Fill Out a Valid Nj Sales Tax St 50 Template

In the world of New Jersey business, staying compliant with sales and use tax regulations is critical, and the ST-50 worksheet is a vital tool in this process. Designed exclusively for online filing, this worksheet offers a step-by-step approach to filing the New Jersey Sales and Use Tax Quarterly Return, ensuring accuracy and compliance. Businesses navigating through their quarterly tax obligations will find specific sections to account for gross receipts, taxable and non-taxable sales, and the calculated tax due. The form dynamically adjusts to accommodate sales tax rates relevant to the filing period, a critical feature given the fluctuations in rates from 6% to 6.625% over specific time frames. Moreover, the ST-50 worksheet facilitates a smooth payment process, allowing for electronic payments directly from bank accounts or via credit cards, although it specifies that accounts funded from financial institutions outside the United States cannot be used for EFT debit payments. At the conclusion of the filing process, a confirmation number is provided, ensuring that businesses can track and record their submission diligently. This comprehensive approach not only aids in the accurate reporting and payment of sales and use taxes but also in maintaining a transparent relationship between New Jersey businesses and tax authorities.

Sample - Nj Sales Tax St 50 Form

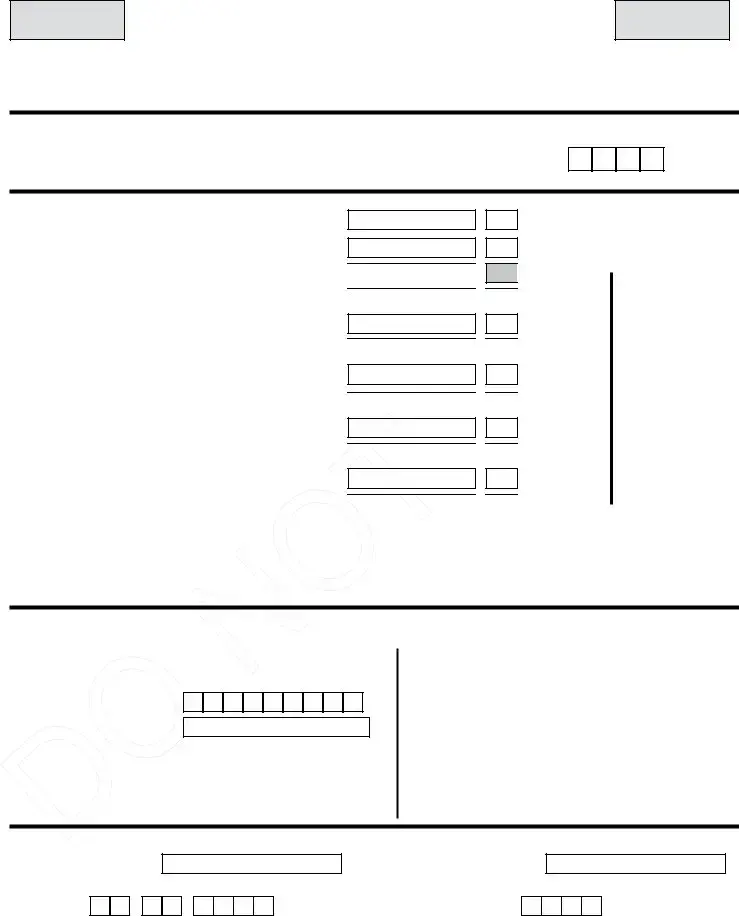

FOR ONLINE FILING ONLY

Online Filing and Payment Services

New Jersey Sales and Use Tax Quarterly Return

FOR ONLINE FILING ONLY

Use this worksheet to record the information you will enter when filing your

RETURN PERIOD

|

Mar (1st quarter – Jan, Feb, and Mar) |

|

Sep (3rd quarter – Jul, Aug, and Sept) |

|

|

|

DO NOT USE FOR 3RD QUARTER 2006 |

|

Jun (2nd quarter – Apr, May, and June) |

Year |

|

Dec (4th quarter – Oct, Nov, and Dec) |

||

|

RETURN INFORMATION

1. |

Gross receipts from all sales (to nearest dollar) |

$ |

2. |

Receipts not subject to Sales Tax |

$ |

|

(to nearest dollar) |

|

3. |

Receipts subject to Sales Tax |

$ |

|

(Line 1 minus Line 2) |

|

4. |

Sales Tax calculated (Line 3 × tax rate*) |

$ |

5. |

Sales Tax collected |

$ |

6. |

Sales Tax due (greater of Line 4 or Line 5) |

$ |

7. |

Use Tax due* |

$ |

8. |

Total tax due (Line 6 plus Line 7) |

$ |

9. |

Total monthly payments previously made |

$ |

10. |

Quarterly amount due (Line 8 minus Line 9) |

$ |

11. |

Penalty and interest |

$ |

12. |

Adjusted amount due (Line 10 plus Line 11) |

$ |

. 0 0

. 0 0

. 0 0

. 0 0

.

.

.

.

.

.

.

.

.

.

.

.

.

.

These lines will be calculated by the filing system when you click the Calculate button

*Use the tax rate that applies to the quarterly return you are filing.

6% – Quarters ending on or before June 30, 2006

7% – Quarters ending December 31, 2006, through December 31, 2016 6.875% – Quarters ending March 31, 2017, through December 31, 2017 6.625% – Quarters ending after December 31, 2017

