Fill Out a Valid Nj Report Template

In the intricate landscape of compliance and affirmative action, the NJ Report form, formally known as the PB-AAF.1, plays a pivotal role. Issued by the Department of the Treasury's Division of Purchase & Property, this form embodies a comprehensive affirmative action supplement designed for term contracts in response to advertised bid proposals. Central to its mandate, the form enforces adherence to N.J.S.A. 10:5-31 et seq. and N.J.A.C. 17:27, setting forth sweeping affirmative action requirements aimed at eliminating discrimination and fostering equal employment opportunities across various dimensions including age, race, creed, color, national origin, ancestry, marital status, affectional or sexual orientation, gender identity or expression, disability, nationality, and sex. Contractors engaged with the State of New Jersey are obliged to weave these stipulations into their employment practices, ensuring an inclusive workspace that thrives on diversity and equality. Among other responsibilities, the form necessitates contractors to declare their support towards these goals through various mediums such as recruitment, advertising, and union notifications, alongside setting forth obligations regarding compliance with the Americans with Disabilities Act and targeted employment goals. Furthermore, the procedural specifics surrounding the submission of the Employee Information Report Form AA302, which includes a non-refundable fee, underscores the rigorous framework established to monitor and enforce compliance, thereby embedding equitable practices into the fabric of contractual engagements with the state.

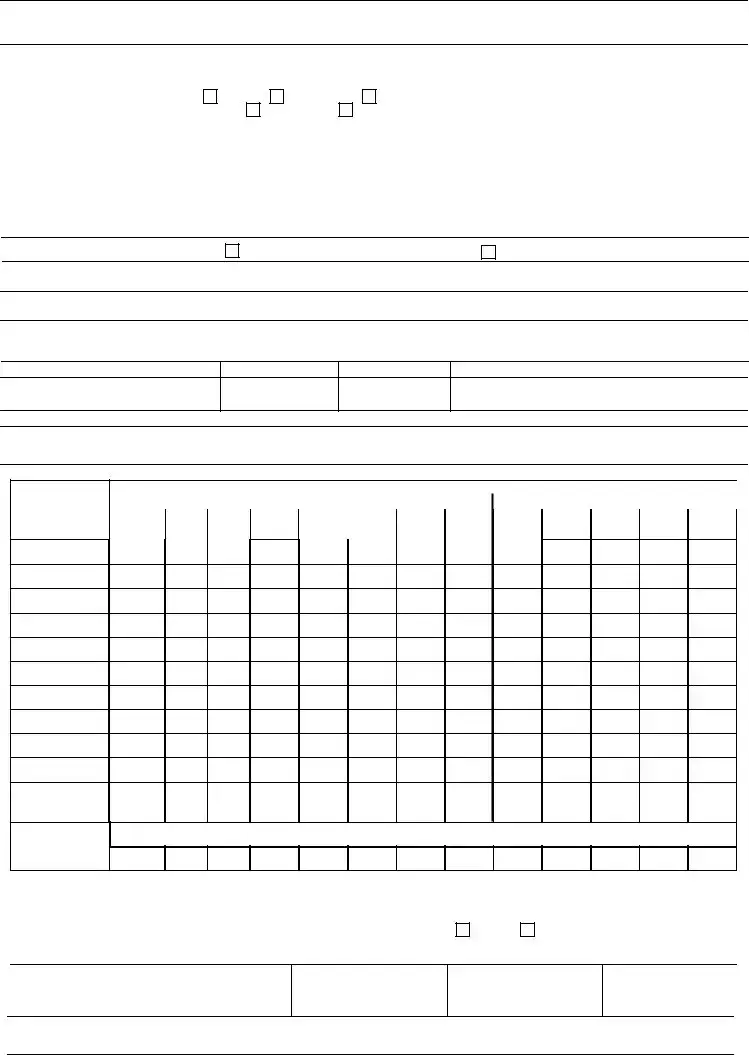

Sample - Nj Report Form

|

Affirmative Action Supplement |

|

||

|

|

|

|

|

AFFRIMATIVE ACTION |

|

Term Contract - Advertised Bid Proposal |

|

|

|

|

|

|

|

Department of the Treasury |

|

Bid Number: |

|

|

|

|

|

||

Division of Purchase & Property |

|

|

|

|

|

Bidder: |

|

||

State of New Jersey |

|

|

||

33 W. State St., 9th Floor |

|

|

|

|

PO Box 230 |

|

|

|

|

Trenton, New Jersey |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT A

MANDATORY EQUAL EMPLOYMENT OPPORTUNITY LANGUAGE

N.J.S.A.

