|||

|

35. Alternative Business Calculation Adjustment (Schedule |

35. |

|

|

|

|

|

|

|

|

|||||||||||

|

36. |

Organ/Bone Marrow Donation Deduction (See instructions) |

36. |

|

|

|

|

|

|

|

|

||||||||||

|

37. |

Total Exemptions and Deductions (Add lines 30 through 36) |

37. |

|

|

|

|

|

|

|

|

||||||||||

|

38. |

..............................Taxable Income (Subtract line 37 from line 29, column A) |

|

|

|

|

38. |

|

|

|

|

|

|

|

|

||||||

|

39. |

Tax on amount on line 38 (From Tax Table) |

|

|

|

|

|

|

|

39. |

|

|

|

|

|

|

|

|

|||

|

40. |

Income Percentage |

B. (line 29) |

= |

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

A. (line 29) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41. |

New Jersey Tax (Multiply amount from line 39 |

|

|

x |

|

% from line 40) |

41. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

42. |

Sheltered Workshop Tax Credit (Enclose |

|

|

|

|

42. |

|

|

|

|

||||||||||

|

43. |

Gold Star Family Counseling Credit (See Instructions) |

|

|

|

|

|

|

|

|

43. |

|

|

|

|

||||||

|

44. |

Credit for Employer of Organ/Bone Marrow Donor (See instructions) |

|

|

|

|

44. |

|

|

|

|

||||||||||

|

45. |

Total Credits (Add lines 42, 43, and 44) |

|

|

|

|

|

|

|

|

|

|

|

45. |

|

|

|

|

|||

|

46. |

Balance of Tax After Credits (Subtract line 45 from line 41) |

|

|

|

|

|

|

|

|

46. |

|

|

|

|

||||||

|

47. |

Penalty for Underpayment of Estimated Tax. Check box |

if Form |

47. |

|

|

|

|

|||||||||||||

|

48. |

Total Tax and Penalty (Add line 46 and line 47) |

|

|

|

|

|

|

|

|

48. |

|

|

|

|

||||||

|

49. Total New Jersey Income Tax Withheld (From enclosed Forms |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

1099) |

|

|

|

|

|

|

|

49. |

|

|

|

Also enter on line 50: |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

50. |

New Jersey Estimated Tax Payments/Credit from 2020 return |

|

50. |

|

|

|

• Payments made in con- |

|

||||||||||||

|

|

|

|

nection with sale of NJ real |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

property |

|

|||

|

51. |

Tax paid on your behalf by Partnership(s) |

|

|

|

|

|

|

|

51. |

|

|

|

• Payments by S corporation |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for nonresident shareholder |

|

|||

|

52. |

Excess NJ UI/WF/SWF Withheld (Enclose Form |

|

|

|

|

|

52. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

53. |

Excess NJ Disability Insurance Withheld (Enclose Form |

53. |

|

|

|

|

|

|

|

|

||||||||||

|

54. |

Excess NJ Family Leave Insurance Withheld (Enclose Form |

54. |

|

|

|

|

|

|

|

|

||||||||||

|

55. |

55. |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name(s) as shown on Form |

Your Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

..............................................................................................56. Total Payments/Credits (Add lines 49 through 55) |

|

|

|

|

|

|

56. |

|

|

|

|

|||||||||

57. If line 56 is less than line 48, you have tax due. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Subtract line 56 from line 48 and enter the amount you owe |

|

|

|

|

|

57. |

|

|

|

|

|||||||||

|

If you owe tax, you can still make a donation on lines 60A through 60F. |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

58. If line 56 is more than line 48, you have an overpayment. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Subtract line 48 from line 56 and enter the overpayment |

