Fill Out a Valid Nj Cbt 2553 R Template

The NJ CBT-2553 R form is a crucial document for corporations in New Jersey seeking to change their tax status to an S corporation retroactively. Managed by the State of New Jersey Division of Taxation, this application allows already authorized corporations to request retroactive S corporation status, a move that can significantly impact tax liabilities and operational flexibility. Applicants must attach this form to the New Jersey S Corporation Election form, CBT-2553, unless S corporation status has already been granted. The application process includes a payment of $100.00 for each tax year or privilege period affected by this retroactive request. It mandates that both corporate officers and shareholders affirm their consent to meet specific requirements laid out by New Jersey law, ensuring all involved parties agree to the terms of taxation under the S corporation status. This consent includes acknowledging New Jersey's jurisdiction over the taxation of the corporation's income, which remains in force even if a shareholder changes residence, except as New Jersey law might otherwise provide. Detailed instructions guide applicants through providing corporate information, making the required payment, and securing necessary consents, ensuring that the process is as smooth as possible. Finally, companies are reminded to mail completed forms and payments to the Division of Revenue, after which they will be notified about the status of their retroactive election. This application process not only underscores the legal obligations corporations must adhere to but also highlights the procedural steps necessary for achieving favorable tax treatment in New Jersey.

Sample - Nj Cbt 2553 R Form

State of New Jersey

Division of Taxation

RETROACTIVE S ELECTION APPLICATION

Complete and attach to form

Mail to:

NJ Division of Revenue PO Box 252

Trenton, NJ

This application is for authorized corporations that desire retroactive New Jersey S Corporation status. If New Jersey S corporation status has not been previously approved, attach this form to the New Jersey S Corporation Election form,

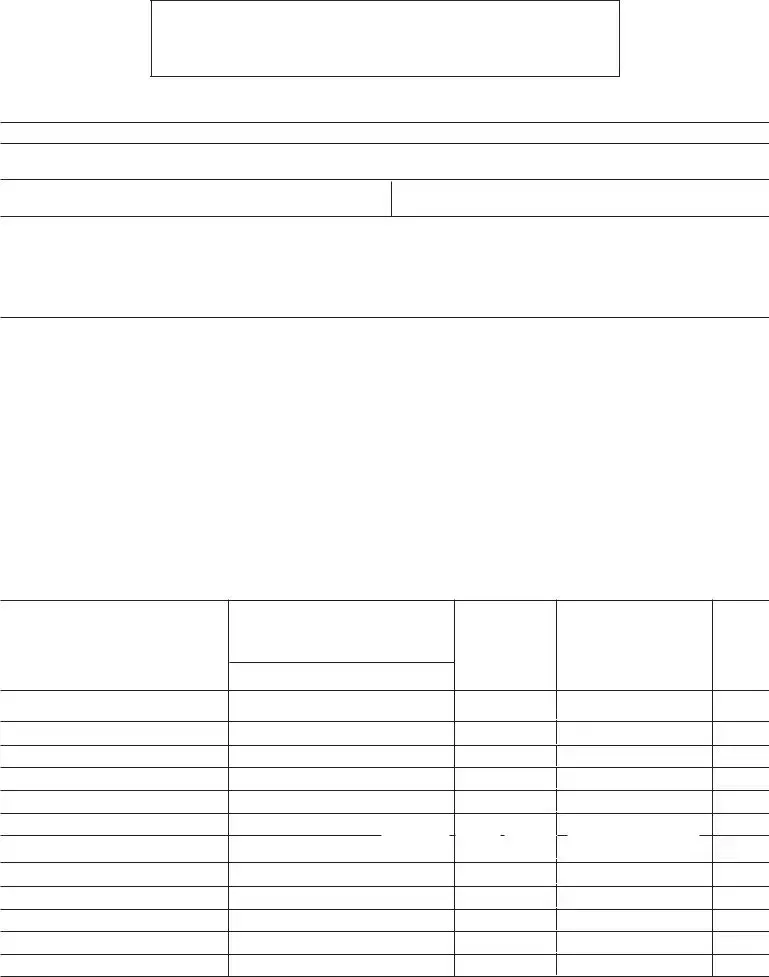

Part I Corporate Information (Type or Print)

Name of Corporation

Federal Employer Identification Number

NJ Corporation Serial Number

Part II Required Payment (Must be submitted with this application)

