Fill Out a Valid Nj 1065 Schedule A Template

In navigating the complexities of tax requirements for partnerships in New Jersey, the NJ-1065 Schedule A form emerges as a critical document, particularly for entities enmeshed in the nuanced structure of tiered partnerships. This form's primary purpose is to distill and report the layers of income and financial activities that cascade through partnerships involved with other partnerships, ensuring a transparent and accurate representation of income earned both directly and indirectly. Through detailed sections, the form prompts the reporting entity to meticulously enumerate income sources such as ordinary business income, net real estate gains, interest, dividends, and other financial streams alongside losses, which then form the basis for the comprehensive tax responsibilities the entity must fulfill. With columns designed to calculate the amount of income reported by the partnership, deducting amounts derived from other partnerships to arrive at a net figure, the summarization of this data culminates in a straightforward declaration of income earned exclusively by the reporting entity. Moreover, an essential segment of the form requires partnerships to list distributive shares received from other partnerships, including necessary identifiers and the allocation of these amounts between all sources and those solely from New Jersey sources, thereby laying the groundwork for accurate state tax obligations. Notably, the strategic organization and completion of the NJ-1065 Schedule A are paramount not only for compliance with New Jersey's taxation norms but also as a reflection of the interconnected nature of business operations and financial relationships within the tiered partnership framework.

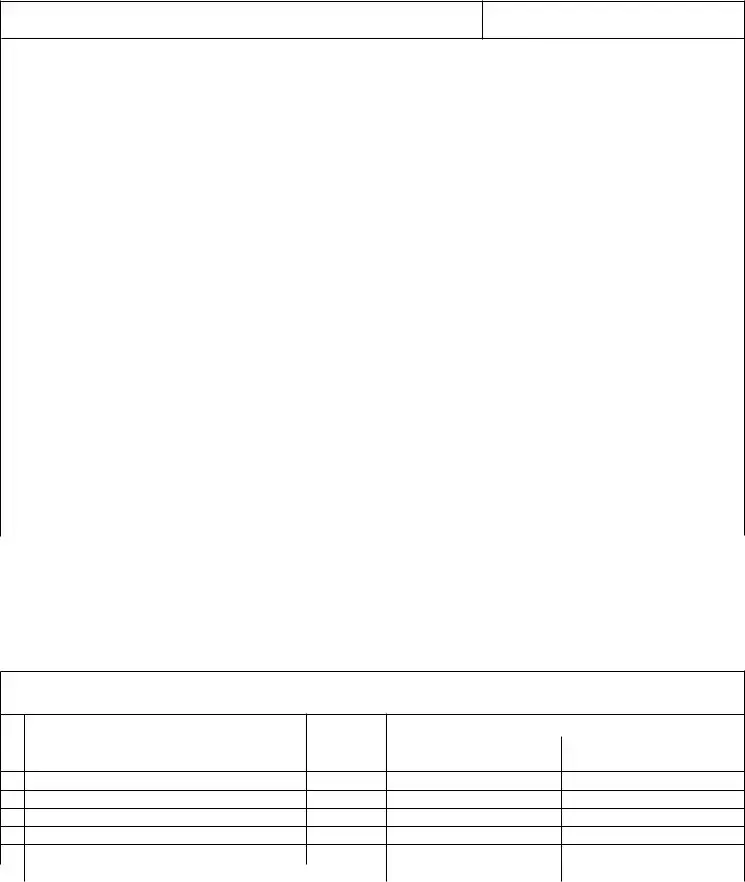

Sample - Nj 1065 Schedule A Form

SCHEDULE A |

Partnership name as shown on Form

Federal EIN

|

SCHEDULE A |

TIERED PARTNERSHIPS |

|

|

||||

|

|

|

(Complete this schedule before completing Form |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column A |