|

|

|

|

|

|

58. |

|

|

|

|

||||||||

59. Amount from line 58 you want to credit to your 2022 tax |

|

|

|

|

|

|

59. |

|

|

|

|

|||||||||

60. Amount you want to credit to: |

|

|

|

|

|

|

|

|

|

NOTE: |

||||||||||

|

|

|

|

|

|

|

|

|

An entry on lines 59 through |

|||||||||||

|

(A) N.J. Endangered Wildlife Fund |

$10, |

$20, |

Other |

|

60A. |

|

|

|

60F will reduce your tax refund |

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

(B) N.J. Children’s Trust Fund |

$10, |

$20, |

Other |

|

60B. |

|

|

|

|

|

|

|

|

||||||

|

(C) N.J. Vietnam Veterans’ Memorial Fund |

$10, |

$20, |

Other |

|

60C. |

|

|

|

|

|

|

|

|

||||||

|

(D) N.J. Breast Cancer Research Fund |

$10, |

$20, |

Other |

|

60D. |

|

|

|

|

|

|

|

|

||||||

|

(E) U.S.S. N.J. Educational Museum Fund |

$10, |

$20, |

Other |

|

60E. |

|

|

|

|

|

|

|

|

||||||

|

(F) Designated Contribution |

|

|

|

$10, |

$20, |

Other |

|

60F. |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

61. Total Adjustments to Tax Due/Overpayment (Add lines 59 through 60F) |

|

|

|

|

61. |

|

|

|

|

|||||||||||

62. Balance due (If line 57 is more than zero, add line 57 and line 61) |

|

|

|

|

|

62. |

|

|

|

|

||||||||||

63. Refund amount (If line 58 is more than zero, subtract line 61 from line 58) |

|

|

|

|

63. |

|

|

|

|

|||||||||||

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my |

Pay amount on line 62 in |

||||||||||||||||||

|

knowledge and belief, it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all information of |

full. Write Social Security |

||||||||||||||||||

|

which the preparer has any knowledge. |

|

|

|

|

|

|

|

|

|

number(s) on check or money |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

order and make payable to: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of New Jersey – TGI |

||||

HERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Division of Taxation |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue Processing Center |

|||||

|

|

Your Signature |

Date |

Spouse’s/CU Partner’s Signature (if filing jointly, BOTH must sign) |

||||||||||||||||

|

|

PO Box 244 |

||||||||||||||||||

|

|

|

||||||||||||||||||

|

If enclosing copy of death certificate for deceased taxpayer, check box (See instructions) |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

Trenton, NJ |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

SIGN |

I authorize the Division of Taxation to discuss my return and enclosures with my preparer (below) |

You can also make a |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

payment on our website: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

nj.gov/taxation. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid Preparer’s Signature |

|

|

|

|

Federal Identification Number |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Firm’s name |

|

|

|

Firm’s Federal Employer Identification Number |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Division 1 |

|

2 |

|

3 |

|

4 |

|

5 |

|

6 |

|

7 |

|

8 |

Use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name(s) as shown on Form

Your Social Security Number

Part I

Net Gains or Income From Disposition of Property

List the net gains or income, less net loss, derived from the sale, exchange, or other disposition of property including real or personal whether tangible or intangible as reported on federal Schedule D.

|

(b) Date |

|

|

(e) Cost or other |

|

|

(a) Kind of property and description |

(c) Date sold |

(d) Gross sales price |

basis as adjusted |

(f) Gain or (loss) |

||

aquired |

||||||

(Mo., day, yr.) |

(see instructions) |

(d less e) |

||||

|

(Mo., day, yr.) |

|

||||

|

|

|

and expense of sale |

|

||

|

|

|

|

|

64.

65.Capital Gains Distribution.......................................................................................................................................

66.Other Net Gains.....................................................................................................................................................

67.Net Gains (Add lines 64, 65, and 66) (Enter here and on line 19) (If loss, enter zero)..........................................

65.

66.

67.

Part II

Allocation of Wage and Salary |

(See instructions if compensation depends entirely on volume of business |

|

Income Earned Partly Inside and |

||

transacted or if other basis of allocation is used.) |

||

Outside New Jersey |

||

|

68.Amount reported on line 15 in column A required to be allocated...........................................................................

69.Total days in taxable year........................................................................................................................................

70.Deduct nonworking days (Sundays, Saturdays, holidays, sick leave, vacation, etc.).............................................

71.Total days worked in taxable year (subtract line 70 from line 69) ..........................................................................

72.Deduct days worked outside New Jersey...............................................................................................................

73.Days worked in New Jersey (subtract line 72 from line 71)....................................................................................

68.

69.

70.

71.

72.

73.