PAYMENT If paying through this filing system, enter the information for your payment method. Note:

If using EFT debit, enter only account type and debit date.

Bank Routing Number.......

Account Number................

Type of Account |

Checking |

Savings |

||||||||||||

Amount to be Debited..... $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

Payment Debit Date |

|

/ |

|

|

/ |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Card

Visa MasterCard American Express Discover

Credit Card Number.... |

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

Expiration Date |

|

|

|

|

|

|

|

|

|

|

|

Payment Amount...... $ |

|

|

|

|

|||||||

|

. |

|

|

||||||||

Convenience Fee..... $ |

|

|

|

||||||||

|

|

|

|

|

|

|

. |

|

|

||

|

(to be calculated by the filing system) |

||||||||||

CONFIRMATION You will be assigned a Confirmation Number. Enter this number and the date in the boxes below.

Return Confirmation Number

Date/

/

Payment Confirmation Number

(if payment is made separately)

Date |

|

|

/ |

|

|

/ |

Filed by:_______________________________________ Filed by:_____________________________________________

Online Filing Quarterly Worksheet |

WORKSHEET MAY BE REPRODUCED |

(5/17) |

Document Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The ST-50 is used for reporting and paying New Jersey Sales and Use Tax on a quarterly basis. |

| Mode of Filing | This form is specifically designed for online filing and cannot be submitted in paper format. |

| Quarterly Return Periods | It covers four quarters: January–March, April–June, July–September, and October–December, each with specific deadlines for submission. |

| Sales Tax Rate Variability | The sales tax rate applied depends on the quarter being filed, reflecting changes in the tax rate over time. |

| Use Tax Reporting | Besides sales tax, the form also requires the reporting of use tax due. |

| Payment Methods | Payments can be made via E-check, EFT debit, or credit card, excluding accounts from financial institutions outside the United States. |

| Governing Laws | The form is governed by New Jersey state laws pertaining to sales and use tax. |

| Confirmation of Submission | After filing, a confirmation number is provided for records, ensuring proof of submission and payment. |

Detailed Steps for Using Nj Sales Tax St 50

Filling out the NJ Sales Tax ST-50 form might seem daunting at first, but it's quite straightforward once you break it down step by step. This form is necessary for reporting and paying the sales and use tax for businesses in New Jersey on a quarterly basis. The process has been designed to be completed online, making it convenient to file from anywhere. After completing the form, you'll need to print the confirmation page for your records. Here's how you can fill it out:

- Choose the quarter you're filing for by selecting Mar, Jun, Sep, or Dec.