|

Column B |

Column C |

|

PART I PARTNERSHIP INCOME |

Amounts Reported by |

|

Portion of Amount in |

Amount Earned by |

|||

|

|

this Partnership on |

|

Column A Earned by |

this Partnership |

|||

|

|

|

|

|

|

|||

|

|

|

|

|

Federal Schedule K |

|

Other Partnerships |

(A minus B) |

|

|

|

|

|

|

|

|

|

|

1 |

Ordinary income (loss) from trade or business activities |

1 |

|

|

|

|

|

|

2 |

Net income (loss) from rental real estate activities |

2 |

|

|

|

|

|

|

3 |

Net income (loss) from other rental activities |

3 |

|

|

|

|

|

|

4 |

Interest Income |

|

4 |

|

|

|

|

|

5 |

Dividend Income |

|

5 |

|

|

|

|

|

6 |

Royalty Income |

|

6 |

|

|

|

|

|

7 |

Net gain (loss) from disposition of property |

7 |

|

|

|

|

|

|

8 |

Guaranteed payments to partners |

8 |

|

|

|

|

|

|

9 |

Net IRC section 1231 gain (loss) |

9 |

|

|

|

|

|

|

10 |

Other income (loss) |

|

10 |

|

|

|

|

|

11 |

Tax exempt interest income |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use the amounts reported in Column C to complete Lines 1 through 11 on Form

Lines 1 - 11

Column A: Follow the instructions for lines 1 through 11 of the

Column B: Enter the portion of each amount reported in Column A that was derived from other partnerships. For each line, this will be the sum of the amounts reported for the corresponding category on the Federal Schedule

Column C: For each line 1 through 11, subtract the amount reported in Column B from the amount reported in column A. Enter the difference in Column C of that line and on the corresponding line on the front of Form

SUMMARY OF SCHEDULE

PART II

(Attach copies of all Schedule

|

|

|

New Jersey Distributive Share of Partnership Income |

|

12 |

Partnership Name |

Federal EIN |

|

|

Column A |

Column B |

|||

|

|

|

Amount from All Sources |

Amount from New Jersey Sources |

A

B

C

D

E

|

13 |

Total Income (Loss) from Tiered Partnerships: |

13 |

|

|

|

|

Line 12: List the Name, Federal EIN and Distributive Share of Partnership Income or Loss reported on Line 4, Columns A and B of each Schedule

Line 13: Add the amounts(s) on Line 12, Columns A and B and enter the result on Line 13, Columns A and B and in the corresponding columns of Line 20 on the front of Form

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose of Schedule A | This schedule is designed to detail the income from tiered partnerships before completing the main NJ-1065 form. |

| Line Items Covered | Covers various income types including ordinary business income, rental income, interest, dividends, and gains or losses from property disposition. |

| Calculation Method | Income reported is the difference between total income and the portion derived from other partnerships. |

| Column B Purpose | Used to report income derived from other partnerships, as informed by Federal Schedule K-1(s). |

| Column C Reporting | Shows the partnership's direct income after subtracting income from other partnerships. |

| Governing Law | Guided by New Jersey State tax laws, specifically for partnerships operating within the state. |

| Integration with Other Documents | The results from Schedule A are essential for completing the NJ-1065 form and for accurate distribution of partnership income reporting. |

Detailed Steps for Using Nj 1065 Schedule A

When you're getting ready to fill out the NJ 1065 Schedule A form, it helps to gather all the necessary documents and information in advance. This is especially true if you're dealing with tiered partnerships, where financial details can get complicated. The form helps New Jersey partnerships report income accurately, ensuring that all financial activities are properly accounted for. With the right preparation, filling out the NJ 1065 Schedule A can be straightforward. Let's walk through the steps to complete this form.

- Refer to page 4 of the NJ-1065 instructions to understand how to report amounts for lines 1 through 11. This will be your guide for Column A.

- For Column B, calculate the portion of each amount in Column A that came from other partnerships. Do this by adding up all the amounts related to each category from the Federal Schedule K-1(s) that were provided by each subsidiary partnership. Make sure you have all the necessary K-1(s) before you start.

- In Column C, subtract the amount you entered in Column B from the amount in Column A for each line. The result is what you'll put in Column C. This amount reflects the income earned directly by the partnership.

- Ensure the differences calculated in Column C are correctly transferred to the corresponding lines on the front of Form NJ-1065. These figures are crucial for accurate reporting of the partnership's income.