N.J.A.C. 17:27

GOODS, PROFESSIONAL SERVICE AND GENERAL SERVICE CONTRACTS

During the performance of this contract, the contractor agrees as follows:

The contractor or subcontractor, where applicable, will not discriminate against any employee or applicant for employment because of age, race, creed, color, national origin, ancestry, marital status, affectional or sexual orientation, gender identity or expression, disability, nationality or sex. Except with respect to affectional or sexual orientation and gender identity or expression, the contractor will ensure that equal employment opportunity is afforded to such applicants in recruitment and employment, and that employees are treated during employment, without regard to their age, race, creed, color, national origin, ancestry, marital status, affectional or sexual orientation, gender identity or expression, disability, nationality or sex. Such equal employment opportunity shall include, but not be limited to the following: employment, upgrading, demotion, or transfer; recruitment or recruitment advertising; layoff or termination; rates of pay or other forms of compensation; and selection for training, including apprenticeship. The contractor agrees to post in conspicuous places, available to employees and applicants for employment, notices to be provided by the Public Agency Compliance Officer setting forth provisions of this nondiscrimination clause.

The contractor or subcontractor, where applicable will, in all solicitations or advertisements for employees placed by or on behalf of the contractor, state that all qualified applicants will receive consideration for employment without regard to age, race, creed, color, national origin, ancestry, marital status, affectional or sexual orientation, gender identity or expression, disability, nationality or sex.

The contractor or subcontractor, where applicable, will send to each labor union or representative or workers with which it has a collective bargaining agreement or other contract or understanding, a notice, to be provided by the agency contracting officer advising the labor union or workers' representative of the contractor's commitments under this act and shall post copies of the notice in conspicuous places available to employees and applicants for employment.

The contractor or subcontractor, where applicable, agrees to comply with any regulations promulgated by the Treasurer pursuant to N.J.S.A.

The contractor or subcontractor agrees to make good faith efforts to afford equal employment opportunities to minority and women workers consistent with Good faith efforts to meet targeted county employment goals established in accordance with N.J.A.C.

The contractor or subcontractor agrees to inform in writing its appropriate recruitment agencies including, but not limited to, employment agencies, placement bureaus, colleges, universities, labor unions, that it does not discriminate on the basis of age, creed, color, national origin, ancestry, marital status, affectional or sexual orientation, gender identity or expression, disability, nationality or sex, and that it will discontinue the use of any recruitment agency which engages in direct or indirect discriminatory practices.

The contractor or subcontractor agrees to revise any of its testing procedures, if necessary, to assure that all personnel testing conforms with the principles of

In conforming with the targeted employment goals, the contractor or subcontractor agrees to review all procedures relating to transfer, upgrading, downgrading and layoff to ensure that all such actions are taken without regard to age, creed, color, national origin, ancestry, marital status, affectional or sexual orientation, gender identity or expression, disability, nationality or sex, consistent with the statutes and court decisions of the State of New Jersey, and applicable Federal law and applicable Federal court decisions.

The contractor shall submit to the public agency, after notification of award but prior to execution of a goods and services contract, one of the following three documents:

Letter of Federal Affirmative Action Plan Approval

Certificate of Employee Information Report

Employee Information Report Form AA302

The contractor and its subcontractors shall furnish such reports or other documents to the Division of Public Contracts Equal Employment Opportunity Compliance as may be requested by the office from time to time in order to carry out the purposes of these regulations, and public agencies shall furnish such information as may be requested by the Division of Public Contracts Equal Employment Opportunity Compliance for conducting a compliance investigation pursuant to Subchapter 10

of the Administrative Code at N.J.A.C. 17:27.

*NO FIRM MAY BE ISSUED A PURCHASE ORDER OR CONTRACT WITH THE STATE UNLESS THEY COMPLY WITH THE AFFIRMATIVE ACTION REGULATIONS

PLEASE CHECK APPROPRIATE BOX (ONE ONLY)

I HAVE A CURRENT NEW JERSEY AFFIRMATIVE ACTION CERTIFICATE, (PLEASE ATTACH A COPY TO YOUR PROPOSAL).

