Fill Out a Valid Nj A 3128 Template

The New Jersey A-3128 form plays a crucial role for taxpayers, including nonresident individuals, estates, or trusts, seeking a refund of the estimated Gross Income Tax payments specifically associated with the sale of New Jersey real estate. This document serves as a claim for refund under provisions outlined in N.J.S.A. 54A:8-8 through N.J.S.A. 54A:8-10, and its proper execution is pivotal for anyone who has overpaid estimated taxes due to exemptions or miscalculations related to the property's sale. Taxpayers are required to attach a copy of the GIT/REP-3 form if claiming a seller’s residency exemption or detail documentation attesting to the overpayment based on the sale's realized gains. The form necessitates comprehensive information, including social security numbers, the taxpayer's current address, details of the property sold, and the calculated tax liability using a provided tax rate table. Moreover, the form outlines a procedural framework for appointing a taxpayer representative and mandates the inclusion of Settlement Statement (HUD-1) or Closing Disclosure form when mailing the claim to the Division of Taxation. By stipulating a systematic approach to claiming a refund, Form A-3128 underscores the importance of accuracy and completeness in tax dealings, ensuring taxpayers who overpaid are justly reimbursed, subject to the Division's verification and approval processes.

Sample - Nj A 3128 Form

New Jersey

Division of Taxation

Claim for Refund of the

Estimated Gross Income Tax Payment for the Sale of New Jersey Real Estate

For Official Use Only

Claim No.

To qualify for this refund, taxpayers must:

1)Attach a copy of the

2)Attach documentation that they overpaid estimated tax based on calculated gain on sale of property.

Print or Type This Form.

Social Security Number(s)

Name of Taxpayer(s): |

Last |

First |

Middle |

|

|

|

|

Current Address of Taxpayer(s): |

|

Number and Street |

|

|

|

|

|

City |

|

State |

ZIP Code |

|

|

|

|

Address of Property Sold: |

|

Number and Street |

|

|

|

|

|

City |

|

State |

ZIP Code |

Property Use:

Personal

Vacation

Rental

Business

Use the Schedule below to determine your estimated tax liability.

Taxpayers who submitted an erroneous payment and qualify for an exemption on the

Date Sold: |

|

|

|

|

|

|

|

Sale Price: |

$ |

|

|

|

|

|

|||||||

Date Purchased: |

|

|

|

|

|

Federal Adjusted Basis: |

$ |

|||

Percentage Owned: |

|

|

Net Gain/Loss: |

$ |

||||||

|

|

|

|

|

|

|

|

(If Net Loss - enter $0.) |

|

|

Estimated Gross Income Tax Payment submitted: |

$ |

|||||||||

Applicable Tax Year: |

|

|

|

$ |

||||||

** Estimated Tax Liability Due: |

|

|

||||||||

Tax Rate Table

Net Gain |

But Not |

|

|

|

Estimated |

Over |

Over |

Multiply |

Net Gain |

By |

Tax Liability |

$0 |

$20,000 |

x |

|

0.014 |

|

$20,000 |

$35,000 |

x |

|

0.0175 |

|

$35,000 |

$40,000 |

x |

|

0.035 |

|

$40,000 |

$75,000 |

x |

|

0.05525 |

|

$75,000 |

$500,000 |

x |

|

0.0637 |

|

$500,000 |

$1,000,000 |

x |

|

0.0897 |

|

$1,000,000 |

and over |

x |

|

0.1075 |

|

Amount of Refund Claim: |

$ |

Additional Information may be requested in order to complete your claim for a refund. The Division must have a record of receiving the “Estimated Gross Income Tax Payment submitted” before your claim can be processed.

**Payment of the Estimated Tax Liability does not relieve you of your responsibility to file the required return, nor does it close the tax year covered. The tax year remains open until the required return has been filed and accepted; all tax, penalties, and interest charges have been paid; and the statutory audit period has expired.

Appointment of Taxpayer Representative

If this form is being prepared by anyone other than the taxpayer(s), an Appointment of Taxpayer Representative must be included.

Under penalties of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer is based on all information of which preparer has any knowledge.