- For Part II, starting with line 12, list every partnership that provided your partnership with a Schedule NJK-1. You'll need the partnership name and Federal EIN for each. Also, record the distributive share of partnership income or loss from both all sources and specifically from New Jersey sources, using Columns A and B.

- The total income (loss) from tiered partnerships is reported on line 13. Sum the amounts from line 12, both Columns A and B, and enter these totals in line 13, Columns A and B. These totals will then be reported on the corresponding columns of Line 20 on the front of Form NJ-1065.

- Attach copies of all Schedule NJK-1(s) received from other partnerships to ensure that all information has been accurately reflected in Part II of the schedule.

After completing the NJ 1065 Schedule A form, double-check all entries for accuracy. Ensure all necessary documents, including the Federal Schedule K-1(s) and Schedule NJK-1(s), are attached. Submitting this form accurately plays a key role in the overall reporting for New Jersey partnerships, addressing both income generated by the partnership and income received from other partnerships.

Learn More on Nj 1065 Schedule A

What is the NJ-1065 Schedule A form?

The NJ-1065 Schedule A form is a required document for partnerships operating in New Jersey, specifically designed for tiered partnerships. It serves as a worksheet to help calculate the income earned by the partnership that needs to be reported on the main Form NJ-1065. The form assists in detailing the portion of income derived from other partnerships versus what is directly earned by the reporting entity.

Who needs to fill out Schedule A of the NJ-1065?

This schedule must be filled out by tiered partnerships operating in New Jersey. A tiered partnership is one that has interests in other partnerships, and therefore, receives income through these interests that must be reported separately.

How is income reported on Schedule A of the NJ-1065?

Income on Schedule A of the NJ-1065 is reported in three columns:

- Column A lists amounts reported by the partnership on its federal Schedule K.

- Column B details the portion of Column A's income that was derived from other partnerships.

- Column C shows the difference between Column A and Column B, representing the amount earned directly by the partnership.

What types of income should be reported on Schedule A?

Various types of income need to be reported on Schedule A, including but not limited to:

- Ordinary income (loss) from trade or business activities

- Net income (loss) from rental real estate activities

- Net income (loss) from other rental activities

- Interest, Dividend, and Royalty Income

- Net gain (loss) from the disposition of property

- Guaranteed payments to partners

- Net IRC section 1231 gain (loss)

- Other income (loss) and tax-exempt interest income

How do partnerships calculate the amounts to enter in Column B?

For each line item, partnerships calculate the amounts to enter in Column B by summing up the amounts reported for the corresponding category on the federal Schedule K-1(s) provided to the partnership by each subsidiary partnership. Essentially, Column B reflects the partner's distributive share of income or losses coming from other partnerships in which it holds an interest.

What should be done with the summary of Schedule NJK-1(s) received from other partnerships?

The summary of Schedule NJK-1(s) received from other partnerships is reported in Part II of Schedule A. Partnerships must list the name, Federal EIN, and distributive share of partnership income or loss as reported on Line 4, Columns A and B of each Schedule NJK-1 received from another partnership. The total of these amounts is then added and reported on Line 13, which in turn affects the calculations on the main Form NJ-1065.

Where can one find instructions for filling out the NJ-1065 Schedule A?

Instructions for filling out the NJ-1065 Schedule A are detailed on the form itself and within the comprehensive instructions for completing Form NJ-1065 provided by the New Jersey Division of Taxation. These resources offer step-by-step guidance and should be consulted to ensure accuracy and compliance with New Jersey tax law.

Common mistakes

When completing the NJ 1065 Schedule A form, it's crucial to avoid common mistakes to ensure accurate filing. Here are 10 mistakes to watch out for:

Not double-checking the partnership name and Federal Employee Identification Number (EIN) to ensure they match those on Form NJ-1065, potentially leading to confusion or processing delays.

Overlooking the need to complete Schedule A before Form NJ-1065, which can result in inaccuracies in reporting the partnership's income and distributions.

Miscalculating amounts in Column A (Amounts Reported by this Partnership on Federal Schedule K) due to misinterpretation of the instructions or simple arithmetic errors.

Failing to accurately report the portion of each amount derived from other partnerships in Column B, which is critical for correct income allocation among partners.

