Fill Out a Valid Nj 927 W Template

In the realm of New Jersey business operations, the NJ 927 W form stands as a critical document, encapsulating the Employer's Quarterly Report. This comprehensive form is tailored for businesses to report wages paid, taxes withheld, and contributions towards unemployment, disability, workforce development, and family leave insurance for each quarter. Specifically, it mandates employers to detail Gross Income Tax (GIT) amounts withheld weekly, alongside providing a breakdown of all wages subject to different state insurances and the taxes due on them. The form also requires businesses to report the count of full-time and part-time employees, offering a closer look into the workforce's structure. Furthermore, employers must account for any payments or credits received within the quarter, ensuring that the report encapsulates the entire fiscal activity pertinent to employee compensation and state obligations. With deadlines set for each quarter's end, the NJ 927 W form epitomizes the nexus between businesses and the New Jersey state tax and labor regulations, making its accurate and timely submission integral to compliance and financial planning.

Sample - Nj 927 W Form

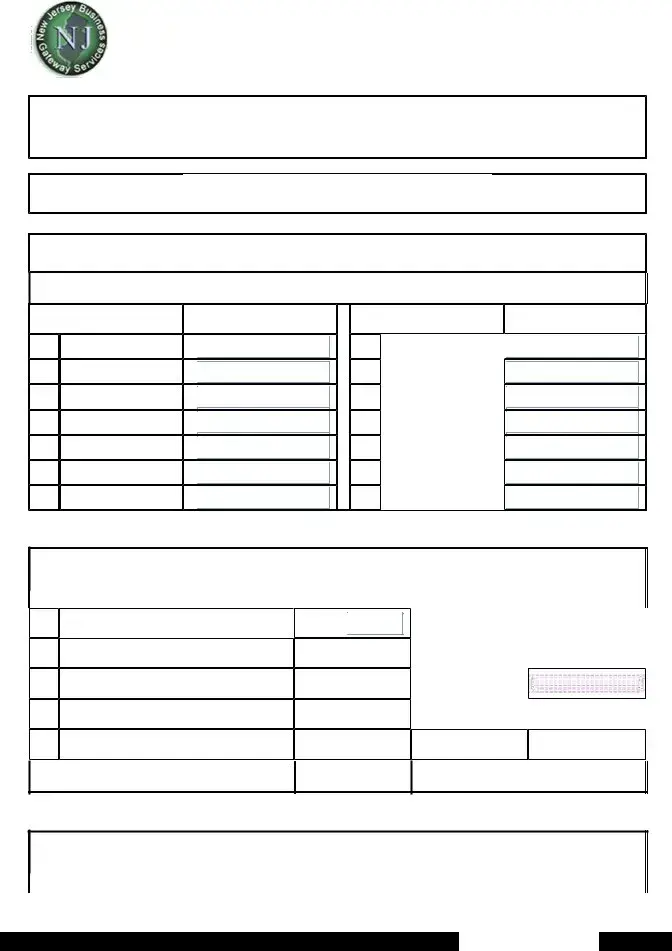

NJ927 - Employer's Quarterly Report |

Page 1 of 3 |

State of New Jersey

NJ927W

Employer's Quarterly Report

FEIN: |

Quarter/Yr: 1/2009 |

||

Business Name: TEST CASE 04 |

|

|

|

|

|

|

|

Quarter Ending Date: 03/31/2009 |

Return Due Date: 04/30/2009 |

||

Date Filed: Not Filed |

|

|

|

GIT Amounts Withheld For Quarter

Enter GIT Amount Withheld Each Period (Press the line description on the left for help)

|

Week/Period |

01 |

|

02 |

|

03 |

|

04 |

|

05 |

06

07

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

Week/Period

08

09

10

11

12

13

14

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

Employer Gross Income Tax (GIT) Withholding

Line (Press the line number for help)

01Wages Subject to Gross Income Tax

02 Total GIT Amount ue This Quarter

03Total GIT Remitted This Quarter Plus Credits (If Applicable)

