Fill Out a Valid Nj Reg C L Template

The State of New Jersey, through its Division of Revenue, facilitates various business and organizational regulatory functions, among which the processing of the REG-C-L form is integral for those entities seeking to amend their registration information. Designed to cater to the dynamic nature of businesses, this form allows for updates to critical aspects such as filing status, business activity, identification details like numbers, names, and addresses without incurring any fee. However, it is clearly articulated that changes pertaining to ownership transitions, incorporation, or significant structural alterations necessitate the completion of a different set of documents. Alongside, the REG-C-EA form serves a complementary role, especially for corporate entities, by providing a structured avenue to report amendments to their foundational documents through a fee-based process. Both forms outline detailed instructions on their use, emphasizing the importance of accuracy in reporting to ensure seamless adaptation to an entity's evolving operational landscape. Entities are reminded to adhere to the specific instructions regarding submission, including the respective addresses and the necessity of typing or printing submissions legibly, reflecting a systematic approach to maintaining up-to-date records in New Jersey’s business registry.

Sample - Nj Reg C L Form

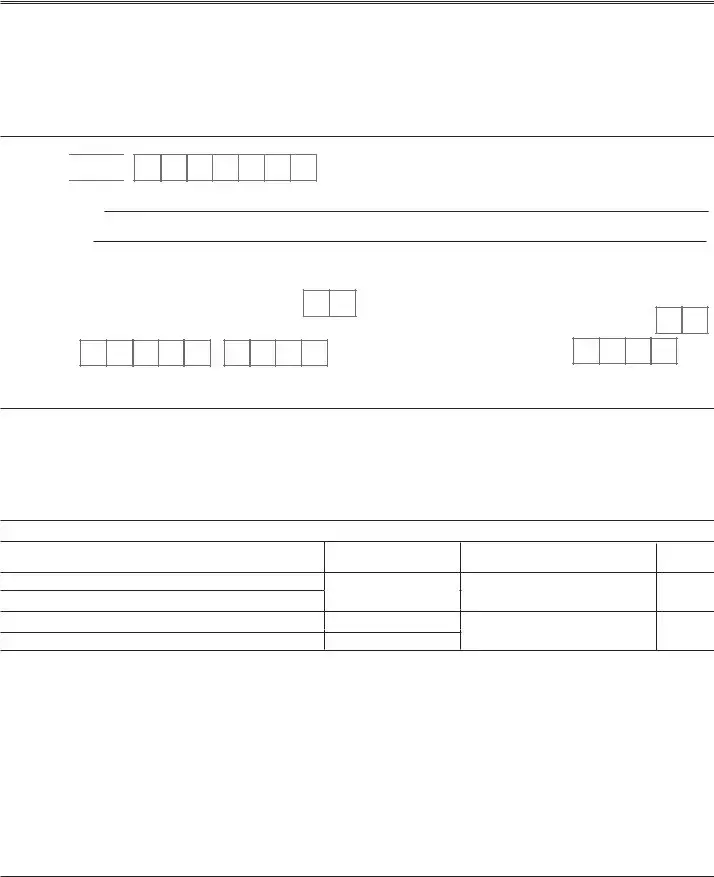

STATE OF NEW JERSEY - DIVISION OF REVENUE |

|

REQUEST FOR CHANGE OF REGISTRATION INFORMATION |

|

|

MAIL TO: PO BOX 252 TRENTON, NJ

NO FEE REQUIRED

Use this form to report any change in filing status, business activity, or to change your identification information such as identification number, business and/or trade name, business address, mailing address, etc. DO NOT use this form for a change in ownership or an incorporation of a busi- ness. A

A.CURRENT INFORMATION (must be completed to process this form) FEIN ____________________________________________

Name ______________________________________________________________________________________________________________

Address ____________________________________________________________________________________________________________

B.CHANGES TO IDENTIFICATION INFORMATION

FEIN

-

-

Business Name

Reason for change of FEIN ________________________________________

(Corporations authorized by the NJ State Treasurer must file a corporate name change amendment, pg. 39)

Trade Name

Business Location: (Do not use P. O. Box for location address) Street ___________________________________________________

City ____________________________________ State

Zip Code

-

Mailing Name and Address:

