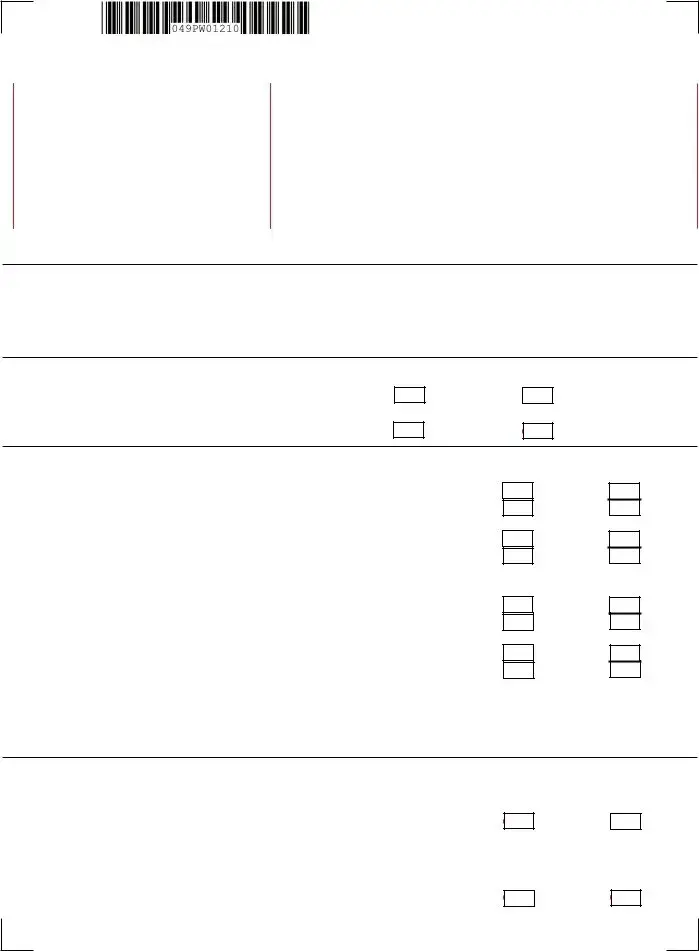

Fill Out a Valid Nj Ptr 1 Template

The Senior Freeze (Property Tax Reimbursement) Program offers critical relief to New Jersey's senior and disabled citizens, assisting them in coping with the often burdensome property taxes that can jeopardize their ability to remain in their homes. The NJ PTR-1 form serves as the initial application for this reimbursement initiative, a cornerstone of New Jersey's efforts to support its vulnerable population. This comprehensive document requires applicants to provide detailed personal information, including Social Security numbers, age or disability status, marital/civil union status, and residency tenure in New Jersey. The form is meticulous in its design, ensuring that all prerequisites for the program are verifiably met, including continuous residency in New Jersey since a specified date, ownership and occupation of the same home within defined timelines, and adherence to strict income limits for the years preceding the application. Moreover, the form necessitates the submission of an array of financial data encompassing varied income sources from the previous two years to ascertain eligibility based on financial constraints. This detailed vetting process, while complex, is a crucial mechanism to ensure that the relief provided reaches those who truly need it, aligning with the program's goal of aiding seniors and disabled individuals in maintaining their residences amidst escalating property taxes.

Sample - Nj Ptr 1 Form

You must enter your Social Security number below

New Jersey

2021 Senior Freeze

(Property Tax Reimbursement) Application

Place preprinted label below ONLY if the information is correct.

Otherwise print or type your name and address.

InstructionsSee |

Your Social Security Number |

|

|

|

|

|

|

Last Name, First Name, Initial (Joint Filers enter first name and middle initial of each. Enter |

|||||||||||

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

spouse’s/CU partner’s last name ONLY if different.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Act Notification, |

Spouse’s/CU Partner’s SSN |

Home Address (Number and Street, including apartment number) |

|

||||||||||||||||||||

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County/Municipality Code (See instructions) |

City, Town, Post Office |

State |

ZIP Code |

|||||||||||||||||||

For Privacy |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This is a

PROOF OF AGE OR DISABILITY FOR 2020 AND 2021 MUST BE SUBMITTED WITH APPLICATION

Age 65 or Older: Copy of one – Birth Certificate, Driver’s License, Church Records

Receiving Federal Social Security Disability Benefits: Copy of Social Security Award Letter

See instructions for more information.

