Fill Out a Valid Nj Payroll Certification Template

The NJ Payroll Certification for Public Works Projects form is a vital document designed to ensure contractors and subcontractors comply with the labor standards set by the New Jersey Department of Labor & Workforce Development. At its core, the form serves multiple purposes: it documents weekly and final payroll details, affirms that workers have been paid their full wages without improper deductions or rebates, and ensures that wage rates meet or exceed the prevailing wage rates required by law. Additionally, it confirms that any apprentices are registered and participating in certified programs, and it outlines the provision of fringe benefits, whether in plans or as cash payments. The form requires the inclusion of detailed information such as the project name, contractor or subcontractor details, work classifications, and demographic data of workers, along with a declaration that all information provided is correct and complete. Importantly, the certification process also necessitates the disclosure of any fringe benefits paid to workers, highlighting the contractor's or subcontractor's adherence to not just wage laws but also benefits provisions. Failure to accurately complete and submit this form within the specified timeline to the appropriate public body or lessor carries significant legal implications, underlining the NJ Payroll Certification form's role in promoting fair labor practices on public works projects in New Jersey.

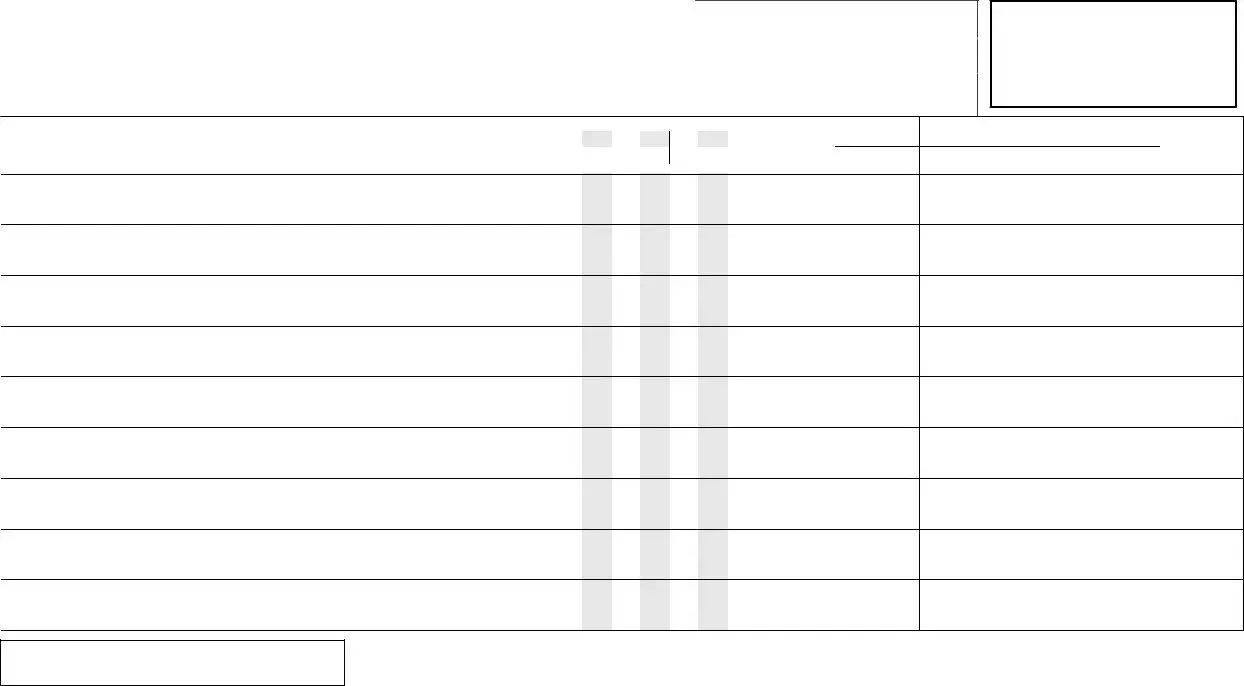

Sample - Nj Payroll Certification Form

NJ Department of Labor & Workforce Development |

Payroll Certification for Public Works Projects |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

for Contractor and Subcontractor’s Weekly and Final Certification |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Project Name |

|

|

|

|

|

||

Name of Contractor or Subcontractor |

|

|

Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

F.E.I.N. |

|

|

|

|

|

Project Location |

|

|

|

|

|

|

|

|

|

Contract I.D. or Project I.D. |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Payroll No. |