- Enter Gross receipts from all sales to the nearest dollar in the space provided.

- Input the amount of Receipts not subject to Sales Tax, again to the nearest dollar.

- Calculate Receipts subject to Sales Tax by subtracting Line 2 from Line 1 and enter the amount.

- Multiply the amount on Line 3 by the applicable tax rate* to determine the Sales Tax calculated, and enter this figure.

- Fill in the Sales Tax collected amount.

- Enter the Sales Tax due, which is the greater of Line 4 or Line 5.

- Add any Use Tax due to the Sales Tax due to find the Total tax due.

- Subtract any Total monthly payments previously made from the Total Tax Due to determine the Quarterly amount due.

- If applicable, add any Penalty and interest to the Quarterly Amount Due to find the Adjusted amount due.

- For payment, if using E-check or EFT debit, enter your bank routing number, account number, type of account, and the amount to be debited along with the payment debit date. For Credit Card payments, provide your credit card number, expiration date, and the payment amount plus any convenience fee calculated by the system.

- After filing, note down the Return Confirmation Number and the date for your records. If payment is made separately, also note the Payment Confirmation Number.

Remember, the tax rate applied will depend on the quarter you're filing for. Be sure to use the correct rate to avoid any mistakes. After you've completed all the necessary fields and submitted your return, ensure you keep a copy of the confirmation page. This serves as proof of filing and may be needed for future reference.

Learn More on Nj Sales Tax St 50

What is the ST-50 form used for in New Jersey?

The ST-50 form is utilized by businesses in New Jersey to file their quarterly sales and use tax returns. It's designed for online filing, allowing businesses to report gross receipts, calculate the sales and use tax owed to the state, and make payments. This form helps ensure that businesses comply with state tax laws by accurately reporting their taxable and non-taxable sales within the designated filing periods.

When are the filing deadlines for the ST-50 form?

The ST-50 form is filed on a quarterly basis, with deadlines as follows:

- 1st Quarter (Jan, Feb, Mar) - Due by April 30th

- 2nd Quarter (Apr, May, June) - Due by July 31st

- 3rd Quarter (Jul, Aug, Sep) - Due by October 31st

- 4th Quarter (Oct, Nov, Dec) - Due by January 31st of the following year

What information is needed to complete the ST-50 form?

When preparing to file the ST-50, the following information is required:

- Gross receipts from all sales to the nearest dollar.

- Receipts not subject to sales tax to the nearest dollar.

- Receipts subject to sales tax, calculated as gross receipts minus non-taxable receipts.

- The calculated sales tax based on taxable receipts and the applicable tax rate.

- Sales tax collected from customers.

- Any use tax due.

- Total tax due, which includes sales tax and use tax.

- Total monthly payments previously made, if applicable.

- The adjusted amount due, which factors in any penalties and interest.

- Payment information, including method and details for electronic payments.

Can I pay the ST-50 form using a credit card?

Yes, you can pay the ST-50 form using a credit card. New Jersey supports payments through Visa, MasterCard, American Express, and Discover. However, it's important to note that a convenience fee, calculated by the filing system, will be applied to your transaction. This fee covers the costs associated with processing the credit card payment.

Are there penalties for late filing or payment?

Late filings or payments of the ST-50 can result in penalties and interest charges. The state imposes these fees as a way to encourage timely compliance with tax regulations. The specific amounts for penalties and interest depend on the extent of the delay and the amount of tax owed. Businesses are advised to file and pay their taxes on or before the due dates to avoid these additional charges.

How do I calculate the sales tax due on the ST-50 form?

To calculate the sales tax due on the ST-50 form, follow these steps:

- Determine your total receipts subject to sales tax.