Incorrect subtraction of Column B from Column A to get the figures for Column C (Amount Earned by this Partnership), affecting the partnership's income as reported to the state.

Omitting or inaccurately reporting net income or loss from rental real estate and other rental activities, leading to an incorrect representation of the partnership's financial activities.

Forgetting to include or misreporting guaranteed payments to partners in Column A, which could affect individual partners' tax liabilities.

Incorrectly calculating or failing to report tax-exempt interest income, potentially leading to underreported income.

Not attaching copies of all Schedule NJK-1(s) received from other partnerships, as required in Part II, which can result in incomplete filing.

Errors in adding up the totals on Line 13 for the Summary of Schedule NJK-1(s) Received, leading to discrepancies between distributed income and the total reported.

To ensure accuracy and compliance with New Jersey state requirements, it is essential for all partnerships to carefully complete the NJ 1065 Schedule A form, paying close attention to these details. Avoiding these common errors will help streamline the processing of the form and prevent potential issues with state tax filings.

Documents used along the form

When preparing and filing the NJ-1065 Schedule A form for partnerships in New Jersey, various other forms and documents are usually involved in the process to ensure comprehensive and accurate reporting of a partnership's financial activities. These documents facilitate the recording, reporting, and analysis of different types of income, deductions, and tax-related information, ensuring compliance with state tax laws and regulations. Below is a brief overview of some of the most common forms and documents that are often completed and submitted alongside the NJ-1065 Schedule A.

- Federal Schedule K-1 (Form 1065): This form is utilized to report the distributive share of a partner's income, credits, deductions, etc., from a partnership. It is crucial for understanding each partner's share of the partnership's federal income and, subsequently, their state income.

- NJ-1065: The NJ-1065 Partnership Return and Instructions form is the primary form filed by partnerships to report their income, deductions, and gains to the State of New Jersey. It serves as the backbone to which the NJ-1065 Schedule A attaches.

- NJ-CBT-1065: This document is required for certain partnerships that must pay the New Jersey Partnership Fee. It is relevant for partnerships with income derived from New Jersey sources.

- Form NJ-1040: While technically an individual income tax return, portions of this form may be necessary for partners in a partnership to complete their personal income tax filings, especially to report any income from the partnership.

- NJK-1 (NJ-1065): This form provides details of the income, deductions, and credits of the partnership that are allocated to each individual partner. It is the state equivalent of the federal Schedule K-1.

- Form WR-30: Employers in New Jersey use this form to report wage and tax information for each employee, applicable if the partnership has employees.

- Form W-2: Alongside Form WR-30, W-2 forms need to be prepared for employees of the partnership, detailing their annual wages and the taxes withheld from their paychecks.

- Form 1099: If the partnership pays non-employee compensation, rent, interest, or other forms of miscellaneous income, the payment of such amounts must be reported using Form 1109s.

- Schedule D (Form 1120): For partnerships that have significant capital gains or losses from the sale or exchange of assets, Schedule D is essential for reporting these transactions for tax purposes.

- Form NJ-REG: Any business operating within New Jersey must register for tax and employer purposes using this form. Although not annually filed, it is critical for starting a partnership.

Together, these documents and forms create a comprehensive dossier that ensures partnerships are accurately reporting their financial activities and complying with tax laws. By thoroughly completing and submitting these forms, partnerships can provide clear and detailed financial information to both partners and tax authorities, promoting transparency and facilitating smooth fiscal operations..

Similar forms

The NJ-1065 Schedule A form is closely related to the IRS Form 1065, U.S. Return of Partnership Income. This similarity stems from their shared purpose of reporting income, gains, losses, deductions, and credits of partnerships. Form 1065 serves as the federal counterpart to the state-focused NJ-1065, detailing the financial activities and positions to the Internal Revenue Service. Specifically, both forms require information about the partnership's income from various sources, such as trade, business activities, and rental real estate activities. The structure of the forms and the type of data requested align closely, facilitating the consistency in reporting partnership financials on both state and federal levels.

The Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., is another document akin to the NJ-1065 Schedule A. Schedule K-1 breaks down each partner's share of the partnership's income, deductions, and credits. Like NJ-1065 Schedule A, it distinguishes between different sources of income, such as interest, dividends, and rent. While Schedule K-1 details the distribution of income and deductions among partners for federal tax purposes, NJ-1065 Schedule A outlines similar information specific to the state of New Jersey, serving a parallel function within the tiered partnership context.

Form NJ-1065, Partnership Return, is inherently linked to NJ-1065 Schedule A since the latter is an essential schedule of the former. Form NJ-1065 is designed to report the income, losses, and other financial details of partnerships operating within New Jersey. The schedule A segment specifically deals with income earned and allocated among tiered partnerships, highlighting its pivotal role in accurately completing the overarching NJ-1065 form. Through this interconnection, the data from Schedule A directly influences the calculation and reporting of the partnership's overall tax obligation to the state, showcasing their operational and informational dependency.

The Federal Schedule K-1 (Form 1065) documents received from other partnerships are directly referenced and necessary for completing the NJ-1065 Schedule A, establishing a strong linkage between the two forms. These federal schedules provide the requisite details on income earned by the partnership through investments in other entities, enabling accurate reporting of tiered partnership income on a state level. Essentially, the functionality of NJ-1065 Schedule A hinges on the information provided by these Federal Schedule K-1 forms, typifying a relationship where state-level reporting requirements are fulfilled using federal-level data.

Lastly, the IRS Form Schedule E (Form 1040), Supplemental Income and Loss, parallels the NJ-1065 Schedule A in its focus on income from rentals, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. While Schedule E caters to individuals, reporting their share of income or losses from various entities and ventures, NJ-1065 Schedule A aggregates similar types of income at the partnership level. Both documents play a crucial role in ensuring that income from pass-through entities is accurately reported and taxed accordingly, albeit at different levels of the tax filing process and to different taxing entities.

Dos and Don'ts

When filling out the NJ-1065 Schedule A form, it's essential to approach the task with attention to detail and accuracy. Below, find a comprehensive guide to help you navigate this process smoothly.

Do:

- Review the instructions for lines 1 through 11 on page 4 of the NJ-1065 form carefully before you start. This ensures you understand the requirements for each entry.

- Enter the portion of each amount reported in Column A that was derived from other partnerships in Column B. These amounts should be the sum of the corresponding categories reported on Federal Schedule K-1(s).

- Calculate the difference between the amounts in Column A and Column B for each line to determine the actual income or loss earned by your partnership. Enter these differences in Column C.

- Attach copies of all Schedule NJK-1(s) received from other partnerships to provide a clear and complete record of tiered partnership income.

- Ensure the information entered in the Summary of Schedule NJK-1(s) Received From Other Partnerships section is accurate, including the partnership name, Federal EIN, and the distributive share of partnership income or loss.

Don't:

- Overlook the importance of ensuring that the amounts reported in Column C are accurately calculated by subtracting Column B from Column A. This calculation is crucial for completing the form accurately.

- Mix up entries between the columns. Each column serves a specific purpose, and mixing up entries can lead to significant errors in your reported amounts.

- Forget to review and verify all the information reported on Federal Schedule K-1(s) before using them to fill out your NJ-1065 Schedule A form. Incorrect information on these schedules can lead to errors on your form.

- Dismiss the need to attach all required Schedule NJK-1(s). Failure to provide these documents can result in processing delays or questions from the tax authorities.

- Assume the process is the same every year without checking for updates. Tax laws and form requirements can change, so it's important to review the instructions and requirements each year before filling out the form.

Misconceptions

Navigating through the complexities of tax forms can be quite a task, which often leads to misconceptions, especially with the New Jersey NJ-1065 Schedule A form. Let's debunk some of those myths to help you understand it better.

Misconception 1: NJ-1065 Schedule A is only for individual partners. In reality, this schedule is specifically designed for partnerships and their tiered relationship structures. It helps report income from other partnerships, not individuals.

Misconception 2: All income reported on Schedule A must come directly from the partnership’s activities. Actually, Schedule A allows for the reporting of income that flows through from other partnerships (Column B), differentiating between income directly earned and income earned through other partnerships.