I HAVE A VALID FEDERAL AFFIRMATIVE ACTION PLAN APPROVAL LETTER, (PLEASE ATTACH A COPY TO YOUR PROPOSAL). I HAVE COMPLETED THE ENCLOSED FORM AA302 AFFIRMATIVE ACTION EMPLOYEE INFORMATION REPORT.

INSTRUCTIONS FOR COMPLETING THE

EMPLOYEE INFORMATION REPORT (FORM AA302)

IMPORTANT: READ THE FOLLOWING INSTRUCTIONS CAREFULLY BEFORE COMPLETING THE FORM. PRINT OR TYPE ALL INFORMATION. FAILURE TO PROPERLY COMPLETE THE ENTIRE FORM AND TO SUBMIT THE REQUIRED $150.00

HAVE A CURRENT CERTIFICATE OF EMPLOYEE INFORMATION REPORT, DO NOT COMPLETE THIS FORM UNLESS YOUR ARE RENEWING A CERTIFICATE THAT IS DUE FOR EXPIRATION. DO NOT COMPLETE THIS FORM FOR CONSTRUCTION CONTRACT AWARDS.

ITEM 1 - Enter the Federal Identification Number assigned by |

ITEM 11 - Enter the appropriate figures on all lines and in all |

the Internal Revenue Service, or if a Federal Employer |

columns. THIS SHALL ONLY INCLUDE EMPLOYMENT DATA |

Identification Number has been applied for, or if your business FROM THE FACILITY THAT IS BEING AWARDED THE |

|

is such that you have not or will not receive a Federal |

CONTRACT. DO NOT list the same employee in more than one |

Employer Identification Number, enter the Social Security |

job category. DO NOT attach an |

Number of the owner or of one partner, in the case of a |

|

partnership. |

Racial/Ethnic Groups will be defined: |

|

Black: Not of Hispanic origin. Persons having origin in any of |

ITEM 2 - Check the box appropriate to your TYPE OF |

the Black racial groups of Africa. |

BUSINESS. If you are engaged in more than one type of |

Hispanic: Persons of Mexican, Puerto Rican, Cuban, or |

business check the predominate one. If you are a |

Central or South American or other Spanish culture or origin, |

manufacturer deriving more than 50% of your receipts from |

regardless of race. |

your own retail outlets, check "Retail". |

American Indian or Alaskan Native: Persons having origins |

|

in any of the original peoples of North America, and who |

ITEM 3 - Enter the total "number" of employees in the entire |

maintain cultural identification through tribal affiliation or |

company, including |

community recognition. |

include all facilities in the entire firm or corporation. |

Asian or Pacific Islander: Persons having origin in any of |

|

the original peoples of the Far East, Southeast Asia, the |

ITEM 4 - Enter the name by which the company is identified. |

Indian |

If there is more than one company name, enter the |

for example, China, Japan, Korea, the Phillippine Islands and |

predominate one. |

Samoa. |

|

|

ITEM 5 - Enter the physical location of the company. Include |

aforementioned Racial/Ethnic Groups. |

City, County, State and Zip Code. |

|

|

ITEM 12 - Check the appropriate box. If the race or ethnic |

ITEM 6 - Enter the name of any parent or affiliated company |

group information was not obtained by 1 or 2, specify by what |

including the City, County, State and Zip Code. If there is |

other means this was done in 3. |

none, so indicate by entering "None" or N/A. |

|

|

ITEM 13 - Enter the dates of the payroll period used to |

ITEM 7 - Check the box appropriate to your type of company |

prepare the employment data presented in Item 12. |

establishment. |

|

an employer whose business is conducted at only one physical |

ITEM 14 - If this is the first time an Employee Information |

location. |

Report has been submitted for this company, check block |

employer whose business is conducted at more than one |

"Yes". |

location. |

|

|

ITEM 15 - If the answer to Item 15 is "No", enter the date |

ITEM 8 - If |

when the last Employee Information Report was submitted by |

enter the number of establishments within the State of New |

this company. |

Jersey. |

|

|

ITEM 16 - Print or type the name of the person completing |

ITEM 9 - Enter the total number of employees at the |

the form. Include the signature, title and date. |

establishment being awarded the contract. |

|

|

ITEM 17 - Enter the physical location where the form is being |

ITEM 10 - Enter the name of the Public Agency awarding the |

completed. Include City, State, Zip Code and Phone Number. |

contract. Include City, County, State and Zip Code. This is |

|

not applicable if you are renewing a current Certificate. |

|

TYPE OR PRINT IN SHARP BALL POINT PEN

THE VENDOR IS TO COMPLETE THE EMPLOYEE INFORMATION REPORT FORM (AA302) AND RETAIN A COPY FOR THE VENDOR'S OWN FILES. THE VENDOR SHOULD ALSO SUBMIT A COPY TO THE PUBLIC AGENCY AWARDING THE CONTRACT IF THIS IS YOUR FIRST REPORT; AND FORWARD ONE COPY WITH A CHECK IN THE AMOUNT OF $150.00 PAYABLE TO THE TREASURER, STATE OF NEW JERSEY(FEE IS