74. Allocation Formula |

(Line 73) |

x |

|

= |

|

(Include this amount on |

|

(Line 71) |

|

(Enter amount from line 68) |

(Salary earned inside N.J.) line 15, col. B) |

||

Part III

Allocation of Business |

(See instructions if other than Formula Basis of allocation is used.) |

|

Income to New Jersey |

||

|

Business Allocation Percentage (From Schedule

Enter below the line number and amount of each item of business income reported in column A that is required to be allocated and multiply by allocation percentage to determine amount of income from New Jersey sources.

From Line No. |

|

|

$ |

|

|

x |

|

% = $ |

|||

|

|

|

|

||||||||

From Line No. |

|

|

$ |

|

|

x |

|

% |

= |

$ |

|

From Line No. |

|

|

$ |

|

|

x |

|

% |

= |

$ |

|

Document Specifications

| Fact Name | Description |

|---|---|

| Form Type | NJ-1040NR is an income tax return form for nonresidents of New Jersey. |

| Tax Year | The form is relevant for the tax year from January 1, 2021, to December 31, 2021, or for other specified periods beginning in 2021 and ending in 2022. |

| Extension and Amendment | Taxpayers can indicate if a federal extension was filed or if this is an amended return. |

| Income Report Requirements | The form requires detailed reporting of various types of income from both New Jersey sources and other sources, including wages, interest, dividends, and business profits. |

| Residency and Income Allocation | Nonresidents must allocate income earned inside and outside of New Jersey and may only be taxed by New Jersey on income from New jersey sources, according to specific allocation formulas provided in the instructions. |

Detailed Steps for Using Nj 1040Nr

After receiving the NJ-1040NR form, it's important to gather all necessary documentation including your Social Security number, any W-2 forms, and information related to income, deductions, and credits before starting to fill out the form. This paperwork will give you most of the information needed to complete the form correctly. Remember to be thorough and double-check your data to ensure accuracy and avoid potential issues with your tax return. Here are the steps to complete the form:

- Write your Social Security Number, full name, and address at the top of the form.

- If filing jointly, include your spouse's or civil union partner's Social Security Number and last name (if different).

- Select your filing status by checking the appropriate box.

- Fill in information about your exemptions, including yourself, spouse/CU partner, dependents, and any qualifications for age, blindness, disability, or veteran exemption.

- Detail your New Jersey residency status, including dates if you were a part-year resident.

- Provide dependent information as requested.

- Decide whether you want to contribute to the Gubernatorial Elections Fund for yourself and, if filing jointly, for your spouse/CU partner.

- Report your income in the sections provided, including wages, interest, dividends, and any other applicable income types, for both New Jersey sources and all income from everywhere.

- Subtract any exclusions you're eligible for from your total income to calculate your gross income.

- Calculate your total exemption amount and list any eligible deductions including medical expenses, alimony payments, conservation contributions, and other specific deductions allowed under New Jersey law.

- Subtract your total exemptions and deductions from your gross income to find your taxable income.

- Use the tax tables or instructions provided to calculate the tax on your taxable income.

- Calculate your New Jersey Tax based on the percentage of income earned in New Jersey.

- Fill in any applicable credits you're eligible for, including Sheltered Workshop tax credit, Gold Star Family counseling credit, and others that may apply.

- Determine your balance of tax after credits, and then calculate any underpayment penalty if applicable.

- Report your New Jersey income tax withheld, estimated tax payments, and any credits from the previous year.

- Calculate your total payments and credit to see if you owe additional taxes or if you have an overpayment to be refunded.

- If you owe tax, decide if you want to make a voluntary contribution to any of the funds listed.

- Sign and date the form. If you're filing jointly, both you and your spouse/CU partner need to sign.

- Review the form one last rime to ensure all information is accurate and complete, then mail it to the provided address or submit it online if that option is available.

Making sure everything is accurate and submitting your form on time will help avoid processing delays or potential penalties. Assistance from a professional may be beneficial if you have complex tax situations or need guidance on specific deductions or credits.

Learn More on Nj 1040Nr

What is the NJ-1040NR form?

The NJ-1040NR form is the New Jersey Non-Resident Income Tax Return. It is designed for individuals who are not residents of New Jersey but have earned income from New Jersey sources during the tax year. This form allows non-residents to file their New Jersey state taxes.

Who needs to file the NJ-1040NR?

