Fill Out a Valid Nj Raffle Report Template

In New Jersey, organizations holding raffles as a form of fundraising are meticulously regulated to ensure transparency and integrity in their gaming practices. Administered by the Office of Attorney General Division of Consumer Affairs and the Legalized Games of Chance Control Commission, the Raffle Report of Operations is an essential document that facilitates this oversight. Positioned at the intersection of accountability and regulatory compliance, this form mandates that licensees submit a comprehensive report detailing various aspects of their raffle activities, including the number of tickets sold, the price of tickets, gross receipts, and net proceeds, among other things. This submission must occur no later than the 15th day of the month following the conclusion of the raffle event, underscoring the timely nature of this regulatory requirement. Not only does the form serve as a declaration of the raffle's financial outcomes, but it also includes sections for the description and retail values of prizes offered or awarded, thereby ensuring a full disclosure of the raffle's execution. Significantly, the process embodies a commitment to integrity, with a section for certification by a designated officer of the organization, who attests to the truthfulness, accuracy, and completeness of the information provided, under the penalty of punishment for any willful falsifications. This procedural step is enhanced by the requirement for notarization, further cementing the seriousness with which these disclosures are treated. In an era where digital convenience is prized, the Commission accommodates electronic submissions for certain types of raffles, offering an e-mail option for filing, though with specific exceptions outlined to maintain stringent control over more complex raffle formats. As such, the Raffle Report of Operations not only exemplifies bureaucratic rigor but also reflects a balance between facilitating community fundraising efforts and upholding the public trust through meticulous regulatory practices.

Sample - Nj Raffle Report Form

New Jersey Office of Attorney General

Division of Consumer Affairs

Legalized Games of Chance Control Commission

124 Halsey Street, 6th Floor, P.O. Box 46000

Newark, New Jersey 07101

(973)

Instructions for Filing the Rafle Report of Operations

PURSUANT TO N.J.A.C.

Control Commission (“Commission”) no later than the 15th day of the calendar month immediately following the calendar month in which the licensed activity was held, operated or conducted.

You may download this report and complete ALL of the entries for each occasion(s) relating to the conduct of all rafles, except for instant rafle games and carnival games and wheels. Once completed, a member/oficer shall certify that he/she has reviewed the report and that the information provided is true, accurate and complete. This will require the person to state their name and title, and sign the document before a notary public.

Rafle Report of Operations for the conduct of

However, for your convenience, we offer the ability to ile reports electronically via

Upon completion, the member/oficer shall certify by placing a check in the box provided, that he/she has reviewed the report and that the information provided is true, accurate and complete. Subsequently, the person must state his/her name and title. Reports that are not properly certiied will be sent or

Rafle Report of Operations completed online must be

It is recommended that you maintain a copy of all reports as part of the organization’s records.

New Jersey Office of Attorney General

Division of Consumer Affairs

Legalized Games of Chance Control Commission

124 Halsey Street, 6th Floor, P.O. Box 46000

Newark, New Jersey 07101

(973)

Rafle Report of Operations

Please print clearly.Identiication number _____________________

Municipality ______________________________________ License number ____________________________

Name of licensee_____________________________________________________________________________

Organization

___________________________________________________________________________________________

Street addressCityStateZIP code

Location of games____________________________________________________________________________

This report, as required by N.J.S.A.

Chance Control Commission no later than the 15th day of the month following the conduct of the game(s) of chance.