Name ____________________________________________________

Street ____________________________________________________

City ______________________________________ State

Zip Code |

|

|

|

|

|

- |

|

|

|

|

|

|

|

(Give |

(Give |

|

C.Contact Information: Contact Person: __________________________________________ Title: __________________________________

Daytime Phone: ( |

) __________ - _______________ |

D.IF SEASONAL, CIRCLE MONTHS BUSINESS WILL BE OPEN:

JAN FEB MAR |

APR MAY JUN |

JUL AUG SEPT |

OCT NOV DEC |

E.CHANGES IN OWNERSHIP OR CORPORATE OFFICERS

-Name (Last Name, First, MI)

-Indicate new or resigning officer/owner and effective date of change

-Social Security Number

-Title

- Home address (Street, City, State, Zip)

%

Ownership

F.CHANGES IN FILING STATUS AND BUSINESS ACTIVITY

Proprietorship/Partnership |

Date |

Corporate Entities |

|

Business Sold or Discontinued |

__________________________ |

Important: Corporate entities may not use this form to dis- |

|

|

|

solve, cancel, withdraw, merge, or consolidate. Forms and |

|

Business Incorporated |

__________________________ |

Instructions for these changes may be obtained online at |

|

www.state.nj.us/njbgs/ or by calling the Division of Revenue |

|||

|

|

||

Owner Deceased |

__________________________ |

at (609) |

|

|

Name and Address of New Owner or Survivor of Merger _____________________________________________________________________

Date Ceased Collecting Sales Tax |

_________________________ |

Date Ceased Renting Motor Vehicles ___________________ |

Date Ceased Paying Wages |

_________________________ |

Date Ceased Sale of New Tires/Motor Vehicles____________ |

List any new State tax for which this business may be eligible: Tax: ____________________________ Effective Date: ___________________

Signature_______________________________________________________ |

Date________________________________________ |

|

Title ___________________________________________________________ |

Telephone ( |

) ___________________________ |

- 37 - |

|

|

STATE OF NEW JERSEY |

Mail to: PO Box 308 |

|

DIVISION OF REVENUE |

Trenton, NJ 08646 |

|

|

BUSINESS ENTITY AMENDMENT FILING |

FEE REQUIRED |

|

|

|

|

|

|

Complete the following information and sign in the space provided. Please note that once filed, the information on this page is considered public. Refer to the instructions for delivery/return options, filing fees and

A.Business Name:_________________________________________________________________________________________________________

Business Entity NJ

B.Statutory Authority for Amendment: _______________________________________________ (See Instructions for List of Statutory Authorities)

C.ARTICLE __________________ OF THE CERTIFICATE of the above referenced business is amended to read as follows. (If more space is necessary, use attachment)

D.Other Provisions: (Optional)______________________________________________________________________________________________

E.Date Amendment was Adopted:____________________

F.CERTIFICATION OF CONSENT/VOTING: (If required by one of the following laws cited, certify consent/voting) N.J.S.A.

N.J.S.A

Amendment was adopted by the Directors and thereafter adopted by the shareholders.

Number of shares outstanding at the time the amendment was adopted __________________, and total number of shares entitled to vote thereon ______________. If applicable, list the designation and number of each class/series of shares entitled to vote:

List votes for and against amendment, and if applicable, show the vote by designation and number of each class/series of shares entitled to vote:

Number of Shares Voting for Amendment |

Number of Shares Voting Against Amendment |

**If the amendment provides for the exchange, reclassification, or cancellation of issued shares, attach a statement indicating the manner in which same shall be effected.

N.J.S.A.

The corporation has does not have members.

If the corporation has members, indicate the number entitled to vote _______, and how voting was accomplished:

At a meeting of the corporation. Indicate the number VOTING FOR _____ and VOTING AGAINST _____. If any class(es) of members may vote as a class, set forth the number of members in each class, the votes for and against by class, and the number present at the meeting:

Class |

Number of Members |

Voting for Amendment |

Voting Against Amendment |

Adoption was by unanimous written consent without a meeting.

If the corporation does not have members, indicate the total number of Trustees ___________________, and how voting was accomplished:

At a meeting of the corporation. The number of Trustees VOTING FOR ______________ and VOTING AGAINST ______________.

Adoption was by unanimous written consent without a meeting.