NJ Department of the Treasury

Division of Public Contracts

Equal Employment Opportunity Compliance

|

P.O. Box 206 |

Trenton, New Jersey |

Telephone No. (609) |

State of New Jersey

Division of Public Contracts Equal Employment Opportunity Compliance

EMPLOYEE INFORMATION REPORT

IMPORTANT- READ INSTRUCTIONS ON BACK OF FORM CAREFULLY BEFORE COMPLETING FORM. TYPE OR PRINT IN SHARP BALLPOINT PEN. FAILURE TO PROPERLY COMPLETE THE ENTIRE FORM AND SUBMIT THE REQUIRED $150.00 FEE MAY DELAY ISSUANCE OF YOUR CERTIFICATE. DO NOT SUBMIT

SECTION A - COMPANY IDENTIFICATION

1. |

FID. NO. OR SOCIAL SECURITY |

2. TYPE OF BUSINESS |

|

|

3. TOTAL NO. OF EMPLOYEES IN THE ENTIRE COMPANY. |

|||

|

|

1. MFG |

2. SERVICE |

|

3. WHOLESALE |

|

|

|

|

|

|

4. RETAIL |

5. OTHER |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

COMPANY NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

STREET |

|

CITY |

|

COUNTY |

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

||

6. |

NAME OF PARENT OR AFFILIATED COMPANY (IF NONE, SO INDICATE) |

|

|

CITY |

STATE |

ZIP CODE |

||

7. CHECK ONE: IS THE COMPANY:

8.IF

9.TOTAL NUMBER OF EMPLOYEES AT ESTABLISHMENT WHICH HAS BEEN AWARDED THE CONTRACT

10. PUBLIC AGENCY AWARDING CONTRACT |

CITY |

COUNTY |

STATE |

ZIP CODE |

Official Use Only

DATE RECEIVED

INAUG DATE

ASSIGNED CERTIFICATION NUMBER

SECTION B - EMPLOYMENT DATA

11.Report all permanent, temporary and

|

|

|

|

|

PERMANENT |

|

|||||

|

All Employees |

|

|

|

|

|

|

|

|||

JOB |

***************** MALE ***************** |

**************** FEMALE **************** |

|||||||||

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

||

Categories |

Total |

COL. 2 |

COL. 3 |

|

|

Amer. |

|

|

Amer. |

|

|

|

|

|

|

|

|

||||||

|

(Cols. 2 & 3) |

MALE |

FEMALE |

Black |

Hispanic |

Indian |

Asian Non Min |

Black Hispanic Indian |

Asian Non Min |

||

|

|

|

|

|

|

|

|

|

|

|

|

Officials/Managers

Professionals

Technicians

Sales Workers

Office & Clerical

Craftworkers

(Skilled)

Operatives

Laborers

(Unskilled)

Service Workers

Total

Total employment

From previous

Report (if any)

Temporary & Part Time Employees

The data below shall NOT be included in the figures for the appropriate categories above.

12. |

HOW WAS INFORMATION AS TO RACE OR ETHNIC GROUP IN SECTION B OBTAINED? |

14. IS THIS THE FIRST |

15. IF NO, DATE LAST |

||

|

|

|

Employee Information |

REPORT SUBMITTED |

|

|

|

|

Report Submitted? |

||

|

|

|

|

||

|

|

|

|

|

|

13. |

DATES OF PAYROLL PERIOD USED |

|

|

|

|

|

FROM: |

TO: |

YES |

NO |

|

|

|

|

|

|

|

SECTION C - SIGNATURE AND INDENTIFICATION

16. NAME OF PERSON COMPLETING FORM (Print or Type)

SIGNATURE

TITLE

DATE

17. ADDRESS NO. & STREET |

CITY |

COUNTY |

STATE |

ZIP CODE |

PHONE, AREA CODE, NO. |

I certify that the information on this form is true an correct.