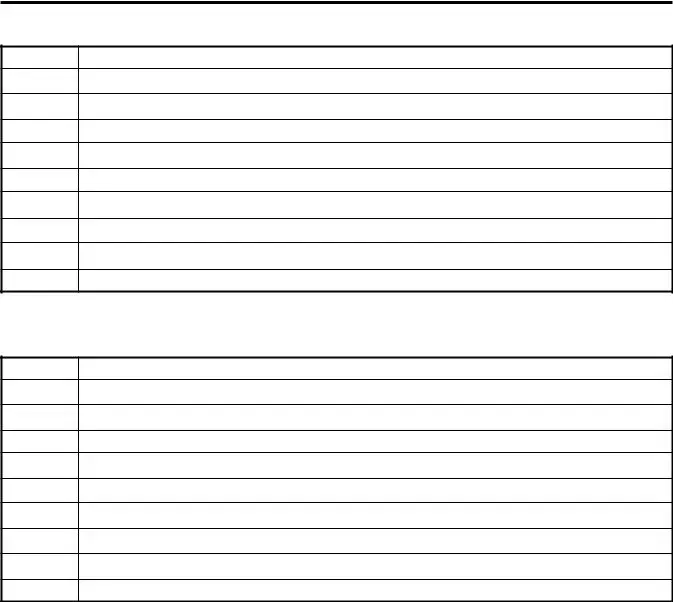

Occasion 1 |

Date ____________________Time _____________________ Type of rafle ______________ |

|||||||

1. |

Number of tickets sold |

___________ |

4. Cost of prizes |

$ __________ Type of prize(s) _____________ |

||||

2. Ticket price |

|

$ ___________ |

5. |

Supplies/Equipment cost |

$ __________ __________________________ |

|||

3. |

Gross receipts |

|

$ ___________ |

6. |

Other expenses |

$ __________ |

|

|

|

|

|

|

|

7. Total expenses |

$ __________ 8. Net proceeds |

$_________ |

|

|

|

|

||||||

Occasion 2 |

Date ____________________Time _____________________ Type of rafle ______________ |

|||||||

1. |

Number of tickets sold |

___________ |

4. |

Cost of prizes |

$ __________ Type of prize(s) _____________ |

|||

2. Ticket price |

|

$ ___________ |

5. |

Supplies/Equipment cost |

$ __________ __________________________ |

|||

3. |

Gross receipts |

|

$ ___________ |

6. |

Other expenses |

$ __________ |

|

|

|

|

|

|

|

7. Total expenses |

$ __________ 8. Net proceeds |

$_________ |

|

|

|

|

||||||

Occasion 3 |

Date ____________________Time _____________________ Type of rafle ______________ |

|||||||

1. |

Number of tickets sold |

___________ |

4. |

Cost of prizes |

$ __________ Type of prize(s) _____________ |

|||

2. Ticket price |

|

$ ___________ |

5. |

Supplies/Equipment cost |

$ __________ __________________________ |

|||

3. |

Gross receipts |

|

$ ___________ |

6. |

Other expenses |

$ __________ |

|

|

|

|

|

|

|

7. Total expenses |

$ __________ 8. Net proceeds |

$_________ |

|

|

|

|

||||||

Occasion 4 |

Date ____________________Time _____________________ Type of rafle ______________ |

|||||||

1. |

Number of tickets sold |

___________ |

4. |

Cost of prizes |

$ __________ Type of prize(s) _____________ |

|||

2. Ticket price |

|

$ ___________ |

5. |

Supplies/Equipment cost |

$ __________ __________________________ |

|||

3. |

Gross receipts |

|

$ ___________ |

6. |

Other expenses |

$ __________ |

|

|

|

|

|

|

|

7. Total expenses |

$ __________ 8. Net proceeds |

$_________ |

|

Occasion 5 |

Date ____________________Time _____________________ Type of rafle ______________ |

||||||

1. Number of tickets sold |

___________ |

4. |

Cost of prizes |

$ __________ Type of prize(s) _____________ |

|||

2. Ticket price |

|

$ ___________ |

5. |

Supplies/Equipment cost |

$ __________ __________________________ |

||

3. Gross receipts |

|

$ ___________ |

6. |

Other expenses |

$ __________ |

|

|

|

|

|

7. Total expenses |

$ __________ 8. Net proceeds |

$_________ |

||

|

|

||||||

Occasion 6 |

Date ____________________Time _____________________ Type of raffle ______________ |

