Fill Out a Valid Nj 1065 Schedule Njk 1 Template

The NJ 1065 Schedule NJK-1 form is a critical document for partners in the State of New Jersey, detailing each partner's share of income, deductions, and credits from a partnership for the tax year. Crafted for the specific needs of the 1999 tax year, with flexibility for both calendar and fiscal year reporting, the form systematically divides information into three parts. Part I focuses on general information, collecting essential details such as the partner's Social Security or Federal EIN, partnership's Federal EIN, and both the partner and partnership's names and addresses, alongside specifying the partner's percentage in profit sharing, loss sharing, and capital ownership at the beginning and end of the year or upon termination. Moreover, it identifies the type of entity the partner is, essential for tailoring tax liability accurately. Part II delves into income information, distinguishing between NJ-1040 and NJ-1040NR filers and categorizing income class, total distribution, New Jersey source amounts, partnership income or loss, and specific deductions including partner's 401(k) contributions and childcare deductions. Lastly, Part III invites supplemental information, emphasizing the form's adaptability to different partnership arrangements and the necessity for thorough documentation. By encapsulating a partner's fiscal relationship to the partnership within New Jersey's tax framework, the NJ 1065 Schedule NJK-1 is undeniably pivotal for accurate and compliant tax reporting.

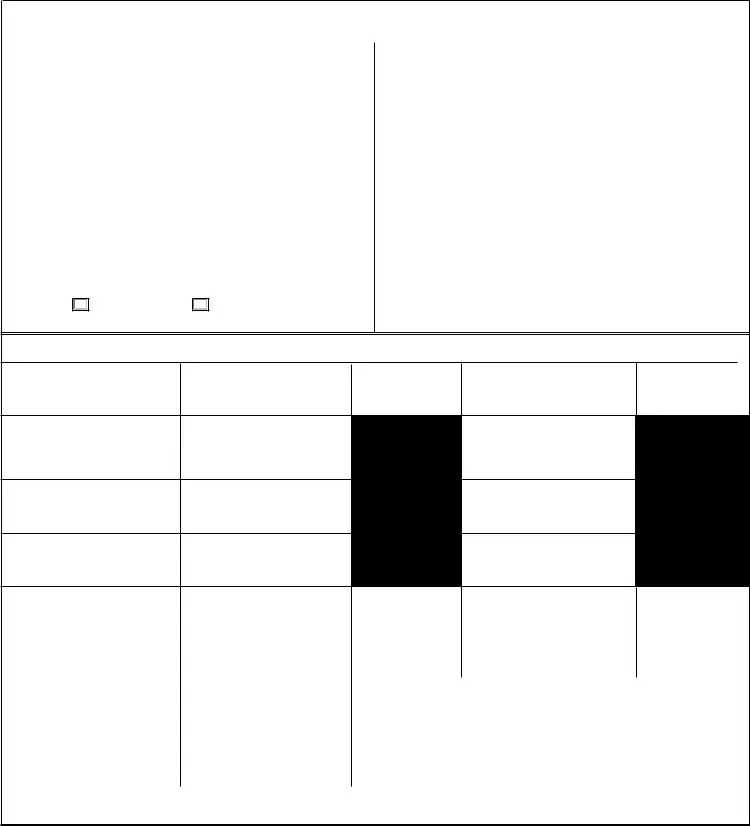

Sample - Nj 1065 Schedule Njk 1 Form

SCHEDULE

STATE OF NEW JERSEY

(Form

1999

PARTNER’S SHARE OF INCOME

For Calendar Year 1999, or Fiscal Year Beginning ____________________, 1999 and ending _______________, 20______