Date Wages Due |

Week Ending Date |

|

|

|

|

|

|

|

|

|

|

|

Contractor Registration # |

|

|

|

|||||||

|

& Paid (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

or |

Final Certification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1. |

|

|

|

2. Work |

3. Demographics |

or |

|

|

|

4. Day and Date |

|

|

|

5. |

6. |

|

|

7. |

||||||

|

|

|

traightS Time |

|

|

|

|

|

|

|||||||||||||||

and Address |

|

Job Title |

|

|

Work Classification/ |

Sex |

Race |

vertimeO |

SU |

MO |

TU |

WE |

TH |

|

FR |

SA |

Hours |

Hourly |

|

Gross Amt. Earned |

||||

|

journeyman, foreman |

|

e.g., carpenter, mason, plumber |

See Key |

|

|

Hours |

worked |

each day |

|

|

|

of Pay |

|

Project |

|

Week |

|||||||

|

|

|

|

|

Occupational Category |

M=Male |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Name |

|

e.g., apprentice, |

|

F=Female |

|

|

|

mm/dd |

mm/dd |

mm/dd |

mm/dd |

mm/dd |

mm/dd |

mm/dd |

Total |

Rate |

|

This |

|

This |

||||

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (specify)

SUBMIT form by

email: equalpayact@dol.nj.gov

IMPORTANT: For purposes of law, you must also submit this form to the appropriate public body or lessor.