||||||

1. Number of tickets sold |

___________ |

4. |

Cost of prizes |

$ __________ Type of prize(s) _____________ |

|||

2. Ticket price |

|

$ ___________ |

5. |

Supplies/Equipment cost |

$ __________ __________________________ |

||

3. Gross receipts |

|

$ ___________ |

6. |

Other expenses |

$ __________ |

|

|

|

|

|

7. Total expenses |

$ __________ 8. Net proceeds |

$_________ |

||

Total number of occasions |

.................................. |

_________ |

|

|

|||

Total number of tickets sold |

_________ |

|

|

||||

Price of tickets |

|

|

$ |

________ |

|

|

|

Total gross proceeds |

$ |

________ |

|

|

|||

Total expenses |

$ |

________ |

|

|

|||

Total net proceeds |

$ |

________ |

|

|

|||

Date

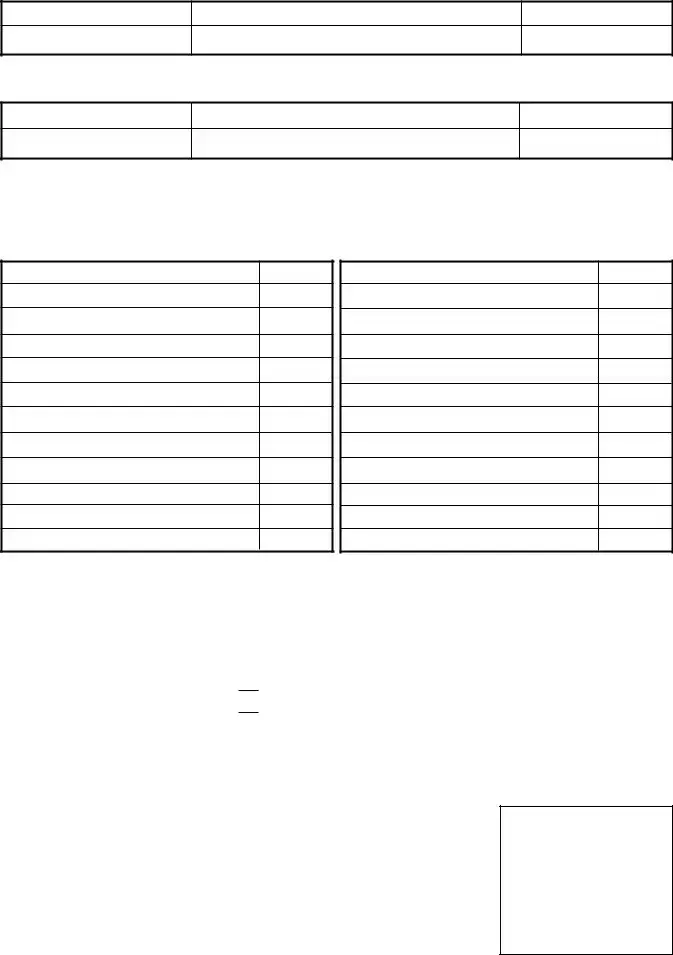

Schedule of Expenses

Description |

Check number |

AMOUNT |

|

|

|

Date

UTILIZATION OF NET PROCEEDS

Description |

Check number |

AMOUNT |

|

|

|

BANK

NAME

Address where balance is deposited

Account number

Person Responsible for Use of Proceeds

NAME

Address

Telephone number

(include area code)

I certify that all of the statements on this report of operations are true, accurate and complete. I am aware that if any of the foregoing statements are willfully false, I am subject to punishment.

Prizes Offered or Awarded

Please list the prizes offered or awarded and their respective retail values.

Prizes Offered or Awarded |

Retail Value |

Prizes Offered or Awarded |

Retail Value

N.J.S.A.

I certify that I have reviewed this report and that the information on this report of operations is true, accurate and complete. I am aware that if any of the foregoing statements are willfully false, I am subject to punishment.

I certify by placing a check in this

box, that I have reviewed the report and that the information provided is true, accurate and complete.

box, that I have reviewed the report and that the information provided is true, accurate and complete.

You must state your name and title below. Reports that are not properly certiied will be sent or

_______________________________________ |

__________________________________________ |

Name and title of oficer (please print) |

Signature of oficer |

Sworn and subscribed to before me this __________

day of ______________________ , ____________

MonthYear

__________________________________________

Name of Notary Public (please print)