Marital/Civil Union Status

1.Your Marital/Civil Union Status on December 31, 2020:

2.Your Marital/Civil Union Status on December 31, 2021:

Single

Single

Married/CU Couple

Married/CU Couple

Age/Disability Status

3a. |

On December 31, 2020, were you age 65 or older? |

Yourself |

|

|

Spouse/CU Partner |

3b. |

On or before December 31, 2020, were you actually |

Yourself |

|

receiving federal Social Security disability benefit |

Spouse/CU Partner |

|

payments? |

|

4a. |

On December 31, 2021, were you age 65 or older? |

Yourself |

|

|

Spouse/CU Partner |

4b. |

On or before December 31, 2021, were you actually |

Yourself |

|

receiving federal Social Security disability benefit |

Spouse/CU Partner |

|

payments? |

|

Yes Yes

Yes Yes

Yes Yes

Yes Yes

No No

No No

No No

No No

Applicant(s) must meet the age or disability requirements for both 2020 and 2021. If neither you nor your spouse/CU partner met the requirements, you are not eligible for the reimbursement, and you should not file this application. See “Eligibility Requirements” on page 1 of instructions.

Residency Requirements

5.Have you lived in New Jersey continuously since December 31, 2010, or earlier as either a homeowner or a renter?

Yes

No

If “No,” STOP. You are not eligible for the reimbursement, and you should not file this application.

6.Have you owned and lived in the same New Jersey home since December 31, 2017, or earlier? (Mobile Home Owners, see instructions)

Yes

No

If “No,” STOP. You are not eligible for the reimbursement, and you should not file this application.

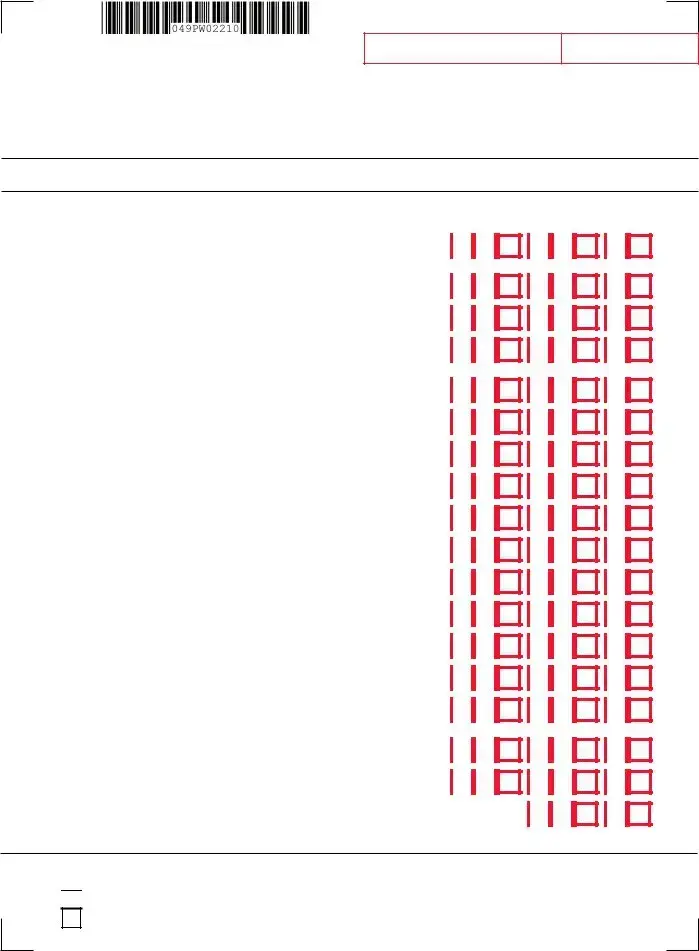

Name(s) as shown on Form

Your Social Security Number

Determining Total Income (Line 7): Enter your annual income for 2020. See “Income Standards” and “Determining Total Income” in the instructions for information on sources of income and how to determine the amount to report. If you had no income in a category, leave that line blank. Losses in one category of income cannot be used to reduce total income. If you have a net loss in any income category, leave that line blank. If you were married or in a civil union as of December 31 of 2020 and living in the same home, combine your incomes for that year. If you lived in separate homes, file as “Single.”

2020 Income

a.Social Security Benefits (including Medicare Part B premiums) paid to or on behalf of applicant. Enter total