04GIT Balance ue

05GIT Overpayment Amount

06

GIT Payment Amount

GIT Payment Amount

$0.00

$0.00

|

|

Payments/Credits |

|

$0.00 |

|

Review Details |

|

|

for Quarter |

||

|

|

|

|

|

|

|

$0.00

Overpayment

$0.00N/A

Instructions

$0.00

Unemployment, Disablity, Work Force, and Family Leave

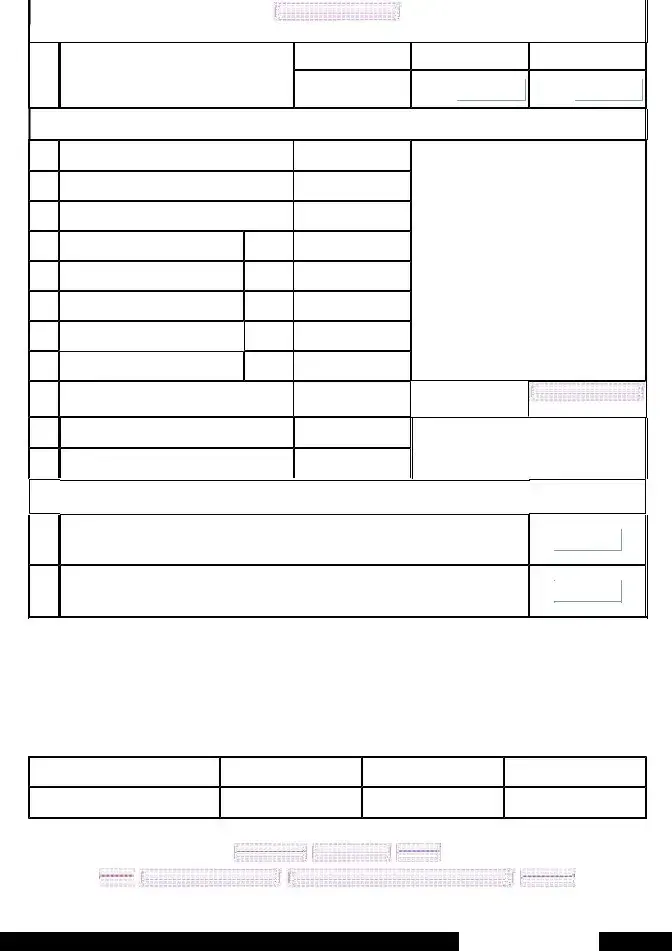

NJ927 - Employer's Quarterly Report |

Page 2 of 3 |

|

|

|

View Rate Detail |

||||

Line (Press the line number for help) |

|

|

|

|

|

|

|

|

The count of all |

Month 1 |

|||||

07 |

covered workers who worked during, or |

|

|

|

|

|

|

|

received pay for the pay period that |

|

0 |

|

|||

|

included the 12th day of each month. |

|

|

||||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

08 |

Total of All Wages Paid Subject to |

|

|

|

|

||

|

|

$0.00 |

|

|

|||

09 |

UI, DI, WF & FLI |

|

|

|

|

|

|

|

|

|

|

|

|

||

Wages in Excess of First $27,700 |

|

|

|

||||

|

|

$0.00 |

|

|

|||

|

|

|

|

|

|

|

|

10 |

Taxable Wages UI & WF |

|

$0.00 |

|

|

||

11 |

Taxable Wages Subject to DI |

P |

$0.00 |

|

|

||

12 |

Taxable Wages Subject to FLI |

P |

$0.00 |

|

|

||

13 |

Total UI & WF Contributions |

0.032250 |

$0.00 |

|

|

||

14 |

Total DI Contributions |

0.000000 |

$0.00 |

|

|

||

15 |

Total FLI Contributions |

0.000000 |

$0.00 |

|

|

||

16 |

Payments Received for this Quarter |

$100.00 |

|

|

|||

17 |

Balance Due - UI, WF, DI & FLI |

|

$0.00 |

|

|||

18 |

Payment Amount - UI, WF, DI & FLI |

$0.00 |

|

||||

Month 2

0

Payments/Credits

for Quarter

Month 3

0

Review Details

Private Plan

The count of all

19Plan" for TDI who worked during or received pay for the pay period that included the 12th day of each month.

The count of all

20Plan" for FLI who worked during or received pay for the pay period that included the 12th day of each month.