Signature of Claimant(s)/Preparer: |

|

Date: |

|

If the preparer of this claim has been paid, indicate the firm’s name, address, the firm’s federal EIN and the preparer’s Social Security number, federal identification number, or federal preparer tax identification number.

Firm’s Name:

Firm’s Address:

Preparer’s SS # or Federal PTIN:

Preparer’s Federal EIN:

Mail this claim form along with the Settlement Statement

Division of Taxation

Taxpayer Accounting Branch

P.O. Box 046

Trenton, N.J.

Instructions for Form

Note: Use this form to claim a refund. Do not use form

1.This form is to be completed by nonresident individuals, estates, or trusts to claim a refund of estimated Gross Income Tax payment paid under provisions of N.J.S.A.

2.Separate forms must be used for each taxpayer, except for husband and wife who file jointly.

3.Include taxpayer’s current address or address where refund should be mailed.

4.Include the address of property sold and the amount of refund being requested.

5.Check box indicating type of property use.

6.Include the date of sale, sale price, date of purchase, federal adjusted basis, percentage owned, and net gain/loss of the property sold.

7.Calculate and enter the estimated tax liability using the table provided on the form. Taxpayers who submitted an erroneous payment and qualify for an exemption on the

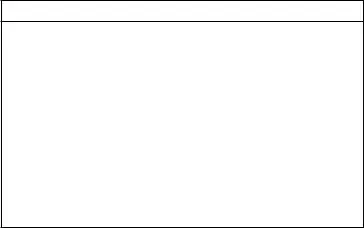

Example:

Date Sold: 2/4/20 |

Sale Price: |

$315,000 |

Date Purchased: 9/21/16 |

Federal Adjusted Basis: |

$279,000 |

Percentage Owned: 100% |

Net Gain/Loss: |

$36,000 |

|

(If Net Loss, enter $0.) |

|

|

|

|

Estimated Gross Income Tax Payment submitted: |

$6,000 |

|

** Estimated Tax Liability Due: |

|

$1,260 |

Amount of Refund Claim: |

|

$4,740 |

Tax Rate Table

Net Gain |

But Not |

|

|

|

Estimated |

Over |

Over |

Multiply |

Net Gain |

By |

Tax Liability |

$0 |

$20,000 |

x |

|

0.014 |

|

$20,000 |

$35,000 |

x |

|

0.0175 |

|

$35,000 |

$40,000 |

x |

$36,000 |

0.035 |

$1,260 |

$40,000 |

$75,000 |

x |

|

0.05525 |

|

$75,000 |

$500,000 |

x |

|

0.0637 |

|

$500,000 |

$1,000,000 |

x |

|

0.0897 |

|

$1,000,000 |

and over |

x |

|

0.1075 |

|

8.Include the estimated Gross Income Tax payment submitted. Payment of the Estimated Tax Liability does not relieve you of your responsibility to file the required return nor does it close the tax year covered. The tax year remains open until the required return has been filed and accepted; all tax, penalties, and interest charges have been paid; and the statutory audit period has expired.

9.Enter the amount of the net refund being claimed.

10.Whenever an agent on behalf of the taxpayer executes a claim, an Appointment of Taxpayer Representative specifically authorizing such agent to act on behalf of the taxpayer must accompany the claim for refund form.

11.Mail this claim for refund along with the Settlement Statement

New Jersey Division of Taxation

Taxpayer Accounting Branch

PO Box 046

Trenton, NJ

12.Failure to complete all required lines on Form

Document Specifications

| Fact Name | Description |

|---|---|

| Purpose of Form A-3128 | This form is designed for nonresident individuals, estates, or trusts to claim a refund of estimated Gross Income Tax payment paid for the sale of real estate in New Jersey. |

| Governing Law | The process and qualifications for claiming a refund are outlined under provisions of N.J.S.A. 54A:8-8 through N.J.S.A. 54A:8-10. |

| Documentation Requirement | To qualify for a refund, one must attach either a copy of the GIT/REP-3 form for erroneous payment exemptions or documentation of overpaid estimated tax based on the sale's calculated gain. |

| Filing Criteria | This form is to be filed with the Division of Taxation after the deed has been recorded with the county clerk, ensuring that the Division has a record of the "Estimated Gross Income Tax Payment submitted" before processing a claim. |

| Submission Details | Claims for refund along with required documents, such as the Settlement Statement (HUD-1) or Closing Disclosure form, should be mailed to the New Jersey Division of Taxation, Taxpayer Accounting Branch, P.O. Box 046, Trenton, NJ 08646-0046. |