|

amount from Box 5 of Form |

....... a. |

|||||||

b. Pension and Retirement Benefits (including IRA and |

|

|

|

|

|

|

|

|

|

|

annuity income) See instructions for calculating amount |

b. |

|||||||

c. Salaries, Wages, Bonuses, Commissions, and Fees |

c. |

||||||||

d. Unemployment Benefits |

d. |

||||||||

e. Disability Benefits, whether public or private (including |

|

|

|

|

|

|

|

|

|

|

veterans’ and black lung benefits) |

e. |

|||||||

f. |

Interest (taxable and exempt) |

f. |

|||||||

g. |

Dividends |

g. |

|||||||

h. |

Capital Gains |

h. |

|||||||

i. |

Net Rental Income |

i. |

|||||||

j. |

Net Profits From Business |

j. |

|||||||

k. |

Net Distributive Share of Partnership Income |

k. |

|||||||

l. |

Net Pro Rata Share of S Corporation Income |

l. |

|||||||

m. Support Payments |

m. |

||||||||

n. Inheritances, Bequests, and Death Benefits |

n. |

||||||||

o. Royalties |

o. |

||||||||

p. Gambling and Lottery Winnings (including New |

|

|

|

|

|

|

|

|

|

|

Jersey Lottery) |

p. |

|||||||

q. All Other Income |

q. |

||||||||

|

|

|

|

|

|

|

|

|

|

7. Enter total 2020 income on line 7. (Add lines |

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Was your total 2020 income on line 7 $92,969 or less?

Yes. See 2021 income eligibility.

Yes. See 2021 income eligibility.

No. STOP. You are not eligible for the reimbursement, and you should not file this application.

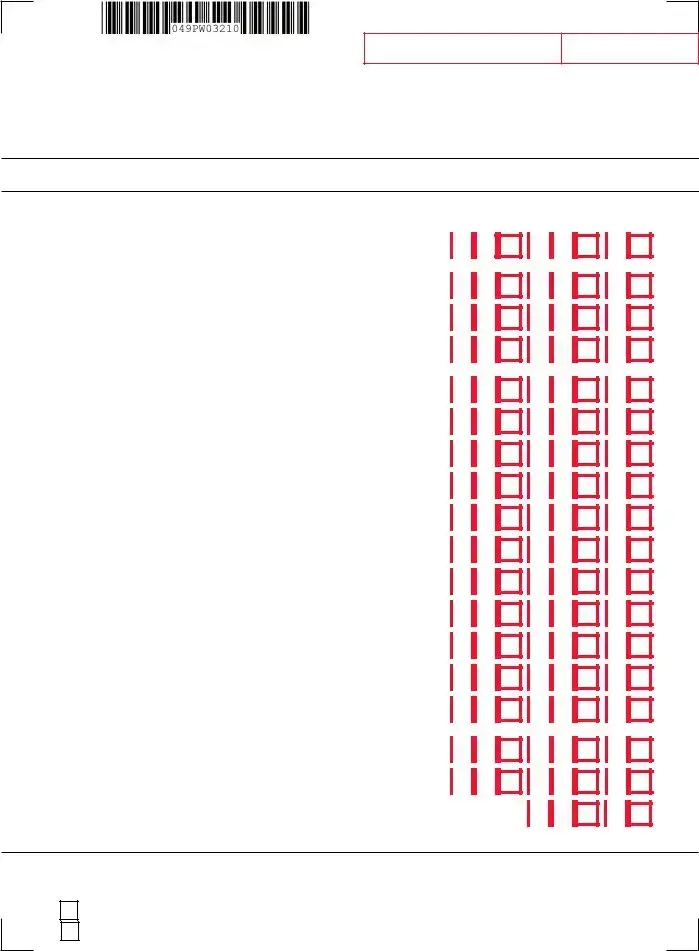

Name(s) as shown on Form

Your Social Security Number

Determining Total Income (Line 8): Enter your annual income for 2021. See “Income Standards” and “Determining Total Income” in the instructions for information on sources of income and how to determine the amount to report. If you had no income in a category, leave that line blank. Losses in one category of income cannot be used to reduce total income. If you have a net loss in any income category, leave that line blank. If you were married or in a civil union as of December 31 of 2021 and living in the same home, com- bine your incomes for that year. If you lived in separate homes, file as “Single.”

2021 Income

a.Social Security Benefits (including Medicare Part B premiums) paid to or on behalf of applicant. Enter total

|

amount from Box 5 of Form |

....... a. |

|||||||

b. Pension and Retirement Benefits (including IRA and |

|

|

|

|

|

|

|

|

|

|

annuity income) See instructions for calculating amount |

b. |

|||||||

c. Salaries, Wages, Bonuses, Commissions, and Fees |

c. |

||||||||

d. Unemployment Benefits |

d. |

||||||||

e. Disability Benefits, whether public or private (including |

|

|

|

|

|

|

|

|

|

|

veterans’ and black lung benefits) |

e. |

|||||||

f. |

Interest (taxable and exempt) |

f. |

|||||||

g. |

Dividends |

g. |

|||||||

h. |

Capital Gains |

h. |

|||||||

i. |

Net Rental Income |

i. |

|||||||

j. |

Net Profits From Business |

j. |

|||||||

k. |

Net Distributive Share of Partnership Income |

k. |

|||||||

l. |

Net Pro Rata Share of S Corporation Income |

l. |

|||||||

m. Support Payments |

m. |

||||||||

n. Inheritances, Bequests, and Death Benefits |

n. |

||||||||

o. Royalties |

o. |

||||||||

p. Gambling and Lottery Winnings (including New |

|

|

|

|

|

|

|

|

|

|

Jersey Lottery) |

p. |

|||||||

q. All Other Income |

q. |

||||||||

|

|

|

|

|

|

|

|

|

|

8. Enter total 2021 income on line 8. (Add lines |

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Was your total 2021 income on line 8 $94,178 or less?