0

0

|

Summary Balance Due and Payment Information |

|

||

|

|

|

|

Grand Total |

|

|

|

|

Gross Income Tax and |

|

Gross Income Tax |

UI, WF, DI & FLI |

UI, WF, DI, & FLI |

|

|

Balance ue |

$0.00 |

$0.00 |

$0.00 |

The Amount You Indicate to Pay |

$0.00 |

$0.00 |

$0.00 |

|

|

|

|||

|

|

|

|

|

|

Calculate |

Next Page |

Reset |

|

Help |

Email the Division |

Return To Processing Center |

Logout |

|

NJ927 - Employer's Quarterly Report |

Page 3 of 3 |

Document Specifications

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Identification | NJ927 is known as the Employer's Quarterly Report. |

| 2 | Form Purpose | It serves for reporting the employer's gross income tax (GIT) withholdings, as well as unemployment, disability, workforce, and family leave insurance contributions. |

| 3 | Specificity | This form is specific to the State of New Jersey. |

| 4 | Governing Law | It is governed by state laws pertaining to employment taxes and contributions in New Jersey. |

| 5 | Quarterly Tracking | The form tracks and reports earnings and taxes withheld for each period within the quarter. |

| 6 | Reporting Requirements | All full-time and part-time employees' earnings subject to various taxes and contributions must be reported. |

| 7 | Contribution Rates | Details unemployment, disability, workforce, and family leave insurance contribution rates applicable for the quarter. |

| 8 | Due Dates | Specifies the quarter ending date and the return due date for the form. |

| 8 | Submission Indicators | Includes fields to indicate payments made, adjustments, overpayments, and any balance due. |

| 9 | Digital Interaction | Provides options for online assistance, calculation tools, and the ability to email the Division or return to processing center. |

Detailed Steps for Using Nj 927 W

Embarking on the task of completing the NJ927W form, an essential document for businesses in New Jersey, involves a series of straightforward but critical steps. This form is whipped out quarterly to account for various tax withholdings and contributions related to unemployment, disability, workforce, and family leave. Getting it right is paramount to ensure compliance with state regulations and to avoid potential fines or complications. Below is a breakdown of the steps needed to fill out the form accurately.

- Locate the FEIN (Federal Employer Identification Number) on the top of the document. Ensure it matches your business's registered FEIN.

- Verify the Quarter/Yr at the top of the form is correct for the period you're reporting.

- Confirm the Business Name listed is correct. If not, make the necessary adjustments to reflect the legal name of your business.

- Check the Quarter Ending Date and Return Due Date to ensure that you're filing within the appropriate timeframe.

- Under the GIT Amounts Withheld For Quarter section, enter the Gross Income Tax (GIT) amount withheld for each listed week/period. If no amount was withheld during those times, ensure to record a $0.00 value.

- Scroll to the Employer Gross Income Tax (GIT) Withholding Line section and accurately input:

- The total wages subject to Gross Income Tax.

- The total GIT amount due this quarter.

- Any total GIT remitted this quarter plus credits, if applicable.

- The GIT balance due or overpayment amount, alongside the GIT payment amount.

- On Page 2, under the section that counts all full-time and part-time workers, accurately reflect the number of covered workers for each month in the quarter you’re reporting.

- Input the total of all wages paid subject to UI, DI, WF, and FLI and any wages that exceed the first $27,700.

- Enter the appropriate taxable wages for UI & WF, taxable wages subject to DI, and taxable wages subject to FLI, following with the total contributions for each.

- Record any payments received for this quarter, the balance due, and the payment amount for UI, WF, DI, & FLI.

- Finalize the form by reviewing the information for accuracy, inputting the total gross income tax, and indicating the amount you plan to pay.

- Use the buttons provided at the bottom of Page 3 to calculate, reset (if necessary), help, email the division for assistance, or log out once completed.

With meticulous attention to detail and careful entry of the required information, completing the NJ927W form becomes an achievable task. This step-by-step guide aims to simplify the process, ensuring that businesses can confidently fulfill their reporting obligations. Remember, accurately completing and timely submitting this form keeps your business in good standing and ensures compliance with New Jersey state laws.

Learn More on Nj 927 W

What is the NJ 927W form?