__________________________________________

Signature of Notary Public

Afix Seal Here

Form LGCCC

Document Specifications

| Fact Name | Description |

|---|---|

| Submission Deadline | The Raffle Report of Operations must be filed with the New Jersey Legalized Games of Chance Control Commission no later than the 15th day of the month following the month in which the raffle was conducted. |

| Governing Law | The operation and reporting of raffles are governed by N.J.S.A. 5:8-37 and N.J.A.C. 13:47-9. |

| Electronic Filing | Electronic submission of the Raffle Report of Operations is available and encouraged, with the exception of off-premises 50/50 raffles involving additional fees. Reports for these specific raffles must be mailed. |

| Prerequisites for Filing | A Raffle Report of Operations for off-premises 50/50 or merchandise raffles must be accompanied by a printer's certificate and a sample ticket. |

| Certification Requirement | Upon completion of the Raffle Report of Operations, the report must be reviewed and certified by a member or officer of the organization, stating their name and title, and must be signed before a notary public. |

Detailed Steps for Using Nj Raffle Report

When filling out the New Jersey Raffle Report Form, it's essential for licensed organizations conducting raffles to ensure accuracy and compliance. This document not only helps in maintaining transparency but also fulfills a legal requirement set by the New Jersey Office of Attorney General, Division of Consumer Affairs, Legalized Games of Chance Control Commission. Timely submission of this form, along with accurate details, supports the integrity of gaming operations within New Jersey.

Here are the required steps to successfully complete the NJ Raffle Report form:

- Start by accessing the form, which can be downloaded from the commission's website or received in paper format.

- Enter the Identification number of the raffle event in the designated space.

- Fill out the Municipality where the raffle took place.

- Provide the License number that was issued for conducting the raffle.

- Write the Name of licensee, which is the name of the organization holding the raffle.

- Next, detail the Organization's address, including street, city, state, and ZIP code.

- Specify the Location of games—where the actual raffle event occurred.

- For each raffle occasion (up to six occasions can be listed), fill in the following details:

- Date and time the raffle was held.

- Type of raffle conducted.

- Number of tickets sold, ticket price, gross receipts, cost of prizes, supplies/equipment cost, other expenses, total expenses, and finally, the net proceeds.

- For the Schedule of Expenses and UTILIZATION OF NET PROCEEDS, list each entry with the description, check number, and amount. This section is crucial for documenting how funds were spent and how proceeds will be used.

- The Bank Name and address where the balance is deposited should be entered, along with the account number.

- The Person Responsible for Use of Proceeds section requires the name, address, and telephone number of the individual overseeing the raffle's earnings.

- In the Prizes Offered or Awarded section, list all prizes along with their respective retail values.

- The last step involves certification. The person completing the form must certify that the report's statements are true, accurate, and complete by placing a check in the box, stating their name and title, and signing before a notary public.

Remember to maintain a copy of this report and all relevant documents as part of your organization’s records. Misrepresentation or failure to submit this report on time can lead to penalties. The transparency and diligence you apply in completing this form play a critical role in ensuring fair and legal gaming practices within the state.

Learn More on Nj Raffle Report

What is the purpose of the NJ Raffle Report Form?

The NJ Raffle Report Form is a document designed to ensure that organizations conducting raffles in New Jersey report their raffle activities to the Legalized Games of Chance Control Commission. This requirement helps maintain transparency and integrity in the conduct of these games, ensuring they comply with New Jersey regulations. The report verifies the details of each raffle event, including the number of tickets sold, the cost and type of prizes, as well as gross receipts and net proceeds, among other financial details.

When is the NJ Raffle Report Form due?

Organizations must submit the NJ Raffle Report Form no later than the 15th day of the calendar month immediately following the month in which the raffle was held. Timely submission is mandatory to comply with N.J.A.C. 13:47-9.1, ensuring that the conduct of raffles is reported promptly and accurately for regulatory purposes.

Can the NJ Raffle Report Form be submitted electronically?

Yes, the NJ Raffle Report Form can be submitted electronically for added convenience, with the exception of off-premises 50/50 raffles that involve additional fees. To submit electronically, complete the form on your computer, certify it by checking the designated box, and email it to the provided address of the Commission. Remember, the form must be properly certified; otherwise, it will be returned to you.

What should be included with the Raffle Report if conducting an off-premises 50/50 or merchandise raffle?

For off-premises 50/50 or merchandise raffles, along with the completed NJ Raffle Report Form, organizations must include a printer’s certificate and a sample ticket. These additional documents provide further verification of the raffle and assure compliance with the specific requirements for these types of raffles.

