Fill Out a Valid Nj Cn 10482 Template

The NJ CN 10482 form, also known as the Appendix V Family Part Case Information Statement, plays a crucial role in family law proceedings within New Jersey's Superior Court, Chancery Division, Family Part. This comprehensive document mandates parties in a case to disclose detailed financial data, which includes income from all sources, monthly living expenses, assets valuation, and liabilities, both personal and shared within the context of the marriage or partnership. The form ensures a transparent assessment of each party’s financial situation, which is pivotal for determining alimony, child support, and the equitable distribution of marital assets. It requires meticulous attention to ensure accuracy, with a specific expectation that the provided information reflects the true financial standing through supporting documentation like tax returns, pay stubs, and bank statements. Given that it is a mandatory document, failure to file or inaccurately filing the Case Information Statement can lead to significant legal repercussions, including the dismissal of a party's pleadings. This form, revised as of September 1, 2017, underscores the importance of financial honesty and transparency in family law proceedings, aiming to achieve a fair resolution on financial issues arising from divorce, dissolution of civil unions, or termination of domestic partnerships.

Sample - Nj Cn 10482 Form

Save

Appendix V

Family Part Case Information Statement

Clear

This form and attachments are confidential pursuant to Rules

Attorney(s):

Office Address:

Tel. No./Fax No.

Attorney(s) for:

Plaintiff,

vs.

Defendant.

SUPERIOR COURT OF NEW JERSEY

CHANCERY DIVISION, FAMILY PART

COUNTY

DOCKET NO.

CASE INFORMATION STATEMENT

OF

NOTICE: This statement must be fully completed, filed and served, with all required attachments, in accordance with Court Rule

INSTRUCTIONS:

The Case Information Statement is a document which is filed with the court setting forth the financial details of your case. The required information includes your income, your spouse's/partner's income, a budget of your joint life style expenses, a budget of your current life style expenses including the expenses of your children, if applicable, an itemization of the amounts which you may be paying in support for your spouse/partner or children if you are contributing to their support, a summary of the value of all assets referenced on page 8 – It is extremely important that the Case Information

Statement be as accurate as possible because you are required to certify that the contents of the form are true. It helps establish your lifestyle which is an important component of alimony/spousal support and child support.

The monthly expenses must be reviewed and should be based on actual expenditures such as those shown from checkbook registers, bank statements or credit card statements from the past 24 months. The asset values should be taken, if possible, from actual appraisals or account statements. If the values are estimates, it should be clearly noted that they are estimates.

According to the Court Rules, you must update the Case Information Statement as your circumstances change. For example, if you move out of your residence and acquire your own apartment, you should file an Amended Case Information Statement showing your new rental and other living expenses.

It is also very important that you attach copies of relevant documents as required by the Case Information Statement, including your most recent tax returns with

If a request has been made for college or

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 1 of 10 |

Part A - Case Information: |

Issues in Dispute: |

|||||||||||||

Date of Statement |

|

Cause of Action |

|

|||||||||||

Date of Divorce, Dissolution of Civil |

Custody |

|

||||||||||||

Union or Termination of Domestic |

|

|

Parenting Time |

|

||||||||||

Partnership |

Alimony |

|

||||||||||||

Date(s) of Prior Statement(s) |

Child Support |

|

||||||||||||

|

|

|

|

|

|

|

Equitable Distribution |

|

||||||

Your Birthdate |

|

Counsel Fees |

|

|||||||||||

Birthdate of Other Party |

|

Anticipated College/Post- |

||||||||||||

Date of Marriage, or entry into Civil Union |

Secondary Education |

|||||||||||||

or Domestic Partnership |

|

|

Expenses |

|

||||||||||

|

|

|

|

|

|

|

Other issues (be specific) |

|||||||

Date of Separation |

|

|

|

Date of Complaint |

|

|

|

Does an agreement exist between parties relative to any issue? |

Yes |

No. |

|

If Yes, ATTACH a copy (if written) or a summary (if oral). |

|

|

|

1.Name and Addresses of Parties: Your Name

Street Address |

|

City |

|

State/Zip |

|

||

Email: |

|

|

|

|

|

||

Other Party’s Name |

|

|

|

|

|

||

Street Address |

|

City |

|

State/Zip |

|

||

Email: |

|

|

|

|

|

||

2.Name, Address, Birthdate and Person with whom children reside: a. Child(ren) From This Relationship

Child’s Full Name |

|

Address |

|

Birthdate |

|

Person’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Child(ren) From Other Relationships |

|

|

|

Child’s Full Name |

Address |

Birthdate |

Person’s Name |

Part B - Miscellaneous Information:

1. Information about Employment (Provide Name & Address of Business, if |

|

|

|

|

||||||||||

Name of Employer/Business |

|

|

|

|

Address |

|

|

|

|

|

||||

Name of Employer/Business |

|

|

|

|

Address |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||

2. Do you have Insurance obtained through Employment/Business? |

|

Yes |

No. |

Type of Insurance: |

|

|

||||||||

Medical |

Yes |

No; Dental |

Yes |

No; Prescription Drug |

Yes |

No; Life |

Yes |

No; Disability |

Yes |

No |

||||

Other (explain) |

|

|

|

|

|

|

|

|

|

|

|

|

||

Is Insurance available through Employment/Business? |

Yes |

|

No |

|

|

|

|

|

||||||

Explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 2 of 10 |

3.ATTACH Affidavit of Insurance Coverage as required by Court Rule

4.Additional Identification:

Confidential Litigant Information Sheet: Filed |

Yes |

No |

5.ATTACH a list of all prior/pending family actions involving support, custody or Domestic Violence, with the Docket Number, County, State and the disposition reached. Attach copies of all existing Orders in effect.