(See “Impact of State Budget” on page 1 of instructions, which explains how the state budget may reduce the income limit.)

Yes. Go to page 4.

No. STOP. You are not eligible for the reimbursement, and you should not file this application.

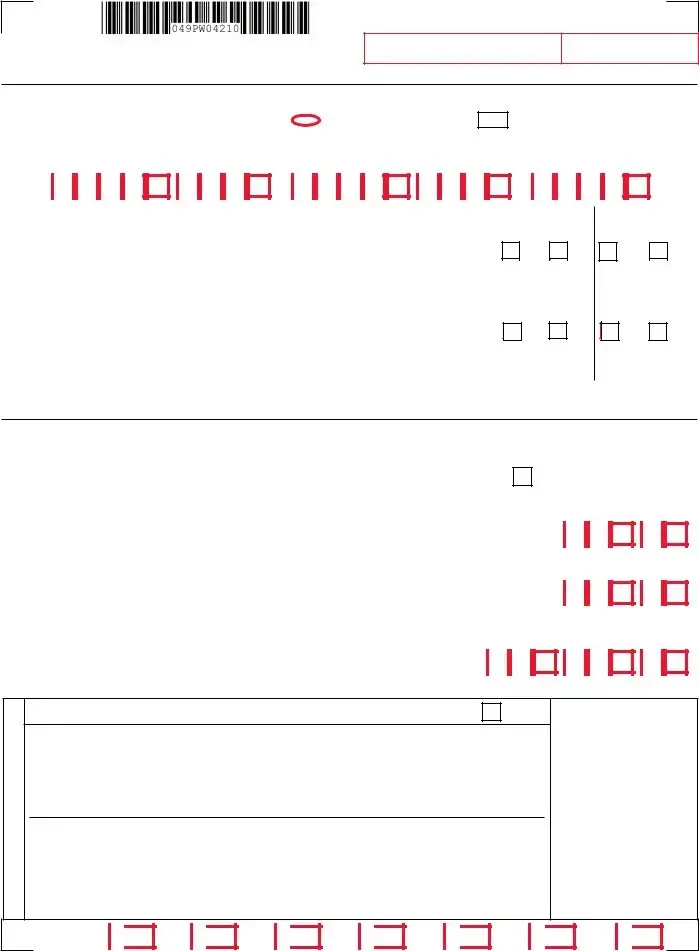

Name(s) as shown on Form

Your Social Security Number

Principal Residence (Main Home)

9. Status (fill in appropriate oval): |

|

Homeowner |

10.Homeowners: Enter the block and lot numbers of your 2021 main home.

Block |

Lot |

Mobile Home Owner

Qualifier

.

.

11a. Did you share ownership of this property with anyone other

than your spouse/CU Partner? (Mobile Home Owners, see instructions) ....

11b. If you answered “Yes,” indicate the share (percentage) of the property

owned by you (and your spouse/CU partner) (Mobile Home Owners,

see instructions) ..........................................................................................

12a. Did this property consist of multiple units? ...................................................

12b. If you answered “Yes,” indicate the share (percentage) of the property

that you (and your spouse/CU partner) used as your main home. ..............

2020 |

2021 |

|

||||

|

|

|

|

|

|

|

|

|

Yes No |

|

Yes |

|

No |

|

|

|

|

|||

|

|

|

|

% |

|

|

|

% |

|

|

|

||||||||

Yes |

|

No |

Yes No |

||||||

|

|

|

|

% |

|

|

|

% |

|

|

|

|

|

|

|

|

|||

If you answered “Yes” at line 11a or 12a, see instructions before completing lines 13 and 14.

Property Taxes

Proof of property taxes due and paid for 2020 and 2021 must be submitted with application. See instructions.

If you are claiming property taxes for additional lots, check box. (See instructions)

13. |

Enter your total 2021 property taxes due and paid (including any |

|||||

|

credits/deductions) on your main home. See instructions. |

|

|

|

|

|

|

(Mobile Home Owners: Property taxes = total site fees paid 0.18) |

13. |

|

|

|

|

14. |

Enter your total 2020 property taxes due and paid (including any |

|||||

|

credits/deductions) on your main home. See instructions. |

|

|

|

|

|

|

(Mobile Home Owners: Property taxes = total site fees paid 0.18) |

14. |

|

|

|

|

Reimbursement Amount (See “Impact of State Budget” on page 1 of instructions.)