What are the consequences of submitting false information on the NJ Raffle Report Form?

Submitting false information on the NJ Raffle Report Form is a serious offense. The form statements are considered to be made under oath, and if found to be willfully false, the individuals responsible are subject to punishment. It emphasizes the importance of accuracy, completeness, and honesty in reporting the operations of raffle activities to adhere to legal obligations and maintain the trustworthiness of charitable gaming activities.

Common mistakes

Filling out the New Jersey Raffle Report form requires careful attention to detail and a thorough understanding of the requirements. Mistakes can lead to delays or the rejection of the report. Here are four common mistakes people make when completing this form:

Not submitting the report on time: The form must be filed with the Legalized Games of Chance Control Commission no later than the 15th day of the month following the conduct of the raffle. Procrastination or misunderstanding of this deadline can result in late submissions.

Incomplete or inaccurate entries: Every entry on the form needs to be completed in full, providing true, accurate, and complete information. Leaving sections blank or entering incorrect information, whether inadvertently or deliberately, can cause the report to be sent back or, worse, lead to penalties.

Failure to certify the report properly: The report must be certified by a member or officer of the organization, stating their name and title, and then signed before a notary public. Sometimes, the certification process is overlooked or the certification box is not checked, leading to the report being rejected or returned.

Omitting required attachments: For certain types of raffles, such as off-premises 50/50 or merchandise raffles, additional documents like a printer’s certificate and a sample ticket must be attached. Failing to include these attachments can render the submission incomplete.

Addressing these common mistakes can streamline the filing process and help ensure that the Raffle Report of Operations is accepted by the Commission without issue. It's also recommended to maintain a copy of all reports as part of the organization's records for future reference and compliance verification.

Documents used along the form

When organizations in New Jersey hold raffles, they must adhere to certain regulations and submit specific forms, including the NJ Raffle Report Form. This form is crucial for maintaining transparency and ensuring compliance with local laws. Along with this pivotal document, there are several other forms and documents that are commonly used to ensure the smooth operation and legal compliance of raffle events. Understanding these additional documents can help organizations navigate the complexities of hosting legal games of chance.

- Application for Raffle License: Before holding a raffle, organizations must first apply for and obtain a raffle license. This application requires details about the organization, the type of raffle being conducted, dates and times of the event, and information on how the proceeds will be used. It's the first step in the regulatory process, ensuring that the raffle meets state and local guidelines.

- Amendment to Raffle License: If any details of the raffle change after the license has been issued—such as the date, time, or location of the event—an amendment form must be submitted. This form keeps the issuing authority up-to-date with the latest information, ensuring that all aspects of the raffle remain in compliance with regulations.

- Printer’s Certificate: For raffles that require tickets to be printed, a Printer’s Certificate must accompany the NJ Raffle Report Form. This document certifies that the tickets were printed in accordance with New Jersey's legal requirements, including proper numbering and record-keeping features that help prevent fraud and maintain integrity.

- Sample Ticket: Along with the Printer’s Certificate, a sample ticket for the raffle must also be submitted. This allows regulatory authorities to verify that the ticket meets all legal requirements, such as containing the license number, the name of the licensed organization, and the price of the ticket. It helps assure consumers and regulatory bodies alike that the game is fair and transparent.

Together, these documents form a comprehensive framework that governs the conduct of raffles in New York. By properly completing and submitting these forms, organizations can ensure their raffle events are enjoyable, fair, and within the bounds of the law. This attention to detail helps protect participants, organizers, and the integrity of the game itself.

Similar forms

The Bingo License Application is similar to the NJ Raffle Report form in several key aspects. Both documents are required by state regulatory agencies to authorize and report on gambling activities, ensuring that organizations comply with specific state laws and regulations. The information required—such as organization details, event specifics, and financial accounting—underscores the control and transparency both forms aim to establish in legalized gambling activities.

An Event Permit Application, often required for public gatherings or events within city or county jurisdictions, shares similarities with the NJ Raffle Report form, particularly in procedural aspects. Both forms necessitate detailed planning information, dates, and types of activities to be conducted. They are essential in obtaining official permission, whether for a raffle or a community event, and must be filed within specified timelines to ensure compliance with local regulations.