PART I |

General Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partner’s SS # or Federal EIN |

|

|

|

Partnership’s Federal EIN |

|

|

|

|

|

|

|

|

|

|

|

Partner’s Name |

|

|

|

Partnership’s Name |

|

|

|

|

|

|

|

|

|

|

|

Street Address |

|

|

|

Partnership’s Street Address |

|

|

|

|

|

|

|

|

|

|

|

City |

State |

|

Zip Code |

City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

Enter Partner’s percentage of: |

|

|

|

What type of entity is partner? (see instructions)___________________ |

|

|

(i) Before Decrease |

(ii) |

End of Year |

||

|

Code |

|

|

or Termination |

|

|

|

|

|

|

|

Profit Sharing |

__________________% |

___________________% |

|

Date Partner’s Interest in Partnership began: _______________________________ |

|

|

|

|

|||

|

Month |

Day |

Year |

|

|

|

|

|

|

|

|

Loss Sharing |

__________________% |

___________________% |

|

¤ |

Final |

¤ |

Amended |

__________________% |

___________________% |

|

|

|

Capital Ownership |

PART II Income Information

Income Classifications |

A. Total Distribution |

Enter Amounts on B. New Jersey Source Amounts |

Line Shown Below

1.Partnership Income (loss)

2.Net Guaranteed Payments

3.Partner’s 401(k) Contribution

4.Distributive Share of Partnership Income (loss)

|

(Line 1 plus Line 2 minus |

Line 20, Page 2 |

|

Line 41, Part I, Page 2 |

|

|

|

|

|

||

|

Line 3) |

|

|

|

|

|

|

|

|

|

|

5. |

Pension |

|

Line 19a, Page 2 |

|

|

|

|

|

|

|

|

6. |

Child Care Deduction |

Refer to |

|

Refer to |

|

Instructions |

|

Instructions |

|||

|

|

|

|

||

|

|

|

|

|

|

PART III |

Supplemental Information |

(Attach Schedule) |

|

|

|

THIS FORM MAY BE REPRODUCED

Document Specifications

| Fact | Detail |

|---|---|

| Form Type | SCHEDULE NJK-1 STATE OF NEW JERSEY (Form NJ-1065) |

| Year | 1999 |

| Purpose | Partner’s Share of Income |

| Applicability | For Calendar Year 1999, or Fiscal Year Beginning in 1999 |

| Sections | General Information, Income Information, Supplemental Information |

| Key Information Needed | Partner’s and Partnership’s Names, SSN or Federal EIN, Address, and Interest Percentages |

| Special Features | Spaces to indicate Final NJK-1 or Amended NJK-1, Partner’s type of entity, and Partner’s percentage of Profit, Loss, and Capital Ownership |

| Income Reporting | Includes Partnership Income/Loss, Net Guaranteed Payments, Partner’s 401(k) Contribution, and more |

| Governing Law | New Jersey State Law |

Detailed Steps for Using Nj 1065 Schedule Njk 1

Once you have gathered all the necessary information, such as the partnership's and the partner's details, along with their shares in profits, losses, and capital, you are ready to fill out the NJ-1065 Schedule NJK-1 form. This form is essential for reporting a partner’s share of income, deductions, and credits from a partnership in New Jersey. The steps below offer guidance on how to complete this form accurately.

- Start with PART I - General Information. Enter the Partner's Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the designated space.

- In the corresponding fields, input the Partnership’s Federal EIN.

- Fill in the Partner’s Name and the Partnership’s Name in their respective areas.

- For both the Partner and the Partnership, write the Street Address, City, State, and Zip Code in the provided boxes.

- Under the section titled "Enter Partner’s percentage of:", input the relevant percentages for Profit Sharing, Loss Sharing, and Capital Ownership before any decrease or termination and at the end of the year.

- Identify the type of entity the partner is and write this in the space provided.

- Specify the Date the Partner’s Interest in the Partnership began by entering the Month, Day, and Year.

- Check the appropriate box to indicate if the submitted NJK-1 is a Final or Amended form.

- Move on to PART II - Income Information.

- For A. Total Distribution, enter the amounts in the corresponding lines underneath for Partnership Income (loss), Net Guaranteed Payments, Partner’s 401(k) Contribution, Distributive Share of Partnership Income (loss), Pension, and Child Care Deduction.

- Under B. New Jersey Source Amounts, input the line amounts as instructed for both NJ-1040 and NJ-1040NR filers, referring to the NJ-1040 or NJ-1040NR instructions as necessary.

- In PART III - Supplemental Information, attach any required schedules detailing additional information that supports the entries made in the previous sections.