Individuals who are not New Jersey residents but have received income from New Jersey sources within the given tax year are required to file the NJ-1040NR. This includes, but is not limited to, wages, business income, or property sales within the state.

Can I file the NJ-1040NR electronically?

Yes, the NJ-1040NR can be filed electronically through the New Jersey Division of Taxation's website or through approved software. Filing electronically is faster and reduces the risk of errors.

What income should be reported on the NJ-1040NR?

All income earned from New Jersey sources during the tax year should be reported on the NJ-1040NR. This includes:

- Wages, salaries, tips, and other compensation for services performed in New Jersey.

- Income from a business, trade, profession, or partnership conducted in New Jersey.

- Net gains from the disposition of property located in New Jersey.

- Other types of income that are sourced to New Jersey.

What are the key sections of the NJ-1040NR?

The NJ-1040NR consists of several sections, including:

- Filer's information and residency status.

- Income from New Jersey sources.

- Calculations for deductions, exemptions, and taxable income.

- Tax calculations, credits, and payments.

- Contributions to New Jersey charitable funds (optional).

- Signature and preparer information.

How do I calculate the tax on my New Jersey source income?

Tax on New Jersey source income is calculated by applying the appropriate tax rates to your taxable income from New Jersey sources. You will need to refer to the tax table supplied with the NJ-1040NR instructions to determine the tax owed based on your taxable income.

Are there any deductions or credits available for non-residents on the NJ-1040NR?

Non-residents may be eligible for certain deductions and credits on the NJ-1040NR, such as:

- Medical expenses deduction.

- Alimony and separate maintenance payments deduction.

- Credits for taxes paid to other states.

- Certain New Jersey specific credits related to contributions and business activities.

What should I do if I need more time to file my NJ-1040NR?

If you need more time to file your NJ-1040NR, you may apply for a federal extension, which also extends your New Jersey filing due date. Make sure to check the applicable box on the NJ-1040NR form and, if required, attach your federal extension confirmation. It's important to note that an extension of time to file is not an extension of time to pay any tax due.

Common mistakes

Filling out tax forms can be tricky, especially when dealing with the NJ-1040NR form. Here are seven common mistakes that people often make during the process:

- Incorrect Social Security Number: It's crucial to double-check the Social Security Numbers (SSNs) entered. An incorrect SSN can delay the processing of your return and any refunds due.

- Filing Status Errors: The choice of filing status affects your tax liability significantly. Make sure you select the one that correctly reflects your situation to avoid paying more than necessary or facing penalties.

- Overlooking Income Sources: All income from New Jersey sources needs to be reported. Missing something like dividends, net gains, or business income can result in an inaccurate return.

- Incorrect Deductions and Exemptions: Knowing what deductions and exemptions you're entitled to can be confusing. It’s easy to claim incorrect amounts, which could either cost you money or trigger an audit.

- Allocation Errors: For those who earned income both inside and outside New Jersey, accurately allocating that income is essential. Messing up this calculation will impact the tax assessed.

- Forgetting to Sign: An unsigned tax return is like an unsigned check – it's not valid. Both you and your spouse or CU partner need to sign if filing jointly.

- Missing Attachments: Failing to attach required documents, such as W-2s or the documentation for credits and exemptions claimed, can result in processing delays or denials of certain claims.

Avoiding these common pitfalls can help ensure that your NJ-1040NR form is correctly filled out, which can lead to a smoother process when filing your nonresident income tax return.

Documents used along the form

Filing tax returns can sometimes feel overwhelming due to the numerous forms and documents involved in the process, especially for those filing the NJ-1040NR form, New Jersey's Nonresident Income Tax Return. To simplify this process, it's helpful to understand other forms and supporting documents often used alongside the NJ-1040NR, each playing a critical role in ensuring compliance and maximizing potential refunds or minimizing tax liabilities.

- Schedule NJ-BUS-1: This form details net profits from a business, essential for nonresidents who operated or were partners in a business within New Jersey.

- Schedule NJ-BUS-2: Required when making adjustments for Alternative Business Calculation. It supports the main form by detailing certain computations that affect the nonresident's taxable income.