Part C. - Income Information:

Complete this section for self and (if known) for other party. If

1. Last Year’s Income

|

|

|

Yours |

|

Joint |

Other Party |

|

1. |

Gross earned income last calendar (year) |

$ |

|

$ |

|

$ |

|

2. |

Unearned income (same year) |

$ |

|

$ |

|

$ |

|

3. |

Total Income Taxes paid on income (Fed., State, |

$ |

|

$ |

|

$ |

|

|

F.I.C.A., and S.U.I.). If Joint Return, use middle |

|

|

|

|

|

|

|

column. |

|

|

|

|

|

|

4. |

Net income (1 + 2 - 3) |

$ |

|

$ |

|

$ |

|

ATTACH to this form a corporate benefits statement as well as a statement of all fringe benefits of employment. (See Part G)

ATTACH a full and complete copy of last year’s Federal and State Income Tax Returns. to show total income plus a copy of the most recently filed Tax Returns. (See Part G) Check if attached:

ATTACH

Other |

2. Present Earned Income and Expenses

|

|

|

|

|

Yours |

|

Other Party |

|

|

|

|

|

|

|

(if known) |

1. |

Average gross weekly income (based on last 3 pay periods – |

$ |

|

$ |

|

||

|

ATTACH pay stubs) |

|

|

|

|

|

|

|

Commissions and bonuses, etc., are: |

|

|

|

|

|

|

|

included |

not included* |

not paid to you. |

|

|

|

|

*ATTACH details of basis thereof, including, but not limited to, percentage overrides, timing of payments, etc. |

|

|

|||||

ATTACH copies of last three statements of such bonuses, commissions, etc. |

|

|

|

|

|||

2. |

Deductions per week (check all types of withholdings): |

$ |

|

$ |

|

||

|

Federal |

|

State |

|

F.I.C.A. |

3. Net average weekly income (1 - 2)

S.U.I.

Other

$ |

|

$ |

3. Your Current

|

|

|

|

Provide Dates: From |

|

To |

||||

1. GROSS EARNED INCOME: $ |

|

|

Number of Weeks |

|

|

|||||

2. TAX DEDUCTIONS: (Number of Dependents: |

|

) |

|

|

|

|

|

|

||

a. |

Federal Income Taxes |

|

a. |

$ |

|

|

|

|

||

b. |

N.J. Income Taxes |

|

b. |

$ |

|

|

|

|

||

c. |

Other State Income Taxes |

|

c. |

$ |

|

|

|

|

||

d. |

F.I.C.A. |

|

d. |

$ |

|

|

|

|

||

e. |

Medicare |

|

e. |

$ |

|

|

|

|

||

f. |

S.U.I. / S.D.I. |

|

f. |

$ |

|

|

|

|

||

g. |

Estimated tax payments in excess of withholding |

|

g. |

$ |

|

|

|

|

||

h. |

|

|

|

|

h. |

$ |

|

|

|

|

i. |

|

|

|

|

i. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

$ |

|

|

|

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 3 of 10 |

3. GROSS INCOME NET OF TAXES $ |

|

$ |

|

|

||||

4. OTHER DEDUCTIONS |

|

|

|

If mandatory, check box |

||||

a. |

Hospitalization/Medical Insurance |

a. |

$ |

|

|

|||

b. |

Life Insurance |

b. |

$ |

|

|

|||

c. |

Union Dues |

c. |

$ |

|

|

|||

d. |

401(k) Plans |

d. |

$ |

|

|

|||

e. |

Pension/Retirement Plans |

e. |

$ |

|

|

|||

f. |

Other Plans - specify |

f. |

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

g. |

Charity |

g. |

$ |

|

|

|||

h. |

Wage Execution |

h. |

$ |

|

|

|||

i. |

Medical Reimbursement (flex fund) |

i. |

$ |

|

|

|||

j. |

Other: |

j. |

$ |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

$ |

|

|

|

5. NET |

|

$ |

|

|

|

|||

NET AVERAGE EARNED INCOME PER MONTH: |

|

$ |

|

|

|

|||

NET AVERAGE EARNED INCOME PER WEEK |

|

$ |

|

|

|

|||

4. Your

(including, but not limited to, income from unemployment, disability and/or social security payments, interest, dividends,

rental income and any other miscellaneous unearned income)

Source |

|

How often paid |

Year to date amount |

||

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

TOTAL GROSS UNEARNED INCOME YEAR TO DATE |

|

|

$ |

|

|

5. Additional Information:

1. |

How often are you paid? |

|

|

|

|

|

|

|

|

2. |

What is your annual salary? |

$ |

|

|

|

|

|

||

3. |

Have you received any raises in the current year? |

Yes |

No |

||||||

|

If yes, provide the date and the gross/net amount. |

|

|

|

|||||

4. |

Do you receive bonuses, commissions, or other compensation, including distributions, taxable or non- |

Yes |

No |

||||||

|

taxable, in addition to your regular salary? |

|

|

||||||

|

If yes, explain: |

|

|

|

|

|

|

|

|

5. |

Does your employer pay for or provide you with an automobile (lease or purchase), automobile expenses, |

Yes |

No |

||||||

|

gas, repairs, lodging and other. |

|

|

|

|

|

|

||

|

If yes, explain.: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 4 of 10 |

6. |

Did you receive bonuses, commissions, or other compensation, including distributions, taxable or non- |

Yes |

No |

||

|

taxable, in addition to your regular salary during the current or immediate past 2 calendar years? |

|

|

||

|

If yes, explain and state the date(s) of receipt and set forth the gross and net amounts received: |

|

|

||

|

|

|

|

|

|

7. |

Do you receive cash or distributions not otherwise listed? |

Yes |

No |

||

|

If yes, explain. |

|

|

|

|

8. |

Have you received income from overtime work during either the current or immediate past calendar year? |