After filling out all the sections carefully and reviewing for accuracy, you will be ready to proceed to the next steps, which may include submitting the form to the required department or authority in New Jersey. Ensure that all the attachments mentioned in Part III are securely included with your NJ-1065 Schedule NJ:K-1 before submission.

Learn More on Nj 1065 Schedule Njk 1

What is the purpose of the Schedule NJK-1 form?

The Schedule NJK-1 form is a document for reporting a partner's share of income, deductions, and credits from a partnership. It details the financial information necessary for partners in the State of New Jersey to properly report their portion of the partnership's income or loss on their personal tax returns. This form supplements the NJ-1065, Partnership Return, and helps ensure that partners meet their state tax obligations accurately.

Who needs to file the Schedule NJK-1?

Any partner in a partnership that operates in New Jersey and reports income to the state is required to file the Schedule NJK-1. This includes individuals, corporations, and entities that are considered partners in the eyes of the law. The form details each partner’s specific share of the partnership's income, deductions, and credits based on their percentage of ownership or profit/loss distribution agreements.

What information is needed to complete the Schedule NJK-1?

To complete the Schedule NJK-1, the following information is required:

- General information about the partner, such as Social Security Number or Federal EIN, name, and address.

- The partnership’s Federal EIN, name, and address.

- Details of the partner’s percentage share of profit sharing, loss sharing, and capital ownership before and at the end of the year, or upon termination.

- The type of entity the partner is.

- Income information including the partnership income (loss), net guaranteed payments, partner’s 401(k) contributions, distributive share of partnership income (loss), pension, and child care deduction amounts.

Partners should also attach any required supplemental information as indicated in Part III of the form.

How does a partner determine their percentage of interest in the partnership?

A partner’s percentage of interest in the partnership is typically determined by the partnership agreement. This document outlines how profits, losses, and capital are to be distributed among partners. The specific percentages of profit sharing, loss sharing, and capital ownership should be documented at the beginning of the partnership and adjusted as necessary, for instance, in the event of a change in partnership composition or a partner's capital contribution. These percentages must be reported on the Schedule NJK-1.

What should I do if my Schedule NJK-1 form needs to be amended?

If you need to amend your Schedule NJK-1, you should check the box labeled “Amended NJK-1” at the top of the form and ensure that all corrected information is accurately reported. The amended Schedule NJK-1 must be submitted along with a revised NJ-1065 form, if applicable, to reflect the updated information. Amending the schedule may be necessary if there were errors or omissions in the original filing or if adjustments to the partner’s share of income, deductions, or credits are required after the original submission.

Common mistakes

Filling out tax forms accurately is critical for compliance and to minimize errors that could lead to audits, penalties, or delays. The NJ 1065 Schedule NJK-1 form is no exception. People often make mistakes on this particular form, affecting their reported income and tax liabilities. Here are eight common mistakes to avoid:

- Failing to correctly enter the Partner’s Social Security Number (SSN) or Federal Employer Identification Number (EIN). This unique identifier is crucial for tax purposes and helps the New Jersey Department of Revenue ensure accurate tax records.

- Incorrectly reporting the Partnership’s Federal EIN. Just like an individual's SSN, the Federal EIN is essential for identifying the partnership itself in all tax dealings.

- Misreporting Partner’s and Partnership’s names and addresses. Accurate names and addresses build the basic foundation of the partnership and partner’s identity for the tax department, helping avoid misdirected correspondence or legal notices.

- Omitting or inaccurately entering the Partner’s percentage of profit, loss, and capital ownership before and at the end of the year. These percentages are vital in calculating the partner’s share of the partnership's income, deductions, and credits.

- Not correctly specifying the type of entity the partner is. This critical detail affects how income and losses are reported and taxed.

- Overlooking to indicate whether the form is a Final NJK-1 or an Amended NJK-1. This information is necessary for the tax authorities to understand the context of the filing.

- Errors in Income Information, including miscalculations or misentries in total distribution, New Jersey source amounts, and specifics related to partnership income or loss, net guaranteed payments, and other deductions. These figures are essential for accurately reporting income and understanding tax obligations.

- Failure to attach required Supplemental Information when necessary. Some situations require additional documentation to support entries on the form. Not providing this information can lead to questions or audits.