The Annual Charity Report Form, required by many states for non-profits to report their yearly activities, has parallels with the NJ Raffle Report form in terms of accountability and transparency. Both documents require detailed financial reporting and are mechanisms through which organizations must demonstrate the responsible handling and allocation of funds, ensuring they are used in accordance with their stated purposes and within legal boundaries.

The Sales Tax Exemption Application shares a commonality with the NJ Raffle Report form because both involve financial disclosures and compliance with state regulations. Organizations seeking sales tax exemptions or conducting raffles must accurately report financial transactions to substantiate their claims for exemption or lawful gambling activities. The purpose behind both documents is to ensure legal compliance and proper accounting practices.

The Liquor License Application, similar to the NJ Raffle Report form, requires detailed information about the event or establishment, including specifics about the activities being licensed. Both forms are regulatory in nature, ensuring that activities are conducted lawfully and within the parameters set by local and state authorities. Compliance with the law and safeguarding public interest are central to the intention behind both documents.

A Building Permit Application, while focused on construction and structural alterations, shares a procedural likeness with the NJ Raffle Report form in that it necessitates detailed planning, adherence to codes, and timely submission for regulatory approval. Both forms are integral to ensuring safety, legal compliance, and adherence to established standards, regardless of the activity or project at hand.

The Vendor Agreement Form, important for events involving multiple vendors or service providers, parallels the NJ Raffle Report form in its focus on detailed arrangements, financial transactions, and operational specifics. Both forms serve as official records of agreements and activities, ensuring clarity, compliance, and accountability in business or charitable endeavors.

Volunteer Waiver and Release Forms, commonly used by non-profits and event organizers, while primarily focused on liability and consent, share an underlying connection with the NJ Raffle Report form through their role in organized events. Both sets of documents necessitate a formal process to manage risk, ensure participant understanding, and uphold organizational responsibilities in accordance with law and policy.

The Financial Audit Report, required of businesses and organizations to review and analyze their financial statements, shares similarities with the NJ Raffle Report form in its emphasis on financial integrity and transparency. Both documents are tools for oversight, ensuring that financial activities are reported accurately and in compliance with regulatory and accounting standards.

Lastly, the Non-Profit Incorporation Form, necessary for establishing a non-profit organization, parallels the NJ Raffle Report form in terms of regulatory compliance and operational transparency. Both forms are foundational to the legal and responsible conduct of organizations, ensuring that activities—whether charitable, business, or gambling-related—are aligned with state laws and contribute positively to their stated missions.

Dos and Don'ts

Fulfilling your civic responsibilities requires attention to detail, especially when it involves reporting to government bodies such as the New Jersey Office of Attorney General Division of Consumer Affairs Legalized Games of Chance Control Commission. When preparing the NJ Raffle Report Form, a precise blend of thoroughness and vigilance ensures not only compliance but also shields your organization from potential legal pitfalls. Let's dive into the do's and don'ts that every licensee needs to bear in mind.

- Do ensure that the report is submitted timely. The form must reach the Commission no later than the 15th day of the month following the calendar month during which the raffle was conducted. Procrastination can lead to unnecessary complications and potentially legal consequences.

- Do complete the report in full. Every field of the form is designed to gather essential information. Leaving out details could be interpreted as noncompliance or negligence. Accuracy and completeness are your best defenses against scrutiny.

- Do have the form certified by a member or officer. This affirmation is not a mere formality; it is a declaration that the information provided is true, accurate, and complete. Such certification not only lends credibility to your submission but also is a legal requirement that holds weight.

- Do include the necessary attachments. For specific types of raffles, additional documentation such as a printer’s certificate and a sample ticket must accompany your report. These elements serve as further proof of your adherence to the rules governing legalized games of chance.

- Do opt for electronic submission when possible. The convenience of emailing your report can save time and resources. However, remember that off-premises 50/50 raffles involving additional fees are exempt from this option and require physical mailing.

- Don't overlook the need for a notary public. The form requires notarization, a step that underscores the legal seriousness of the document. A notary public acts as an impartial witness, helping to deter fraud and ensuring that the signers have willingly executed the document.

- Don't forget to maintain a copy for your records. Keeping a comprehensive archive of all submissions is not only a recommendation; it’s a cornerstone of good practice. This record-keeping facilitates future reference and substantiates your organization's operations should questions arise.