- Apply the applicable sales tax rate to the taxable receipts. The rate depends on the quarter you are filing for and any recent tax rate changes.

- Compare the calculated sales tax with the amount of sales tax actually collected. The higher amount between the two is what you owe.

What are the tax rates applicable for filing the ST-50 form?

The applicable tax rates for filing the ST-50 form have varied over the years:

- 6% for quarters ending on or before June 30, 2006.

- 7% for quarters ending December 31, 2006, through December 31, 2016.

- 6.875% for quarters ending March 31, 2017, through December 31, 2017.

- 6.625% for quarters ending after December 31, 2017.

Is there a way to amend a previously filed ST-50 form?

If you need to amend a previously filed ST-50 form, you can do so through the same online filing system used for the original submission. When filing an amended return, it's essential to correct any inaccuracies or provide any additional information that was omitted in the original filing. Amending a return helps ensure you are fully compliant with state tax laws and can help avoid penalties for incorrect reporting.

How can someone avoid mistakes while filing the ST-50 form?

To avoid mistakes when filing the ST-50 form, consider the following tips:

- Double-check all figures, especially the calculation of taxable vs. non-taxable sales.

- Ensure that you are using the correct tax rate for your filing period.

- Take advantage of the online system's calculation feature to reduce errors in tax computation.

- Keep accurate and detailed records of all transactions throughout the quarter to simplify the filing process.

- File and pay on time to avoid penalties and interest for late submission.

How do I confirm that my ST-50 form has been successfully filed?

After filing your ST-50 form online, you will be assigned a confirmation number. This number, along with the filing date, serves as proof of your submission. It's recommended that you print or save the confirmation page for your records. Additionally, if you make a separate payment, you’ll receive a payment confirmation number. Keeping these confirmations ensures that you can verify your compliance with filing requirements and provides a record for future reference.

Common mistakes

Filing the New Jersey Sales and Use Tax Quarterly Return, known as the ST-50 form, is a critical task for businesses. However, individuals often encounter stumbling blocks during this process. Below are five common mistakes made when completing this form:

Failing to round the gross receipts and receipts not subject to sales tax to the nearest dollar. Precise rounding is essential for accurate reporting and to avoid discrepancies that could result in errors in the calculated sales tax due.

Incorrectly subtracting receipts not subject to sales tax from gross receipts. This calculation forms the basis for assessing the amount subject to sales tax, and mistakes here can significantly alter the tax liability.

Using the wrong sales tax rate when calculating the sales tax due. The applicable rate varies depending on the quarter being filed for, and not applying the correct rate can result in underpayments or overpayments of tax.

Omitting the total monthly payments previously made during the quarter from the final calculation of the quarterly amount due. This oversight can lead to inaccurately representing the amount owed, considering these payments reduce the taxable amount.

Providing incorrect banking information when opting to pay via E-check or EFT debit, particularly if the account is funded from a financial institution outside the United States, which is not accepted. Ensuring accurate banking details is crucial for the payment to be processed successfully.

Each mistake carries the potential to affect the accuracy of the return, possibly leading to penalties or interest due to underreported taxes. Attention to detail and careful review of the form before submission can mitigate these issues.

Documents used along the form

When it comes to managing sales and use tax, businesses in New Jersey have quite a few forms and documents that go hand-in-hand with the NJ Sales Tax ST-50 form. These documents are crucial for maintaining compliance and ensuring accurate tax reporting. They range from registration forms to detailed schedules for various types of transactions. Here's a brief look at some of these important documents that often accompany the ST-50 form.

- NJ-REG: This is a must-have for any new business in New Jersey. The NJ-REG form helps businesses register for tax and employer purposes. It's the first step to obtaining a sales tax permit, which you need before you can file the ST-50 form.

- ST-3 Resale Certificate: Businesses use this form when purchasing goods intended for resale without paying sales tax. It’s vital for transactions between businesses where the buyer intends to resell the purchased goods.