When completing the NJ 1065 Schedule NJK-1 form, attention to detail is paramount. Avoiding these common mistakes can help ensure the form is filled out correctly, helping partners and the partnership meet their tax responsibilities without unnecessary complications.

Documents used along the form

When dealing with the complexities of filing partnership taxes in New Jersey, it's essential to recognize the forms and documents that typically accompany the NJ 1065 Schedule NJK-1 form. While this document plays a crucial role in detailing each partner's share of income, profit-sharing, and losses, navigating through the broader tax obligations requires a holistic approach. Here, we'll outline some of the critical forms and documents often used alongside Schedule NJK-1, shedding light on their purposes to ensure thorough and accurate tax reporting.

- NJ-1065 (Partnership Return): This serves as the primary tax return document for partnerships in New Jersey. It details the income, deductions, and credits of the partnership as a whole.

- Form NJ-1040: Individual partners might need this form to report their share of partnership income on their personal New Jersey Income Tax returns.

- Form NJ-1040NR: Non-resident partners use this form to report their New Jersey source income, including income from partnerships.

- Form 1065 (U.S. Return of Partnership Income): This federal form mirrors the purpose of NJ-1065 but for the Internal Revenue Service (IRS), reporting the partnership's financial activities on a national level.

- Schedule K-1 (Form 1065): Accompanying the federal Form 1065, this schedule details each partner's share of the partnership's earnings, losses, deductions, and credits for federal tax purposes.

- Schedule NJ-BUS-1: This form is utilized within the NJ-1065 tax return to report the partnership's business income and losses, specifically catering to New Jersey taxation requirements.

- Schedule NJ-BUS-2: Partnerships that distribute income to partners resident in different states use this schedule to allocate and report the income sourced to New Jersey, ensuring appropriate state tax obligations are met.

- Partnership Agreement: Though technically not a tax form, the partnership agreement document is crucial as it defines the terms of profit sharing, losses, and other fiscal responsibilities, which affect all financial reporting.

- Form NJ-REG: Any business, including partnerships, must register with the State of New Jersey, and this form is a critical step in that process, often preceding the tax filing.

- Records of Direct Partner Contributions: Documentation of all partners' contributions to the partnership is not a formal form but is essential for accurate financial and tax reporting, affecting the allocation of income and losses.

Understanding each of these forms and documents, and how they interact with the NJ 1065 Schedule NJK-1, is vital for partners to navigate the complexities of state and federal tax compliance successfully. Keeping a comprehensive record and staying informed on the requirements can make the process smoother, ensuring that both the partnership and the individual partners meet their tax obligations accurately and efficiently.

Similar forms

The Schedule K-1 (Form 1065) from the IRS is closely related to the New Jersey Schedule NJK-1, as both forms are designed to report a partner's share of partnership income, deductions, and credits to the respective tax authorities. While the NJK-1 is specific to New Jersey, detailing a partner's income and losses that are taxable at the state level, the IRS Schedule K-1 serves a similar purpose on a federal scale. Each form requires information about the partnership and the partner's share of profit, loss, and other financial data.

The Schedule C (Form 1040) also shares similarities with the NJK-1, as both involve reporting income from business activities. However, Schedule C is used by sole proprietors or single-member LLCs to report business income and expenses to the IRS, whereas the NJK-1 is specifically for reporting a partner’s share of income and expenses from a partnership to the state of New Jersey.

Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, parallels the NJK-1 in its aim to report income and financial data related to partnerships. Form 8865 is for international partnerships involving U.S. persons, capturing similar types of income and expense data on a global scale. Conversely, the NJK-1 is focused on providing this information to the New Jersey state tax authority for domestic partnership businesses.

The W-2 form, while primarily for reporting wages, taxes withheld, and other compensation to employees, has an indirect link to the NJK-1 in the income reporting process. Partners may receive guaranteed payments from the partnership, which could be likened to wages, and the W-2’s reporting structure provides a foundational comparison for understanding how individuals receive and report different types of income, despite the NJK-1 applying specifically to partnership distributive shares.

