Fill Out a Valid Nj 1080C Template

The NJ-1080C form, a vital document for the 2004 tax year, provides a structured framework for nonresident individuals in New Jersey to file their income taxes through a composite return. This form particularly caters to members of specific entities such as general and limited partnerships, professional athletic teams, limited liability partnerships (LLPs), limited liability companies (LLCs), New Jersey electing S corporations, estates, and trusts. It uniquely simplifies tax filing by allowing these individuals to directly aggregate their incomes and calculate taxes based on adjusted rates of 6.37% for those earning under $250,000 and 8.97% for incomes at or above this threshold. The form's design includes specific schedules for listing participants according to their income levels alongside provisions for those not participating in the return. To be eligible for this composite filing, nonresident individuals must meet rigorous criteria, including the entirety of the tax year spent outside New Jersey and foregoing any personal exemptions, credits, or deductions. Interestingly, the process involves a mandatory election by each participant to be included in this return through Form NJ-1080-E, signaling a binding agreement which extends to their respective legal successors. Unlike previous years, entities now enjoy the liberty to file the NJ-1080C without needing prior approval from the Division, streamlining the process further. The form also outlines specific due dates and the process for requesting filing extensions, emphasizing the importance of timely submissions to avoid penalties. Moreover, it includes provisions for designating funds to the Gubernatorial Elections Fund without affecting tax liabilities or refunds, demonstrating an integration of civic engagement within tax procedures.

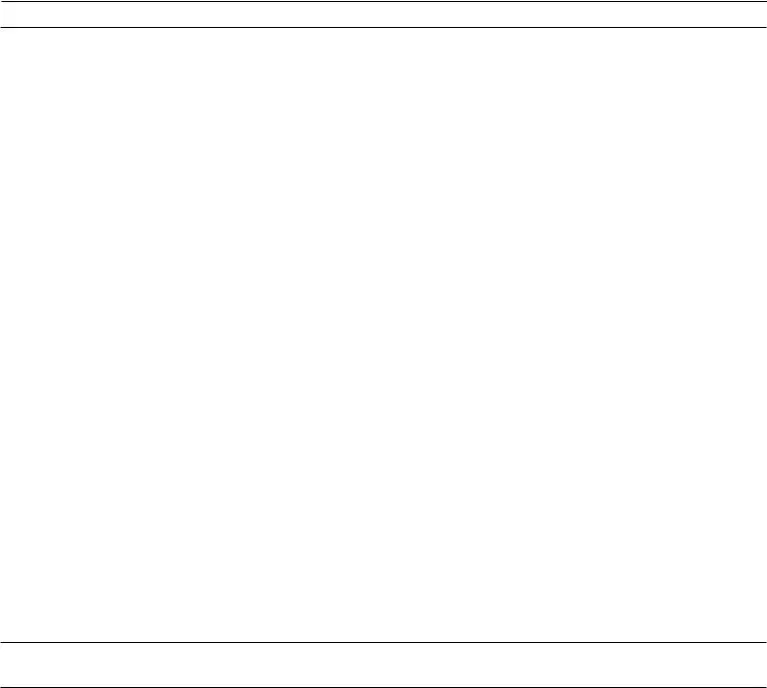

Sample - Nj 1080C Form

2004

STATE OF NEW JERSEY

INCOME TAX - NONRESIDENT COMPOSITE RETURN

For Tax Year January 1 - December 31, 2004

|

|

|

|

|

|

|

|

|

|

ID Number |

|

Legal Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Trade Name (if different from legal name) |

|

|

|

|

|||

_______ Number of individuals |

|

|

|

|

|

|

|

|

|

Address (number and street) |

|

|

|

|

|

||||

participating in this |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||

return |

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if: 1. |

Professional Athletic Team |

2. |

|

Partnership |

3. |

|

New Jersey Electing S Corporation |

||

|

|

||||||||

4. |

Limited Liability Company |

5. |

|

Limited Liability Partnership |

6. |

|

Estate or Trust |

||

|

|

||||||||

|

|

||||||||

7. GUBERNATORIAL |

|

|

|

|

|

|

|

|

|

|

Do you wish to designate $1 of your taxes for this fund? |

|

|

YES |

|

|

|

NO |

|

ELECTIONS FUND |

|

|

|

|

|

|

|||

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: If you check the “YES” box it will not increase the tax or reduce the refund.

|

|

INCOME INFORMATION |

|

Column A |

|

|

Column B |

||||

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Wages, salaries, tips, and other employee compensation |

8 |

|

|

|

8 |

|

|

|

|

|

9. |

Taxable interest |

9 |

|

|

|

9 |

|

|

|

|

|

10. |

Dividends |

10 |

|

|

|

10 |

|

|

|

|

|

11. |

Net gain or income from disposition of property |

11 |

|

|

|

11 |

|

|

|

|

|

12. |

Distributive share of Partnership income |

12 |

|

|

|

12 |

|

|

|

|

|

13. |

Net Pro Rata Share of S Corporation |

13 |

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Net gains or income from rents, royalties, patents & copyrights |

14 |

|

|

|

14 |

|

|

|

|

|

15. |

Net gains or income derived through Estates or trusts |

15 |

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

Other - state nature and source ___________________________ |

16 |

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Total New Jersey Taxable Income (Add Lines 8 through 16) |

17 |

|

|

|

17 |

|

|

|

|

|

18. |

Tax (Multiply Line 17, Col. A by 6.37%, Line 17, Col. B by 8.97%) |

18 |

|

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

Total Tax (Add Line 18, Col. A and Line 18, Col. B) |

. . . |

. . . . . . . . . . . . . . . . . . . . |

. |

. . |

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Total New Jersey Tax Withheld |

20 |

|

|

|

|

Check |

|

if Form |

||

|

|

|

|

|

|

|

|

|

is attached |

||

21. |

Estimated Payments / Credit from 2003 Composite return |

21 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

22. |

Tax Paid on Partners Behalf by Partnership |

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

Total Payments / Credits (Add Line 20 through 22) |

. . . |

. . . . . . . . . . . . . . . . . . . . |

|

. . |

23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. |

If payments are LESS THAN tax - enter Amount Due |

. . . |

. . . . . . . . . . . . . . . . . . . . |

|

. . |

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. |

If payments are MORE THAN tax - enter OVERPAYMENT |

. . . |

. . . . . . . . . . . . . . . . . . . . |

|

. . |

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

REFUND (Amount of Line 25 to be refunded) |

. . . |

. . . . . . . . . . . . . . . . . . . . |

|

. . |

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. |

CREDIT to 2005 Tax |

27 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature (See instructions) |