Date requested to begin this election ________/________/________

Number of calendar or fiscal period’s included: ___________________________

Number of periods x $100.00 = $ ______________.00

Part III Corporate Consent Statement

By signing this statement, the corporate officer affirms that this corporation is a New Jersey authorized corporation which meets the requirements for a New Jersey S corporation as set forth by law and on the form

Under penalties of perjury, I declare that I have examined this application, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete

________________________________________________________________ _____________________________________________________

Name of authorized officerTitle

________________________________________________________________ _____________________________________________________

Signature of authorized officer |

Date |

|

|

Part IV Shareholder’s Consent Statement - By signing this election, we the undersigned shareholders, consent (1) to the corporation’s retroactive election to be treated as a New Jersey S corporation under N.J.S.A.

Name of each past and present shareholder, each person having a community property interest in the corporation’s stock, and each tenant in common, joint tenant, and tenant by the entirety, past and present. (A husband and wife (and their estates) are counted as one shareholder).

Signatures must be provided

Signature |

Date |

|

|

Stock Owned

Number |

Dates |

|

of |

||

acquired |

||

shares |

|

|

|

|

Social Security Number

or

Employer Identification Number

for an estate or qualified trust

*Share- holder’s state of

residency

* You must provide the address of any shareholder who is not a resident of New Jersey on a rider and attach it to this form.

INSTRUCTIONS FOR FORM

1.This form is to be used by a currently authorized corporation electing New Jersey S corporation status effective retroactively to a prior return period. Submit a copy of the original

2.Part I Name of Corporation: Type or print the name exactly as it appears on form

3.Part I Federal Employer Identification Number (FEIN): As assigned by the Internal Revenue Service.

4.Part II Payment of $100.00 (non refundable) must be included for each and every year or privilege period for which this retroactive request applies.

5.Part III Please read the Corporate Attestation and the cited New Jersey rule.

6.Part III Print the name and title of the current corporate officer signing this document and the

7.Part IV All shareholders including original and subsequent shareholders for the retroactive period in question must sign and consent to New Jersey taxation in Part IV.

8.Mail the completed forms and appropriate payment to: New Jersey Division of Revenue, PO Box 252, Trenton, NJ

9.After the application is reviewed, the taxpayer will be notified if the retroactive election is granted.

N.J.A.C.

(a)A taxpayer that is authorized to do business in New Jersey and that is registered with the Division of Taxation and that has filed

(b)An administrative user fee of $ 100.00 shall be included with a taxpayer's filing of its retroactive New Jersey S corporation election Form

(c)A retroactive New Jersey S corporation or Qualified Subchapter S Subsidiary election will not be granted if:

1.All appropriate corporation business tax returns have not been timely filed and taxes timely paid as if the New Jersey S corporation election request had been previously approved;

2.A New Jersey S corporation request is not received before an assessment becomes final;

3.The Division has issued a notice denying a previous late filed New Jersey S election request, and the taxpayer has not protested the denial within 90 days; or

4.All shareholders have not filed appropriate tax returns and paid tax in full when due as if the New Jersey S corporation election request had been previously approved, and the taxpayers have not reported the appropriate S corporation income on those returns.

Document Specifications

| Fact Name | Description |

|---|---|

| Form Title | CBT-2553-R Retroactive S Election Application |

| Governing Body | New Jersey Division of Taxation |

| Application Purpose | For corporations desiring retroactive New Jersey S Corporation status |

| Required Attachment | Attach to form CBT-2553 when applying |

| Mailing Address | NJ Division of Revenue, PO Box 252, Trenton, NJ 08646-0252 |

| User Fee | $100.00 per tax year or privilege period |

| Governing Law | N.J.A.C. 18:7-20.3 |

| Eligibility Criteria | Authorized to do business in New Jersey and registered with Division of Taxation |

| Application Condition | All required business tax returns and taxes must have been timely filed and paid |

Detailed Steps for Using Nj Cbt 2553 R

Once you've decided to pursue retroactive New Jersey S Corporation status for your corporation, filling out the NJ CBT 2553 R form is your next step. This form is crucial for corporations that, though already authorized in New Jersey, aim to have their S Corporation status recognized retroactively. After completing this application accurately and providing all required documents, your submission to the New Jersey Division of Revenue will initiate the review process. Following this, you'll be notified regarding the approval of your retroactive election. To ensure a seamless process, follow the steps below carefully.