The NJ 927W form, known as the Employer's Quarterly Report, is a document required by the State of New Jersey. It is used by employers to report wages paid, gross income tax withheld from employees, and unemployment, disability, workforce, and family leave insurance contributions for each quarter of the calendar year. This form plays a crucial role in ensuring compliance with state tax and insurance contribution requirements.

Who needs to file the NJ 927W form?

This form must be filed by every employer who pays wages to employees working in New Jersey or to New Jersey residents. This requirement applies regardless of whether the employer is located within New Jersey or out of state. It is an essential document for reporting state payroll taxes and contributions.

When is the NJ 927W form due?

The form is due on a quarterly basis, with specific dates for each period. For example, for the first quarter ending March 31, the due date is April 30. It's important for employers to adhere to these deadlines to avoid penalties and interest for late submissions.

What information is required on the NJ 927W form?

- Gross Income Tax (GIT) amounts withheld for each week of the quarter

- Summary of employer and employee contributions toward Unemployment Insurance, Disability Insurance, Workforce Development Partnership Fund, and Family Leave Insurance

- Total of wages paid subject to UI, DI, WF, and FLI

- Payment information for the reported quarter

How can employers submit the NJ 927W form?

Employers have the option to file this form electronically through the Division of Revenue and Enterprise Services' online system. This paperless method is encouraged for its efficiency and convenience. Alternatively, if necessary, employers can file paper forms by mailing them to the designated processing center.

What happens if an employer does not file the NJ 927W form or pays late?

Late filing or payment can result in penalties and accrued interest. The state of New Jersey imposes specific fines for these violations, which can grow over time if the issue remains unresolved. Employers are therefore encouraged to file the form and make any necessary payments by the stipulated deadlines to avoid these additional costs.

Can amendments be made to a previously filed NJ 927W form?

Yes, if an employer discovers an error in a previously filed NJ 927W form, amendments can be submitted. The process for making corrections involves submitting a revised form with the accurate information for the quarter in question. This ensures that payroll records are kept accurate and up to date with the state.

Common mistakes

Filling out the NJ 927-W form is crucial for employers in New Jersey, as it directly relates to unemployment, disability, workforce, and family leave contributions, as well as Gross Income Tax (GIT) withheld from employees' wages. However, several common errors can delay processing and potentially lead to penalties. Here is an expanded list of mistakes to avoid:

Not double-checking the Federal Employer Identification Number (FEIN). An incorrect FEIN can result in the misidentification of your business entity.

Entering the wrong quarter year or quarter-ending date. This mistake could cause your report to be filed under the wrong period, leading to discrepancies in your tax records.

Failing to properly record the GIT amounts withheld each period. It's important to accurately enter the amount withheld for each week or period to ensure the correct total GIT amount for the quarter.

Overlooking to detail the wages subject to Gross Income Tax. This figure is crucial for calculating the total GIT due.

Misreporting or not reporting the total taxable wages for UI (Unemployment Insurance), DI (Disability Insurance), WF (Workforce Development), and FLI (Family Leave Insurance). When these figures are inaccurately reported, it can affect your tax liability.

Forgetting to include the total number of full-time and part-time covered workers each month. This figure helps determine the correct contribution rates and amounts for your business.

Miscalculating your tax due or payment amounts. Accurate calculations are essential for meeting your tax obligations without underpaying or overpaying.

Leaving the payment amounts section incomplete or incorrect, which can lead to underpayments, overpayments, or delayed processing of your form. Ensuring this section is accurately filled out signifies you've reviewed and acknowledged your tax and contribution responsibilities for the quarter.

Avoiding these errors can help streamline the filing process, ensure compliance with state requirements, and avoid potential financial penalties. Always review your form for accuracy before submission.

Documents used along the form

When preparing the NJ 927W - Employer's Quarterly Report, businesses in New Jersey must often accompany this form with additional documentation to ensure full compliance with state taxation and employment laws. These documents are essential for providing a holistic view of an employer's fiscal responsibilities and employee contributions throughout a quarter.

- WR-30: Employer Report of Wages Paid - Required alongside the NJ 927W, this report details each employee's wages to calculate unemployment and disability contributions accurately.

- W-2: Wage and Tax Statement - Essential for reporting annual wages and the amount of taxes withheld from employees' paychecks to the state and the IRS.