15. Reimbursement. (Amount to be sent to you. Subtract line 14 |

|

from line 13) |

15. |

,

,

,

.

.

.

If line 15 is zero or less, you are not eligible for a reimbursement, and you should not file this application.

SIGN HERE

If enclosing copy of death certificate for deceased applicant, check box. (See instructions)

Under penalties of perjury, I declare that I have examined this Senior Freeze (Property Tax Reimbursement) Application, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by a person other than applicant, this declaration is based on all information of which the preparer has any knowledge.

Your Signature |

Date |

|

Spouse’s/CU Partner’s Signature (if filing jointly, BOTH must sign) |

Your daytime telephone number and/or email address (optional)

Paid Preparer’s Signature |

|

Federal Identification Number |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name |

|

Firm’s Federal Employer Identification Number |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due Date: October 31, 2022 Mail your completed application to :

NJ Division of Taxation Revenue Processing Center Senior Freeze (PTR)

PO Box 635

Trenton, NJ,

Senior Freeze (PTR) Hotline:

Division Use

1

2

3

4

5

6

7.  .

.

Document Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The PTR-1 Form is for the New Jersey Senior Freeze (Property Tax Reimbursement) Application intended for seniors to potentially receive property tax reimbursement. |

| Eligibility Requirements | Applicants must meet specific age or disability requirements for the years 2019 and 2020, have a total income of $91,505 or less for 2019 and $92,969 or less for 2020, and meet residency and homeownership criteria. |

| Income Information & Documentation | Applicants are required to provide detailed income information for both 2019 and 2020, including sources like Social Security benefits, pensions, and wages. Documentation such as Social Security Award Letter or tax documents must be submitted with the application. |

| Governing Law | The form is governed by New Jersey state law, specifically designed to provide assistance to senior and disabled residents in the form of property tax reimbursement as part of the state's Senior Freeze Program. |

Detailed Steps for Using Nj Ptr 1

The New Jersey PTR-1 Form, or Senior Freeze (Property Tax Reimbursement) Application, offers eligible seniors and individuals with disabilities a chance for a reimbursement on their property taxes. Navigating through the application can be made simpler by understanding the necessary steps required to fill it out correctly. It is crucial to provide accurate and complete information to ensure your eligibility and secure your reimbursement. Following the steps listed below will guide individuals through the application process.

- Begin with your personal details. Enter your Social Security number at the top of the form. If the preprinted label is accurate, affix it in the designated area. Otherwise, print or type your name, address, and other requested information in the respective fields.

- For the section titled "Act Notification," fill in your spouse’s/CU partner’s Social Security Number (SSN), if applicable.

- Under "Proof of Age or Disability," check the appropriate box that applies to you for both 2019 and 2020. Remember to attach the necessary documents like a birth certificate for age or a Social Security Award Letter for disability.

- Indicate your Marital/Civil Union Status as of December 31, 2019, and December 31, 2020, by selecting the correct status.

- Answer questions about your Age/Disability Status for both 2019 and 2020, for yourself and your spouse/CU partner, indicating "Yes" or "No" to whether you were 65 or older or receiving federal Social Security disability benefits.

- Respond to the Residency Requirements questions to confirm continuous residency in New Jersey since December 31, 2009, and ownership and occupancy of the same New Jersey home since December 31, 2016, or earlier.

- Move to the section labeled "Determining Total Income" for both 2019 and 2020. Carefully enter all sources of income as instructed, making sure to add them up correctly and inputting the total in the space provided. If you did not have income in a category, leave it blank.

- Verify your total income for each year does not exceed the thresholds stated in the application. If it does, unfortunately, you are not eligible for the reimbursement.

- Under "Principal Residence (Main Home)," choose the correct status that applies to you and provide details such as block and lot numbers for your main home in 2020.

- Answer questions regarding shared ownership of the property and if the property consists of multiple units, provide the percentage of the property owned by you and used as your main home.

- For the Property Taxes section, enter the total 2020 and 2019 property taxes due and paid on your main home. Attach proof of the property taxes paid as instructed.

- Calculate and enter the Reimbursement Amount by subtracting the 2019 property taxes from the 2020 property taxes paid.

- Sign the application. If filing jointly, both you and your spouse/CU partner must sign. Include a daytime telephone number and/or email address for contact purposes.

- Review the entire application for accuracy and completeness. If you had a paid preparer complete the application for you, ensure they sign the form as well, providing their Federal Identification Number and firm’s details.

- Mail the completed application including all required attachments to the address provided on the form by November 1, 2021. Remember to keep a copy of the entire application for your records.