- Begin by gathering all necessary information, including the corporation's name as registered, the Federal Employer Identification Number (FEIN), and the New Jersey Corporation Serial Number.

- Type or print the corporation’s name in Part I, matching the name exactly as it appears on form NJ-REG and the CBT-2553.

- Enter the Federal Employer Identification Number (FEIN) in the designated field in Part I. This number is assigned by the IRS.

- For Part II, calculate the required payment by multiplying $100.00 by the number of years or privilege periods you are applying retroactive status for. Enter the calculated amount.

- Read the Corporate and Shareholder's Consent Statements in Part III carefully, as these sections confirm the corporation's and shareholders' agreement with New Jersey's terms for S Corporation status.

- In Part III, print the name and title of the current corporate officer authorized to sign this document. Ensure that the officer's name and signature are the same on both the CBT-2553 R and the original CBT-2553 form, if applicable.

- In Part IV, include the signatures of all shareholders—past and present—during the consent period. Make sure to provide their names, the number of shares owned, acquisition dates, Social Security Numbers (or Employer Identification Numbers for estates or trusts), and state of residency. Attach additional sheets if necessary.

- Review the entire application for accuracy and completeness to avoid delays in processing.

- Mail the completed form, along with the appropriate payment and any necessary attachments, to: New Jersey Division of Revenue, PO Box 252, Trenton, NJ 08646-0252.

After your form is received, it will be reviewed by the New Jersey Division of Revenue. The review process involves checking for completeness, accuracy, and compliance with New Jersey laws regarding S Corporation status. Your corporation will be contacted with the outcome of your application, detailing whether your retroactive election request has been granted or if additional information is needed.

Learn More on Nj Cbt 2553 R

What is the purpose of the CBT-2553-R Form?

The CBT-2553-R form is specifically designed for authorized corporations that want to obtain retroactive New Jersey S corporation status. This is an essential process for businesses that, for various reasons, did not previously apply for or were unable to secure S corporation status by the required deadline but wish to have this classification applied back to an earlier date. Completing and submitting this form, along with the required documentation and payment, allows a corporation to request the State of New Jersey to recognize their S corporation status retroactively.

Who needs to sign the CBT-2553-R Form?

- A current corporate officer must sign Part III of the form, affirming the corporation's eligibility and consent for S corporation status. The signature testifies that the corporation meets the necessary requirements as stipulated by New Jersey law and regulations.

- All shareholders, including past and present, during the period for which retroactive status is sought, must sign in Part IV. This collective consent is crucial for the election to be valid, as it signifies agreement to the corporation’s and each shareholder’s rights and obligations under New Jersey S corporation tax regulations.

What is the required payment for the CBT-2553-R Form, and how is it calculated?

There is a non-refundable administrative fee of $100.00 for each year or privilege period for which the retroactive S corporation status is requested. This means if a corporation seeks to apply this status for three previous years, the total fee would be $300.00. This fee must be submitted with the application to cover the administrative costs of processing the retroactive election.

Where and how should the CBT-2553-R Form be submitted?

After completing the CBT-2553-R Form and gathering all necessary consents and documentation, including the required payment, corporations should mail their application to the following address: New Jersey Division of Revenue, PO Box 252, Trenton, NJ 08646-0252. It's important for applicants to ensure that all parts of the form are fully and accurately completed and that all required signatures are obtained to avoid delays in the processing of their retroactive S corporation status request.

Common mistakes

Filling out the NJ CBT-2553-R form correctly is crucial for corporations that wish for New Jersey to recognize their S corporation status retroactively. However, there are common mistakes that can lead to delays or rejection of your application. Understanding these pitfalls can streamline the process and enhance your chances of approval. Here are four frequently encountered missteps:

- Incorrect Corporate Information: The name of the corporation, Federal Employer Identification Number (FEIN), and NJ Corporation Serial Number must be typed or printed exactly as they appear on the form NJ-REG and the original CBT-2553. Any inconsistency in these details can lead to confusion and delay the processing of the form.

- Insufficient Payment: Each request for a retroactive S corporation status requires a non-refundable fee of $100.00 for each tax year or privilege period for which the retroactive request applies. Often, applicants either forget to include the payment altogether or miscalculate the total due, especially when multiple periods are being requested.

- Incomplete Shareholder Consent: For the election to be valid, signed consent must be obtained from every past and present shareholder during the consent period. This includes individuals who had a community property interest in the corporation’s stock or were part of a joint tenancy. Failing to gather and attach these consents could result in the invalidation of the entire application.