Document Specifications

| Fact Name | Description |

|---|---|

| Governing Laws | The form is governed by N.J.S.A. 10:5-31 et seq. (P.L. 1975, C. 127) and N.J.A.C. 17:27 under New Jersey law. |

| Objective | Its purpose is to ensure adherence to mandatory equal employment opportunity language in goods, professional service, and general service contracts. |

| Non-Discrimination Clause | Contractors agree not to discriminate against any employee or applicant based on various factors including age, race, creed, color, national origin, and more. |

| Compliance and Reporting | Contractors must submit one of three specific documents for compliance and may be required to furnish additional documents or reports to support equal employment opportunity compliance. |

Detailed Steps for Using Nj Report

Filling out the New Jersey Affirmative Action Employee Information Report (Form AA302) is an essential step in ensuring your compliance with the state's affirmative action regulations. This document is mandatory for companies that have been awarded contracts by the State of New Jersey and serves as a promise to abide by non-discriminatory employment practices. It's important to approach this document with attention to detail, ensuring that all parts are completed accurately. Here’s a simple guide on how to fill it out correctly.

- Company Identification Section:

- Enter the Federal Identification Number (FID) or Social Security Number in the first box depending on your business's registration.

- Check the box that best describes the type of your business.

- Write the total number of employees across the entire company, including all locations.

- Provide the official company name.

- Include the complete street address, city, county, state, and ZIP code of the company.

- If applicable, list any parent or affiliated company and provide their address.

- Indicate whether your company is a single-establishment or multi-establishment employer.

- If you are a multi-establishment employer, state the number of establishments in New Jersey.

- Specify the number of employees at the establishment being awarded the contract.

- Enter the details of the public agency awarding the contract, including their city, county, state, and ZIP code.

- Employment Data Section (Section B):

- Report the employment data for all permanent, temporary, and part-time employees. Ensure that you fill in the total number of employees, the breakdown by gender, and then further by race/ethnicity across the different job categories provided.

- Answer how the race or ethnic group information was obtained.

- Fill in the dates of the payroll period that was used to prepare this data.

- Signature and Identification (Section C):

- Print or type the name of the person completing the form, sign it, and provide your title and the date.

- Include the address where the form was filled out, along with your phone number.

Upon completing the form, ensure to check it for errors. Along with the completed form, remember to include a check for $150.00, payable to the Treasurer, State of New Jersey. This fee is non-refundable. You should make a copy for your records and then mail the original form and the check to the NJ Department of the Treasury, Division of Public Contracts Equal Employment Opportunity Compliance. Completing this form accurately and in its entirety is crucial for remaining in compliance and upholding the principles of affirmative action and equal employment opportunity.

Learn More on Nj Report

What is the purpose of the NJ Report form?

The NJ Report form, specifically the Affirmative Action Employee Information Report (Form AA302), is an essential document designed to ensure compliance with affirmative action regulations in New Jersey. It requires businesses engaging in public contracts to submit detailed employment data, reflecting their commitment to providing equal employment opportunities. The form serves as a tool for the New Jersey Department of the Treasury and the Division of Public Contracts Equal Employment Opportunity Compliance to monitor and enforce non-discrimination and affirmative action policies within the state, particularly focusing on preventing discrimination based on age, race, creed, color, national origin, ancestry, marital status, affectional or sexual orientation, gender identity or expression, disability, nationality or sex.

Who is required to complete the NJ Report form?

The requirement to complete the NJ Report form applies to contractors and subcontractors who have been awarded public contracts or are engaging in public bids with the State of New Jersey. Specifically, this includes businesses involved in goods, professional services, and general service contracts with any state agency, who must affirm their compliance with affirmative action regulations by submitting this form as part of their contract fulfilment process.

What information must be included on the NJ Report form?

Completing the NJ Report form, businesses must provide thorough details concerning their employment practices and demographics. This includes:

- The total number of employees within the company, including both full-time and part-time workers, and breaking these numbers down by job category.

- A breakdown of employee demographics, including race, ethnicity, and gender, across various job categories.

- Information about the company's affirmative action policies and practices, such as recruitment strategies and any measures taken to ensure equal employment opportunities.

Is there a fee associated with the submission of the NJ Report form?