After submitting the application, it is important to patiently wait for processing. The New Jersey Division of Taxation will review your application to determine your eligibility for the Senior Freeze reimbursement. Should there be any discrepancies or if additional information is required, they may contact you. Ensure your contact information is up to date and correct to facilitate easy communication. Completing the PTR-1 form accurately is the first critical step towards potentially receiving your property tax reimbursement.

Learn More on Nj Ptr 1

What is the PTR-1 form?

The PTR-1 form is an application used in New Jersey for the Senior Freeze (Property Tax Reimbursement) program. It is designed for residents who are 65 years or older or receiving federal Social Security disability benefits to potentially receive reimbursement for property tax increases on their primary residence. This form requires applicants to provide detailed information regarding their income, property taxes paid, and residency status to determine eligibility for reimbursement.

Who is eligible to file the PTR-1 form?

To file the PTR-1 form, applicants must meet specific eligibility criteria, including:

- Age 65 or older or receiving federal Social Security disability benefits by December 31 of both 2019 and 2020.

- Continuous residency in New Jersey since December 31, 2009, or earlier as either a homeowner or a renter.

- Ownership and occupancy of the same New Jersey home since December 31, 2016, or earlier.

- Total income for 2019 must be $91,505 or less, and for 2020 must be $92,969 or less.

What documents are required to be submitted with the PTR-1 application?

When submitting the PTR-1 form, additional documents are necessary for the application to be processed. These include:

- Proof of age or disability for 2019 and 2020, such as a birth certificate, driver's license, or Social Security Award Letter.

- Proof of property taxes due and paid for 2019 and 2020.

How is income calculated for the PTR-1 application?

Income calculation for the PTR-1 application considers various sources, including Social Security benefits, pension and retirement benefits, salaries, wages, unemployment benefits, and more. Applicants must report the total amount of income received in both 2019 and 2020 from these sources. It is important to note that losses in one income category cannot be used to reduce total income. Additionally, income must be reported accurately, as exceeding the allowable limit disqualifies the application.

What happens if I file the PTR-1 form and I'm not eligible for reimbursement?

If it is determined that you are not eligible for reimbursement after submitting the PTR-1 form, your application will be denied, and you will not receive the Senior Freeze benefit. Reasons for ineligibility may include exceeding the income limits, not meeting the age or disability requirements, or not having continuous residency in New Jersey. It is crucial to carefully review eligibility criteria before applying to avoid any unnecessary denial.

Where and when should the PTR-1 form be submitted?

The completed PTR-1 form, along with all required documentation, should be mailed to the New Jersey Division of Taxation Revenue Processing Center, specifically to the Senior Freeze (PTR) section at PO Box 635, Trenton, NJ, 08646-0635. The application has a due date of November 1, 2021, and it is important to submit all paperwork by this deadline to ensure your application is considered for the Senior Freeze reimbursement for the year 2020.

Common mistakes

When applying for the Senior Freeze (Property Tax Reimbursement) with the NJ PTR-1 form, individuals often make mistakes that can delay processing or result in denial of the reimbursement. It's crucial to approach this form with precise attention to detail. Here are five common mistakes to avoid:

- Incorrect or Incomplete Social Security Numbers: Every applicant must enter their social security number accurately. This is a fundamental step, as it helps in identifying the applicant's tax records.

- Failure to Provide Proof of Age or Disability: Applicants must submit a copy of a birth certificate, driver's license, or church records for proof of age or a Social Security Award Letter for disability proof. Missing documents can lead to immediate disqualification.

- Errors in Marital/Civil Union Status: Accurately reporting the marital/civil union status for both the years in question (2019 and 2020) is essential. Incorrect information can impact eligibility and the amount of reimbursement.

- Miscalculating Income: Often, applicants mistakenly include income that should not be counted or incorrectly calculate their total income. All sources of income must be reported accurately according to the guidelines set forth in the instructions.

- Overlooking Residency and Ownership Requirements: The form requires continuous residency in New Jersey since December 31, 2009, and homeownership since December 31, 2016. Applicants sometimes misinterpret these sections or fail to realize their importance.

Understanding and avoiding these mistakes can lead to a smoother application process. It is advisable to review the form multiple times before submission and refer to the provided instructions to ensure all information is complete and accurate.

Documents used along the form

The NJ PTR-1 form, or the New Jersey Property Tax Reimbursement (Senior Freeze) Application, requires applicants to provide detailed personal, financial, and property information to apply for a reimbursement of property taxes. The process, while aimed at providing financial relief, can sometimes become complex, involving various other forms and documents to ensure the accuracy and eligibility of the application. Let's explore some of these additional forms and documents often used alongside the NJ PTR-1 form.