G.AGENT/OFFICE CHANGE

New Registered Agent: ___________________________________________________________________________________________________

Registered Office: ( Must be a NJ street address)

Street__________________________________________________________________ City _______________________ Zip ________________

H.SIGNATURE(S) FOR THE PUBLIC RECORD (See Instructions for Information on Signature Requirements)

Signature_________________________________________________Title ____________________________________________ Date _____________

Signature_________________________________________________Title ____________________________________________ Date _____________

The

- 39 -

INSTRUCTIONS

BUSINESS CHANGE AND AMENDMENT FORM

I.GENERAL INSTRUCTIONS

A. Use the appropriate form for filing:

1.Sole Proprietorships and Partnerships should use Form

2.Business Entities - i.e. Foreign or domestic corporations, limited partnerships, limited liability companies and limited liability partnerships, should use Form

NJ authorized corporations may not use the Business Change/Amendment Form to DISSOLVE, CANCEL, WITHDRAW, MERGE OR CONSOLIDATE. Contact the Division of Revenue at (609)

REMEMBER TO TYPE OR MACHINE PRINT ALL AMENDMENT FILING SUBMISSIONS.

B.For Delivery/Return Options for Amended Business Filings, please see page 21, items

C.Fee Schedule for Business Entity Amendment Filings

1.Basic Filing Fees

a.Filing fees for all corporate and limited partnership amendments is $75 per filing.

b.Filing fee for all limited liability company and limited liability partnership amendments is $100 per filing.

c.Filing fee for corporate and limited partnership agent changes is $25 per filing.

d.Filing fee for limited liability company and limited liability partnership agent changes is $25 per filing.

2.Service Fees and Other Optional Fees (All added to basic fees above if selected, see page 21 Items

a.Expedited service per filing request for corporations,

b.Same day service for FAX requests only, fee is $50.00 per filing.

c.Fax page transmission, fee is $1 per page for all filings that are FAXED back through the FAX filing service.

d.Certified copy fee for accepted filings is $25 per copy.

- 35 -

II.LINE BY LINE REQUIREMENTS FOR BUSINESS AMENDMENT FILING

A.Business Name and NJ

B.Statutory Authority for Amendment - In accordance with the following table, state the statutory authority for the amendment. Business entities seeking only to change registered office/agent may leave this blank.

|

|

Statutory Authority (NJSA |

|

|

Business Entity Type |

Amendment By: |

Title) to Enter in Field B |

|

|

Domestic Profit Corps. |

Incorporators |

|

|

|

Domestic |

|

|

||

Domestic Profit Corps. |

Shareholders |

|

||

Domestic |

Members or Trustees |

|

||

Foreign Profit Corps. |

The Business Entity |

|

||

Foreign |

|

|

||

All Limited Liability Companies |

The Business Entity |

42:2B |

|

|

All Limited Partnerships |

The Business Entity |

42:2A |

|

|

All Limited Liability Partnerships |

The Business Entity |

42 |

|

|

|

|

|

|

|

If you are changing the corporate name, provide a designator that indicates the type of business

The Division of Revenue will add an appropriate designator if none is provided.

**Remember that the name must be distinguishable from other names on the State’s data base. The Division of Revenue will check the proposed name for availability as part of the filing process. If desired, you can reserve/register a name prior to submitting your filing. To obtain information about reservation/registration services and fees, visit the Division's Web site at www.state.nj.us/njbgs/ or call (609)

F.Certification of Consent/Voting - If applicable, pursuant to the statutes listed, provide the requested information on consent/voting relative to the proposed amendment. MARK THE METHOD of consent or voting employed to adopt the amendment, and where applicable, provide the requested details associated with the chosen method.

G.Change of Agent/Office - If you are changing the registered agent or office or both, provide the following information as applicable:

1. New Registered Agent - Enter one agent only - the agent may be an individual or a corporation duly registered and in good standing with the State Treasurer; and/or

2. New Registered Office - Provide a New Jersey street address. A Post Office Box may be used only if the street address is listed as well.