Yes, submitting the NJ Report form incurs a non-refundable fee of $150.00. This fee must be paid through a check made payable to the Treasurer, State of New Jersey, and submitted alongside the completed form. The fee covers administrative costs associated with the review and processing of the Report.

What are the consequences of non-compliance with the NJ Report form requirements?

Failure to submit the NJ Report form or non-compliance with its requirements can have significant consequences for businesses. These may include delays in the execution of a goods and services contract with the state, potential investigations by the Division of Public Contracts Equal Employment Opportunity Compliance, and, in severe cases, revocation of contracts or disqualification from future state contracts. Businesses found in violation may also be subject to penalties under New Jersey's affirmative action regulations.

How can a business obtain or submit the NJ Report form?

To obtain the NJ Report form, businesses can download it directly from the New Jersey Department of the Treasury’s website or the Division of Public Contracts Equal Employment Opportunity Compliance website. Once completed, the form, along with the required $150.00 fee and any supporting documents, should be submitted to the address specified on the form itself. Businesses should also retain a copy of the submitted form and all related documentation for their records.

Common mistakes

When filling out the NJ Report form, particularly the Affirmative Action Employee Information Report Form AA302, errors can occur that may lead to delays or inaccuracies in processing. To ensure accurate and timely submission, here are six common mistakes to avoid:

Incorrect or Incomplete Identification Information: Failing to provide the correct Federal Identification Number or, if applicable, the Social Security Number of the owner in Item 1 can lead to significant processing delays. Ensuring accurate business identification is crucial for the form's acceptance.

Selection of Incorrect Type of Business: In Item 2, it's essential to check the box that correctly describes your type of business. Mislabeling your business type can affect the relevance and processing of your report.

Inaccurate Total Employee Count: Item 3 asks for the total number of employees in the entire company, including part-time employees. Underestimating or overestimating this figure can lead to an inaccurate representation of your workforce.

Omitting Physical Location Details: For Item 5, failing to include comprehensive physical location details of the company can cause confusion and delays. This information is vital for state records and correspondence.

Improper Employee Data Reporting: In Section B, Item 11, not accurately categorizing employees according to the specified racial/ethnic groups and job categories, or failing to distinguish between permanent, temporary, and part-time roles can misrepresent the company's employment practices. Accuracy in this section is critical for demonstrating compliance with affirmative action requirements.

Insufficient Detail on Method of Data Collection: Item 12 requires clarification on how information regarding the race or ethnic group was obtained. Not specifying or using an undefined method can raise questions about the reliability and validity of the data reported.

Adhering to the detailed instructions and double-checking responses can mitigate these common errors. Ensuring the submission of a correctly completed and accurate form facilitates compliance with New Jersey's affirmative action regulations and supports the promotion of equal employment opportunities.

Documents used along the form

When working with the New Jersey Report form, especially in the realm of Affirmative Action and Equal Employment Opportunity compliance, there are a handful of other documents and forms that frequently play a role alongside it. Understanding these documents is crucial for navigating compliance and ensuring that your organization meets all necessary legal requirements efficiently and effectively.

- Certificate of Employee Information Report: This certificate is issued by the New Jersey Department of Treasury, Division of Public Contracts Equal Employment Opportunity Compliance, and verifies that a business has submitted its Employee Information Report (AA302), contributing towards compliance with affirmative action regulations.

- Public Works Contractor Registration Certificate: For contractors engaging in public works projects, this certificate ensures they are registered to perform public work and have met the required compliance standards, including wage and hour law and public safety regulations.

- Business Registration Certificate: Required for any business seeking to conduct transactions with the public sector in New Jersey, this certificate verifies the company is registered with the State for tax purposes and complies with other regulatory requirements.

- Division of Revenue and Enterprise Services (DORES) Public Records Filing: For newly formed businesses, this filing is essential for incorporation or formation in the State of New Jersey, vital for establishing a legal entity for compliance and contractual purposes.

- New Jersey Tax Clearance Certificate: Often required in the procurement process, it serves as proof that a business is in good standing with respect to New Jersey state taxes, a necessity for contract award considerations.

- Proof of Insurance: Businesses must often submit proof of various types of insurance, including workers' compensation, general liability, and professional liability insurance, as part of their compliance and risk management strategies when undertaking contracts.

Awareness and understanding of these documents, in conjunction with the New Jersey Report form, are part of laying the groundwork for successful contract execution with the State of New Jersey. Ensuring these requirements are met not only facilitates compliance but also enhances the integrity and quality of contracts undertaken by businesses and contractors alike.