|

|

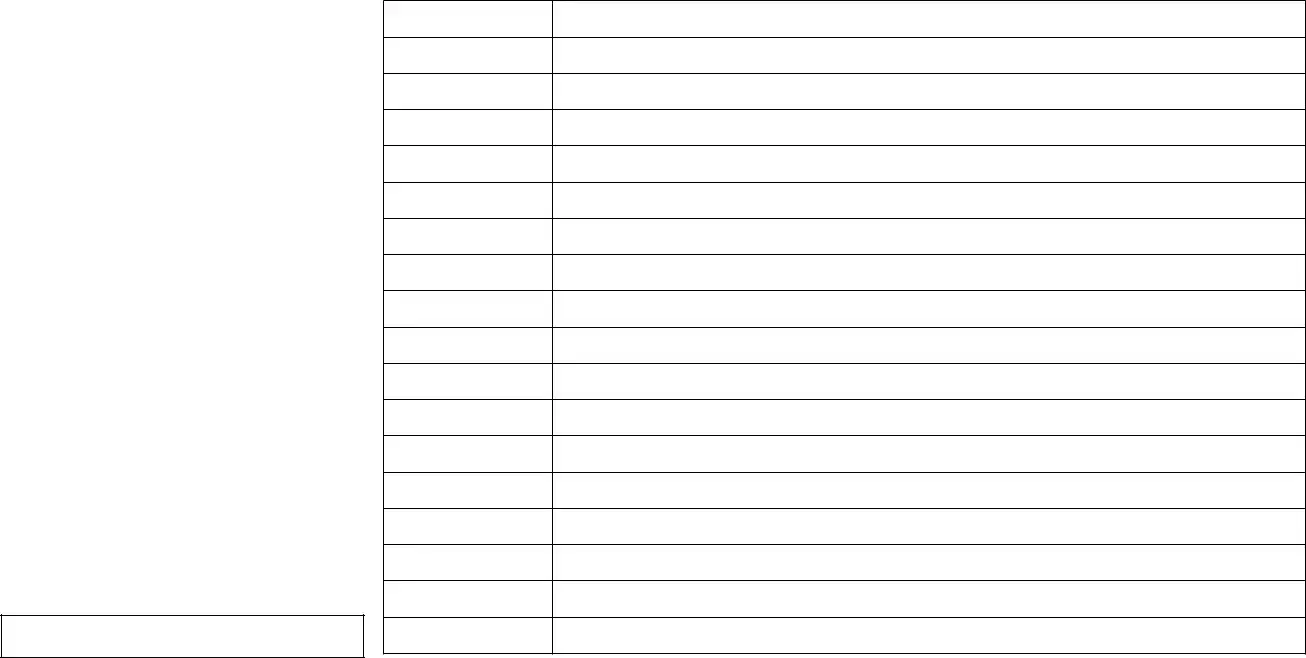

8. |

|

|

|

|

|

9. |

10. |

||

|

|

|

Deductions |

|

|

|

Total |

||||

|

|

|

|

|

Net Wages |

Fringe |

|||||

|

Federal |

|

State |

|

Other |

|

(specify) |

|

Total |

||

|

|

|

|

|

|||||||

|

|

|

|

|

Paid for |

Benefit |

|||||

|

|

Tax |

|

|

|

|

|

||||

FICA |

Tax |

|

|

|

|

|

|

Deductions |

Week |

Cost/Hour |

|

|

|

|

|

|

|

|

|

|

|

|

|

KEY W= White; B= Black or African American;

A= Asian; N= American Indian or Native Alaskan;

I = Native Hawaiian or Pacific Islander; M= 2 or More

Check if additional sheets used

I, the undersigned, do hereby state and certify:

(1)That I pay or supervise the payment of the persons employed by

_________________________________________________________

(Contractor or Subcontractor)

on the ___________________________________________________

(Project Name & Location)

that during the payroll period beginning on (date) _____________, and ending on (date) _____________, all persons employed on said project have been paid the full weekly wages earned, that no rebates have been or will be made either directly or indirectly to or on behalf of the aforenamed Contractor or Subcontractor from the full weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions as defined in the New Jersey Prevailing Wage Act, N.J.S.A.

(2)That any payrolls otherwise under this contract required to be sub- mitted for the above period are correct and complete; that the wage rates for laborers or mechanics contained therein are not less than the applicable wage rates contained in any wage determination in- corporated into the contract; that the classifications set forth therein for each laborer or mechanic conform with the work he performed.

(3)That any apprentices employed in the above period are duly registered with the United States Department of Labor, Bureau of

Apprenticeship and Training and enrolled in a certified apprenticeship program.

(4)That:

(a)WHERE FRINGE BENEFITS ARE PAID TO APPROVED PLANS, FUNDS OR PROGRAMS

q In addition to the basic hourly wage rates paid to each laborer or mechanic listed in the

(b)WHERE FRINGE BENEFITS ARE PAID IN CASH

q Each laborer or mechanic listed in the

(5)N.J.S.A.

(6)By checking this box and typing my name below, I am electronically signing this application. I understand that an electronic signature has the same legal effect as a written signature.

Name _____________________________________________________________

Title ____________________________________ Date (mm/dd/yy) ______________

THE FALSIFICATION OF ANY OF THE ABOVE STATEMENTS MAY SUBJECT THE CONTRACTOR OR SUBCONTRACTOR TO CIVIL OR CRIMINAL PROSECUTION.

— N.J.S.A. 34:11- 56.25 ET SEQ. AND N.J.A.C. 12:60 ET SEQ. AND N.J.S.A.

Program Title, Classification Title,

or Individual Workers

4(c) Benefit Program Information in AMOUNT CONTRIBUTED PER HOUR (Must be completed if 4(a) is checked)

To calculate the cost per hour, divide 2,000 hours into the benefit cost per year per employee.

Health/ |

|

|

Apprenticeship/ |

(e.g., training, |

Fund, Plan, or Program Administrator |

Filing Number/EIN |

&/or Contract Person |

|

|

Vacation/Holiday |

Pension |

||||||

|

Welfare |

Training |

|

Other Benefit Type and Amount |

Name & Address of Fringe Benefit |

USDOL Benefit Plan |

||

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for certifying weekly and final payroll details for contractors and subcontractors on public works projects in New Jersey. |

| Governing Laws | It adheres to the New Jersey Prevailing Wage Act (N.J.S.A. 34:11-56.25 et seq.), Regulation N.J.A.C. 12:60 et seq., and the Payment of Wages Law (N.J.S.A. 34:11-4.1 et seq.). |

| Fringe Benefits Reporting | It includes sections for reporting whether fringe benefits are paid to approved plans, funds, or programs or in cash, and details about the benefit program must be provided if applicable. |

| Electronic Submission | Forms can be submitted via email to equalpayact@dol.nj.gov, requiring an electronic signature that has the same legal effect as a written signature. |

| Submission Deadlines and Falsification Penalties | Employers must submit certified payroll records to the relevant public body or lessor within 10 days of wage payment. False statements may lead to civil or criminal prosecution under N.J.S.A. 34:11-56.25 et seq., N.J.A.C. 12:60 et seq., and N.J.S.A. 34:11-4.1 et seq. |