Detailed Steps for Using Nj A 3128

Filing for a refund can seem like a daunting process, especially when it involves tax matters related to real estate transactions in New Jersey. However, understanding the procedure for claiming a refund of the estimated Gross Income Tax payment due to the sale of New Jersey real estate can provide peace of mind. The New Jersey Division of Taxation requires that certain steps be followed and specific forms be used for such claims to be processed efficiently. By diligently completing Form A-3128 and attaching the necessary documentation, individuals can navigate the refund process with greater ease and confidence.

To correctly fill out Form A-3128, please follow these steps:

- Ensure the form is printed or typed to maintain readability.

- Enter the taxpayer(s)' social security number(s) at the top of the form.

- Fill in the name(s) of the taxpayer(s) – last, first, and middle.

- Provide the current address of the taxpayer(s), including the number and street, city, state, and ZIP code.

- List the address of the property sold, also including the number and street, city, state, and ZIP code.

- Mark the box indicating the type of property use: Personal, Vacation, Rental, or Business.

- Enter the date the property was sold and its sale price.

- Provide the date the property was purchased and its federal adjusted basis.

- Indicate the percentage owned and calculate the net gain or loss from the sale of the property. If there's a net loss, enter $0.

- Insert the amount of the estimated Gross Income Tax payment that was submitted.

- If applicable, enter the calculated estimated tax liability using the provided tax rate table. If you qualified for an exemption on the GIT/REP-3 form, indicating you submitted an erroneous payment, enter $0 and attach a completed copy of the GIT/REP-3 form.

- Determine and enter the amount of the refund being claimed.

- Include any necessary additional documentation as requested or required to support your claim.

- If the form is prepared by anyone other than the taxpayer(s), ensure an Appointment of Taxpayer Representative form is included.

- The taxpayer(s) or preparer must sign and date the form at the bottom, declaring under penalties of perjury that the information provided is true, correct, and complete.

- If the form is prepared by a paid preparer, fill in the firm’s name, address, the preparer's social security number, federal identification number, or preparer tax identification number, and the firm’s federal EIN.

- Mail the completed A-3128 form along with the Settlement Statement (HUD-1) or Closing Disclosure form to the Division of Taxation, Taxpayer Accounting Branch, P.O. Box 046, Trenton, NJ 08646-0046.

Filing this claim is a critical step in ensuring that any overpayments or errors in estimated tax payments are rectified. Remember, it is crucial to complete all required lines on Form A-3128 and attach all the required documentation to avoid delays or rejections of your claim. Careful adherence to these instructions will facilitate a smoother processing of your refund claim.

Learn More on Nj A 3128

Who needs to file Form A-3128?

Form A-3128 must be filed by nonresident individuals, estates, or trusts who seek a refund of their estimated Gross Income Tax payment made for the sale of New Jersey real estate. This form is specifically designed for taxpayers who have either erroneously paid estimated tax based on exemptions listed on the GIT/REP-3 form or overpaid estimated tax based on the calculated gain from the sale of property.

What documents are required to be attached with Form A-3128?

When filing Form A-3128, taxpayers must include the following documents:

- A copy of the GIT/REP-3 form if claiming an exemption.

- Documentation supporting the overpayment based on the calculated gain from the sale of the property.

- The Settlement Statement (HUD-1) or Closing Disclosure form.

When can Form A-3128 be filed?

This form can be filed with the New Jersey Division of Taxation only after the deed has been recorded with the county clerk. It's important to ensure that this condition is met before attempting to file the refund claim to avoid any unnecessary delay in processing.

Can a taxpayer representative fill out Form A-3128?

Yes, an agent on behalf of the taxpayer can complete and file Form A-3128. However, an Appointment of Taxpayer Representative form must specifically authorize the agent to act on the taxpayer's behalf and must accompany the claim for a refund. This ensures that the representative has the taxpayer's permission to manage their affairs regarding this matter.

How is the estimated tax liability calculated on Form A-3128?