Similar forms

The New Jersey Affirmative Action Plan Approval Letter is closely akin to the NJ Report form, primarily because both documents are integral to ensuring compliance with affirmative action regulations. Like the NJ Report form, the Affirmative Action Plan Approval Letter serves as evidence that a business adheres to state-imposed requirements aimed at promoting equal employment opportunities. Both demand that enterprises not discriminate against job applicants or employees based on race, gender, or other protected characteristics, demonstrating a shared objective to foster an inclusive and diverse work environment.

Another document resembling the NJ Report form is the Certificate of Employee Information Report. This certificate functions as a confirmation that a business has duly submitted its employee composition data, which gets analyzed for compliance with affirmative action and equal employment mandates. Much like the NJ Report form's purpose, the certificate is a testament to the company's commitment to maintaining non-discriminatory employment practices, and both documents are prerequisites for securing state contracts.

The Employee Information Report Form AA302 shares similarities with the NJ Report form, as both are instruments for collecting detailed employment data, segmented by job category and employee demographics. This similarity underscores their role in assessing a company's adherence to fair employment laws. Crucially, the AA302 form is directly mentioned within the NJ Report form, highlighting their interconnected use in certifying contractors’ compliance with New Jersey's affirmative action laws.

The Affirmative Action Supplement, frequently accompanying proposals for state contracts, parallels the NJ Report form in its objective. It mandates contractors to declare their affirmative action policies outright, ensuring an active stance against discrimination in their hiring practices. This supplement reinforces the principles echoed in the NJ Report form, emphasizing a proactive approach to equal employment opportunity throughout the duration of state-contracted work.

Finally, the Federal Affirmative Action Plan mirrors the NJ Report form in its overarching goal to promote workplace diversity and prevent employment discrimination. While the federal plan encompasses requirements on a national scale, including businesses operating across state lines, both documents serve as critical tools in enforcing affirmative action policies. The NJ Report form, along with the Federal Affirmative Action Plan, works to establish standards for equal employment opportunity, ensuring that businesses remain vigilant and committed to these important social objectives.

Dos and Don'ts

When you're filling out the NJ Report form, especially concerning the Affirmative Action Supplement and the Employee Information Report (Form AA302), there are several best practices and common pitfalls to be aware of. This guidance ensures that your submission is not only compliant with New Jersey's regulations but also reflects your commitment to equal employment opportunities. Below are ten do’s and don’ts to consider:

Do:- Read all instructions carefully before starting to fill out the form to ensure you understand the requirements.

- Use a sharp ballpoint pen or print clearly if completing the form by hand to ensure all information is legible.

- Fill out every section of the form, including all requested employment data, to comply fully with state requirements.

- Check the appropriate boxes, especially when indicating the type of business, to ensure accurate categorization.

- Include the $150.00 non-refundable fee with your submission, as failure to do so may delay the processing of your certificate.

- Verify the accuracy of your Federal Identification Number (FID) or Social Security number to avoid processing delays.

- Update all employment data accurately, including the breakdown of permanent, temporary, and part-time employees.

- Sign and date the form, affirming that all provided information is true and correct.

- Retain a copy of the completed form for your records, as this is crucial for future reference and verification.

- Submit the form and any attachments to the correct address provided by the NJ Department of the Treasury to ensure timely processing.

- Omit the social security number or Federal Identification Number, as this is essential for processing your form.

- Fill out the form if you have a current certificate and are not nearing expiration, to avoid unnecessary duplication.

- Use the form for construction contract awards, as specified instructions indicate it’s not applicable.

- Attach an EEO-1 Report in place of completing Section B, Item 11, as this will not meet the form's requirements.

- Record the same employee in more than one job category, to prevent data inaccuracies.

- Exclude any employment data or leave any sections blank, as complete information is necessary for compliance.

- Forget to include the non-refundable fee, which is essential for the submission process.

- Misstate the type of business, which could lead to incorrect categorization and potential compliance issues.

- Submit outdated or incorrect employment data, as accurate and current information reflects compliance with affirmative action requirements.

- Ignore the mailing instructions, including the correct address and necessary attachments, to avoid delays or submission errors.

Adhering to these guidelines will help ensure that your submission is processed efficiently and reflects your organization's commitment to equal employment opportunities.