Under penalties of perjury, I declare that I have examined |

this return, including accompanying schedules and |

||

|

statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer is based |

|||

|

on all information of which preparer has any knowledge. |

|

|

|

|

Paid Preparer’s Signature |

|

Date |

|

|

|

|

|

Check if |

|

|

|

|

|

|

|

|

|

|

Title |

Firm’s Name (or yours if |

|

Preparer’s SS # |

|

Date

Preparer’s Address |

Preparer’s Federal EIN # |

Division

Use |

1____________ 2_____________ 3________________________________ 4_____________ 5_____________ 6____________ 7_______________________________ |

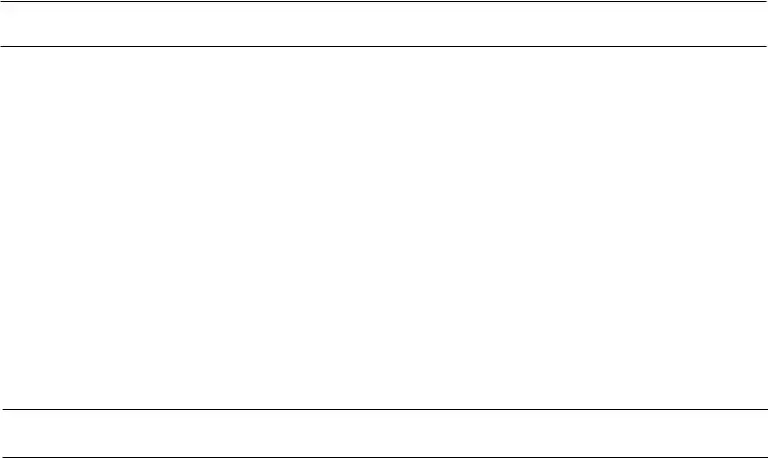

SCHEDULE A - PARTICIPANT DIRECTORY - Total Income Less Than $250,000

See instructions on page 7 for the diskette requirements.

Legal name as shown on Form

ID Number

List all participants, including principal address. Add additional sheets as necessary.

Social Security Number or EIN |

|

Name |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Taxable Income This Page |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|||

___________ Additional Pages Attached |

|

|

|

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . .Total Taxable Income All Pages (Carry to Line 17, Column A) |

|

|

|

||||

Total NJ Income Tax This Page |

|

|

|

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

||||

___________ Additional Pages Attached |

|

|

|

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . .Total NJ Income Tax All Pages (Carry to Line 18, Column A) |

|

|

|

||||

|

|

|

|

|

|

|

|

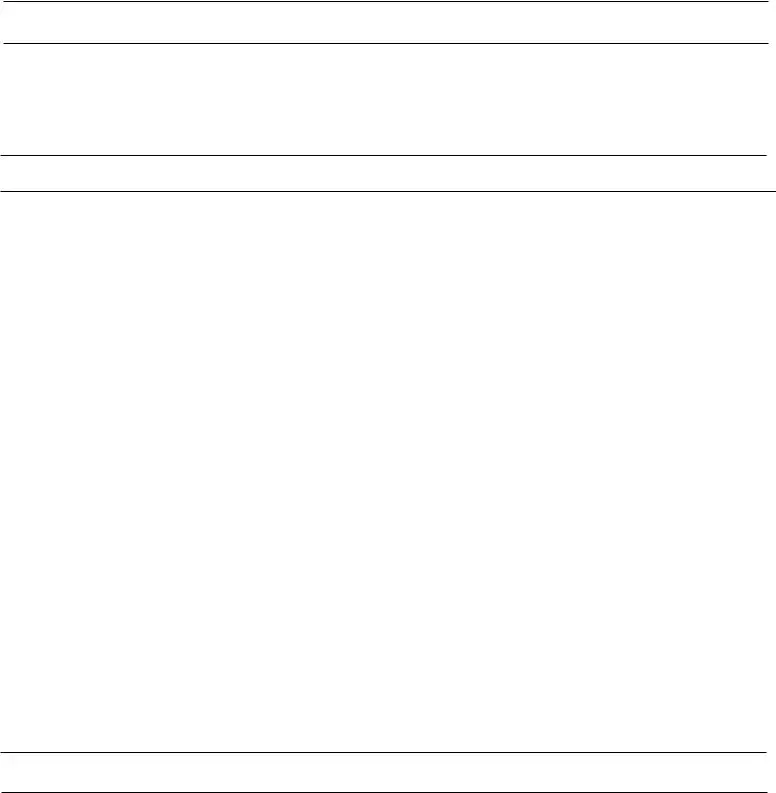

SCHEDULE B - PARTICIPANT DIRECTORY - Total Income Greater Than or Equal to $250,000

See instructions on page 7 for the diskette requirements.

Legal name as shown on Form

ID Number

List all participants, including principal address. Add additional sheets as necessary.

|

Social Security Number or EIN |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

Zip Code |

||||||

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

Zip Code |

||||||

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

Zip Code |

||||||

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

Zip Code |

||||||

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

Zip Code |

||||||

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

Zip Code |

||||||

|

NJ Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Taxable Income This Page |

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|||

|

___________ Additional Pages Attached |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . .Total Taxable Income All Pages (Carry to Line 17, Column B) |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Total NJ Income Tax This Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

||||

|

___________ Additional Pages Attached |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . .Total NJ Income Tax All Pages (Carry to Line 18, Column B) |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE C - NONPARTICIPANT DIRECTORY

See instructions on page 7 for the diskette requirements.

Legal name as shown on Form

ID Number

List all nonparticipants, including principal address. Add additional sheets as necessary.

Social Security Number or EIN |

Name |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

Name |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

Name |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

Name |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

Name |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

Name |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

Name |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

Social Security Number or EIN |

Name |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

2004 COMPOSITE RETURN INSTRUCTIONS

Qualified nonresident individuals who are members of general and limited partnerships, professional athletic teams, limited liability partnerships, limited liability companies, New Jersey electing S corporations, estates and trusts may participate in a composite return. Any composite return which is filed on behalf of 25 or more participants must be filed on diskette. General diskette specifications can be found beginning on page 5.