- Form NJ-2450: Used for claiming Excess NJ UI/WF/SWF, Disability, and Family Leave Insurance. It's necessary for those who had excessive withholdings and wish to claim a refund.

- Form NJ-2210NR: For nonresidents who need to calculate penalties for underpayment of estimated taxes, ensuring they're not penalized for failing to pay enough tax throughout the year.

- Schedule NJ-BUS-1, Part III and IV: These sections report distributive share of partnership income and S Corporation income, respectively, providing a breakdown of income from these sources for proper tax calculation.

- Form W-2: Wage and tax statements received from employers that show the amount of taxes withheld from a paycheck. It is crucial for reporting earnings and taxes paid.

- Form 1099: A series of documents that report various types of income other than wages, salaries, and tips. Especially relevant for reporting interest, dividends, independent contractor income, and other earnings.

- Form GIT-317: A document for claiming Sheltered Workshop Tax Credit, applicable to businesses employing individuals with disabilities.

- Federal Extension Application: If a federal extension was filed, attaching a copy or entering the confirmation number on the NJ-1040NR form is necessary.

- Payment Vouchers (NJ-1040NR-V): Used when submitting payments. Essential for those who owe tax and are making a payment by check or money order.

Understanding and organizing these forms is vital for a smooth tax filing experience. Each document has specific instructions and criteria that must be met, so reviewing them closely ensures accuracy and compliance with New Jersey tax laws. Though this list is not exhaustive, it covers many of the primary documents that accompany the NJ-1040NR form. When preparing to file, having these forms ready can streamline the process, making it more manageable and less time-consuming.

Similar forms

The Form NJ-1040 is a document that closely relates to the NJ-1040NR, focusing primarily on the tax responsibilities for New Jersey residents. While the NJ-1040NR caters to nonresidents, the NJ-1040 includes similar sections such as income reporting, deductions, and credits, but tailored for residents who have spent the entire year within New Jersey. Both forms delve into the complexities of tax calculations, exemptions, and potential credits, while also considering various income sources including wages, interest, and dividends. Moreover, residents, like nonresidents, are required to report specific financial details, though the relevance to state residency differs.

The 1040 U.S. Individual Income Tax Return shares foundational similarities with the NJ-1040NR, as it encompasses the federal tax obligations of individuals. This document is comprehensive, covering areas like income, tax deductions, credits, and taxes due to the federal government. The principle of operation between the federal 1040 and the NJ-1040NR is analogous; both documents are essential for calculating the respective taxes owed but on different governmental levels. They also inquire about personal information, financial earnings, and allow for adjustments based on family size, educational expenses, and charitable contributions.

The IT-203 Nonresident and Part-Year Resident Income Tax Return form is New York's counterpart to New Jersey's NJ-1040NR, serving nonresidents and part-year residents who earned income in the state. This document, much like the NJ-1040NR, segregates income into various categories, necessitating detailed disclosures of earnings, such as wages and dividends, stemming from sources within the state. Both forms play a critical role in ensuring that individuals fulfill their tax obligations in states where they've generated income without establishing residency, maintaining equitable taxation across state lines.

The California Nonresident or Part-Year Resident Income Tax Return (Form 540NR) also parallels the NJ-1040NR form. Similar to its New Jersey counterpart, the 540NR is designed for individuals who either lived outside California for part of the year or did not reside in the state at all, yet earned income from California sources. Both states require nonresidents to report their incomes, apply deductions specific to their situations, and calculate the tax based on the portion of their earnings attributable to state sources, reflecting the states' desires to tax income generated within their borders.

Form PA-40, the Pennsylvania Income Tax Return, is structured to capture similar kinds of information as the NJ-1040NR for Pennsylvania residents. It too breaks down income into various categories, allows for deductions and credits, and addresses tax liability within the state. Although one is for residents while the other is for nonresidents, each form plays a pivotal role in state-level taxation, ensuring that individuals pay taxes on income earned within the state, including wages, interest, and dividends.

Form IL-1040, the Illinois Individual Income Tax Return, while primarily for Illinois residents, shares the approach of dissecting an individual's income, deductions, and credits to ascertain tax liability, akin to what's seen in the NJ-1040NR. It exemplifies a state's effort to tax income earned within its boundaries, whether by residents or nonresidents, paralleling the comprehensive way in which New Jersey's form manages tax responsibilities for nonresidents and part-year residents. This similarity underscores the uniform need among states to thoroughly capture and tax income generated within their locales.