Yes |

No |

||

|

If yes, explain. |

|

|

||

9. |

Have you been awarded or granted stock options, restricted stock or any other |

Yes |

No |

||

|

entitlement during the current or immediate past calendar year? |

|

|

||

|

If yes, explain. |

|

|

|

|

10. |

Have you received any other supplemental compensation during either the current or immediate past calendar |

Yes |

No |

||

|

year? |

|

|

||

|

If yes, state the date(s) of receipt and set forth the gross and net amounts received. Also describe the nature |

|

|

||

|

of any supplemental compensation received. |

|

|

||

|

|

|

|

||

|

|

|

|

||

11. |

Have you received income from unemployment, disability and/or social security during either the current or |

Yes |

No |

||

|

immediate past calendar year? |

|

|

||

|

If yes, state the date(s) of receipt and set forth the gross and net amounts received. |

|

|

||

12.List the names of the dependents you claim:

13. |

Are you paying or receiving any alimony? |

Yes |

No |

|

|

If yes, how much and from or to whom? |

|

|

|

|

|

|

|

|

14. |

Are you paying or receiving any child support? |

Yes |

No |

|

|

If yes, list names of the children, the amount paid or received for each child and to whom paid or from whom |

|

|

|

|

received. |

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Is there a wage execution in connection with support? |

Yes |

No |

|

|

If yes explain. |

|

|

|

16. |

Does a Safe Deposit Box exist and if so, at which bank? |

Yes |

No |

|

17. |

Has a dependent child of yours received income from social security, SSI or other government program |

Yes |

No |

|

|

during either the current or immediate past calendar year? |

|

|

|

|

If yes, explain the basis and state the date(s) of receipt and set forth the gross and net amounts received |

|

|

|

18.Explanation of Income or Other Information:

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 5 of 10 |

Part D - Monthly Expenses (computed at 4.3 wks/mo.)

Joint Marital or Civil Union Life Style should reflect standard of living established during marriage or civil union. Current expenses should reflect the current life style. Do not repeat those income deductions listed in Part C – 3.

|

|

|

|

Joint Life Style |

Current Life Style |

||||

|

|

|

Family, including |

|

Yours and |

||||

|

|

|

|

|

children |

|

|

|

children |

SCHEDULE A: SHELTER |

|

|

|

|

|

|

|

|

|

If Tenant: |

|

|

|

|

|

|

|

|

|

Rent |

$ |

|

|

$ |

|

|

|||

Heat (if not furnished) |

$ |

|

|

$ |

|

|

|||

Electric & Gas (if not furnished) |

$ |

|

|

$ |

|

|

|||

Renter’s Insurance |

$ |

|

|

$ |

|

|

|||

Parking (at Apartment) |

$ |

|

|

$ |

|

|

|||

Other charges (Itemize) |

$ |

|

|

$ |

|

|

|||

If Homeowner: |

|

|

|

|

|

|

|

|

|

Mortgage |

$ |

|

|

$ |

|

|

|||

...........................Real Estate Taxes (if not included w/mortgage payment) |

$ |

|

|

$ |

|

|

|||

...........................Homeowners Ins. (if not included w/mortgage payment) |