H.Signatures for the Public Record - If a corporate amendment is being filed by the incorporators, then the incorporators and only the incorporators may sign. For all other corporate amendments, the Chairman of the Board, president or

- 36 -

Document Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | Used to report changes in filing status, business activity, or identification information (e.g., business name, address). |

| Exclusions | Not for use in reporting changes in ownership or business incorporation. |

| Applicable Entity Types | Applicable to sole proprietorships and partnerships for specific changes; other entity types for address or seasonal changes only. |

| No Fee Requirement | No fee is required for submitting this form. |

| Governing Law | Governed by New Jersey state law and managed by the Division of Revenue. |

| Form Submission | Must be mailed to the specified address in Trenton, NJ. |

Detailed Steps for Using Nj Reg C L

When it's time to update your business's registration details with the State of New Jersey, the REG-C-L form is the document you'll need to complete for reporting any changes such as your filing status, business activity, or your identification information like tax ID number, business name, address, and more. It's crucial to keep this data current to ensure compliance with state regulations and to facilitate smooth operations for your business. Carefully follow the step-by-step instructions provided here to fill out your form accurately and entirely.

- Start by clearly printing the current FEIN (Federal Employer Identification Number) of your business in the space provided under "A.CURRENT INFORMATION".

- Input the current legal name and address of the business as recorded with the state under the respective fields in section A.

- Proceed to section B, "CHANGES TO IDENTIFICATION INFORMATION," and enter the new FEIN if it has changed, and explain the reason for the FEIN change in the space provided. For corporations filing a corporate name change amendment, remember this section’s requirement and refer to page 39 for instructions.

- Write the new business name and/or trade name if this has changed from the original registration.

- Under the "Business Location:" section, list the new physical address of your business if this has changed. Remember, P.O. Boxes are not acceptable for location addresses.

- Next, update the mailing name and address in the provided fields if they are different from the business location or have changed.

- In section C, "Contact Information:", list the name of the contact person for the business, their title, a daytime phone number, and an email address. This information is essential for any communications that may be needed.

- If the business is operational on a seasonal basis, circle the months your business will be open in section D.

- For changes in ownership or corporate officers, complete section E with the details of the changes including names, social security numbers, titles, home addresses, percent ownership, and the effective dates of the changes.

- Section F is for changes in filing status and business activity. Specify the type of change such as the business being sold, incorporated, the owner's death, etc., and provide the date of these changes along with the name and address of new owners or survivors of a merger.

- Finally, sign and date the form at the bottom, providing your title and telephone number for any follow-up that may be required.

After filling out the REG-C-L form completely, mail it to the Division of Revenue at the address listed at the top of the form. This update will ensure that your business information remains accurate and up to date with the New Jersey Division of Revenue, helping to avoid any potential issues or complications with your business's registration status.

Learn More on Nj Reg C L

What is the purpose of the REG-C-L form in New Jersey?

The REG-C-L form is used by businesses in New Jersey to report any changes in their registration information. This could include updates to filing status, business activity, or identification information such as the Federal Employer Identification Number (FEIN), business or trade name, business address, and mailing address. It's important to note that this form is not for use in reporting a change in ownership or for the incorporation of a business. Such changes require completion of the NJ-REG form.

When should I not use the REG-C-L form?

The REG-C-L form is not suitable for all types of business changes. Specifically, it should not be used for changes in ownership or for the incorporation process of a business. Additionally, corporate entities are prohibited from using this form to dissolve, cancel, withdraw, merge, or consolidate their business. Different forms and procedures are available for these actions, which can be accessed by contacting the Division of Revenue or visiting the New Jersey Business Gateway Service website.

What information do I need to provide when completing the REG-C-L form?

Completing the REG-C-L form requires several pieces of information:

- Current business information including the FEIN, business name, and address.

- Details on the changes to identification information, which may include a new FEIN, business name, trade name, business location, and mailing address.

- Contact information for a representative of the business, with name, title, daytime phone number, and email address.

- If the business operates on a seasonal basis, the months during which the business will be open must be indicated.

- Information on any changes in ownership or corporate officers, including personal details and the effective date of the change.

- Updates to filing status and business activity, such as if the business was sold, discontinued, or incorporated.

How do I submit the REG-C-L form and is there a fee?

To submit the REG-C-L form, you must mail it to the Division of Revenue at the address provided on the form itself: PO Box 252, Trenton, NJ 08646-0252. No fee is required for the submission of this form, making it easily accessible for businesses needing to update their registration information without incurring additional costs.