For tax year 2004, the

Individual participants with income of less than $250,000, from the entity preparing and filing the composite

Individual participants with income greater than or equal to $250,000, from the entity preparing and filing the composite

Only individuals are eligible to file as part of a composite return. To qualify for participation in a composite return the nonresident must be a member of one of the specified entities and satisfy all of the following conditions:

1.The individual was a nonresident for the entire taxable year;

2.The individual did not maintain a permanent place of abode in New Jersey at any time during the taxable year;

3.The individual was not a fiscal year filer;

4.The individual did not have income derived from or connected with New Jersey sources other than the income reported on composite return(s);

5.The individual waives the right to claim any New Jersey personal exemption, credit or deduction and agrees to have the tax calculated directly on the individual’s income reported on the composite return at the highest tax rate in effect for single taxpayers for the tax year; and

6.The individual elects to be included in a composite return by completing and delivering to the filing entity a Form

An individual may participate in other New Jersey gross income tax composite returns, providing that the requirements of subsections 1 through 6 above, are satisfied. Once a nonresident elects to participate in a composite return the election is binding on the individual’s heirs, representatives, assigns, successors, executors and administrators and constitutes an express consent to personal jurisdiction in New Jersey for New Jersey personal income tax purposes.

ELECTION TO PARTICIPATE

Every participating member must make the election to be part of the composite return in writing each year by filing Form

PERMISSION TO FILE NOT REQUIRED

In previous years, the Division accepted composite returns only when written permission had been requested by the filing entity and a copy of the permission letter was attached to the composite return when filed. Written permission to file a composite return is not required. Any entity which is eligible to file a composite return may now do so without first putting the Division on notice.

WHEN TO FILE

Returns for calendar year 2004 are due April 15, 2005. No fiscal composite returns will be accepted.

POSTMARK DATE

All New Jersey income tax returns postmarked on or before the due date of the return are considered to be filed on time. Tax returns postmarked after the due date are considered to be filed late. When a return is postmarked after the due date, the filing date for that return is the date the return was received by the Division, not the postmark date of the return.

EXTENSION OF TIME TO FILE

An extension of time to file will be granted on a composite basis only. The request for an extension of time to file must be made on Form

If the filing entity has requested and been granted a four month extension, it may apply for an additional two month extension before the four month extension expires. The request for the additional two month extension must be made on Form

Taxpayers who file Form

If the requirements for extension are not satisfied, or if the return is not filed by the extended due date, the extension will be denied and penalties and interest will be imposed from the original due date of the return. See “Penalty and Interest Charges” on page 2.

WHERE TO FILE

Mail Form

State of New Jersey

Division of Taxation

Revenue Processing Center

PO Box 188

Trenton, New Jersey

ESTIMATED TAX

If the filing entity has filed a composite return in the previous years and the amount estimated to be the total income tax liability for the composite return for the current tax year exceeds $400, the filing entity must file a declaration of estimated tax and make quarterly estimated tax payments using Form

UNDERPAYMENT OF ESTIMATED TAX

If the filing entity failed to make the required estimated tax payments as described above, the entity must complete Form NJ- 2210, Underpayment of Estimated Tax by Individuals. Completing Form

NOTE: Credit will not be given on the composite return for estimated tax payments made by any of the qualified electing nonresident participants.

ACCOUNTING METHOD

The accounting method used for Form

ACCOUNTING PERIODS

The accounting period for a nonresident composite return is the calendar year.

FORMS AND ASSISTANCE

Forms are available by calling

http://www.state.nj.us/treasury/taxation/

Assistance is available by calling the Division’s Customer Service Center at

Any composite return which is filed on behalf of 25 or more participants must be filed on diskette. A filing entity with less than 25 participants may also file on diskette, but is not required to do so. See page 6 for general diskette specifications.

ROUNDING OFF WHOLE DOLLARS

The money items on the return and schedules may be shown in whole dollars. This means that any amount under 50 cents may be eliminated and amounts of 50 cents or more should be increased to the next higher dollar.

AMENDED RETURNS

An amended Form

An amended composite return should also be filed if the filing entity issues amended or corrected information returns (e.g. Form

PENALTIES AND INTEREST CHARGES

Penalty and interest should be included with the payment of any tax due.

The Division may impose the following:

Late filing penalty: 5% per month (or fraction of a month) up to a maximum of 25% of the outstanding tax liability when a return is filed after the due date or extended due date. Also, a penalty of $100 per month for each month the return is late may be imposed.

Late payment penalty: 5% of the outstanding tax balance may be imposed.

Interest: 3% above the prime rate for every month or fraction of a month the tax is unpaid, compounded annually. At the end of each calendar year, any tax, penalties and interest remaining due (unpaid) will become part of the balance on which interest is charged.

SIGNATURES

Form

Anyone who prepares a composite return for a fee must sign the return as a “Paid Preparer” and must enter his or her social security number. The company or corporation name and Federal Employer Identification Number, must be included, if applicable. The preparer required to sign the composite return must sign it by hand; signature stamps or labels are not acceptable. If someone prepares the return at no charge, the paid preparer’s area need not be completed. A tax preparer who fails to sign the return or provide a correct tax identification number may incur a $25 penalty for each omission.

- 2 -

GENERAL INSTRUCTIONS FOR FORM

PRIVACY ACT NOTIFICATION

The Federal Privacy Act of 1974 requires an agency requesting information from individuals to inform them why the request is being made and how the information is being used.

Social security numbers are used primarily to account for and give credit for tax payments. The Division of Taxation also uses social security numbers in the administration and enforcement of all tax laws for which it is responsible.

FEDERAL/STATE TAX AGREEMENT

The New Jersey Division of Taxation and the Internal Revenue Service have entered into a Federal/State Agreement to exchange income tax information in order to verify the accuracy and consistency of information reported on Federal and New Jersey income tax returns.

FRAUDULENT RETURN

Any person who willfully fails to file a return, files a fraudulent return, or attempts to evade the tax in any manner may be liable for a penalty not to exceed $7,500 or imprisonment for a term between three years and five years, or both.

GENERAL INFORMATION

Enter the exact legal name, trade name, if any, and address of the entity filing the return on behalf of its participating members. The legal name is the name in which the business owns property or acquires debt. Enter the trade name or d/b/a

Enter the entity’s Federal Employer Identification Number (EIN).

Enter the number of nonresident individuals participating in the composite return in the space provided.

Check the appropriate box to indicate the type of entity which is filing the return.