$ |

|

|

$ |

|

|

|||

Other Mortgages or Home Equity Loans |

...................................................... |

$ |

|

|

$ |

|

|

||

Heat (unless Electric or Gas) |

$ |

|

|

$ |

|

|

|||

Electric & Gas |

$ |

|

|

$ |

|

|

|||

Water & Sewer |

$ |

|

|

$ |

|

|

|||

Garbage Removal |

$ |

|

|

$ |

|

|

|||

Snow Removal |

.............................................. |

$ |

|

|

$ |

|

|

||

Lawn Care |

$ |

|

|

$ |

|

|

|||

Maintenance/Repairs |

$ |

|

|

$ |

|

|

|||

..........................................................Condo, |

$ |

|

|

$ |

|

|

|||

Other Charges (Itemize) |

$ |

|

|

$ |

|

|

|||

Tenant or Homeowner: |

|

|

|

|

|

|

|

|

|

Telephone |

$ |

|

|

$ |

|

|

|||

Mobile/Cellular Telephone |

$ |

|

|

$ |

|

|

|||

Service Contracts on Equipment |

$ |

|

|

$ |

|

|

|||

Cable TV |

$ |

|

|

$ |

|

|

|||

Plumber/Electrician |

$ |

|

|

$ |

|

|

|||

Equipment & Furnishings |

$ |

|

|

$ |

|

|

|||

Internet Charges |

$ |

|

|

$ |

|

|

|||

Home Security System |

.............................................. |

$ |

|

|

$ |

|

|

||

Other (itemize) |

|

$ |

|

|

$ |

|

|

||

|

|

TOTAL |

$ |

|

|

$ |

|

|

|

SCHEDULE B: TRANSPORTATION |

|

|

|

|

|

|

|

|

|

Auto Payment |

$ |

|

|

$ |

|

|

|||

Auto Insurance (number of vehicles: |

|

) |

$ |

|

|

$ |

|

|

|

Registration, License |

$ |

|

|

$ |

|

|

|||

Maintenance |

$ |

|

|

$ |

|

|

|||

Fuel and Oil |

$ |

|

|

$ |

|

|

|||

Commuting Expenses |

$ |

|

|

$ |

|

|

|||

Other Charges (Itemize) |

$ |

|

|

$ |

|

|

|||

|

|

TOTAL |

$ |

|

|

$ |

|

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 6 of 10 |

SCHEDULE C: PERSONAL |

Joint Life Style |

Current Life Style |

||||||

|

Family, including |

|

|

Yours and |

||||

|

|

|

|

children |

|

|

|

children |

Food at Home & household supplies |

$ |

|

|

$ |

|

|

||

Prescription Drugs |

$ |

|

|

$ |

|

|

||

$ |

|

|

$ |

|

|

|||

School Lunch |

$ |

|

|

$ |

|

|

||

Restaurants |

$ |

|

|

$ |

|

|

||

Clothing |

$ |

|

|

$ |

|

|

||

Dry Cleaning, Commercial Laundry |

$ |

|

|

$ |

|

|

||

Hair Care |

$ |

|

|

$ |

|

|

||

Domestic Help |

$ |

|

|

$ |

|

|

||

Medical (exclusive of psychiatric)* |

$ |

|

|

$ |

|

|

||

Eye Care* |

$ |

|

|

$ |

|

|

||

Psychiatric/psychological/counseling* |

$ |

|

|

$ |

|

|

||

Dental (exclusive of Orthodontic* |

$ |

|

|

$ |

|

|

||

Orthodontic* |

$ |

|

|

$ |

|

|

||

Medical Insurance (hospital, etc.)* |

$ |

|

|

$ |

|

|

||

Club Dues and Memberships |

$ |

|

|

$ |

|

|

||

Sports and Hobbies |

$ |

|

|

$ |

|

|

||

Camps |

$ |

|

|

$ |

|

|

||

Vacations |

$ |

|

|

$ |

|

|

||

Children’s Private School Costs |

$ |

|

|

$ |

|

|

||

Parent’s Educational Costs |

$ |

|

|

$ |

|

|

||

Children’s Lessons (dancing, music, sports, etc.) |

$ |

|

|

$ |

|

|

||

Babysitting |

$ |

|

|

$ |

|

|

||

$ |

|

|

$ |

|

|

|||

Entertainment |

$ |

|

|

$ |

|

|

||

Alcohol and Tobacco |

$ |

|

|

$ |

|

|

||

Newspapers and Periodicals |

$ |

|

|

$ |

|

|

||

Gifts |

$ |

|

|

$ |

|

|

||

Contributions |

$ |

|

|

$ |

|

|

||

Payments to |

$ |

|

|

$ |

|

|

||

Prior Existing Support Obligations this family/other families |

|

|

|

|

|

|

|

|

(specify) |

$ |

|

|

$ |

|

|

||

Tax Reserve (not listed elsewhere) |

$ |

|

|

$ |

|

|

||

Life Insurance |

$ |

|

|

$ |

|

|

||

Savings/Investment |

$ |

|

|

$ |

|

|

||

Debt Service (from page 7) (not listed elsewhere) |

$ |

|

|

$ |

|

|

||

Parenting Time Expenses |

$ |

|

|

$ |

|

|

||

Professional Expenses (other than this proceeding) |

$ |

|

|

$ |

|

|

||

Pet Care and Expenses |

$ |

|

|

$ |

|

|

||

Other (specify) |

$ |

|

|

$ |

|

|

||

*unreimbursed only |

|

|

|

|

|

|

|

|

TOTAL |

$ |

|

|

$ |

|

|

||

Please Note: If you are paying expenses for a spouse or civil union partner and/or children not reflected in this budget, attach a schedule of such payments.

Schedule A: Shelter |

$ |

|

$ |

Schedule B: Transportation |

$ |

|

$ |

Schedule C: Personal |

$ |

|

$ |

Grand Totals |

$ |

|

$ |

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 7 of 10 |

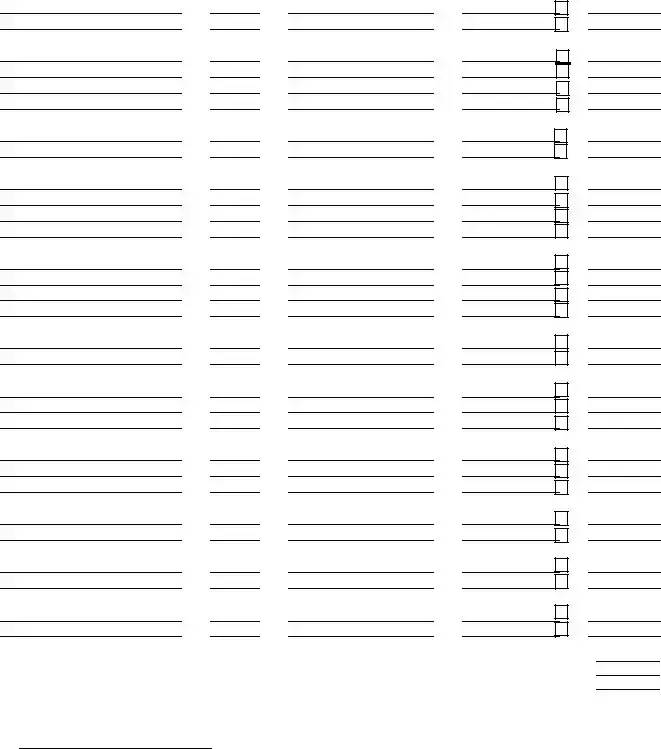

Part E - Balance Sheet of All Family Assets and Liabilities

Statement of Assets

|

Title to |

Date of purchase/acquisition. |

|

Date of |

|

|

If claim that asset is exempt, |

Value $ |

|||

Description |

Property |

Evaluation |

|||

state reason and value of |

Put * after exempt |

||||

|

(P, D, J)1 |

Mo./Day/ Yr. |

|||

|

what is claimed to be exempt |

|

|||

|

|

|

|

1.Real Property

2.Bank Accounts, CD’s (identify institution and type of account(s))