- Failure to Attach Necessary Documentation: If New Jersey S corporation status has not previously been approved, the original CBT-2553 form must be submitted alongside the CBT-2553-R. Moreover, if the corporation has received New Jersey S corporation status approval in the past, a copy of the original CBT-2553 filed must be attached. Overlooking these attachments can halt the approval process.

By avoiding these errors, applicants can facilitate a smoother and more efficient application process. Clearly, attention to detail and thorough preparation play pivotal roles in achieving the desired retroactive S corporation status for your business in New Jersey.

Documents used along the form

Completing the NJ CBT-2553-R form for a retroactive S Corporation Election in New Jersey is a step that involves detailed compliance with tax regulations, often necessitating the collection and submission of additional documents to ensure that a corporation meets state legislative requirements. This requirement underscores the broader regulatory landscape that businesses must navigate, encompassing various forms and documents crucial for comprehensive compliance.

- NJ-REG: This form is essential for any business starting in New Jersey, as it registers the business with the state for tax and employer purposes. It is fundamental when delineating the type of corporation you are establishing, ensuring legal recognition.

- CBT-2553: The New Jersey S Corporation Election form is required for corporations that elect to be treated as S corporations for state tax purposes. Initially, the CBT-2553 needs to be filed; the CBT-2553-R serves to request retroactive status if this election has not been initially sought or approved.

- NJ-CBT-100S: The New Jersey S Corporation Business Tax Return is necessary for S corporations to file their annual taxes. This form communicates the company's financial activity to the state, ensuring that the appropriate taxes are assessed and collected.

- IRS Form 2553: The Election by a Small Business Corporation form used by corporations to elect S corporation status at the federal level. This form is critical for aligning state and federal tax treatment of the corporation.

- Corporate Bylaws: While not submitted to the state, corporate bylaws are crucial internal documents that outline the corporation’s operational rules. They often need to be referenced or updated in conjunction with submitting forms for corporate status changes.

- Stock Ledger: A detailed record of stock transactions within the corporation is crucial for accurately completing parts of the CBT-2553-R form, including the identification of shareholders for the retroactive period in question.

- Shareholder’s Agreement: This document may be referenced or required to verify shareholder consent for the S corporation election, particularly where shareholder rights and responsibilities in terms of taxation are concerned.

When preparing to submit the NJ CBT-2553-R form and associated documents, careful attention must be paid to the specific requirements of each, ensuring that detailed, accurate information is provided. This process not only involves internal document preparation, such as updating bylaws or maintaining stock ledgers, but also necessitates a clear understanding of state and federal tax obligations. The meticulous completion and submission of these documents collectively safeguard the corporation’s compliance with complex tax legislations, thereby securing its operational standing and future financial health. Businesses should consider seeking professional advice to navigate these processes effectively.

Similar forms

The IRS Form 2553, "Election by a Small Business Corporation," is closely related to the New Jersey CBT-2553-R form in terms of its purpose, which is for corporations electing S corporation status. Both forms are used by corporations to request a special tax status that impacts how they are taxed. While the IRS Form 2553 applies at the federal level, allowing businesses to be taxed under subchapter S of Chapter 1 of the Internal Revenue Code, the CBT-2553-R is specific to New Jersey, allowing corporations to be recognized as S corporations for state tax purposes. The forms share the requirement for detailed corporate information and consent from shareholders.

The New Jersey CBT-100S, "S Corporation Business Tax Return," shares similarities with the CBT-2553-R form since both are integral to the taxation process of S corporations within New Jersey. Upon successfully electing S corporation status using CBT-2553 or its retroactive counterpart, CBT-2553-R, a corporation must file its business taxes using the CBT-100S form. This form focuses on the income and deductions specific to S corporations, underscoring the post-election compliance that follows the acceptance of S corporation status.

The U.S. IRS Form 1120S, "U.S. Income Tax Return for an S Corporation," is analogous to the CBT-2553-R in its relation to S corporation tax reporting, but at a federal level. After a corporation elects S status with Form 2553, it must file its income tax returns using Form 1120S. Similar to New Jersey's approach with the CBT-100S, Form 1120S requires detailed accounting of the corporation's income, losses, and deductions, highlighting the continuity between election and subsequent tax reporting obligations.