Common mistakes

Filling out official documents can sometimes feel like navigating through a maze. Especially so with forms like the New Jersey Request for Change of Registration Information, or REG-C-L for short. It's easy to make small mistakes that can lead to big headaches down the line. Here are eight common pitfalls people encounter when completing this form:

- Not completing the A.CURRENT INFORMATION section in its entirety. This might seem straightforward, but missing any detail here can mean your form won’t be processed.

- Using a P.O. Box for the business location address. The form explicitly states to provide a street address for the business location. Overlooking this instruction is a common misstep.

- Failure to specify the reason for a change of FEIN in the Changes to Identification Information section. Simply entering a new number without explanation won’t suffice.

- Omitting the new state tax eligibility information. If your business may now be eligible for new state taxes, leaving this section blank can lead to issues come tax season.

- Incomplete contact information. Not providing a full daytime phone number or an email address can slow down the processing time, as the Division of Revenue might need to contact you for clarification.

- Forgetting to circle the months the business will be open if it’s seasonal. This detail is crucial for accurate registration and compliance.

- Not specifying new or resigning corporate officers or owners in the E. CHANGES IN OWNERSHIP OR CORPORATE OFFICERS section. This information is vital for maintaining current records.

- Overlooking the signature and date at the end of the form. An unsigned or undated form is invalid and will be returned.

It's also worth noting an often-misunderstood aspect of the REG-C-L form related to changes in business activity or ownership:

- The REG-C-L form cannot be used for significant alterations like a change in ownership structure or incorporation. Such changes require a different form altogether, the NJ-REG, which is something folks occasionally miss.

Understanding and avoiding these common errors can streamline the process, ensuring your business information is updated correctly and efficiently.

Documents used along the form

When dealing with the REG-C-L form for reporting changes in business registration in New Jersey, additional documentation is often needed to complete the process effectively. Below is a list of nine documents and forms that are frequently used alongside the REG-C-L form, each with a brief description to understand their purpose and relevance.

- NJ-REG: This form is necessary for businesses to initially register with the State of New Jersey for tax and employer purposes. It's often required if there's a change in ownership or the business structure.

- REG-C-EA: Used by business entities to file amendments to their registration, such as name changes, changes in business activity, or updates to the registered agent or office location.

- Form C-150G: Required for registering an alternate name for a business entity, ensuring the name is distinguishable and reserved for the business’s exclusive use in New Jersey.

- Certificate of Incorporation: Relevant for corporations, this document establishes the corporation’s existence in New Jersey and may need to be amended or referenced when filing changes.

- Articles of Organization: Required for Limited Liability Companies (LLCs) to outline the organization's structure and operations, which may need updates or reference in the process of changing business information.

- Partnership Agreement: Essential for partnerships, detailing the agreement between partners that may need to be updated or referenced when changes in business structure or operations occur.

- Limited Partnership Agreement: Similar to the partnership agreement, but specifically for limited partnerships, detailing the roles and contributions of both general and limited partners.

- Certificate of Formation: This foundational document is necessary for LLCs and Limited Partnerships, indicating the creation of the entity and possibly requiring updates with business changes.

- Annual Report: Required annually for most business entities to maintain good standing. Changes made with the REG-C-L might also necessitate updates in the annual report filings to ensure continuity and accuracy of the business’s public records.

Each document plays a crucial role in ensuring that business changes are documented accurately and in compliance with New Jersey state regulations. It's important for business owners and their representatives to understand the purpose and requirements of these forms and documents to maintain the legal and operational standing of their business in New State of Jersey.

Similar forms

The NJ REG-C-L form is closely related to the Business Entity Amendment Filing (REG-C-EA) document. Both the REG-C-L and REG-C-EA forms are essential for businesses in New Jersey to report changes in their registration information to the Division of Revenue. While the REG-C-L form is utilized for updates like changes in business activity, address, or identification information without fee requirements, the REG-C-Ea form is specifically for amendments that may alter the recorded articles or the name of the corporation, involving a filing fee. Essentially, both documents facilitate keeping business records current but serve slightly different administrative processes within the state’s regulatory framework.