The estimated tax liability on Form A-3128 is calculated using a specific Tax Rate Table provided on the form. Taxpayers should use the following steps:

- Enter the net gain or loss from the sale of the property.

- If a net loss, enter $0 as the liability.

- For net gains, use the corresponding rate from the Tax Rate Table to calculate the estimated tax liability based on the amount of gain.

Where should Form A-3128 be mailed?

Complete Form A-3126, along with all required documentation, should be mailed to the following address: New Jersey Division of Taxation, Taxpayer Accounting Branch, P.O. Box 046, Trenton, NJ 08646-0046. It is crucial to ensure all required lines on the form are completed and necessary documents are attached to avoid the claim being returned as incomplete.

Common mistakes

Filing out the NJ A-3128 form for claiming a refund on Estimated Gross Income Tax Payment for the Sale of New Jersey Real Estate can be tricky. Avoiding errors can help ensure your claim is processed smoothly and effectively. Here are four common mistakes people make:

Not attaching required documents: The need to attach specific documentation, such as a copy of the GIT/REP-3 form for those who qualify for one of the exemptions, or other documentation proving overpaid taxes based on the calculated gain on the sale of property, is commonly overlooked. This form serves as a key validator of your eligibility for a refund, and forgetting to include it can delay processing.

Incorrect calculation of estimated tax liability: Making errors in calculating the estimated tax liability using the provided Tax Rate Table is another frequent mistake. Accurate calculations are crucial to determine the correct amount of refund being claimed. Misinterpretation of the tiers and applicable rates can lead to incorrect refund claims.

Failing to include current or correct mailing address: It's essential to provide the current address or the address where the refund should be mailed. Claims can be delayed or lost if the address provided is incorrect or outdated, leading to potential problems with receiving your refund.

Not appointing a taxpayer representative properly: If the form is being prepared by anyone other than the taxpayer(s), an Appointment of Taxpayer Representative form must accompany the claim for a refund. Without this authorization, actions on behalf of the taxpayer can't be officially recognized, which could stall the process.

Understanding these common pitfalls and taking care to avoid them can help ensure that your claim for a refund is submitted accurately and processed without unnecessary delays.

Documents used along the form

Dealing with real estate transactions can require navigating through a maze of forms and documents, especially when it comes to tax implications in the state of New Jersey. The NJ A-3128 form plays a pivotal role for nonresident individuals, estates, or trusts looking to claim a refund of estimated Gross Income Tax payments for the sale of New Jersey real estate. But the A-3128 form is just one piece of the puzzle. Accompanying this critical document are several others that you may need to familiarize yourself with for a successful claim process.

- Settlement Statement (HUD-1) or Closing Disclosure: This document outlines the final transaction details between the buyer and seller of the property, including sales price, loan amounts, and adjustments.

- Form GIT/REP-3, Seller's Residency Certification/Exemption: To accompany the A-3128, this form is used by sellers to certify their residency status and claim any applicable exemptions from the estimated tax payment.

- Appointment of Taxpayer Representative: If someone other than the taxpayer is preparing the claim, this document authorizes that person to represent the taxpayer in matters related to the claim for a refund.

- Form GIT/REP-1, Nonresident Seller's Tax Declaration: Required for nonresident sellers, this form details the seller's tax declarations relevant to the property sale.

- Form GIT/REP-2, Nonresident Seller's Tax Prepayment Receipt: Evidence of the estimated tax payment made by a nonresident seller on the sale of real estate in New Jersey.

- Form GIT/REP-4, Waiver of Seller's Filing Requirement of GIT/REP Forms: This waiver form is used when certain conditions are met that allow the seller to avoid filing the usual GIT/REP forms.

- Income Tax Return for the applicable year: The claim for refund on the A-3128 form may influence the seller's income tax return, requiring adjustments or amendments based on the outcome of the refund claim.

- Power of Attorney: Similar to the Appointment of Taxpayer Representative but broader in scope, this legal document allows an individual to act on behalf of the taxpayer in a wide range of legal and financial matters.

- Proof of Payment Documents: Receipts or bank statements demonstrating the payment of the estimated Gross Income Tax payment which the taxpayer is seeking to have refunded.