GUBERNATORIAL ELECTIONS FUND

The Gubernatorial Elections Fund, financed by taxpayer

designated $1 contributions, provides partial public financing to qualified candidates for the office of Governor of New Jersey. With its contribution and expenditure limits, the Gubernatorial Public Financing Program has since 1977 assisted 44 candidates to conduct their campaigns free from the improper influence of excessive campaign contributions. Operation of the program has also permitted candidates of limited financial means to run for election to the State’s highest office. As a condition of their receipt of public financing, candidates must agree to participate in two debates which provide the public with an opportunity to hear the views of each candidate. For more information on the Gubernatorial Public Financing Program, contact the New Jersey Election Law Enforcement Commission at (609)

Participation in the $1 income tax

ATTACHMENTS

For each qualified electing nonresident participant a copy of the following must be enclosed with Form

•Schedule

•Form

•Schedule

•Schedule D, Form

COMPLETING FORM

INSTRUCTIONS FOR PARTNERSHIPS, LIMITED LIABILITY COMPANIES AND LIMITED LIABILITY PARTNERSHIPS

New for 2004

For tax year 2004, the

Individual participants with income of less than $250,000, from the entity preparing and filing the composite

Individual participants with income greater than or equal to $250,000, from the entity preparing and filing the composite NJ- 1080C return, are listed on Schedule B - Participant Directory - Total Income Greater than or Equal to $250,000. The addition of the Taxable Income amounts for all the participants on Schedule B is carried over to the appropriate line(s) 8 through 16, Column B. The tax rate to be used on Schedule B and on line 18 of Column B on the

front of the return is 8.97%.

The income entered on Line 12 - Distributive Share of Partnership Income will be the combined income reported in Column B of Schedule

Lines 8 through 11 - Enter “0” (zero) on each of these lines.

Line 12 - Distributive Share of Partnership Income - Enter on this line the composite amount of income from the partnership that was reported on Line 4, Column B, Schedule

Lines 13 through 16 - Enter “0” (zero) on each of these lines.

Line 17 - Total New Jersey Taxable Income - Enter on Line 17 the total of lines 8 through 16.

- 3 -

COMPLETING FORM

INSTRUCTIONS FOR PARTNERSHIPS, LIMITED LIABILITY COMPANIES AND LIMITED LIABILITY PARTNERSHIPS

Line 18 - Tax - Compute the tax by multiplying the amount on Line 17, by 6.37% in Column A or 8.97% in Column B.

Line 19 - Total Tax - Enter on Line 19 the total of Line 18, Column A and Line 18, Column B.

Line 20 - Total New Jersey Tax Withheld - Enter “0” (zero) on Line 20.

Line 21 - Estimated Payments / Credit from 2003 Composite Return - Enter on Line 21 the total of:

•Estimated tax payments made by the partnership for 2004;

•Credit, if any, applied from the partnership’s 2003 composite return;

•Amount, if any, paid to qualify for an extension of time to file.

Credit will not be given on the composite return for estimated tax payments made on an individual basis by any of the participating partners during the tax year.

Line 22 - Tax Paid on Partners Behalf by Partnership - Enter on Line 22 the total amount of New Jersey income tax paid on

participating partners’ behalf by the partnership, as shown on Line 1, Column B, Part III of Schedule

Line 23 - Total Payments/Credits - Enter on Line 23 the total of Lines 20, 21 and 22.

Line 24 - Amount Due - If Line 19 is more than Line 23, there is a balance due. If you are enclosing Form

Line 25 - Overpayment - If Line 19 is less than Line 23, there is an overpayment.

Line 26 - Refund - Enter on Line 26 the amount from Line 25 (Overpayment) that you want refunded to the partnership.

Line 27 - Credit to 2005 Tax - Subtract Line 26 (Refund) from Line 25 (Overpayment). Enter the result on Line 27. This is the amount that will be credited to the 2005 composite tax liability.

COMPLETING FORM

INSTRUCTIONS FOR NEW JERSEY ELECTING S CORPORATIONS

New for 2004

For tax year 2004, the

Individual participants with income of less than $250,000, from the entity preparing and filing the composite

Individual participants with income greater than or equal to $250,000, from the entity preparing and filing the composite NJ- 1080C return, are listed on Schedule B - Participant Directory - Total Income Greater than or Equal to $250,000. The addition of the Taxable Income amounts for all the participants on Schedule B is carried over to the appropriate line(s) 8 through 16, Column B. The tax rate to be used on Schedule B and on line 18 of Column B on the front of the return is 8.97%.

Lines 8 through 12 - Enter “0” (zero) on each of these lines.

Line 13 - Net Pro Rata Share of S Corporation Income - Enter on this line the combined amount of S Corporation Income that was reported on Line 1, Part II, Schedule

Lines 14 through 16 - Enter “0” (zero) on each of these lines.

Line 17 - Total New Jersey Taxable Income - Enter on Line 17 the total of Lines 8 through 16.

Line 18 - Tax - Compute the tax by multiplying the amount on Line 17 by 6.37% in Column A or 8.97% in Column B.

Line 19 - Total Tax - Enter on Line 19 the total of Line 18, Column A and Line 18, Column B.

Line 20 - Total New Jersey Tax Withheld - Enter “0” (zero) on Line 20.

Line 21 - Estimated Payments / Credit from 2003 Composite Return - Enter on Line 21 the total of:

•Estimated tax payments made by the New Jersey electing S Corporation for 2004.

•Amount, if any, paid to qualify for an extension of time to file.

•In addition, the total on line 21 must include any payments made by an S Corporation on behalf of any nonresident nonconsenting shareholders who have elected to participate in the composite return. If a nonresident nonconsenting shareholder elects to participate in a composite return the shareholder’s social security number reported on Form NJ-

Credit will not be given on the composite return for estimated tax payments made on an individual basis by any of the participating shareholders during the tax year.

Line 22 - Tax Paid on Partners Behalf by Partnership - Enter “0” (zero) on Line 22.

Line 23 - Total payments / Credits - Enter on Line 23 the total of Lines 20, 21, and 22.

- 4 -

COMPLETING FORM

INSTRUCTIONS FOR NEW JERSEY ELECTING S CORPORATIONS

Line 24 - Amount Due - If Line 19 is more than Line 23, there is a balance due. If you are enclosing Form

Line 25 - Overpayment - If Line 19 is less than Line 23, there is an

overpayment.

Line 26 - Refund - Enter on Line 26 the amount from Line 25 (Overpayment) that you want refunded to the S Corporation.