3.Vehicles

4.Tangible Personal Property

5.Stocks, Bonds and Securities (identify institution and type of account(s))

6.Pension, Profit Sharing, Retirement Plan(s), 40l(k)s, etc. (identify each institution or employer)

7.IRAs

8.Businesses, Partnerships, Professional Practices

9.Life Insurance (cash surrender value)

10.Loans Receivable

11.Other (specify)

TOTAL GROSS ASSETS: $

TOTAL SUBJECT TO EQUITABLE DISTRIBUTION: $

TOTAL NOT SUBJECT TO EQUITABLE DISTRIBUTION: $

1 P = Plaintiff; D = Defendant; J = Joint

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 8 of 10 |

Statement of Liabilities

|

Name of |

|

|

|

|

|

Description |

Responsible |

If you contend liability should |

Monthly |

Total |

Date |

|

Party |

not be shared, state reason |

Payment |

Owed |

|||

|

|

|||||

|

(P, D, J) |

|

|

|

|

1.Real Estate Mortgages

2.Other Long Term Debts

3.Revolving Charges

4.Other Short Term Debts

5.Contingent Liabilities

TOTAL GROSS LIABILITIES: |

$ |

|

|

(excluding contingent liabilities) |

|

|

|

NET WORTH: |

$ |

|

|

(subject to equitable distribution) |

|

|

|

TOTAL SUBJECT TO EQUITABLE DISTRIBUTION: $ |

|

||

TOTAL NOT SUBJECT TO EQUITABLE DISTRIBUTION: |

$ |

|

|

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 9 of 10 |

Part F - - Statement of Special Problems

Provide a Brief Narrative Statement of Any Special Problems Involving This Case: As example, state if the matter involves complex valuation problems (such as for a closely held business) or special medical problems of any family member, etc.

Part G - Required Attachments

Check If You Have Attached the Following Required Documents

1. A full and complete copy of your last federal and state income tax returns with all schedules and attachments. (Part

2. Your last calendar year’s

3. Your three most recent pay stubs.

4. Bonus information including, but not limited to, percentage overrides, timing of payments, etc.; the last three statements of such bonuses, commissions, etc. (Part C)

5. Your most recent corporate benefit statement or a summary thereof showing the nature, amount and status of retirement plans, savings plans, income deferral plans, insurance benefits, etc. (Part C)

6. Affidavit of Insurance Coverage as required by Court Rule

7. List of all prior/pending family actions involving support, custody or Domestic Violence, with the Docket Number, County, State and the disposition reached. Attach copies of all existing Orders in effect. (Part

8. Attach details of each wage execution (Part

9. Schedule of payments made for a spouse or civil union partner and/or children not reflected in Part D.

10. Any agreements between the parties.

11. An Appendix IX Child Support Guideline Worksheet, as applicable, based upon available information.

12. If a request has been made for college or

I certify that, other than in this form and its attachments, confidential personal identifiers have been redacted from documents now submitted to the court, and will be redacted from all documents submitted in the future in accordance with Rule

I certify that the foregoing information contained herein is true. I am aware that if any of the foregoing information contained therein is willfully false, I am subject to punishment.

DATED: |

|

SIGNED: |

Revised to be effective September 1, 2017. CN: 10482 (Court Rules Appendix V) |

Page 10 of 10 |

Document Specifications

| Fact Name | Description |

|---|---|

| Form Title | Appendix V Family Part Case Information Statement |

| Confidentiality Status | Confidential pursuant to Rules 1:38-3(d)(1) and 5:5-2(f) |

| Governing Law | New Jersey Court Rules, specifically Court Rule 5:5-2 for filing requirements |

| Filing Requirement | Must be filed within 20 days after the filing of the Answer or Appearance |

| Purpose | To provide detailed financial information crucial for determining alimony/spousal support, child support, and equitable distribution |

| Accuracy Importance | The form must be as accurate as possible to help establish lifestyle for support determinations, requiring certification of truthfulness |

| Update Requirement | The Case Information Statement must be updated as circumstances change, with a corresponding Amended Case Information Statement to be filed |

| Attachment Requirements | Relevant documents including tax returns, pay stubs, and if applicable, documentation related to college or post-secondary school contribution |

Detailed Steps for Using Nj Cn 10482

Getting through the paperwork for legal processes can be daunting, but by breaking down the steps, the task becomes manageable. The NJ CN 10482 form, specifically designed for detailing the financial aspects of a case in the Family Part of the Superior Court of New Jersey, is a complex but crucial document. Filling it accurately ensures that the court has a complete financial picture, which is essential for matters such as alimony, child support, and the division of assets. Here’s a step-by-step guide to fill out the form correctly.

- At the top section, fill in the attorney's information, including name, office address, telephone and fax numbers, and who the attorney represents (Plaintiff or Defendant).

- Enter the court information: County and Docket Number.

- In the Part A - Case Information section, note all relevant dates (like Date of Divorce, Date of Separation, etc.), your birthdate, and the other party's birthdate. Here, you must also list any issues in dispute such as alimony, child support, or custody.

- If there's an agreement between parties on any issue, mark 'Yes' and attach the necessary documentation as indicated.

- Under Name and Addresses of Parties: Provide your name, street address, city, state/zip, and email, and do the same for the other party.

- For children from this relationship and other relationships, include their full names, addresses, birthdates, and the person they reside with.

- In the Miscellaneous Information section, detail your employment information, including self-employment details if applicable, and answer questions regarding insurance obtained through employment/business.