- ST-4 Exempt Use Certificate: This document is used by purchasers when buying goods or services that will be used in a manner qualifying them as exempt from sales tax. It's important to keep records of these for audit purposes.

- ST-8 Capital Improvement Certificate: When a purchase qualifies as a capital improvement to real property, this form enables buyers to make such purchases without paying sales tax. Proper documentation is crucial for capital improvement projects and tax exemptions.

- ST-75 Sales Tax Collection Schedule: This schedule is often used together with the ST-50 form to accurately calculate the amount of sales tax owed based on varying tax rates across different New Jersey localities.

- ST-350 Bulk Sales Notification: In the event of a bulk sale, which is the sale of a business or a substantial part of its inventory and equipment, this form alerts the state to ensure that the seller pays any outstanding taxes before the transaction completes.

- Form NJ-927: Businesses that have employees must file this form to report payroll taxes on a quarterly basis. It goes hand in hand with the ST-50 when businesses are managing both sales and payroll tax obligations.

- Form WR-30: Filed alongside Form NJ-927, this form details the wages paid to employees each quarter. It's crucial for businesses to maintain accurate records of employee compensation for both state and federal reporting.

- Annual Report: While not a form per se, most businesses in New Jersey must file an annual report with the state. This report ensures that the state has up-to-date information on the business, including its current operations and management structure.

Filing and maintaining these documents requires attention to detail and an understanding of New Jersey's tax laws and regulations. Each document plays a specific role in ensuring businesses meet their legal obligations while taking advantage of applicable exemptions and deductions. By staying organized and informed, businesses can navigate the complexities of tax compliance with confidence.

Similar forms

The Form ST-50, associated with New Jersey's Sales and Use Tax, shares operational similarities with the Form ST-3, which also pertains to New Jersey Sales and Use Tax. Both forms are integral for businesses in reporting and remitting sales tax collected from customers. Where the ST-50 serves a quarterly filing purpose, the ST-3 is often used for monthly sales tax submissions. In essence, both forms compile sales data over a period to calculate the tax owed to the state, reflecting on the businesses' adherence to tax collection responsibilities.

Comparable to the Form ST-50 is the Form 941 used by employers to report federal payroll taxes. While Form 941 focuses on reporting income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks, it parallels the ST-50 in its periodic nature of tax reporting. Both forms require the aggregation of financial information over a set term, quarterly for both, to ensure proper tax remittance and compliance with governmental regulations.

Another document resembling the ST-50 is the Sales and Use Tax Return form used in various other states, such as the California form BOE-401-EZ. Though these forms cater to different state tax systems, they share the fundamental purpose of reporting taxable sales, taxable purchases, and the tax collected or owed to the state. They are tailored to fit the sales and use tax laws within their respective states but maintain the objective of facilitating tax compliance for businesses.

The Uniform Commercial Code (UCC)-1 Financing Statement bears conceptual relevance to the ST-50, albeit serving a distinct legal purpose. The UCC-1 form secultures a secured party's interest in the collateral offered by a debtor, which can vary from inventory to personal property. Like the ST-50, it requires detailed information filing to a governmental authority, ensuring public record and legal compliance. Although one pertains to security interests and the other to tax liability, both necessitate precise data entry to fulfill statutory requirements.

Form W-2, Wage and Tax Statement, provides a parallel in information reporting for tax purposes, similar to the ST-50. Employers issue Form W-2 to employees and the Social Security Administration to report annual wages and the amount of taxes withheld from paychecks. Both the W-2 and ST-50 forms fulfill obligations for reporting to government entities, ensuring that the correct amount of taxes is collected and remitted within prescribed deadlines.

Form 1040, U.S. Individual Income Tax Return, shares similarities with the NJ ST-50 form in terms of periodic tax reporting and remittance. While Form 1040 is utilized by individuals to report their annual income and calculate federal tax liability, the ST-50 is used by businesses to report quarterly sales tax. Both are essential tools for taxpayers to fulfill their tax obligations, ensuring accurate reporting and payment of taxes owed.