The Massachusetts Nonresident/Part-Year Resident Tax Return (Form 1-NR/PY) is specifically formulated for individuals not fully residing in Massachusetts but who have earned income from the state, making it another document akin to the NJ-1040NR. This form requires detailed income reporting, adjustments based on various factors similar to those in New Jersey's nonresident return, and calculation of taxes owed from Massachusetts-sourced income. Such forms ensure that nonresidents contribute their fair share to the state coffers, based on the economic activities conducted within the state boundaries.

Dos and Don'ts

When completing the NJ-1040NR form, certain practices can help ensure accuracy and compliance with New Jersey tax laws. Below are guidelines to consider:

Things You Should Do:

- Review the entire form before starting: This helps understand all the required information and ensures you have all necessary documentation.

- Double-check your Social Security Number (SSN) and other personal information: Errors in personal information can lead to processing delays or issues with your tax return.

- Report all income from New Jersey sources: Even as a nonresident, you are required to report income earned in New Jersey, such as wages or business income.

- Utilize the NJ-1040NR instructions for guidance: The instruction booklet provides detailed explanations for each line on the form and can answer many common questions.

- Claim all eligible deductions and credits: Review the list of deductions and credits to ensure you're not missing out on any eligible tax benefits.

- Sign and date the form: An unsigned tax return is considered invalid and can delay processing.

- Keep a copy for your records: It's important to have a copy of your filed tax return and all related documents in case of future inquiries or amendments.

Things You Shouldn't Do:

- Don't guess your income or deductions: Ensure all reported amounts are accurate and backed by documentation, such as W-2 or 1099 forms, and receipts.

- Avoid rounding numbers: Report exact amounts where possible to enhance the accuracy of your tax return.

- Don't leave any mandatory fields blank: Incomplete forms can be rejected. If a section does not apply, enter "0" or "N/A."

- Avoid using correction fluid or tape: Errors should be cleanly erased or the form should be reprinted if a significant correction is needed.

- Don't file late without an extension: Late filing without an extension can result in penalties and interest charges.

- Don't forget to include all necessary schedules or documentation: Missing documentation can delay processing and lead to an incomplete return.

- Avoid neglecting your federal return: Issues on your federal return can affect your state tax obligations and vice versa.

Misconceptions

When it comes to the NJ-1040NR form, which is used for nonresident income tax returns in New Jersey, there are several misconceptions that can lead to confusion. Understanding these can help in accurately completing the form and potentially avoiding common mistakes.

- Misconception 1: Nonresidents do not need to file an NJ-1040NR if they did not earn income in New Jersey.

- Misconception 2: The filing status chosen on the federal return must match the one on the NJ-1040NR.

- Misconception 3: All income reported on the federal return must be reported in the same way on the NJ-1040NR.

- Misconception 4: Nonresidents cannot claim deductions or credits on their NJ-1040NR.

- Misconception 5: The physical presence test determines residency for New Jersey tax purposes.

This is not accurate. Nonresidents who have earned income from New Jersey sources are required to file an NJ-1040NR. This includes income from employment, property, or business operations within the state.

Filing status for New Jersey purposes does not always have to match the federal return. While often they are the same, differences in state and federal tax law may make another status more advantageous or appropriate for New Jersey tax purposes.

Not all income treated as taxable on the federal level is taxed the same way by New Jersey. For example, New Jersey offers different exemptions and deductions, and certain types of income that are taxable at the federal level may not be taxable for New Jersey purposes.

Nonresidents can claim deductions and credits on their NJ-1040NR, but they may be limited compared to residents. For instance, nonresidents can claim medical expenses, property taxes paid on New Jersey properties, and even qualify for certain credits like the Excess NJ UI/WF/SWF Withheld.

While physical presence plays a role in determining tax residency, it is not the sole factor. New Jersey considers other factors such as domicile and the intent to return when determining residency status for tax purposes. Simply spending less than 183 days in the state does not automatically qualify someone as a nonresident.

Clarifying these misconceptions helps nonresidents accurately fulfill their New Jersey tax obligations and potentially avoid common filing errors.