- Remember to attach an Affidavit of Insurance Coverage, a copy of the Confidential Litigant Information Sheet, and a list of all prior/pending family actions involving support, custody, or domestic violence, including docket number, county, state, and the disposition reached, plus copies of all existing orders in effect.

- Part C requires detailed Income Information :

- Fill in last year’s income for yourself, jointly (if applicable), and for the other party, including gross earned income, unearned income, and total taxes paid. Attach necessary documents like corporate benefits statements, fringe benefits details, and the last year's Federal and State Income Tax Returns with W-2s, 1099s, Schedule C's, etc.

- Detail your present earned income and expenses, including average gross weekly income based on the last three pay periods. Here, you need to attach your pay stubs. Also, detail deductions and net average weekly income.

- Provide your current Year-to-Date Earned Income by filling in the gross earned income to date, tax deductions, other deductions, your net Year-to-Date earned income, and additional financial information requested.

- For your Year-to-Date Gross Unearned Income from all sources, list each source, how often you are paid, and the year-to-date amount. Sum up the total gross unearned income year to date.

- Continue with the form's instructions by detailing any indemnity payments received, bonuses, commissions, employer-provided benefits, stock compensation, and any other supplemental compensation or income from the past calendar year, including payments from unemployment, disability, and/or social security.

- List the dependents you claim and answer questions regarding alimony and child support payments, including amounts and recipients.

- Finally, complete any additional sections about wage executions, safe deposit box details, dependent child's income from government programs, and provide a thorough explanation of income or other information if necessary.

Fill out the form carefully, reviewing each section to ensure accuracy and completeness. The aim is to give a comprehensive view of your financial situation, making it easier for the court to make informed decisions regarding your case. Remember, accuracy and honesty are paramount when completing this form to avoid potential legal complications.

Learn More on Nj Cn 10482

What is the NJ CN 10482 form?

The NJ CN 10482 form, also known as the Family Part Case Information Statement, is a document submitted to the Superior Court of New Jersey. It details financial information in family law cases, helping to inform decisions on alimony, child support, and the equitable distribution of assets.

Who needs to file the NJ CN 10482 form?

This form must be filed by parties involved in family law proceedings in New Jersey where financial matters are in dispute. This includes divorce, child support, and alimony cases. It's required to be filed and served by each party according to Court Rule 5:5-2.

When is the filing deadline for the NJ CN 10482 form?

The form must be filed within 20 days after the filing of an Answer or Appearance by a party in a family law case.

What happens if I don't file the NJ CN 10482 form?

Failure to file the form may lead to the dismissal of your pleadings in the family law case, which could severely impact the outcome of the case in your favor.

What information is required on the NJ CN 10482 form?

The form requires detailed financial information, including:

- Your income and your spouse/partner's income

- Monthly expenditures

- Child-related expenses, if applicable

- Information on the support you may be providing or receiving

- An itemization and summary of all assets

Why is accuracy important when completing the NJ CN 10482 form?

Accuracy is crucial because the information provided will be used to determine financial matters such as alimony, child support, and the division of assets. Inaccurate information can lead to unfavorable decisions and legal repercussions.

How often do I need to update the NJ CN 10482 form?

You must update the Case Information Statement as your circumstances change to ensure that all decisions are based on current and accurate information.

What attachments are required with the NJ CN 10482 form?

Required attachments include:

- Your most recent tax returns with all W-2s and 1099s

- Your three most recent pay stubs

- Documentation related to child-related expenses, if applicable

- Any other relevant financial documents as specified

Can I file an amended NJ CN 10482 form?

Yes, if your financial situation or personal circumstances change, you should file an Amended Case Information Statement to reflect these changes accurately.

Where can I find the NJ CN 10482 form and instruction for completing it?

The form and instructions for completing it are available on the New Jersey Judiciary's website. It is important to review the instructions thoroughly before filling out the form to ensure completeness and accuracy.

Common mistakes

When filling out the New Jersey Family Part Case Information Statement (Form CN 10482), it is essential for individuals to navigate the form with accuracy and care. The significance of this document in family law proceedings cannot be overstated, as it provides a comprehensive overview of one's financial situation. However, common mistakes are often made, which can impact the outcomes of cases significantly. Understanding and avoiding these errors can facilitate a smoother legal process.

- Not filling out the form completely or accurately: Many individuals fail to provide all the necessary information or inadvertently provide inaccurate details. This form demands thoroughness, as incomplete or false information can lead to legal ramifications including the dismissal of pleadings.

- Overlooking the requirement for attachments: The form mandates the inclusion of several critical documents, such as recent tax returns, pay stubs, and an affidavit of insurance coverage. Neglecting to attach these documents can result in an incomplete submission.

- Failing to update the form as circumstances change: Life circumstances evolve, and so must the information on the form. Whether it's a change in income, employment, or living arrangements, updates are essential to maintaining the accuracy of the case information statement.

- Estimating expenses and income without substantiation: While estimates are sometimes necessary, they must be based on actual data when possible. Unsupported estimations can diminish the credibility of the financial disclosure.

- Not being precise with income and expenses: Accuracy is crucial when detailing income and expenses. The form serves as a foundation for determining obligations such as alimony and child support, making precision paramount.

- Ignoring the confidentiality of the document: Given the sensitive nature of the information required, it's vital to remember that this document is confidential according to court rules. Treating it with the appropriate level of privacy and care is essential.

To navigate these pitfalls, attention to detail, honesty, and openness to seeking assistance when needed are key strategies. Ensuring the accuracy and completeness of every section, double-checking attachments, and updating the form to reflect current circumstances will contribute to a more effective and efficient legal process. Keep in mind that this form is not just a procedural requirement but a critical document that influences the course of family law proceedings.