New Jersey's NJ-REG form, necessary for businesses to register for tax and employer purposes, can be considered a precursor to the CBT-2553-R application. While the NJ-REG is broader in scope, involving the initial registration of a business within the state, it establishes a corporation's formal recognition by the state— a prerequisite before specialized tax statuses, like that sought through CBT-2553-R, can be elected. Both documents necessitate accurate corporate identification and are foundational to a business's compliance and operational presence in New Jersey.

The "SS-4 Form," Application for Employer Identification Number (EIN), issued by the IRS, although federal in nature, complements the information required in New Jersey's CBT-2553-R form. The EIN obtained through Form SS-4 is crucial for identifying a corporation on both federal and state tax forms, including S corporation election applications. This linkage underscores the interconnectedness of federal and state tax administration, with both levels requiring a consistent corporate identifier.

The "Annual Report," filed by corporations in New Jersey, shares a connection with the CBT-2553-R in its requirement for up-to-date corporate data. Though primarily focused on current corporate structure and activities rather than tax status, the filing of an Annual Report with the New Jersey Division of Revenue ensures that a corporation remains in good standing—a condition that could affect its eligibility for S corporation status and hence the relevance of the CBT-2553-R form.

The "Form NJ-CBT-100," New Jersey Corporation Business Tax Return, is related to the CBT-2553-R but addresses broader corporate tax responsibilities for entities not electing or eligible for S corporation status. The distinction between CBT-100 and CBT-2553-R illustrates the varied tax regimes applicable to New Jersey corporations, delineating the specific pathway and continuing obligations for those that choose S corporation treatment.

The "Form 8832," Entity Classification Election, by the IRS allows business entities to choose how they are classified for federal tax purposes. Similar to the New Jersey CBT-2553-R, which enables a corporation to elect S corporation status specifically within New Jersey, Form 8832 provides entities the flexibility at the federal level. The choices made on Form 8832 can directly influence a corporation's eligibility and need to file forms like the CBT-2553-R, highlighting the strategic considerations businesses must navigate in tax planning.

New Jersey's "Amended Business Tax Return" form, applicable when adjusting previously filed tax returns, is relevant to those using the CBT-2553-R when rectifying or amending tax filings following a retroactive S corporation election approval. The process of amending tax returns to reflect an S corporation status accepted retroactively necessitates a detailed understanding of both the implications of the election and the mechanics of correct tax reporting, linking the amendment process closely with the initial election.

Lastly, the "Application for Certificate of Authority," necessary for foreign corporations to operate in New Jersey, has a procedural similarity to the CBT-2553-R. Although serving different ends—one for operational permission and the other for tax status election—both forms signify a corporation's intention to align with New Jersey's regulatory and tax frameworks. Successful filing of either document extends the corporation's capabilities within the state, whether through operational legitimacy or beneficial tax treatment.

Dos and Don'ts

When it comes to filing the NJ CBT-2553-R form for retroactive New Jersey S Corporation status, it’s important to cross every T and dot every I meticulously. Here’s a handy list of dos and don'ts that can guide you through this process smoothly:

Do:- Ensure all required information is accurate and complete. Double-check the corporate information in Part I, especially the name and Federal Employer Identification Number, to ensure they match the details on form NJ-REG and any previously filed CBT-2553 forms.

- Include the appropriate payment. Verify the number of periods you're requesting retroactive status for, and multiply by $100.00, as required in Part II. Remember, this payment is non-refundable.

- Get all necessary consents. Part IV requires the signed consent of every shareholder during the period in question. Ensure you gather all these consents without skipping anyone to avoid any issues with your application.

- Mail the completed forms and payment to the correct address. Once everything is in order, send your document package to the New Jersey Division of Revenue, PO Box 252, Trenton, NJ 08646-0252, as instructed.

- Forget to attach the original CBT-2553 form if New Jersey S Corporation status has been previously approved. If this is your first time applying for retroactive status, the original form is crucial to have your application considered.

- Leave any fields blank. Complete every required part of the form. Incomplete applications may be rejected or delayed, so take your time filling it out.

- Ignore signature requirements. The corporate officer's signature in Part III and all shareholder's signatures in Part IV are mandatory. Your application cannot be processed without them.

- Miss the deadline. Make sure you submit your application in a timely manner. Failure to meet New Jersey's filing deadlines can result in your request for S Corporation status being denied.