Misconception 3: The totals of Column A should match the front page of Form NJ-1065. This isn't the case as Column A reports gross amounts before subtracting the income from other partnerships. It's the amounts in Column C, the net income after deductions, that match the front page of your NJ-1065.

Misconception 4: You don’t need to attach additional documents with Schedule A. Contrary to this belief, Part II requires attaching copies of all Schedule NJK-1(s) received from other partnerships, providing a detailed trail of distributive share incomes or losses.

Misconception 5: Interest and dividend income are not important on Schedule A. This misconception might stem from misunderstanding passive versus active income. Still, interest (Line 4) and dividend income (Line 5) play critical roles, especially in understanding the partnership's investment income and financial health.

Misconception 6: Guaranteed payments to partners (Line 8) are deducted from the partnership's overall income in Column C. However, these payments represent fixed amounts paid to partners, which are then deducted from their distributive shares, not the partnership's total income.

Misconception 7: Tax-exempt interest should not be reported on Schedule A. While it may seem counterintuitive, tax-exempt interest (Line 11) must be reported to provide a complete financial picture, even though it might not be taxable at the state level.

Misconception 8: Net income or loss from rental real estate activities is irrelevant for a partnership without real estate. This is misleading as any partnership, regardless of its main business, must report income or loss from rental real estate activities (Line 2) if such activities occur through tiered partnerships.

Misconception 9: The purpose of Column C is to report adjustments made by the partnership. Actually, Column C is designed to reflect the amount of income that is directly earned by the partnership after subtracting the portion derived from other partnerships (Column B).

Misconception 10: The summary of Schedule NJK-1(s) received (Part II) is just for record-keeping. While it might appear as a mere formality, this summary is crucial for the state to verify income sources and to ensure that all distributive income from tiered partnerships is accounted for properly on the NJ-1065.

Understanding the nuances of NJ-1065 Schedule A can significantly simplify reporting for partnerships, clearing up any confusion and ensuring accurate compliance with New Jersey tax regulations.

Key takeaways

Filling out and using the NJ 1065 Schedule A form is an essential process for partnerships in New Jersey, especially those involved in multiple partnership layers. Here are seven key takeaways to guide partnerships through this process:

- The NJ 1065 Schedule A form is designed for tiered partnerships, requiring careful reconciliation of income earned directly by the partnership and income derived from other partnerships.

- Part I of the form focuses on Partnership Income, breaking down various income categories such as ordinary income, net income from rental real estate, interest income, and more, for accurate reporting and subsequent taxation purposes.

- Columns A, B, and C on Schedule A are crucial for correctly reporting incomes. Column A lists amounts reported by the partnership on the Federal Schedule K; Column B captures the portion of Column A income derived from other partnerships; and Column C shows the income earned directly by the partnership after subtracting income from other partnerships.

- To complete Form NJ-1065 accurately, amounts calculated in Column C for each category of income must be used. This ensures that double taxation of income derived from other partnerships is avoided.

- Column B requires detailed information from Federal Schedule K-1(s) furnished by subsidiary partnerships. It is necessary for the partnership to maintain accurate records and perform diligent calculations to ensure that the income reported is precise.

- Part II of the form deals with the Summary of Schedule NJK-1(s) Received from Other Partnerships, highlighting the need to attach copies of all Schedule NJK-1(s) received. This documentation supports the amounts entered in Column B and is vital for audit and verification purposes.

- Understanding and accurately completing the NJ 1065 Schedule A form is vital for compliance with New Jersey state tax regulations. It assists in properly determining the partnership's liability based on both its direct income and its distributive share of income from other partnerships.

Partnerships must approach the completion of the NJ 1065 Schedule A form with diligence and attention to detail, ensuring that all income is accurately reported and documented. This process plays a critical role in the state tax filing process, impacting the overall tax liability of the partnership.

Popular PDF Documents

Nj Family Court Forms - This document proves fundamental in bridging the gap between legal compliance and the practicalities of posting bail, ensuring a fair legal stance for the defendant.

Nj Franchise Tax - The form provides a framework for corporations to calculate their income tax rate, which is determined based on New Jersey state guidelines.