Detailed Steps for Using Nj Payroll Certification

Filling out the NJ Payroll Certification form is a crucial step for contractors and subcontractors working on public works projects in New Jersey. This document ensures that all workers have been compensated according to the state’s prevailing wage laws. It's not just a formality; it's a commitment to fairness and legal compliance. Properly completing this form requires attention to detail and an understanding of its sections to accurately report wages, deductions, and certifications. Here's a step-by-step guide to help you navigate this process smoothly.

- Start by entering the Project Name at the top of the form.

- Indicate whether you are the Contractor or Subcontractor by checking the appropriate box.

- Fill in your Business Address and F.E.I.N. (Federal Employer Identification Number).

- Provide the Project Location and the Contract I.D. or Project I.D.

- Enter the Payroll No., the Date Wages Due, and the Week Ending Date.

- List your Contractor Registration Number. If this is the final payroll certification, check the Final Certification box.

- For every employee, provide their Name, Demographics (Sex, Race), Job Title, Work Classification (e.g., Journeyman, Foreman), and Address.

- Document each employee's work hours and earnings. Include Day and Date, Straight Time Hours, Overtime Hours, and Gross Amount Earned for each day of the week.

- Under Deductions, itemize the total deductions taken from the wages, including Federal, State, and FICA Tax Deductions, as well as any Other Deductions specified.

- Calculate and record the Total Net Wages Paid for the Week and the Fringe Benefit Cost/Hour if applicable.

- Check the box if additional sheets are used and attach them accordingly.

- In the certification section at the bottom, provide the full name and title of the person completing the form. Then, add the date and electronically sign the form by typing your name.

After completing the NJ Payroll Certification form, it must be submitted by email to equalpayact@dol.nj.gov and also sent to the appropriate public body or lessor, as specified in the instructions. This ensures both compliance with New Jersey's laws and a transparent, fair compensation process for those involved in public works projects. Keep a copy of the form and all attachments for your records. Remember, accurately reporting this information is not only a legal requirement but also a reflection of your commitment to ethical business practices.

Learn More on Nj Payroll Certification

What is the purpose of the NJ Payroll Certification form?

The NJ Payroll Certification form is a document required by the New Jersey Department of Labor & Workforce Development for contractors and subcontractors working on public works projects. Its main purpose is to ensure that all workers on a project have been paid the appropriate wages according to the hours worked, including any overtime and fringe benefits, in compliance with prevailing wage laws and regulations.

Who needs to submit this form?

Both contractors and subcontractors involved in public works projects in New Jersey are required to fill out and submit the NJ Payroll Certification form. It is essential for verifying that employees are paid in accordance with the law.

What information is required on the Payroll Certification form?

The form requires several pieces of information, including:

- Project Name and Location

- Contractor or Subcontractor's Information (including Business Address and Federal Employer Identification Number (FEIN))

- Workers' classifications, hours worked, and compensation details

- Details on deductions, net wages, and any fringe benefits paid

- Confirmation of compliance with relevant wage laws

- An electronic signature from a person of authority within the contracting company.

Where should the Payroll Certification form be submitted?

The completed form must be submitted by email to equalpayact@dol.nj.gov . Additionally, it is important to submit a copy of the form to the appropriate public body or lessor overseeing the public works project to ensure compliance with all local requirements.

What are the deadlines for submitting this form?

Employers are required to submit the certified payroll records to the relevant public body or lessor each pay period within 10 days of the payment of wages.

What happens if a contractor or subcontractor fails to submit the form or submits incorrect information?

Falsification of any information on the NJ Payroll Certification form or failure to submit it may subject the contractor or subcontractor to civil or criminal prosecution. Accurate and timely submission of this form is crucial to ensure compliance with New Jersey labor laws and avoid potential legal issues.

How does the form ensure workers are paid appropriately?

The form acts as a certification that all workers employed on a specific project have been paid the full weekly wages earned, without unauthorized deductions or rebates. It verifies that wages paid meet or exceed the prevailing wage rates and that any benefits due are correctly allocated. This accountability helps protect workers’ rights and ensures fair compensation.