Misconceptions

Understanding the complexities of the New Jersey Affirmative Action Supplement (PB-AAF.1 R5/26/09) for state contracts can be challenging. Several misconceptions surround its requirements, and clarifying these can aid businesses in ensuring compliance. Here are nine common misconceptions explained:

All New Jersey businesses must complete the NJ Affirmative Action Employee Information Report (Form AA302). In reality, only businesses entering into a term contract for Goods, Professional Service, and General Service Contracts with the State of New Jersey are required to either show an existing valid affirmative action certificate, provide a federal affirmative action plan approval, or submit the completed Form AA302 alongside the specified fee.

Completion of the NJ Report form guarantees immediate contract approval. Completing the NJ Report form is a crucial step, but it represents part of the broader compliance process with New Jersey's mandatory equal employment opportunity language. Approval also depends on meeting all other specified contract requirements and conditions.

The form applies to construction contracts. The instructions explicitly state that this particular affirmation action supplement is not to be completed for construction contract awards, indicating that different procedures may apply to those kinds of contracts.

Any employee can be listed in multiple job categories. Employees must be listed in only one job category, based on their primary duties, to ensure accurate reporting of the employer’s workforce composition.

The $150.00 fee is refundable if the contract is not awarded. The fee paid along with the Form AA302 submission is non-refundable, regardless of the contract being awarded or not.

A current Certificate of Employee Information Report exempts a company from affirmative action regulations. While having a current certificate is part of demonstrating compliance, companies must also adhere to non-discrimination and equal employment opportunity practices throughout the contract duration.

The NJ Report form is an internal document that doesn't need to be shared. A copy of the completed form, along with the verification fee, should be sent to the NJ Department of the Treasury, Division of Public Contracts Equal Employment Opportunity Compliance. Additionally, a copy should be attached to the proposal being submitted to the public agency awarding the contract.

Submission of an EEO-1 Report can substitute for the NJ Report form. The instructions specifically instruct not to attach an EEO-1 Report in lieu of completing the designated sections of the form. The NJ Report form is designed to capture data pertinent to New Jersey’s regulations.

Temporary and part-time employees do not need to be reported. The form requires employers to report all employees, including permanent, temporary, and part-time workers, to accurately reflect the full scope of the workforce engaged under the contract.

Businesses intending to contract with the State of New Jersey must carefully review and understand these requirements to ensure full compliance with the state's affirmative action policies. This not only facilitates smoother contract processing but also supports the broader goals of promoting equal employment opportunities.

Key takeaways

When filling out and using the NJ Report form, individuals and businesses should pay special attention to several critical areas to ensure compliance with New Jersey's laws and regulations regarding affirmative action and employment practices. Below are key takeyaways to consider:

- Understanding the commitment to non-discrimination is crucial. The form outlines that during the performance of a contract, contractors or subcontractors must not discriminate against any employee or applicant based on age, race, creed, color, national origin, ancestry, marital status, affectional or sexual orientation, gender identity or expression, disability, nationality, or sex. This extends to various aspects of employment, including recruitment, termination, compensation, and training.

- Posting and communication requirements are mandated. Contractors are required to post notices in conspicuous places accessible to employees and applicants for employment. These notices, provided by the Public Agency Compliance Officer, detail the nondiscrimination clause. Moreover, contractors must inform recruitment agencies, labor unions, and others of their non-discrimination practices.

- Submission of an Employee Information Report or proof of an existing affirmative action plan is necessary for contract execution. Before executing a goods and services contract, a contractor must submit one of the following: a Letter of Federal Affirmative Action Plan Approval, a Certificate of Employee Information Report, or the Employee Information Report Form AA302 accompanied by a non-refundable fee of $150.00. This step is critical for demonstrating compliance with affirmative action regulations.

- Accuracy and detail in completing the Employee Information Report (Form AA302) are imperative. The form requires detailed information about company identification, employment data, and the racial/ethnic breakdown of employees. Failure to provide accurate and complete information, along with the required fee, may delay the issuance of a certification, impacting contract eligibility.

Adhering to these guidelines not only helps ensure compliance with New Jersey's affirmative action regulations but also promotes fair and equitable employment practices within your organization.

Popular PDF Documents

Abandoned Property Nj - Failing to provide a signature and adhering to the legal assertions results in the ineffectiveness of the claim submission.

Where to Find 1040 Form - Simplifies the entry of pension, annuity, and IRA withdrawals.