- Form SSA-1099: This form from the Social Security Administration reports the total amount of social security benefits received. It's crucial for determining the income reported on the NJ PTR-1 form.

- Form RRB-1099: Similar to the SSA-1099, this form is for beneficiaries of Railroad Retirement Board benefits and must be reported as part of the income on the NJ PTR-1.

- Property Tax Statements: These documents prove the amount of property taxes paid in the required tax years, essential for calculating the reimbursement amount.

- Proof of Age or Disability: Applicants can submit copies of birth certificates, driver's licenses, or Social Security Disability Award letters to satisfy age or disability requirements.

- Proof of Residency: Documents like utility bills or lease agreements may be required to prove continuous residency in New Jersey.

- Form 1040: U.S. Individual Income Tax Return forms may be necessary to verify income sources and amounts not covered by other specific documents.

- Marriage Certificate or Civil Union Documentation: These documents might be needed to establish marital or civil union status for the relevant tax years.

- Death Certificate: If applying on behalf of a deceased spouse, a copy of the death certificate may be required to process the application.

- Proof of Ownership: Homeowners might need to show deeds or titles proving ownership of the property for which the reimbursement is being sought.

- Power of Attorney: If someone is filing on behalf of the homeowner, legal documentation granting them the authority to do so might be necessary.

Fulfilling the eligibility requirements and assembling the needed documentation can be demanding. However, understanding each form and document's role can streamline the process, making it more manageable for applicants seeking the Senior Freeze reimbursement. Assistance from a professional or the NJ Division of Taxation can also provide guidance through the application process to ensure all requirements are met accurately.

Similar forms

The PTR-1 form for New Jersey’s Senior Freeze (Property Tax Reimbursement) shares similarities with the IRS Form 1040, the U.S. Individual Income Tax Return. Both forms require detailed income information from the applicant, including wages, Social Security benefits, pensions, and various other sources of income. Each form is used to determine eligibility for tax relief based on the detailed financial information provided, ensuring that benefits are extended to those meeting specific criteria. Where the PTR-1 form focuses on property tax reimbursement for seniors and disabled individuals, the Form 1040 serves a broader purpose of assessing annual income tax obligations.

Comparable to the PTR-1 form is the Homestead Benefit Application used in New Jersey as well. This document also collects comprehensive information regarding a homeowner's residency and property taxes, similar to the PTR-1's requirements for proving age, disability, continuous residency, and property tax payments. Both applications aim to provide tax relief, with the Homestead Benefit focusing on reducing the burden of property taxes for homeowners, while the PTR-1 targets senior citizens and disabled persons with reimbursements for increases in their property taxes.

The VA Form 21-526EZ, used for applying for disability compensation and related compensation benefits, shows a resemblance to the PTR-1 form in its requirement for applicants to provide evidence of a qualifying condition. For the PTR-1, applicants must submit proof of age or demonstrate receipt of federal Social Security disability benefits. Both forms serve to assist individuals in need, offering financial relief through different programs designed to aid those with disabilities or, in the case of the PTR-1, senior citizens confronted with significant property tax increases.

The HUD Section 8 Application, another document with a similar purpose, seeks to assist low-income families, the elderly, and the disabled in affording decent, safe, and sanitary housing. Like the PTR-1 form, applicants must provide detailed information about their household income, family composition, and residency. Both applications evaluate financial eligibility and are aimed at offering subsidies to alleviate expenses; however, the PTR-1 specifically focuses on property tax reimbursement for eligible New Jersey residents.

Dos and Don'ts

Filling out the NJ PTR-1 form, a crucial document for New Jersey residents seeking the Senior Freeze (Property Tax Reimbursement), requires attention to detail and accuracy. To assist in the process, here's a comprehensive list of essential dos and don’ts:

- Do ensure you meet the eligibility requirements before filling out the form. This includes age or disability status, residency, and income limitations.

- Do gather all necessary documentation before beginning, such as proof of age or disability, Social Security numbers for you and your spouse/CU partner, and records of income and property taxes paid.

- Do carefully read and follow all instructions provided with the form to ensure all sections are completed accurately.

- Do use black ink and fill in ovals completely if completing the form by hand.

- Do double-check your Social Security number and other personal information for accuracy to prevent any delays in processing.

- Do include documentation for proof of age or disability for both 2019 and 2020, as required by the application instructions.

- Do sign and date the form. If filing jointly, both you and your spouse/CU partner must sign.

- Don't use the preprinted label if any of the information is incorrect. Instead, clearly print or type your correct information.

- Don't neglect to verify your marital/civil union status as of December 31 for both 2019 and 2020, as it affects how you should file.

- Don't leave income fields blank if you had no income in a category; instead, ensure that every line is addressed appropriately.