Can additional sheets be used with the NJ Payroll Certification form?

Yes, if a contractor or subcontractor needs more space to provide the required details for all workers, additional sheets can be attached to the original form. It is important to clearly indicate that additional sheets are included by checking the appropriate box on the form to ensure all information is accounted for during the review process.

Common mistakes

Filling out the NJ Payroll Certification form properly is crucial for contractors and subcontractors working on public works projects in New Jersey. Missteps can lead to serious legal issues, including fines and penalties. To ensure accuracy and compliance, here are four common mistakes to avoid:

Incorrect or Incomplete Contractor Information: One of the first pitfalls involves the section where the contractor or subcontractor must identify themselves. It's essential to provide complete and accurate information regarding the name, business address, and Federal Employer Identification Number (F.E.I.N.). Likewise, distinguishing between contractor and subcontractor status by ticking the correct box is a detail that can't be overlooked.

Failure to Accurately Report Work Classification and Hours: The form requires detailed information about each employee, including job titles, work classification (e.g., journeyman, apprentice), hours worked (including overtime), and hourly gross amount earned. Misclassifying workers or inaccurately reporting hours can not only affect the employees' wages but can also result in non-compliance with labor laws, leading to consequences for the employer.

Omitting Deductions and Fringe Benefits Information: Deductions from wages must be noted carefully, including federal and state taxes, FICA, and any others specified. Additionally, the section on fringe benefits, whether paid to plans or in cash, requires attention. Failing to note these correctly can not only misrepresent an employee's earnings but also mislead about the employer's contributions to benefits, which is a legal requirement.

Electronic Signature Missteps: The requirement for an electronic signature at the form's end is more than a formality. It's a legal assertion that the information provided is accurate and complete. Ensuring that this section is properly filled out, with the signatory's name, title, and the date, is essential. Neglecting this step or entering information incorrectly undermines the form's validity, potentially leading to allegations of fraud or misrepresentation.

Avoiding these mistakes requires diligence, attention to detail, and a clear understanding of the legal obligations involved in public works projects in New Jersey. Keeping these guidelines in mind will help ensure that the NJ Payroll Certification form is filled out correctly and comprehensively, avoiding legal complications and ensuring fair treatment for all workers involved.

Documents used along the form

When dealing with the NJ Payroll Certification for Public Works Projects, it's important to understand that this is not the only document necessary for compliance and thorough record-keeping. In fact, a variety of additional forms and documents are frequently required to ensure full adherence to laws, regulations, and standards governing public works projects. These additional materials play critical roles in certifying that all project-related activities meet the legislative and contractual guidelines.

- Wage and Hour Division (WHD) Certification: Confirms compliance with the minimum wage, overtime pay, and child labor standards.

- Apprenticeship Agreement: Documented agreement for apprentices working on the project, ensuring they’re registered and their program is certified.

- Employee Rights Notice: A poster or document that informs employees of their rights under local, state, and federal labor laws.

- Prevailing Wage Determination: Specifies the set wage rates and fringe benefits for labor classifications within a public works project.

- Overtime Authorization:: Written approval for any overtime work, ensuring it’s documented and compensated according to state and federal laws.

- Work Hours Schedule: Outlines the daily and weekly work schedules of employees, ensuring adherence to work hours regulations.

- Incident Report Forms: Used to record any workplace incidents or accidents, essential for compliance with occupational safety and health regulations.

- Proof of Fringe Benefits Payment: Documentation verifying that payments for fringe benefits have been made to the appropriate plans, funds, or programs.

- W-4 Form: Employee’s withholding certificate for tax purposes, ensuring the correct federal income tax is withheld.

- I-9 Form: Employment eligibility verification form required by the Department of Homeland Security, ensuring all employees are legally permitted to work in the U.S.

Together, these documents form a comprehensive framework supporting the NJ Payroll Certification form, ensuring that contractors and subcontractors not only comply with wage and hour laws but also maintain rigorous standards of employee rights, workplace safety, and fair labor practices. The integration of these documents ensures transparency, accountability, and protection for all parties involved in public works projects.