Line 27 - Credit to 2005 Tax - Subtract Line 26 (Refund) from Line 25 (Overpayment). Enter the result on Line 27. This is the amount that will be credited to the 2005 composite tax liability.

COMPLETING FORM

INSTRUCTIONS FOR ESTATES AND TRUSTS

New for 2004

For tax year 2004, the

Individual participants with income of less than $250,000, from the entity preparing and filing the composite

Individual participants with income greater than or equal to $250,000, from the entity preparing and filing the composite NJ- 1080C return, are listed on Schedule B - Participant Directory - Total Income Greater than or Equal to $250,000. The addition of the Taxable Income amounts for all the participants on Schedule B is carried over to the appropriate line(s) 8 through 16, Column B. The tax rate to be used on Schedule B and on line 18 of Column B on the front of the return is 8.97%.

Lines 8 through 14 - Enter “0” (zero) on each of these lines.

Line 15 - Net Gains or Income Derived Through Estates or Trusts Enter on this line the combined amount of estate or trust income that was distributed to all participating beneficiaries, but only to the extent that those items were attributable to New Jersey sources and included in the amounts reported on Schedule G, Form

Line 19 - Total Tax - Enter on Line 19 the total of Line 18, Column A and Line 18, Column B.

Line 20 - Total New Jersey Tax Withheld - Enter “0” (zero) on Line 20.

Line 21 - Estimated Payments / Credit from 2003 Composite Return - Enter on Line 21 the total of:

•Estimated tax payments made by the estate or trust for 2004

•Amount, if any, paid to qualify for an extension of time to file.

Credit will not be given on the composite return for estimated tax payments made on an individual basis by any of the participating beneficiaries during the tax year.

Line 22 - Tax Paid on Partners Behalf by Partnership - Enter “0” (zero) on Line 22.

Line 23 - Total Payments / Credits - Enter on Line 23 the total of Lines 20, 21 and 22.

Line 24 - Amount Due - If Line 19 is more than Line 23, there is a balance due. If you are enclosing Form

Line 25 - Overpayment - If Line 19 is less than Line 23, there is an overpayment.

Line 16 - Other Income - Enter “0” on this line.

Line 17 - Total New Jersey Taxable Income - Enter on Line 17 the total of Lines 8 through 16.

Line 18 - Tax - Compute the tax by multiplying the amount on Line 17 by 6.37% in Column A or 8.97% in Column B.

Line 26 - Refund - Enter on Line 26 the amount from Line 25 (Overpayment) that you want refunded to the estate or trust.

Line 27 - Credit to 2005 Tax - Subtract Line 26 (Refund) from Line 25 (Overpayment). Enter the result on Line 27. This is the amount that will be credited to the 2005 composite tax liability.

COMPLETING FORM

INSTRUCTIONS FOR PROFESSIONALATHLETIC TEAMS

New for 2004

For tax year 2004, the

Individual participants with income of less than $250,000, from the entity preparing and filing the composite

Individual participants with income greater than or equal to $250,000, from the entity preparing and filing the composite NJ- 1080C return, are listed on Schedule B - Participant Directory - Total Income Greater than or Equal to $250,000. The addition of the Taxable Income amounts for all the participants on Schedule B is carried over to the appropriate line(s) 8 through 16, Column B. The tax rate to be used on Schedule B and on line 18 of Column B on the front of the return is 8.97%.

- 5 -

COMPLETING FORM

INSTRUCTIONS FOR PROFESSIONALATHLETIC TEAMS

Line 8 - Wages, salaries, tips and other employee compensation - Enter on this line the combined amount of wages that was paid by the team to the participating athletes as a result of duty days spent in New Jersey during the tax year. See “New for 2004” above.

Lines 9 through 16 - Enter “0” (zero) on each of these lines.

Line 17 - Total New Jersey Taxable Income - Enter on Line 17 the total of lines 8 through 16.

Line 18 - Tax - Compute the tax by multiplying the amount on Line 17 by 6.37% in Column A or 8.97% in Column B.

Line 19 - Total Tax - Enter on Line 19 the total of Line 18, Column A and Line 18, Column B.

Line 20 - Total New Jersey Tax Withheld - Enter on Line 20 the total New Jersey income tax withheld.

Line 21 - Estimated Payments/Credit from 2003 Composite Return - Enter on Line 21 the total of:

•Estimated tax payments, if any, made by the team for 2004.

•Amount, if any, paid to qualify for an extension of time to file.

• Credit, if any, applied from the team’s 2003 Composite return.

Credit will not be given on the composite return for estimated tax payments made on an individual basis by any of the participating nonresident athletes during the tax year.

Line 22 - Tax Paid on Partners Behalf by Partnership - Enter “0” (zero) on Line 22.

Line 23 - Total Payments/ Credits - Enter on Line 23 the total of Lines 20, 21, and 22.

Line 24 - Amount Due - If Line 19 is more than Line 23, there is a balance due. If you are enclosing Form

Line 25 - Overpayment - If Line 19 is less than Line 23, there is an overpayment.

Line 26 - Refund - Enter on Line 26 the amount from Line 25 (Overpayment) that you want refunded to the team.

Line 27 - Credit to 2005 Taxes - Subtract Line 26 (Refund) from Line 25 (Overpayment). Enter the result on Line 27. This is the amount that will be credited to the 2005 composite tax liability.

INSTRUCTIONS FOR SCHEDULES A, B and C

SCHEDULE A

PARTICIPANT

income amounts for all participants on this page.

___ Additional Pages Attached. Enter the number of attached pages.

Total Taxable Income All Pages (Carry to Line 17, Column A). Enter the total of the taxable income amounts for all participants listed on every Schedule A page.

___ Additional Pages Attached. Enter the number of attached pages.

Total NJ Income Tax All Pages (Carry to Line 18, Column A). Enter the total of the tax computed for all participants listed on every Schedule A page.

Any composite return which is filed on behalf of 25 or more participants (on Schedule A and Schedule B combined) must be filed on diskette. See page 7 for general diskette specifications.

SCHEDULE B

PARTICIPANT

List all participants with income of $250,000 or more each. Be sure to include their name, principal address and social security

number. Indicate each participant’s share of New Jersey taxable income and the amount of New Jersey gross income tax liability calculated at the rate of 8.97%. Attach additional sheets if necessary.

Total Taxable Income This Page. Enter the total of the taxable income amounts for all participants on this page.