- Correspondence from New Jersey Division of Taxation: Any official letters or notices received from the New Jersey tax authority pertaining to the property sale or estimated tax payments, which may support the claim for a refund.

While navigating through the process of claiming a refund using the NJ A-3128 form, it’s essential to gather and prepare all accompanying documents with care. Each form and document serves its unique purpose, from proving your eligibility for a refund to certifying legal representation. Keeping these documents organized and understanding their significance not only aids in the successful completion of your refund claim but also ensures compliance with New Jersey’s real estate transaction requirements. Indeed, being well-prepared with the right documentation can make all the difference in achieving a favorable outcome.

Similar forms

The Form 1040 for the U.S. Individual Income Tax Return shares similarities with the NJ A-3128 form, especially in the way both require individuals to report income, calculate tax liability, and assess any applicable refunds or additional payments due. Both forms necessitate detailed financial information from the taxpayer, including income sources, tax payments already made, and eligibility for deductions or credits. Similarly, they require the attachment of additional documents or schedules to substantiate claims made on the main form, such as income statements or proof of tax payments, to ensure accurate tax liability assessment and refund processing.

The IRS Form 843, Claim for Refund and Request for Abatement, also mirrors the NJ A-3128 form in its purpose and structure. This federal form is used to request a refund of overpaid taxes, penalties, fees, or interest, which aligns with the NJ form's objective of claiming a refund for overpaid estimated gross income tax on real estate sales. Both forms require the taxpayer to provide a rationale for the refund claim, along with supporting documentation that justifies the request, such as overpayment evidence or exemption qualifications that reduce tax liability.

Another related document is the HUD-1 Settlement Statement used in real estate transactions, which is notably referenced in the instructions for completing the NJ A-3128 form. Although the HUD-1 primarily serves to itemize all charges imposed upon the buyer and seller during a real estate transaction, its relevance to the NJ A-3128 comes from providing the necessary sale and financial details required for accurately calculating the estimated tax liability and substantiating the refund claim for overpaid gross income tax.

The GIT/REP-3, Seller’s Residency Certification/Exemption, directly ties to the NJ A-3128 form in manner and necessity. Applicants for the NJ A-3128 refund must attach a completed GIT/REP-3 if they believe they incorrectly paid estimated taxes due to a qualifying exemption. Both documents focus specifically on New Jersey real estate transactions, emphasizing the importance of accurately assessing tax obligations based on residency status, ownership details, and the nature of the property use, thereby affecting the seller's tax liabilities and potential refund entitlements.

Dos and Don'ts

When it comes to filling out the NJ A-3128 form for claiming a refund of the estimated gross income tax payment for the sale of New Jersey real estate, there are certain dos and don'ts that can help streamline the process and increase the likelihood of your claim being accepted. Below are 10 guidelines to consider:

- Do attach a copy of the GIT/REP-3 form if you are claiming an exemption due to an error in estimated tax payment.

- Do include documentation proving that you overpaid estimated tax based on the actual gain on the sale of the property.

- Do ensure that the form is filled out legibly, whether by printing or typing, to avoid any processing delays.

- Do provide your current address correctly, as this is where the refund will be mailed.

- Do include all necessary details about the property sold, such as the address, sale price, date of purchase, federal adjusted basis, and your percentage of ownership.

- Don't leave any required fields blank; incomplete forms can be rejected.

- Don't forget to calculate and enter your estimated tax liability using the provided tax rate table, unless you're exempt and have attached the GIT/REP-3 form indicating as such.

- Don't neglect to include the estimated Gross Income Tax payment previously submitted. This is crucial for processing your refund claim.

- Don't omit the appointment of a taxpayer representative form if someone other than the taxpayer(s) is completing the form. This must be properly authorized.

- Don't mail your refund claim without the necessary supporting documents, such as the Settlement Statement (HUD-1) or Closing Disclosure form. Incomplete submissions can delay processing or result in a rejected claim.

Following these guidelines can help ensure that your refund claim is complete and processed smoothly. Remember, accuracy and attention to detail when completing the NJ A-3128 form are key to a successful refund claim.

Misconceptions

When dealing with the NJ A 3128 form, which is important for claiming a refund of the estimated gross income tax payment for the sale of New Jersey real estate, several misconceptions commonly arise. Understanding and clarifying these misconceptions is crucial for a smooth and successful refund process.