- NJ-W4: Employee's Withholding Certificate - Used by employees to determine the amount of state income tax to withhold from their wages.

- UI/DI/FLI Contribution Report - A detailed report of unemployment insurance, disability insurance, and family leave insurance contributions that must be submitted separately or as part of the NJ 927W filing.

- Quarterly Contribution and Wage Report - Another vital report that provides a breakdown of wages on which contributions are calculated, often required for federal documentation.

- Payment Voucher - Used when submitting payments for taxes or contributions owed as reported on the NJ 927W, ensuring that payments are correctly applied to an employer's account.

- New Hire Reporting Form - Required for all New Jersey employers to report new or rehired employees, aiding in the enforcement of child support obligations.

- Request for Extension of Time to File - Employers who need additional time to prepare their NJ 927W and accompanying reports may submit this request to avoid penalties for late filing.

Together, these documents fulfill a comprehensive reporting obligation to the State of New Jersey, ensuring that employees' rights are protected and that the state receives necessary funds for public services. Employers should remain diligent in completing not just the NJ 927W but also the related documentation required each quarter.

Similar forms

The NJ-927W form is closely related to the IRS Form 941, known as the Employer's Quarterly Federal Tax Return. Both documents are designed for employers to report earnings and withholding amounts for their employees on a quarterly basis. The NJ-927W focuses on state-level obligations in New Jersey, including gross income tax (GIT) withholdings, while the IRS Form 941 handles federal taxes, which include federal income tax, Social Security, and Medicare withholdings. Despite the different jurisdictions they cover, both forms serve a similar purpose: ensuring employers accurately report and remit taxes withheld from employee wages.

Another document resembling the NJ-927W is the Form UC-2, Employer's Quarterly Report, used in many states for unemployment insurance (UI) reporting. Just like the NJ-927W includes information about wages subject to unemployment, disability insurance, workforce development, and family leave insurance, the Form UC-2 collects data on total wages paid to employees to calculate the employer's unemployment insurance contribution. Though they address different specific insurance funds, both forms are crucial for maintaining compliance with state-level employment and tax laws.

The Quarterly Combined Withholding, Wage Reporting and Unemployment Insurance Return, often referred to simply as the quarterly wage report in various states, shares similarities with the NJ-927W form. This document consolidates the reporting of wages paid, taxes withheld from employees, and unemployment insurance contributions into a single filing. Like the NJ-927W, it simplifies the employer's filing obligations by merging multiple reporting requirements, thereby ensuring that employee wages, withholdings, and employer contributions are accurately documented for state authorities.

Lastly, the NJ-927W form is akin to the State Disability Insurance (SDI) reporting forms found in states that offer this benefit. These SDI forms require employers to report wages subject to disability insurance contributions. Although the specific details and purpose of the SDI reporting forms may vary from the NJ-927W, both sets of documents are essential for the administration of employee benefit programs. They help ensure that adequate funds are collected to support workers who require temporary disability benefits, reflecting a shared goal of worker protection and support.

Dos and Don'ts

Filling out the NJ 927W form is an important process for any business. Attention to detail and accuracy are key. Below are nine tips to help guide businesses through this process effectively and efficiently. Following these do’s and don’ts can save time and avoid potential issues with the State of New Jersey.

- Do ensure that the Federal Employer Identification Number (FEIN) is entered correctly. This unique identifier is crucial for the State of New Jersey to process your form accurately.

- Do accurately report the Gross Income Tax (GIT) amounts withheld for each period. This ensures compliance with state taxation requirements.

- Do review the total of all wages paid subject to Unemployment, Disability, Workforce, and Family Leave Insurance. Accurately reporting these figures is essential for the correct calculation of taxes and contributions.

- Do verify the accuracy of your calculations before submission, including the number of covered workers, taxable wages, and contributions to UI, WF, DI, and FLi.

- Do make use of the help options available for each line. These are designed to assist employers in understanding what information is required.

- Don’t leave any fields blank that are applicable to your business. Incomplete forms may be rejected or may require additional correspondence with the state, delaying processing times.

- Don’t estimate amounts. Use exact figures to prevent discrepancies and possible audits. Accurate reporting is essential for compliance and for your business records.