The 1040-NR form, used by non-resident aliens to file U.S. tax returns, shares a connection with the NJK-1 through its possible inclusion of income from partnerships operating within the United States. Non-resident New Jersey filers would use information from a form like NJK-1 to correctly report their state-taxable income from partnerships, underpinning the interconnection between state-specific and federal tax reporting requirements for international individuals.

Form 1120S, U.S. Income Tax Return for an S Corporation, and the NJK-1 have common ground in reporting business income, albeit for different types of entities. The 1120S is for S Corporations to report income, losses, and other financials to the IRS. Although the NJK-1 is for partnerships, both documents serve to attribute the business's financial activity to its owners or partners for tax purposes, specifying each individual's share.

The Schedule E (Form 1040) is used by taxpayers to report income from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Its resemblance to the NJK-1 is seen through the section dedicated to reporting partnership and S corporation income, highlighting how individual partners or S corporation shareholders must report their portion of business income or loss on their personal tax returns.

Form 1065, U.S. Return of Partnership Income, serves as the foundation from which the NJK-1 form derives. Form 1065 is filed with the IRS to report a partnership's financial information, including income, deductions, and taxes. The NJK-1 complements this federal requirement by collecting and reporting a partner's share of these figures specifically for New Jersey state tax purposes, underlining the interdependence of state and federal tax obligations for partnerships.

The New Jersey Gross Income Tax Return (NJ-1040) intersects with the NJK-1 in the broader tax return process for individuals involved in partnerships. Partners in New Jersey must report their share of income—as detailed on the NJK-1—on their NJ-1040 forms, showcasing the role of the NJK-1 in completing state tax obligations and how it fits into the personal income tax reporting landscape in New Jersey.

Dos and Don'ts

Filling out financial forms accurately is crucial, especially when it comes to tax documents like the New Jersey Schedule NJK-1 (Form NJ-1065). This form, integral for reporting a partner’s share of income, gains, losses, deductions, and credits from a partnership, must be handled with precision. To ensure accuracy and compliance, here are six essential dos and don'ts to consider:

Do:

- Double-check partner and partnership information: Ensure that the partner’s Social Security Number or Federal EIN, as well as the partnership’s Federal EIN, are entered correctly. Accuracy in these numbers is critical for proper tax reporting and identification.

- Accurately report percentages: Carefully enter the partner’s percentage of profit, loss, and capital ownership at both the beginning and end of the year. These figures affect the allocation of income or loss to the partner.

- Review the instructions for entity type details: The form requires specifying the type of entity the partner is. Make sure to consult the instructions to correctly determine and enter this classification.

- Report New Jersey source amounts correctly: For partners filing NJ-1040 or NJ-1040NR forms, it’s essential to accurately enter New Jersey source amounts, as these directly impact state tax obligations.

- Include all necessary supplemental schedules: Sometimes, additional details or breakdowns are necessary. If the form indicates that a supplemental schedule is required, be sure to attach it to provide comprehensive information.

- Check for amendments or the final NJK-1 designation: If the Schedule NJK-1 being filed is amended or final, ensure to appropriately mark this on the form to indicate to the New Jersey tax authorities the specific nature of the submission.

Don't:

- Overlook the fiscal year details: If reporting for a fiscal year that doesn’t align with the calendar year, be sure to accurately state the beginning and end dates of the fiscal period in the space provided.

- Estimate financial figures: Guessing or approximating financial amounts can lead to errors in tax calculation and potential issues with tax authorities. Always use exact numbers.

- Leave blank fields without justification: If a section doesn’t apply, consider if a notation such as “N/A” is appropriate instead of leaving it blank. This clarifies that the omission was intentional rather than an oversight.

- Ignore the instructions for specific lines: Each section and line of the Schedule NJK-1 can have specific instructions. Failing to follow these guidelines can result in inaccuracies that may affect tax liability or processing times.

- Forget to report all income classifications: Ensure every applicable type of income, deduction, and credit is reported in the relevant sections. Missing information can lead to incomplete filings and potential penalties.

- Misplace the form’s attachments: Any supplemental information attached to the Schedule NJK-1 should be secure and correctly labeled. Losing these attachments can cause incomplete submissions and delays in processing.