Misconception 1: Any New Jersey resident can use Form A-3128 to claim a refund. In reality, this form is specifically designed for non-resident individuals, estates, or trusts. Its purpose is to facilitate the refund of estimated Gross Income Tax payments made due to the sale of real estate in New Jersey.

Misconception 2: Form A-3128 and Form GIT/REP-4 are interchangeable for claiming refunds. This is not the case. While both forms pertain to transactions involving New Jersey real estate, Form A-3128 is exclusively for claiming refunds of estimated gross income tax payments, and should not be confused with Form GIT/REP-4, which serves a different purpose.

Misconception 3: Taxpayers can file Form A-3128 before the deed is recorded with the county clerk. Contrary to this belief, the form can only be submitted to the Division of Taxation after the recording of the deed. This step is a prerequisite for the processing of any refund claim.

Misconception 4: Joint filers must submit separate A-3128 forms. Actually, husband and wife who file jointly can, and are encouraged to, use a single form. This streamlines the process, making it more efficient for both the taxpayers and the Division of Taxation.

Misconception 5: The form doesn't require detailed financial information regarding the property sale. On the contrary, detailed information about the sale price, date of purchase, federal adjusted basis, percentage owned, and the net gain or loss is essential. This data is crucial for accurately calculating the estimated tax liability and, consequently, the refund amount.

Misconception 6: Submission of estimated tax payment is sufficient for processing the claim. While providing the estimated Gross Income Tax payment is necessary, it is not the only requirement. The claim for a refund must include all required documentation, such as a copy of the GIT/REP-3 form for those qualifying for exemptions or proof of overpayment based on calculated gain on sale of property, and a proper completion of Form A-3128 is crucial. Failing to complete all required sections or attach necessary documentation will result in the claim being rejected as incomplete.

Addressing these misconceptions head-on helps ensure that taxpayers complete the NJ A 3128 form accurately and efficiently, paving the way for a successful claim of a refund on the estimated gross income tax payment for the sale of New Jersey real estate.

Key takeaways

When seeking a refund for estimated Gross Income Tax payment made from the sale of New Jersey real estate, it’s essential to use Form A-3128 correctly. Below are key takeaways to ensure the process is smooth and successful:

- Eligibility: Form A-3128 must be used by nonresident individuals, estates, or trusts aiming to claim a refund of estimated Gross Income Tax payments related to the provisions of N.J.S.A. 54A:8-8 through 54A:8-10.

- Filing Requirements: This form can be filed only after the deed has been recorded with the county clerk.

- Joint Filing: Separate forms are necessary for each taxpayer, except for married couples filing jointly.

- Address Information: Be sure to include both the taxpayer's current or refund mailing address and the address of the property sold.

- Property Details: Indicate the property use type, include sale and purchase dates, sale price, federal adjusted basis, percentage owned, and the net gain or loss.

- Documentation: Attach a completed GIT/REP-3 form for exemptions, or documentation proving overpayment of estimated taxes is crucial for processing the claim.

- Calculation of Liability: Accurately calculate your estimated tax liability using the provided tax rate table. If you qualify for an exemption, enter $0 for the liability.

- Submission with Supporting Documents: Always include the estimated Gross Income Tax payment made and mail your claim alongside the Settlement Statement (HUD-1) or Closing Disclosure form.

- Authorized Representation: If a tax agent or preparer submits the claim, an Appointment of Taxpayer Representative form must be included to authorize them.

- Complete Submission: Failure to fill out all required sections or attach necessary documents will lead to your claim being rejected as incomplete. Ensure the claim is properly filled and supported by relevant documents before mailing.

It’s crucial to understand that the payment of the estimated tax liability does not fulfill the obligation to file the required return, nor does it conclude the tax year in question. The tax year remains open until the required return is filed and accepted, all related payments, penalties, and interest charges are settled, and the statutory audit period has lapsed.

Popular PDF Documents

How to Change Llc Name in Nj - Must be printed, filled out clearly, and sent via fax or mail to the provided Board Office address or number.

1040nr - It includes sections for personal information, income, tax deductions, and credits specific to New Jersey tax laws.