Documents used along the form

When individuals are navigating through family law matters in New Jersey, particularly in matters of divorce or child support, the Case Information Statement (Form CN 10482) is a fundamental tool used to outline financial information. This form helps to provide a clear financial snapshot to the courts, but often, it is not the only document required for comprehensive family law proceedings. Several other forms and documents frequently accompany this form to paint a full picture of an individual's financial and personal situation.

- Confidential Litigant Information Sheet (R. 5:4-2(f)): This required form accompanies many filings in family court. It collects basic but essential personal information about the parties involved, ensuring the court can accurately process documents and communicate with the parties.

- Uniform Child Support Order and Worksheet: In cases involving child support, this document is used alongside the Case Information Statement to calculate the appropriate amount of child support, based on the state guidelines and the financial information provided by both parties.

- Notice of Proposed Final Judgment (R. 5:5-10): Before a divorce is finalized, this form is submitted, outlining the agreement reached by both parties on issues like asset division, alimony, child support, and parenting time. It ensures both parties agree to the terms before the final judgment is issued.

- Family Part Case Information Statement (Amendment): After the initial filing, any significant changes in a party's financial situation should be updated through an amended Case Information Statement. This ensures that all decisions regarding support and asset division are based on the most current information.

- Income and Expense Declaration: Though similar in nature to the Case Information Statement, this document offers a more detailed look into the income and monthly expenses of each party. It is particularly useful for temporary support hearings or when modifying child support or alimony.

Together, these documents complement the Case Information Statement (Form CN 10482) by providing a comprehensive overview of an individual’s financial stance, employment, insurance, and dependents, which are crucial for family court rulings on matters such as divorce, child support, and alimony. Each plays its role in ensuring that all parties have a fair and transparent presentation of the facts, which aids in the court's ability to make informed decisions that affect the lives of all involved.

Similar forms

The NJ CN 10482 form, recognized as the Case Information Statement in Family Part Cases, focuses on providing a comprehensive overview of financial details pertinent to family court matters. A similarly important document is the Financial Affidavit used in many states for divorce or child support proceedings. This affidavit also collects detailed information about an individual’s income, expenses, assets, and liabilities, allowing the court to make informed decisions about financial support and asset division. Like the Case Information Statement, it requires accuracy and regular updates to reflect current financial status.

The Child Support Worksheet, another parallel document, is used to calculate the amount of child support based on the parents' financial information, including income, childcare costs, and health insurance premiums. Though it specifically focuses on child support determination, it shares the foundational requirement of detailed financial disclosure found in the NJ CN 10482 form. This worksheet aids in applying state-specific guidelines to ensure fair support orders, closely mirroring the function of the Case Information Statement in relation to child support and spousal support issues.

The Uniform Support Petition is a form utilized for establishing or modifying child and spousal support across state lines. This petition requires detailed information about the petitioner's and respondent's financial circumstances, similar to the Case Information Statement. By gathering comprehensive financial data, it assists the court in making decisions on support that are equitable, much like the goals aimed to be achieved with the NJ CN 10482 form in family law cases.

The Marital Settlement Agreement (MSA) document, while broader in scope, shares similarities with the NJ CN 10482 form in its inclusion of detailed financial disclosures. The MSA addresses the division of assets, debts, alimony, child support, and other financial arrangements upon divorce. By requiring a full disclosure of financial information, it ensures that the division and support agreements are made with a clear understanding of each party’s financial situation, resonating with the purpose of the Case Information Statement to inform equitable decisions.

Pretrial Statements in family law cases, much like the NJ CN 10482 form, compile comprehensive financial and personal information to prepare for trial. These statements outline the disputed issues, financial data, and proposed resolutions, ensuring both parties and the court have a full understanding of the matters at hand. The requirement for detailed financial disclosure closely aligns with the Case Information Statement’s role in providing the court with necessary information for informed decision-making.

The Property Settlement Statement, found in real estate transactions, similarly requires detailed information about financial aspects, albeit in a different context. It itemizes the financial transactions between the buyer and seller. Similarly, the Case Information Statement provides a detailed account of financial data, but geared towards informing decisions in family law cases. Both documents serve to ensure transparency and informed decision-making by presenting detailed financial overviews.

The Declaration of Disclosure is a mandatory form in some states during divorce proceedings where both parties disclose their financial status fully and accurately, reflecting the comprehensive financial disclosure aim of the NJ CN 10482 form. This document includes all assets, debts, income, and expenses, helping to ensure fair and equitable division of property and financial responsibilities. Its thorough approach to financial transparency mirrors the intent behind the Case Information Statement’s detailed financial reporting requirements.

Lastly, the Domestic Relations Financial Affidavit functions similarly to the NJ CN 10482 by requiring individuals involved in family law cases to outline their financial situations in detail. Like the Case Information Statement, it includes income, expenses, assets, and liabilities. This affidavit provides the court with the necessary information to make informed decisions about alimony, child support, and division of assets, highlighting the importance of full financial disclosure in family law matters.

Dos and Don'ts

When filling out the NJ CN 10482 form, also known as the Case Information Statement for the Family Part of the Superior Court of New Jersey, there are several dos and don'ts to keep in mind for a successful and accurate submission.

Do:

- Ensure that all required fields are accurately completed based on the most recent and relevant information you have. This includes personal details, financial data, and any other requested information.

- Attach all required documents such as your most recent tax returns, W-2 forms, 1099s, pay stubs, and any applicable documentation related to insurance, employment, and assets.

- Review and update your monthly expenses based on actual expenditures. Use checkbook registers, bank statements, or credit card statements from the past 24 months to provide accurate figures.