Guided by these principles, organizations can navigate the complexities of the NJ Raffle Report Form with confidence. The goal is not merely to meet a regulatory requirement but to affirm your organization's commitment to lawful and transparent operations. Remember, compliance is not a burden but a standard to uphold, reflecting the integrity of your organization and its endeavors.

Misconceptions

Many organizations and individuals in New Jersey participating in raffles hold misconceptions regarding the NJ Raffle Report Form requirements and regulations. It's crucial to address these misunderstandings to ensure compliance with the state's gaming laws and avoid potential legal issues.

Misconception: Electronic submission is available for all types of raffles. Fact: While the report for certain raffles can be filed electronically, off-premises 50/50 raffles involving additional fees must be submitted on paper to the Legalized Games of Chance Control Commission.

Misconception: The report doesn’t need to be certified by a notary if submitted electronically. Fact: Regardless of the submission method, a member/officer must certify the report, including a notary public's signature when submitting on paper. For electronic submissions, the certifying check box in the form acts as a digital certification, but it must still be reviewed for accuracy and completeness.

Misconception: Only the net proceeds need to be reported. Fact: The form requires detailed information including, but not limited to, the number of tickets sold, the cost of prizes, gross receipts, and total expenses, in addition to the net proceeds.

Misconception: Any organization can conduct a raffle whenever they choose. Fact: Only licensed organizations are permitted to hold raffles, and they must report each occasion separately on the NJ Raffle Report Form within the specified timeframe.

Misconception: The form is optional and only serves as a guideline for best practices. Fact: Submitting the Raffle Report of Operations is mandatory, not optional. It must be filed no later than the 15th day of the month following the conduct of the game(s) of chance. Failure to comply with these regulations may result in fines or revocation of the license to conduct raffles.

Understanding and correcting these misconceptions is essential for any organization planning to conduct a raffle in New Jersey. Following the correct procedures not only ensures compliance with state law but also contributes to the integrity and success of the charitable or non-profit event.

Key takeaways

Filing the New Jersey Raffle Report form is an essential process for organizations to comply with state regulations. Here are key takeaways to ensure accuracy and compliance:

- Timely Submission: Organizations must submit their Raffle Report to the Legalized Games of Chance Control Commission by the 15th day of the month following the month in which the raffle was held.

- Complete Information: It's crucial to fill out all entries on the form for each raffle occasion, excluding instant raffle games and carnival wheels and games.

- Verification: A designated member or officer of the organization must review the report for accuracy, state their name and title, and sign the document before a notary public. This ensures the information is true, accurate, and complete.

- Additional Documentation: For off-premises 50/50 or merchandise raffles, a printer’s certificate and a sample ticket must accompany the Raffle Report of Operations.

- Electronic Submission Option: The form allows for electronic submission, except for off-premises 50/50 raffles that involve additional fees. This convenience is encouraged for prompt and efficient filing.

- Maintaining Records: To facilitate proper record-keeping, organizations are advised to keep a copy of all submitted reports. This assists in eventual verification or audit processes.

- All Details Matter: Details such as the type of raffle, the number of tickets sold, ticket price, and costs associated with prizes and supplies, among others, are all required for a comprehensive report.

- Financial Accountability: The form requires a detailed breakdown of expenses and net proceeds, underscoring the importance of financial transparency in the conduct of raffles.

- Penalty for False Statements: Any willfully false statements made in the Raffle Report are subject to punishment, emphasizing the seriousness of accurate reporting.

By adhering to these guidelines, organizations can ensure that their raffle activities are conducted within the legal frameworks set by the New Jersey Office of the Attorney General and the Division of Consumer Affairs Legalized Games of Chance Control Commission.

Popular PDF Documents

Nj Petit Juror Questionnaire - Explicitly outlines the requirements for financial assurance mechanisms, ensuring preparedness for potential environmental cleanup situations.

Nj Annulment Forms Pdf - By requiring detailed expenditure lists, it helps in accurately assessing the needs of children within the family court system.

Nj Family Court Forms - It aligns with the broader legal ethos of ensuring that every step taken within the confines of the law respects transparency and accountability.