_____ Additional Pages Attached. Enter the number of attached

pages.

Total Taxable Income All Pages (Carry to Line 17, Column B). Enter the total of the taxable income amounts for all participants listed on every Schedule B page.

_____ Additional Pages Attached. Enter the number of attached

pages.

Total NJ Income Tax All Pages (Carry to Line 18, Column B). Enter the total of the tax computed for all participants listed on every Schedule B page.

Any composite return which is filed on behalf of 25 or more participants (on Schedule A and Schedule B combined) must be filed on diskette. See page 7 for general diskette specifications.

SCHEDULE C

NONPARTICIPANT DIRECTORY

List all members of the filing entity, including partnerships and corporations, which have not elected to or are not qualified to participate in the composite return. Be sure to include each members name, principal address and social security number or EIN. Attach additional sheets if necessary.

If Schedules Aand B are required to be submitted on diskette because there are 25 or more participants, Schedule C must also be submitted on diskette.

INSTRUCTIONS FOR COMPLETING FORM

Every qualified nonresident who wishes to participate in a composite return must read and complete Form

- 6-

Document Specifications

| Fact | Detail |

|---|---|

| Form Designation | NJ-1080C is designed for Income Tax - Nonresident Composite Return. |

| Tax Year | Applies to the tax year January 1 - December 31, 2004. |

| Eligible Entities | Includes Professional Athletic Teams, Partnerships, NJ Electing S Corporations, Limited Liability Companies, Limited Liability Partnerships, Estates, and Trusts. |

| Gubernatorial Elections Fund | Offers an option to designate $1 of taxes to this fund without increasing the tax or reducing the refund. |

| Income Information | Consists of various income types such as wages, taxable interest, dividends, and gains from disposition of property. |

| Use of Two Tax Rates | Uses two tax rates, 6.37% for individual participants with income less than $250,000 and 8.97% for those with income greater than or equal to $250,000. |

| Eligibility for Composite Return | Nonresidents must meet certain conditions such as not maintaining a permanent abode in NJ and waiving the right to claim personal exemptions, among others. |

| Extension of Time to File | A four-month extension can be requested with Form NJ-630, with the possibility of a further two-month extension under specific conditions. |

Detailed Steps for Using Nj 1080C

Filing the NJ-1080C form is important for nonresident individuals part of specific entities within New Jersey seeking to file a composite return for the stated tax year. The process requires careful attention to detail and thoroughness to ensure accuracy and compliance with New Jersey state tax laws. By following the steps provided below, preparers can accurately complete the NJ-1080C form for their respective entities.

- Begin by entering the tax year for which the form is being filed at the top of the form.

- Fill in the "ID Number," "Legal Name," and "Trade Name" (if applicable) in the designated fields.

- Provide the "Address," "City," "State," and "Zip Code" of the entity filing the return.

- Indicate the type of entity by checking the appropriate box: Professional Athletic Team, Partnership, New Jersey Electing S Corporation, Limited Liability Company, Limited Liability Partnership, Estate or Trust, or GUBERNATORIAL.

- If willing to designate $1 of your taxes to the GUBERNATORIAL ELECTIONS FUND, check "YES" next to the fund name. Checking "YES" does not increase your tax or reduce your refund.

- For income information, complete Columns A and B by entering the appropriate figures for wages, salaries, tips (Line 8), taxable interest (Line 9), dividends (Line 10), net gain or income from disposition of property (Line 11), and other specified income sources through to Line 16.

- Sum the amounts from Lines 8 through 16 to calculate the "Total New Jersey Taxable Income" for both Column A and Column B on Line 17.

- Calculate the tax for each column on Line 18 by applying the respective tax rates provided in the form instructions.

- Add the calculated taxes from Column A and Column B to determine the "Total Tax" on Line 19.

- Report any "New Jersey Tax Withheld," "Estimated Payments / Credit from 2003 Composite return," and "Tax Paid on Partners Behalf by Partnership" on Lines 20 through 22.

- Add Lines 20 through 22 to report the "Total Payments / Credits" on Line 23.

- If payments are less than the total tax, enter the amount due on Line 24. If payments exceed the tax, enter the overpayment amount on Line 25.

- If there is an overpayment, indicate the amount to be refunded on Line 26. Alternatively, specify if the overpayment should be credited to the next tax year on Line 27.

- The preparer must sign and date the return at the bottom, providing their name, title, firm’s name (if applicable), social security number, address, and Federal EIN number.

- For entities with participants' income less than $250,000, complete "SCHEDULE A - PARTICIPANT DIRECTORY - Total Income Less Than $250,000" as per instructions on page 7 of the form instructions.

- For entities with participants' income equal to or greater than $250,000, complete "SCHEDULE B - PARTICIPANT DIRECTORY - Total Income Greater Than or Equal to $250,000" following guidelines on page 7.

- If applicable, complete "SCHEDULE C - NONPARTICIPANT DIRECTORY" for any relevant nonparticipants.

- Review the completed form for accuracy, ensuring that all necessary documentation is attached and that the form is compliant with the instructions and guidelines provided.

This document, once properly filled out, serves as a declaration of income and tax liability for nonresident individuals collectively through a composite return. Accuracy and diligence in preparation can help avoid errors and ensure that the entity complies with New Jersey tax laws. Filing by the prescribed deadline is crucial to avoid penalties or interest charges.

Learn More on Nj 1080C

What is the NJ-1080C form?

The NJ-1080C form is a tax document used by the State of New Jersey for nonresident composite income tax returns. This form allows certain entities, such as partnerships, limited liability companies, and S corporations, to file a single composite return for eligible nonresident individuals who are members or partners instead of each nonresident filing separately.

Who is eligible to participate in a composite return using the NJ-1080C form?

Eligibility to participate in a composite return using the NJ-1080C form requires individuals to be nonresidents of New Jersey for the entire tax year, not maintain a permanent place of abode in the state during the year, not be a fiscal year filer, have no other New Jersey source income outside of what's reported on the composite return, waive the right to any New Jersey personal exemptions, credits, or deductions, and elect to participate in the composite return by completing Form NJ-1080-E.

What entities can file a NJ-1080C form?

The entities that can file a NJ-1080C form include professional athletic teams, partnerships, New Jersey electing S corporations, limited liability companies (LLCs), limited liability partnerships (LLPs), estates, and trusts.

How are tax rates determined on the NJ-1080C form?