- Don’t ignore the due dates. Submitting the NJ 927W form after the due date can result in penalties and interest charges. Mark your calendar with the return due date to ensure timely compliance.

- Don’t forget to review the summary balance due and payment information at the end of the form. This final step is important to verify that all previous entries are correct and complete.

By paying close attention to these do’s and don’ts, businesses can successfully fulfill their reporting requirements with the State of New Jersey, maintaining compliance and avoiding unnecessary penalties or delays.

Misconceptions

When handling the NJ 927W form, employers and employees often encounter misconceptions. Correct understanding is crucial for accurate completion and submission. Here are six common misconceptions:

- Filing is only for businesses with employees. Even if a business did not pay wages during the quarter, it still needs to file the NJ 927W form to report this information to the state.

- All businesses must report the same types of wages. The NJ 927W form requires details on various wage types, such as unemployment, disability, workforce, and family leave insurance contributions. Each business may have different obligations based on its operations and the benefits it offers.

- Overpayments are rare and insignificant. Overpayments can occur and should be accurately reported on the form. They affect the balance due and can be applied toward future liabilities or requested as refunds.

- Electronic submission is optional. The State of New Jersey encourages, and in some cases requires, electronic submission of the NJ 927W form to streamline processing and ensure timely reporting.

- The form is the same for every business. Although the layout of the NJ 927W form is standardized, the information reported varies significantly depending on the business's payroll size, number of employees, and the wages paid during the quarter.

- Accuracy is not crucial if the business owes no taxes. Even if a business believes it does not owe taxes for the quarter, accurate and complete reporting is essential. This ensures compliance with state laws and can prevent potential penalties or fines for underreporting.

Understanding and debunking these misconceptions is vital for businesses to maintain compliance with New Jersey’s reporting requirements. It ensures that the financial and operational aspects are accurately reflected in official records, supporting transparent and efficient state tax administration.

Key takeaways

Understanding the nuances of the NJ927-W form is pivotal for employers in New Jersey, ensuring accurate reporting of wages, taxes withheld, and contributions towards unemployment, disability, workforce, and family leave insurance. The following key takeaways guide employers through the meticulous completion and application of this essential document.

- The NJ927-W form is a comprehensive report that requires employers to detail the Gross Income Tax (GIT) amounts withheld from employees each quarter. It is a critical document for state tax compliance, necessitating careful attention to the included data.

- Accuracy in reporting the GIT Amount Withheld for each period within the quarter is crucial. This includes diligently entering amounts for every week or period, ensuring that the state receives precise information on withheld taxes.

- The form is divided into sections that encompass not just the GIT but also contributions towards Unemployment Insurance (UI), Disability Insurance (DI), Workforce Development (WF), and Family Leave Insurance (FLI). This underscores the importance of understanding the different components of payroll taxation and insurance contributions in New Jersey.

- Each section demands specific details, such as the count of all full-time and part-time employees covered, total wages paid subject to various taxes and contributions, and the exact amount due for each type. Employers must meticulously calculate and report these figures to avoid discrepancies and ensure compliance.

- The document includes functionality for employers to review their quarter's details, ensuring all payments and credits are accurately applied. This review process allows employers to identify and correct any errors before submission, a crucial step in maintaining accurate financial records.

- Finally, the completion and timely submission of the NJ927-W form are fundamental to maintaining compliance with New Jersey state requirements. Employers should be cognizant of due dates and ensure that this form, along with the necessary payments, is submitted promptly to avoid penalties and interest charges.

By adhering to these key takeaways, employers can navigate the complexities of the NJ927-W form effectively, ensuring accurate reporting and compliance with New Jersey's tax and employment laws. This not only aids in maintaining accurate records and financial integrity but also supports the broader economic system by ensuring the correct allocation of funds towards unemployment, disability, workforce development, and family leave benefits for all workers in the state.

Popular PDF Documents

Nj 2440 - Learn about the exclusions from gross income taxation for accident and health insurance payments with form NJ-2440.

Selling a Boat in Nj - Affords peace of mind to both parties by formalizing the sale with signatures witnessed by a notary public.

How to Change Llc Name in Nj - Facilitates compliance with state laws regarding professional licensing and personal information accuracy.