Similar to the IRS Form 8822-B, which is used by businesses to notify the IRS of a change in address or the responsible party, the NJ REG-C-L form also allows entities to update their contact information. However, the IRS form is focused on federal tax obligations and reporting requirements, while the NJ REG-C-L targets state-level updates. Both forms ensure that governmental bodies have accurate and current information, preventing miscommunication and potential compliance issues.

The Secretary of State’s Office often requires a Statement of Change of Registered Agent form for businesses seeking to update their registered agent or office location. This is somewhat akin to section G of the REG-C-EA form, which addresses changes to an entity’s registered agent or office in New Jersey. Each form serves to ensure that there is a reliable method for the state to communicate with a registered entity, which is crucial for legal and regulatory compliance.

The Uniform Commercial Code (UCC) Financing Statement Amendment is another document related to REG-C-L in its purpose to amend previously filed information. While the UCC amendment pertains to the change in status or details of a secured transaction or party, the REG-C-L deals with a broader range of business information updates. Both documents play pivotal roles in the clear documentation and acknowledgment of changes that might affect legal rights or business operations.

Application for Amended Certificate of Authority is used by businesses when they need to update or change specific information with the state they are operating in, such as changes in the business name or address similar to what's reported in the REG-C-L. However, this application is specifically for entities that are registered to do business in a state other than their origin. It underscores the importance of keeping business information current across different jurisdictions.

The Business License Update forms that various states offer, much like the NJ REG-C-L form, aid businesses in updating their licensure details to reflect current operations, addresses, or owner information. Such updates are vital for maintaining the validity of a business license and ensuring compliance with local and state business regulations. Both sets of documents are key to preventing lapses in licensing that might otherwise disrupt business continuity.

The Change of Address form provided by most local tax authorities mirrors the intent of the NJ REG-C-L form by asking businesses to keep their official address on file current. This is crucial for receiving tax bills, compliance notices, and other official communications. While focused on the tax aspect, both forms highlight the necessity for governments to have accurate records for official correspondence.

Likewise, the Articles of Amendment for Corporations, similar to the REG-C-EA, allows a corporation to formally change its recorded information with the state, such as its corporate name, address, or the nature of the business. This careful update ensures that all business dealings and legal proceedings are conducted under the correct corporate identity and information, maintaining the entity’s legal standing and compliance profile.

Dos and Don'ts

When you're ready to update your business information using the New Jersey REG-C-L form, there are specific dos and don'ts to keep in mind to ensure the process goes smoothly. The form allows you to report any changes in your filing status, business activity, or identification information like your business name, address, and more. Here's a consolidated list to guide you through the process:

Things you should do:

Double-check that you've completed the section A. CURRENT INFORMATION fully and accurately to ensure your form can be processed without delays.

Use the correct form for your business type and the specific amendments you're aiming to report. Remember, if you're undergoing a change in ownership or incorporation, a NJ-REG must be filled out instead.

Sign and date the form before submission to validate your request. An unsigned form can lead to processing delays or outright rejection.

Ensure you've provided a non-P.O. Box street address for the business location as required by the form instructions.

Verify all the identification numbers, including your FEIN, to avoid any issues with your business's tax-related identity.

Consult the instruction page or the Division of Revenue's website for detailed filing guidelines or call them directly for assistance.

Things you shouldn't do:

Don't use the REG-C-L form for changes involving ownership transition or business incorporation. The correct form for these situations is the NJ-REG.

Avoid providing outdated or incorrect contact information. Ensuring accurate and current details helps prevent communication delays.

Don't forget to specify the reason for your FEIN change if it's applicable to your situation. This helps clarify the nature of your amendment request.

Avoid using a P.O. Box for your business location address. The form specifically requires a physical location to be provided.

Don't leave the signature section blank. The form must be signed to be considered complete and ready for processing.

Refrain from submitting the form without double-checking all entered information for accuracy. Mistakes can lead to processing delays or errors in your records.

Adhering to these guidelines will help ensure your REG-C-L form is filled out correctly and processed efficiently, allowing you to update your business's records with the state without unnecessary hassle.

Misconceptions

When addressing the complexities of the REG-C-L form for the State of New Jersey, several misconceptions can arise due to the detailed nature of its requirements and its purpose. Understanding these can help in navigating the process more efficiently.