Similar forms

The Federal WH-347 Payroll Form, utilized by contractors and subcontractors performing work on federally funded or assisted construction projects, shares similarities with the NJ Payroll Certification Form. Both require detailed weekly wage reporting for each worker, including information on hours worked, rates of pay, gross earnings, and deductions. Additionally, they mandate the classification of work performed and compliance with prevailing wage regulations to ensure fair compensation.

An Employee W-4 Form, primarily used for tax withholding purposes, also bears resemblance to the NJ Payroll Certification Form in that it gathers personal and demographic information about employees. While the W-4 focuses more on federal tax withholdings, both forms serve to collect necessary employee data for compliance with government regulations.

The Certified Payroll Professional (CPP) Examination Application, although an application rather than a reporting form, shares the objective of ensuring compliance with payroll standards and regulations. Like the NJ Payroll Certification Form, it underscores the importance of understanding and adhering to labor laws and payroll practices, albeit from a certification perspective for professionals in the field.

The Fair Labor Standards Act (FLSA) Compliance Checklist is a tool for employers to assess their adherence to wage and hour laws, similar to the self-certification aspect of the NJ Payroll Certification Form where contractors affirm legal compliance. Both documents play crucial roles in enforcing labor standards and protecting worker rights.

State-specific Unemployment Insurance Wage Reporting Forms, which employers submit periodically, also align with the NJ Payroll Certification Form in terms of requiring detailed employee wage information. Both sets of documents are essential for the administration of worker benefits and ensuring accurate record-keeping for governmental oversight.

The Employee's Withholding Allowance Certificate, similar to a W-4 but used in some states, collects information that influences payroll deductions and withholdings. This document, akin to the NJ Payroll Certification Form, is integral to the payroll process, ensuring that employers withhold and report the correct amount of state income tax from their employees' wages.

Internal project invoicing documents, used within companies to bill for labor on projects, share the NJ Payyroll Certification Form's focus on accuracy in reporting hours worked and corresponding pay rates. Both types of documents contribute to transparent financial and labor practices, ensuring that workers are paid appropriately for their time and efforts.

The Equal Employment Opportunity (EEO) self-identification forms, requiring employee information on demographics without disclosing specific individuals' earnings or hours, indirectly complement the NJ Payroll Certification Form's demographic section. While serving different primary purposes—EEO forms for monitoring diversity and preventing discrimination—the collection of demographic information in both respects privacy and supports regulatory compliance.

Dos and Don'ts

When completing the NJ Payroll Certification form for public works projects, attention to detail is crucial. To ensure accuracy and compliance, here are essential dos and don'ts:

Do:- Verify all information before submission: Double-check entries for accuracy, including project details, employee hours, wages, and personal information.

- Ensure compliance with applicable laws: Adhere to guidelines set by the New Jersey Prevailing Wage Act and other relevant statutes, confirming that wages and fringe benefits meet or exceed required standards.

- Use the correct wage classifications: Accurately classify workers according to their specific job roles and responsibilities to ensure correct wage rates are applied.

- Include accurate workweek dates: Clearly state the beginning and ending dates of the payroll period to avoid confusion and ensure compliance with pay schedule requirements.

- Record complete hours worked: Log daily and total hours worked for each employee, including overtime, to ensure full and fair compensation.

- Submit on time: Adhere to submission deadlines to the New Jersey Department of Labor & Workforce Development and the appropriate public body or lessor to avoid penalties or delays.

- Sign electronically with care: Understand that an electronic signature carries the same legal weight as a written signature, signifying your affirmation that all provided information is accurate and complete.

- Forget to check for additional sheets: If additional sheets were used due to space constraints, make sure they are attached and properly marked to ensure all data is reviewed.

- Omit fringe benefits details: If applicable, thoroughly document fringe benefits paid either directly or through approved plans or programs, providing specific amounts and payee details.

- Include incorrect personal employee information: Misidentification can lead to serious errors in records and payments, so pay particular attention to correct employee names, job titles, and demographic information.

- Leave sections incomplete: Ensure no required sections are left blank. Incomplete forms may be rejected or require resubmission, leading to potential delays in certification.

- Overlook the apprenticeship section: If apprentices are employed, confirm their registration with the United States Department of Labor, Bureau of Apprenticeship and Training, and enrollment in a certified apprenticeship program.

- Misspellings or inaccuracies in project information: Accurate project details such as name, location, and contract ID are critical for the form's validity and future reference.