For the tax year 2004, the tax rates on the NJ-1080C form are determined based on the income levels of the individual participants. Income less than $250,000 is taxed at 6.37%, and income $250,000 and above is taxed at 8.97%.

Is it required to elect annually to participate in a composite return?

Yes, every member must elect annually to be included in a composite return by filing Form NJ-1080-E with the entity. The election is kept on file with the entity and is not sent to the tax division unless requested.

When is the NJ-1080C form due?

The NJ-1080C form for the calendar year 2004 is due by April 15, 2005. Extensions for filing can be requested, but no fiscal year composite returns are accepted.

How can an extension to file the NJ-1080C be obtained?

An extension can be requested using Form NJ-630 by the original due date. A four-month extension can be granted if at least 80% of the estimated tax liability is paid by the due date. An additional two-month extension might be available before the four-month extension expires, also requested by Form NJ-630.

What are the requirements for filing a composite return on diskette?

Composite returns filed on behalf of 25 or more participants must be submitted on diskette. General diskette specifications and requirements are detailed starting on page 5 of the NJ-1080C instruction booklet.

Can participants of other composite returns still participate in the NJ-1080C composite return?

Yes, individuals may participate in multiple New Jersey gross income tax composite returns, provided they meet all the eligibility conditions for each return.

What happens if a return is filed late?

Returns filed after their due date are considered late, and the date of receipt by the Division, not the postmark date, becomes the filing date. Late returns may be subject to penalties and interest charges from the original due date of the return.

Common mistakes

Filling out the NJ-1080C form can be daunting, and mistakes can easily happen. Here are common errors to avoid to ensure the process is as smooth as possible:

- Not checking the appropriate entity type box at the top of the form, such as Partnership or S Corporation, which can lead to incorrect tax calculations.

- Forgetting to indicate the total number of individuals participating in the return, which is crucial for accurately splitting the tax burden among members.

- Omitting the legal name or trade name, if applicable, which could result in processing delays or the rejection of the form.

- Incorrectly filling out the address, city, state, and zip code fields, which might lead to mailed correspondence and refund checks being sent to the wrong location.

- Failing to designate $1 of your taxes to the Gubernatorial Elections Fund when desired. This election does not affect your refund or amount due but supports public financing of gubernatorial elections.

- Misreporting income information in Columns A and B, leading to underpayment or overpayment of taxes.

- Neglecting to list all participants on Schedule A or B correctly, including their Social Security Number or Employer Identification Number, address, and the correct amount of taxable income and NJ income tax.

- Forgetting to attach Form NJ-2210 if it applies to your situation, which is necessary if you’re claiming underpayment of estimated tax.

- Incorrectly calculating the total New Jersey Taxable Income and the tax due on Lines 17 and 18, which can lead to miscalculated tax liabilities.

- Overlooking the signature section at the bottom of the form, which is required to validate the return. An unsigned form can be considered incomplete and lead to processing delays.

It’s important to review the entire form upon completion carefully, double-checking all entries and calculations, and ensuring that all required signatures are in place. Taking these steps will help to avoid the common mistakes listed and aid in the timely and accurate processing of your NJ-1090C form.

Documents used along the form

When preparing and filing the NJ-1080C form for Nonresident Composite Return, entities often need to gather and submit additional forms and documents to comply fully with New Jersey tax regulations. These documents play crucial roles in ensuring accurate and compliant tax reporting for all participants included in the composite return. Below is a list of other forms and documents commonly used alongside the NJ-1080C form, along with brief descriptions of each.

- NJ-1080-E: Election to be Included in a Composite Return - This form is used by individual members of the specified entities who choose to participate in the composite return. It signifies the individual's consent and is a prerequisite for inclusion.

- NJ-2210: Underpayment of Estimated Tax by Individuals, Estates, or Trusts - If the estimated tax payments are insufficient, this form is attached to calculate any interest due.

- NJ-630: Application for Extension of Time to File New Jersey Gross Income Tax Return - This document requests additional time for filing the NJ-1080C, ensuring compliance even when unforeseen delays occur.

- W-2: Wage and Tax Statement - Employed participants’ earnings, tax withholding, and other related information are detailed in this document, important for accurate income reporting.

- 1099-DIV: Dividends and Distributions - This form reports dividend or distribution earnings from investments, required for participants earning such income.

- 1099-INT: Interest Income - Documents the amount of interest earned by the participants, necessary for complete income disclosure.

- 1099-MISC: Miscellaneous Income - Any other income earned by participants, not specifically classified elsewhere, is reported on this form.

- K-1 (Partnership, LLC/LLP, Trusts, and S Corporations): Reports the participant's share of income, deductions, and credits from partnerships, S corporations, estates, or trusts.

- Schedule NJ-BUS-1: New Jersey Gross Income Tax – Business Income Summary Schedule - This schedule details business income for entities and might be needed for accurate reflection of business-related income on the composite return.

- Schedule NJ-BUS-2: New Jersey Gross Income Tax – Business Allocation Schedule - Used by businesses to report income from New Jersey sources, crucial for entities operating in multiple states.

Accurately completing and including these documents with the NJ-1080C ensures that all income is properly reported and taxes are correctly calculated, fulfilling the obligations of the participating entities and individuals towards New Jersey's tax laws. Each document serves its unique purpose, from declaring participation in the composite return to detailing specific kinds of income and eligibility for extended filing. It's essential for entities to understand these requirements and diligently prepare all needed documentation to maintain compliance and fulfill their tax responsibilities.

Similar forms

The NJ-1080C form shares similarities with other tax-related documents, specifically designed to accommodate the reporting requirements of various entity types and their members or partners. One such related document is the IRS Form 1065, U.S. Return of Partnership Income. Both forms are used by partnerships for tax filing purposes. The NJ-1080C form is used by nonresident members of partnerships in New Jersey for a composite tax return, whereas Form 1065 is filed by partnerships at the federal level to report their income, gains, losses, deductions, credits, etc. Both serve as a means for entities to report their financial information to tax authorities.

Similarly, the IRS Form 1120S, U.S. Income Tax Return for an S Corporation, aligns with the NJ-1080C form in its target audience of S Corporations. Like NJ-1080C's provision for New Jersey Electing S Corporations, Form 1120S is tailored for S Corporations to report their income, gains, losses, and credits to the IRS. These documents ensure that entities pass their individual tax obligations to their shareholders or members, paralleling in their fundamental purpose of streamlining the tax reporting process for pass-through entities and their owners.