It's only for reporting changes in business names or addresses: While the REG-C-L form is indeed used to report changes in business identification information such as names and addresses, it also covers a wider range of updates. These include changes in filing status, business activity, and contact information, among others.

A fee is required to process the form: Contrary to some assumptions, no fee is required when submitting the REG-C-L form. This detail is clearly stated at the top of the document, emphasizing the state's approach to facilitating administrative changes for businesses.

It can be used for changes in ownership or business incorporation: The REG-C-L form explicitly instructs against its use for reporting changes in ownership or the incorporation of a business. Instead, these types of changes require completing a different form, specifically the NJ-REG.

Any type of business can use it for any kind of amendment: There’s a limitation on who and what can be reported through the REG-C-L form. Specifically, corporations authorized by the NJ State Treasurer must file a corporate name change amendment separately, and it’s not intended for dissolving, canceling, withdrawing, merging, or consolidating corporate entities.

A post office box is acceptable for all sections of the form: The form stipulates that a P.O. Box cannot be used as a business location address, ensuring that an actual physical address is provided for record purposes.

It includes changes in corporate officers: While changes in corporate officers can be significant for a business, the REG-C-L form is not the correct document for reporting such changes. Detailed information on how to report these changes is provided elsewhere and may require additional forms.

Seasonal business details aren't important: On the contrary, if a business operates on a seasonal basis, indicating the months of operation is a critical component of the form, ensuring accurate and up-to-date records with the state.

Email addresses and other contact information aren't necessary: The inclusion of a contact person, including their title, daytime phone number, and email address, is required to process the form. This information is crucial for any follow-up or clarification that might be needed.

Submitting changes regarding tax collection is not possible with this form: The REG-C-L form allows businesses to report on a variety of changes, including cessation of certain tax collections such as sales tax, renting motor vehicles, and more, marking a comprehensive approach towards updating state records.

Navigating the specific requirements and allowances of the REG-C-L form ensures that your business remains compliant and up-to-date with the State of New Jersey's Division of Revenue. The clarity in understanding what the form is — and, just as importantly, what it isn't — for can significantly streamline the administrative process for businesses.

Key takeaways

Understanding the process of updating registration information with the New Jersey Division of Revenue is crucial for businesses to ensure compliance and accuracy in their records. Here are five key takeaways about completing and utilizing the NJ Reg C L form:

- Specific Use: The NJ Reg C L form is designated for reporting changes related to a business's filing status, business activity, or updates to identification information such as changes in the business name, address, or Federal Employer Identification Number (FEIN). It's important for entities to utilize this form accurately to reflect any modifications in their operational or identification data.

- Limitations: It is critical to note that this form is not applicable for reporting changes in business ownership or for the incorporation process. Instead, a NJ-REG form must be completed to report these significant alterations. This distinction ensures that businesses use the correct forms for various changes, streamlining the process for both the company and the state.

- Comprehensive Completion: The form requires detailed current information in Section A as a prerequisite for processing. The importance of this section cannot be overstated, as it provides the foundation upon which changes are reported. Inaccuracies or omissions in this part of the form may result in delays or issues in updating the business's records.

- Reporting Changes: Sections B through F of the form cover a wide range of modifications, from identification and contact information to changes in business activity and filing status. Businesses must review and complete these sections carefully to ensure that all relevant changes are reported comprehensively and accurately.

- No Fee Requirement: An essential aspect of this process is that no fee is required to submit the NJ Reg C L form. This policy facilitates timely and cost-effective updates to registration information, encouraging businesses to maintain current and accurate records without the barrier of additional costs.

In addition to these specific details about the NJ Reg C L form, businesses should be aware of the separate REG-C-EA form for amendments to recorded articles, such as name changes or modifications to the business entity's certificate. The attention to detail and adherence to the correct procedural requirements when completing these forms are vital to ensuring smooth transitions and updates to business registration information in New Jersey.

Popular PDF Documents

Who Must File Nj Inheritance Tax Return - Aids in understanding the interplay between federal and state tax obligations for estates subject to New Jersey law.

Nj Economic Development Authority - Details specific to the project such as NJEDA project number, owner/applicant company name, and the exact location are required to uniquely identify and register the project.

Nj Sales and Use Tax Quarterly Return - The form includes detailed instructions for calculating the correct amount of sales and use tax due for the filing quarter.