By adhering to these dos and don'ts, partners and their accountants can navigate the complexities of Schedule NJK-1 (Form NJ-1065) more confidently, ensuring accurate and compliant tax reporting for their partnership activities in New Jersey.

Misconceptions

Understanding the New Jersey Schedule NJK-1 form, associated with Form NJ-1065, can be challenging due to several common misconceptions. Below are explanations aimed at clarifying some of these misunderstandings:

Only applicable for companies based in New Jersey: It’s a common thought that the NJK-1 form is only for partnerships operating within New Jersey. However, this form must be filed by all entities that have derived income from New Jersey sources, regardless of where they are based.

Individual partners do not need to file: There is a misconception that if a partnership files this form, individual partners are not required to include this information in their personal tax returns. In reality, partners must report their share of income or loss on their personal New Jersey income tax returns.

Profit and loss sharing percentages are fixed: The belief that the percentages for profit, loss, and capital ownership are fixed at the beginning of the year and cannot change is incorrect. These percentages may change throughout the year due to various partnership decisions.

Only profits are reported: Some think the NJK-1 only reports income or profits. However, this form covers a wider range of financial activities, including losses, guaranteed payments to partners, and specifics like partner’s 401(k) contributions and childcare deductions.

Filing is done annually by default: While many partnerships operate on a calendar year basis, the NJK-1 allows for fiscal year reporting, meaning the “beginning” and “ending” dates for the fiscal year must be clearly indicated on the form, contrary to the assumption that the calendar year is the only option.

Amended NJK-1 is rare: The belief that amended NJK-1 forms are seldom needed is not accurate. Corrections or adjustments to previously submitted information can require an amended filing. This option is integral to ensuring accuracy in partnership records and tax obligations.

Personal information is not crucial: Every detail requested on the NJK-1, including personal information such as Social Security numbers or Federal EINs, is crucial for identifying the correct entities and individuals associated with the income reported. It is a misconception that this information is not vital.

New Jersey source amounts are only for NJ residents: Some might wrongly assume that only income earned by New Jersey residents needs to be reported in the "New Jersey Source Amounts" section. However, this part of the form is dedicated to identifying income derived from New Jersey sources, affecting both residents and non-residents.

Clearing up these misconceptions helps partnerships and their members properly fulfill their reporting obligations, ensuring compliance with New Jersey’s tax laws.

Key takeaways

Filling out the NJ 1065 Schedule NJK-1 form is a critical task for partners in a partnership doing business in New Jersey. Here are nine key takeaways to understand and utilize this form effectively:

- The form is designated for reporting a partner's share of income, deductions, and credits from a partnership.

- It is applicable for the calendar year 1999, or a fiscal year beginning in 1999 and ending in the subsequent year, indicating its specific time relevance.

- Partners must provide both personal information (such as Social Security Number or Federal EIN) and detailed partnership information, including the partnership's name and address.

- Significant on the form is the indication of the partner’s percentage of profit sharing, loss sharing, and capital ownership, both before any decrease and at the end of the year or upon termination.

- Identifying the type of entity the partner is, based on instructions provided, helps in understanding the tax implications and responsibilities of each partner.

- The form distinguishes between final NJK-1 forms, for indicating the final share of income for a partner, and amended NJK-1 forms, for any corrections or updates to previously submitted information.

- Income information is split into sections for NJ-1040 filers and NJ-1040NR (non-resident) filers, each with specific lines for various types of income such as partnership income (loss), net guaranteed payments, and partner’s 401(k) contribution.

- Additional deductions and credits, such as pension contributions and child care deductions, are also reported, demonstrating the comprehensive nature of the form in capturing a partner’s financial interest in a partnership.

- The form includes a section for supplemental information, requiring the attachment of a schedule if necessary, to provide further details or explanations regarding the reported figures.

Understanding these key takeaways can significantly streamline the process of completing the NJ 1065 Schedule NJK-1 form, ensuring accurate and compliant reporting of a partner's income from partnership activities in New Jersey.

Popular PDF Documents

Renew Ucr - Facilitates a comprehensive understanding of the motivations behind bias incidents, supporting more effective law enforcement training.

How to Get a Police Report Nj - Functions as a critical tool in the state's efforts to promote diversity and inclusivity in the workforce.