Misconceptions

When navigating the complexities of New Jersey's retroactive S corporation status application via the CBT-2553-R form, many misconceptions can arise. Addressing these misconceptions is key to a smooth application process for businesses looking to take advantage of this tax status retroactively.

Here are ten common misconceptions about the NJ CBT 2553-R form:

- Any corporation can file for retroactive status at any time.

Only authorized corporations that meet specific New Jersey S corporation requirements and are in good standing can apply for retroactive status, and there are deadlines to be met. - The $100.00 payment is a one-time fee regardless of the number of years applied for.

The application requires a $100.00 fee for each year or privilege period the business is applying retroactively. It is cumulative, not a single fee. - Filing the form guarantees retroactive S corporation status.

Submission of the form and fee does not guarantee approval. The Division of Revenue reviews all applications and their decision is final. - All shareholders don’t need to consent to the retroactive election.

New Jersey requires the signed consent of every past and present shareholder, including those with community property interest, during the consent period. - The form is only necessary if the corporation did not previously apply for S corporation status.

The CBT-2553-R form is necessary whether or not New Jersey S corporation status was previously approved, with different submission requirements in each scenario. - Electronic submissions are accepted.

Currently, the form along with the appropriate payment must be mailed to the New Jersey Division of Revenue; electronic submission is not available for this specific process. - Shareholder’s residency changes invalidate the retroactive election.

The jurisdiction of New Jersey to tax the S corporation's income is not affected by a shareholder's change of residency, with very limited exceptions. - The form is straightforward and requires minimal documentation.

A detailed compilation of corporate and shareholder consent is necessary, sometimes necessitating additional sheets or rider for non-resident shareholders. - Shareholders’ social security numbers or EINs are optional.

These are required for identifying past and present shareholders, persons with a community property interest, and others as detailed in the form. - Approval of the retroactive status affects only state tax filings.

While the retroactive S corporation status primarily affects state tax obligations, it can have implications on how income and losses are reported federally as well.

Understanding the specific requirements and addressing these common misconceptions are essential steps in successfully navigating the complexities of applying for retroactive S corporation status in New Jersey. Businesses should carefully review the form's instructions and seek professional guidance if necessary, to ensure compliance with all submission requirements.

Key takeaways

When seeking retroactive S corporation status in New Jersey, corporations must accurately complete and submit the NJ CBT-2553 R form to the New Jersey Division of Revenue. This process, while straightforward, has several key points that require careful attention to ensure compliance and approval. Here are the most crucial takeaways for filling out and using this form:

- Authorized Use: The form is specifically designed for corporations that are already authorized to conduct business in New Jersey and are aiming to elect S corporation status retroactively. This applies to a period prior to the current tax year.

- Attachment Guidelines: If New Jersey S corporation status has not been previously approved, this form must be attached to the New Jersey S Corporation Election form, CBT-2553. However, if approval has already been granted, a copy of the originally filed CBT-2553 should accompany the submission.

- Key Information Required: Corporations must provide comprehensive corporate information including the corporation's name, Federal Employer Identification Number (FEIN), and New Jersey Corporation Serial Number.

- Payment Obligation: A non-refundable fee of $100 must be included for each tax year or privilege period the retroactive request encompasses.

- Corporate and Shareholder Consents: The form requires a declaration from a corporate officer affirming the corporation meets the requirements for New Jersey S corporation status. Additionally, all shareholders during the consent period must sign, indicating their agreement to the retroactive election and taxation conditions.

Mailing Instructions: Once completed, the form along with the appropriate payment should be mailed to the New Jersey Division of Revenue.

Review Process: After submission, the application will undergo a review process. The corporation will be notified if the retroactive election is granted or if additional information is needed.- Conditions for Denial: It’s important to be aware that the retroactive election may not be granted if specific conditions are not met. These include failing to file all required business tax returns and pay taxes as if the S corporation status had been previously approved, or if a request is received after an assessment becomes final and no protest was filed within the specified timeframe.

Understanding these key aspects of the NJ CBT-2553 R form can significantly streamline the process of requesting retroactive S corporation status in New Jersey, ensuring that corporations comply with state tax laws while leveraging the benefits of S Corporation election.

Popular PDF Documents

New Jersey Tax Id Number - Mailing or faxing the completed form to the Office of Management and Budget is required for submission.

Nj Sales and Use Tax Quarterly Return - A confirmation number is provided upon successful filing and payment, ensuring traceability and acknowledgement of submission.