- Don't try to reduce total income by reporting losses in one income category against another. Losses should not be used to alter the income figure.

- Don't forget to check the residency requirements section to confirm continuous residency in New Jersey since on or before December 31, 2009.

- Don't file this application if neither you nor your spouse/CU partner meets the age or disability requirements for both 2019 and 2020.

- Don't send in the application without first ensuring that all required documents and proofs are attached.

By following these guidelines, applicants can navigate the NJ PTR-1 form more confidently, helping ensure the process is as smooth and error-free as possible.

Misconceptions

Understanding the New Jersey Senior Freeze (Property Tax Reimbursement) Application, or the PTR-1 form, is crucial for residents who seek property tax relief. However, misconceptions about the form can lead to confusion or discourage eligible citizens from applying. Here are five common misconceptions clarified:

- Misconception 1: The PTR-1 Form is only for the elderly.

While it's true that the program is often referred to as the "Senior Freeze," eligibility is not limited to age alone. Individuals who are 65 or older qualify, but so do residents of any age who receive federal Social Security Disability benefits, as long as other conditions are met. Thus, the program benefits a broader group than just seniors.

- Misconception 2: You can't apply if you've recently moved within New Jersey.

This belief misunderstands the residency requirements. Applicants must have lived in New Jersey continuously since December 31, 2009, or earlier, but this does not mean they need to have lived in the same house for the entire time. However, to be eligible for reimbursement, you must have owned and lived in your current home since December 31, 2016, or earlier.

- Misconception 3: All sources of income disqualify you.

Many people believe that having any source of income will make them ineligible for the Senior Freeze program. In reality, the form requires detailed income information to ensure that applicants fall within the approved income brackets. As stated in the instructions, some types of income are indeed counted towards your total, but there are caps on how much income you can still have to qualify for the reimbursement.

- Misconception 4: If you're denied once, you can never apply again.

Eligibility can change from year to year based on income, residency, and other factors. If an individual’s application was denied one year due to surpassing income limits or other reasons, they'll have the opportunity to apply again in future years if their circumstances change.

- Misconception 5: The application process is too complex and not worth the effort.

While the application does require various information and documents, the potential financial benefits for eligible residents can be significant. Many resources are available to assist applicants, including instructions within the form itself, the Senior Freeze hotline, and local tax assistance programs. Efforts made in completing the application could result in substantial savings on property taxes.

Understanding the specific requirements and clarifying these misconceptions about the New Jersey PTR-1 form can help eligible residents take advantage of the Senior Freeze program, potentially offering significant relief on property taxes.

Key takeaways

Understanding how to properly fill out and use the New Jersey PTR-1 Form, which stands for the Senior Freeze (Property Tax Reimbursement) Application, can be crucial for many seniors in securing much-needed relief on their property taxes. Here are six key takeaways to keep in mind:

- Eligibility Importance: Applicants need to meet certain age or disability requirements for both the years 2019 and 2020 to be eligible. If neither the applicant nor their spouse or civil union partner meet these requirements, they should not file the application.

- Continuous Residency: To qualify for the reimbursement, the applicant must have lived in New Jersey continuously since December 31, 2009, or earlier, either as a homeowner or a renter.

- Ownership and Residency: Applicants must have owned and lived in the same New Jersey home since December 31, 2016, or earlier. This requirement ensures that only those with a longer-term stake in their properties benefit.

- Income Criteria: There are strict income criteria that must be met for both 2019 and 2020. Applicants should carefully calculate their total income according to the guidelines provided in the instructions to determine eligibility. Importantly, losses in one category of income cannot be used to reduce total income in another, and combined incomes for couples living together as of December 31 of each year must be considered.

- Proof of Property Taxes: It is necessary to submit proof of property taxes due and paid for 2019 and 2020 along with the application. This proof is essential in calculating the amount of reimbursement owed to the applicant.

- Application Accuracy and Honesty: Filling out the PTR-1 form accurately and honestly is critical. Applicants declare under penalties of perjury that all the information provided in the application, including schedules and statements, is true, correct, and complete to the best of their knowledge.

Ultimately, the Senior Freeze Program provides meaningful assistance to seniors by freezing the property taxes on their residences, making it easier for them to afford staying in their homes. Those who believe they qualify should pay close attention to the details and instructions provided in the PTR-1 form to ensure their application is completed correctly and submitted on time.

Popular PDF Documents

Nj Sales and Use Tax Quarterly Return - The worksheet guides filers through entering sales data, calculating tax, and reporting previous payments to arrive at the quarterly amount due.

Update Nj Business Registration - Businesses can reserve or register a name prior to submitting the filing, as advised in the form.

Proof of Service Nj - Details the responsibilities and powers vested in the Pro Vice once elected.