- Clearly note if any asset values included in the form are estimates. If possible, provide these values based on actual appraisals or account statements.

- Update the Case Information Statement as your circumstances change, for example, if you move or if there are significant changes in your income or expenses.

Don't:

- Leave sections incomplete. If a section does not apply to you, ensure to note it as such, rather than leaving it blank.

- Forget to sign and date the form where required. An unsigned form may be considered invalid or incomplete.

- Estimate financial details without checking your records. Accuracy is crucial for this document as it impacts decisions related to alimony, child support, and the division of assets.

- Attach outdated or irrelevant documentation. Only the most recent and applicable documents should be attached to support the information provided in the statement.

- Fail to file within the required timeframe. Submitting your Case Information Statement beyond the deadline can lead to the dismissal of your pleadings within the case.

Misconceptions

When dealing with the New Jersey Case Information Statement (CIS), form CN 10482, many individuals have misconceptions about its purpose, requirements, and impact on their family law case. Understanding the truths behind these common misunderstandings can significantly influence the outcome of alimony, child support, and other financial disputes in family law cases.

Only financial high-rollers need to fill it out. Many believe that the CIS is only for those with substantial wealth. However, this document is crucial for all parties in a divorce or any family law matter involving finances, regardless of economic status. It ensures a clear picture of the family's financial situation.

It's okay to estimate all numbers. While estimates are sometimes necessary, accuracy is crucial, especially for income, expenses, and asset values. Estimates should be clearly marked as such, and whenever possible, actual numbers should be used to provide a factual basis for any financial discussions or decisions.

Once filed, it cannot be updated. Circumstances change, and the CIS can and should be updated to reflect significant changes in financial circumstances or living arrangements. Amendments are not only allowed but are necessary to maintain credibility and accuracy throughout the court process.

Attaching documents is optional. Submission of relevant documents is not optional but a requirement. These documents include tax returns, pay stubs, and insurance coverage affidavits. They provide essential verification of the information presented in the CIS.

It's just a formality with no real impact. The CIS is a critical tool in the court's evaluation of financial issues in family law cases. It provides a basis for determining alimony, child support, and the equitable distribution of assets. Its accuracy can significantly affect the case's outcome.

Personal expenses are irrelevant. The opposite is true. Detailed current personal and children's expenses are vital for assessing alimony and child support needs. This information assists the court in understanding the standard of living established during the marriage.

Children’s financial information is not needed. Information regarding children from the marriage or other relationships, including their living arrangements and any income they might have, is essential. This information can impact child support calculations and considerations for their well-being.

All assets are divided equally. The CIS helps paint a picture of the marital standard of living and the assets accumulated. However, equitable does not always mean equal. The division is based on various factors, including the information provided in the CIS.

You need a lawyer to fill it out. While legal guidance can ensure accuracy and completeness, individuals can fill out the CIS themselves. Understanding each section and accurately providing the required information can be done without legal assistance, although consulting with an attorney can be beneficial.

It exclusively determines financial outcomes. While the CIS is crucial for financial deliberations, it is part of a larger picture. The court also considers statutory factors, case law, and other documents and testimonies in its final decisions.

Dispelling these misconceptions about the New Jersey Case Information Statement is essential for those involved in family law cases. Understanding the purpose, requirements, and significance of the CIS ensures that parties can effectively contribute to the legal process, leading to fairer and more equitable outcomes. It's a testament to the complexity of family law and the importance of clear, accurate, and complete financial information.

Key takeaways

When dealing with the NJ CN 10482 form, also known as the Family Part Case Information Statement, it is crucial to understand the following key takeaways to ensure the accuracy and completeness of the submission:

- The form is confidential as per Rules 1:38-3(d)(1) and 5:5-2(f), designed to detail the financial landscape of parties in a family law case within the New Jersey Superior Court, Chancery Division, Family Part.

- It must be filled out entirely and submitted alongside all required attachments in line with Court Rule 5:5-2, based on the available information.

- Filing must occur within 20 days following the Answer or Appearance’s filing. Failure to submit could lead to the dismissal of pleadings for the involved party.

- Accuracy is paramount when completing this statement as it plays a critical role in establishing lifestyle considerations crucial to alimony, spousal support, and child support deliberations.

- Monthly expenses should be reported based on actual expenditures, ideally verified through bank statements, checkbook registers, or credit card statements from the previous 24 months.

- Asset valuations should be supported by appraisals or account statements when available; otherwise, estimates must be clearly identified as such.

- The form requires updating as circumstances change, necessitating the submission of an Amended Case Information Statement to reflect new living expenses or other significant modifications.

- Evidence in the form of recent tax returns, W-2 forms, 1099s, and the three most recent pay stubs is mandatory, alongside pertinent documentation related to requests for college or post-secondary school contributions.

- The document is comprehensive, demanding detailed information regarding employment, income, living expenses, and assets for both the filing party and, if known, the other party.

- It includes sections that must detail any existing agreements between the parties, children involved, insurance information, past and pending family actions, and any other miscellaneous information that impacts the financial aspects of the case.

Ensuring the form is filled accurately and completely, supported by the required documentation, is critical for the fair assessment of the financial situations impacting family law decisions. This comprehensive approach helps safeguard interests and foster a smoother legal process.

Popular PDF Documents

Certified Payroll Forms Nj - Instructs contractors and subcontractors on documenting and reporting hours worked, overtime, and gross earnings for each employee.

Nj Family Court Forms - Navigate the complex process of executing against real estate, potentially leading to the sale of the debtor's property to satisfy the judgment.

Power of Attorney Form Nj Dmv - Comes with a clear set of terms and conditions to safeguard both the requestor’s and subject’s privacy and legal rights.