- Falsify information: Understand that providing false statements or information may lead to civil or criminal prosecution under applicable New Jersey statutes.

Misconceptions

When it comes to completing and submitting the NJ Payroll Certification form for Public Works Projects, there are a number of misconceptions that can lead to confusion. Here, we explain and correct some of the most common misunderstandings:

Only contractors need to submit the form: Both contractors and subcontractors are required to submit this form weekly and for final certification. It's important for all parties involved in the public works project to comply.

Electronic signatures aren't accepted: Contrary to this belief, electronic signatures are indeed accepted and have the same legal effect as written signatures. This modern convenience aims to streamline the submission process.

It's only about wages: While the form primarily reports wages due, it also covers demographics, work classification, hours worked, deductions, and fringe benefits. These additional details are crucial for ensuring full compliance with labor laws.

Demographic information is optional: The form requires information about the worker's job title, work classification, sex, and race. This data is necessary to ensure adherence to equal pay and anti-discrimination laws.

Fringe benefits can be ignored: If applicable, payments made to approved plans, funds, or programs for fringe benefits must be reported. Alternatively, if fringe benefits are paid in cash, this must also be clearly reported on the form.

The form is only a formality: Falsification of any statement on this form can subject the contractor or subcontractor to civil or criminal prosecution. Accuracy and honesty in filling out this form are paramount.

Apprentices don't need to be registered: The certification requires that any apprentices employed are duly registered with an appropriate program. This ensures that apprentices are properly trained and compensated according to the law.

I can submit the form whenever convenient: There is a stipulation that certified payroll records must be submitted within 10 days of the payment of wages. Timely submission is crucial for compliance.

Only the final certification matters: Weekly submissions are just as important as the final certification. These weekly forms ensure ongoing compliance and help avoid any end-of-project discrepancies or issues.

All deductions are permissible: The form clearly states that no deductions can be made from the wages earned by any person other than permissible deductions as defined in the New Jersey Prevailing Wage Act and related laws and regulations.

Understanding the requirements and purpose of the NJ Payroll Certification form is essential for contractors and subcontractors involved in Public Works Projects. By addressing these misconceptions, we can promote a smoother compliance process and protect the rights of all workers involved.

Key takeaways

Filling out the New Jersey (NJ) Payroll Certification form accurately is crucial for contractors and subcontractors involved in public works projects. Here are six key takeaways to ensure compliance and proper submission:

- Every contractor or subcontractor must submit a completed payroll certification form weekly for the duration of the project, and a final certification upon completion, to the NJ Department of Labor & Workforce Development. This is to certify that all employees have been paid their full weekly wages without any illegal deductions or rebates.

- The form requires detailed information about the project, including the name and business address of the contractor or subcontractor, the Federal Employer Identification Number (F.E.I.N.), project location, contract or project ID, and payroll number.

- It is important to accurately report the work classification/job title, demographics (including sex and race/ethnicity), hours worked each day, hourly rate, and gross amount earned for each employee. Additional sheets may be attached if necessary.

- Declaration of fringe benefits is essential. The form distinguishes between benefits paid to approved plans, funds, or programs, and those paid in cash directly to employees. Contractors must specify the type and amount of fringe benefits provided, or note if they are included in the hourly rate.

- Compliance with legal requirements for apprentices is mandatory. Any apprentices employed during the payroll period must be registered with the United States Department of Labor, Bureau of Apprenticeship and Training and enrolled in a certified apprenticeship program.

- The form must be submitted within 10 days of wage payment for each period. A digital or electronic signature of the contractor or subcontractor affirming the accuracy and completeness of the payroll records is required. Falsification of these statements can result in civil or criminal prosecution under relevant NJ statutes and regulations.

Understanding these key points will help ensure that the process of completing and submitting the NJ Payroll Certification form is carried out correctly, thereby maintaining compliance with NJ labor laws and regulations.

Popular PDF Documents

What Is Njwd-es Box 14 - Filing requirements and technical specifications are provided to assist in correctly submitting W-2 information electronically to NJ.

How Many Allowances to Claim - Enables proactive tax management for employees in New Jersey by specifying withholding allowances and exemptions.

Nj 927 - Similar reporting is required for any private plan related to Family Leave Insurance (FLI).