Another comparable document is the IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, which is akin to the NJ-1080C in how it serves estates or trusts. The NJ-1080C allows estates and trusts with nonresident beneficiaries to file a composite return in New Jersey. Meanwhile, Form 1041 is used by estates and trusts to report income, deductions, and credits to the federal government. Both documents facilitate a cohesive tax reporting mechanism for entities and their beneficiaries, ensuring compliance with tax laws at both the state and federal levels.

Furthermore, the IRS Form 8804, Partnership Withholding Tax Return (Section 1446), has parallels to the NJ-1080C form, specifically in its focus on withholding tax obligations for partnerships. While Form 8804 pertains to federal tax withholdings for partnerships with income effectively connected to the United States, the NJ-1080C includes provisions for tax paid on a partner's behalf by the partnership. Each of these forms plays a critical role in managing and reporting the tax withholdings of partners or members, ensuring that the entities meet their tax obligations on behalf of their non-resident participants.

In essence, while the NJ-1080C form is specific to New Jersey for nonresident composite returns, it shares fundamental reporting objectives and structures with these other tax documents. Whether at the state or federal level, for partnerships, S Corporations, estates, or trusts, these forms collectively ensure that entities accurately report income and distribute tax responsibilities among their members, partners, or beneficiaries, promoting tax compliance across different types of entities.

Dos and Don'ts

When completing the NJ-1080C form, there are several key practices to ensure accuracy and compliance with New Jersey tax laws. Below are eight things you should and shouldn't do:

- Do ensure all participants meet the eligibility requirements before including them in the composite return. This includes being a nonresident for the entire taxable year and not maintaining a permanent place of abode in New Jersey.

- Do not include individuals who have not elected to be part of the composite return by completing Form NJ-1080-E.

- Do accurately calculate and report income for all columns and schedules, paying close attention to the specific instructions provided for each section of the form.

- Do not miss the due date. Ensure the form is postmarked by April 15, following the end of the tax year, to avoid penalties and interest.

- Do apply for an extension if necessary, using Form NJ-630, and ensure that at least 80% of the actual tax liability is paid by the original due date to qualify for the extension.

- Do not guess or estimate figures. Use actual financial records to provide the most accurate information possible.

- Do utilize the correct tax rates for calculating the tax owed - 6.37% for individuals with income less than $250,000 and 8.97% for those with income $250,000 and above.

- Do not forget to sign and date the return. An unsigned return could be considered invalid and may delay processing and potential refunds.

Adhering to these dos and don'ts will help in the accurate and timely filing of the NJ-1080C form, ensuring compliance with state tax requirements and minimizing potential issues.

Misconceptions

When it comes to filing taxes, especially for those who are not residents of the state but are subject to tax rules due to their affiliations, clear information is crucial. The NJ-1080C form, a nonresident composite return, often leaves people confused due to prevailing misconceptions. Here, we will debunk eight common misconceptions to provide clarity and assistance for accurate tax filing.

"The NJ-1080C form is only for individuals." Contrary to popular belief, the NJ-1080C form is not for individuals but for entities such as partnerships, S corporations, and limited liability companies, which file the return on behalf of their nonresident members. Individuals can't file this form for their personal income tax return.

"Filing the NJ-1080C automatically covers all my New Jersey tax obligations." This is incorrect. The NJ-1080C form only covers income derived from the specific entity or entities participating in the composite return. Nonresidents may have other New Jersey source income that requires filing of additional New Jersey tax returns.

"Every nonresident member of an entity must be included in the NJ-1080C." In reality, inclusion in the NJ-1080C is not mandatory for all nonresident members. It’s an elective decision, and members must consent to participate by filing Form NJ-1080-E with the entity.

"There is only one tax rate applied to all taxable income on the NJ-1080C." The form applies two different tax rates based on the level of taxable income: 6.37% for income less than $250,000, and 8.97% for income of $250,000 or greater. This ensures a more equitable tax structure for participants.

"You can file the NJ-1080C form anytime during the year." Like many tax documents, the NJ-1080C has a strict filing deadline. Returns are due on April 15th following the close of the calendar year. However, extensions can be requested using Form NJ-630.

"Electing to participate in a composite return precludes the need for estimated tax payments." Even if participating in a composite return, members might still need to make estimated tax payments if their share of the entity’s income generates a sufficient tax liability.

"Once you elect to participate in a composite return, you cannot opt out." The election to participate in a composite return is binding for the specific tax year for which it is made. Decisions for subsequent years can be changed annually.

"A professional athletic team cannot participate in the NJ-1080C filing." This is not true. Professional athletic teams can file the NJ-1080C form on behalf of their nonresident athletes, provided the income is from New Jersey sources.

Understanding these aspects of the NJ-1080C form is essential for entities and their members to ensure compliance with New Jersey’s tax laws. It is also advisable to consult with a tax professional to navigate the complexities of state tax obligations accurately.

Key takeaways

Filling out and using the NJ-1080C form involves understanding some crucial aspects to ensure it is done correctly and effectively. Here are key takeaways:

- The NJ-1080C form is designed for the composite return of income for nonresident individuals who are members of partnerships, S corporations, limited liability companies, professional athletic teams, limited liability partnerships, estates, and trusts in New Jersey.

- This form allows qualified nonresidents to participate in a composite return, simplifying the filing process for both the entity and the individuals by filing one combined return instead of multiple individual returns.

- To be eligible to file a composite return, a nonresident individual must meet several conditions, including being a nonresident for the entire tax year and not maintaining a permanent place of abode in New Jersey.

- Participants must elect to be included in the composite return by completing Form NJ-1080-E and delivering it to the filing entity before the composite return is filed.

- The form introduces two tax rates: 6.37% for individual participants with income less than $250,000, and 8.97% for those with income equal to or greater than $250,000, highlighting the importance of properly categorizing participants to apply the correct tax rate.

- Each participating member’s election is binding and gives consent to jurisdiction in New Jersey for tax purposes, which is an important aspect of the collective filing approach.

- Filing on a diskette is required when a composite return includes 25 or more participants, a detail that entities must prepare for well in advance of the filing deadline.

- No prior permission from the Division is required to file a composite return; any eligible entity wishing to file may do so without seeking approval, simplifying the process for first-time filers.

- The form emphasizes the strict deadlines for filing and the potential extensions, underlining the importance of timely submission to avoid penalties and interest charges for late filing.