The Quarterly Federal Excise Tax Return, Form 720, is akin to the ST-50 as it requires filers to report and pay taxes collected over a quarterly period. Form 720 applies to businesses responsible for collecting excise taxes on specific goods, services, and activities. This mirrors the obligation of businesses using Form ST-50 to report and remit sales tax, underscoring their roles in the collection and payment of different types of taxes to government authorities.

Form VAT-100, the Value Added Tax return in several jurisdictions outside the United States, shares a common goal with the ST-50 of reporting tax collected on sales. Although VAT and sales tax differ conceptually—VAT being a tax on the added value at each stage of production or distribution and sales tax being charged at the point of sale—both forms serve as means for businesses to report these taxes to the government, ensuring compliance and remittance of tax liabilities.

Lastly, the Business Property Statement (Form 571-L) used in California for reporting assesvaluble business personal property, parallels the ST-50 in its requirement for businesses to declare items of value for tax purposes. While the 571-L focuses on the assesvaluble property to determine property tax obligations, the ST-50 focuses on sales and transactions to calculate sales tax liability. Both forms require businesses to assess and report values that affect their tax responsibilities.

The Employer's Quarterly Federal Tax Return, Form 940, closely resembles the ST-50 in its quarterly tax reporting structure. Form 940 is utilized by employers to report and pay unemployment taxes to the federal government, mirroring the ST-50’s role in collecting sales tax on a quarterly basis. Although they target different tax types, both forms play significant roles in ensuring businesses meet their periodic tax reporting and payment duties.

Dos and Don'ts

When filling out the New Jersey Sales Tax ST-50 form, there are important dos and don'ts to ensure the process is completed accurately and efficiently. Here are five key actions to take and avoid:

- Do ensure all gross receipts from all sales are reported to the nearest dollar.

- Do calculate the receipts not subject to sales tax carefully to ensure accuracy.

- Do use the applicable tax rate for the quarter you are filing for to calculate the sales tax due.

- Do double-check the total tax due, including any use tax, to confirm all calculations are correct.

- Do print the confirmation page after filing your return online for your records.

- Don't use the ST-50 form for the 3rd quarter of 2006 as specified in the instructions.

- Don't round off cents to the nearest dollar when entering amounts for gross receipts and receipts not subject to sales tax—it must be to the nearest dollar.

- Don't ignore the instruction regarding payment methods; remember that payments from accounts outside the United States will not be accepted.

- Don't inaccurately calculate the sales and use tax due—ensure to apply the correct tax rate based on the quarter's end date.

- Don't forget to include your payment information if paying through the filing system, ensuring all required fields are completed and accurate.

Misconceptions

When tackling tax forms, it's easy to get tangled up in misconceptions, especially with the New Jersey Sales Tax ST-50 form. Let's clear up some common misunderstandings:

It's only for businesses with physical products. Actually, the ST-50 form covers receipts from all sales, not just physical products. Services subject to sales tax must also be reported.

You can file it manually on paper. The form clearly states "FOR ONLINE FILING ONLY," which means you must file it through New Jersey's online system. Paper submissions aren't accepted.

All sales are subject to sales tax. This isn't the case. The form requires you to differentiate between gross receipts and receipts not subject to sales tax. Certain services or items might be exempt, depending on New Jersey law.

The sales tax rate is the same every quarter. The form notes that the sales tax rate can change. It's crucial to use the tax rate applicable to the quarter you're filing for, as rates have varied over the years.

Payment can be made with any bank account worldwide. Actually, the form specifies that e-check or EFT debit payments from bank accounts outside the United States are not accepted.

If you don't collect enough sales tax, you don't owe additional money. The form instructs to report the greater of the sales tax calculated or collected. If you've calculated more tax than collected, you owe the difference.

You can wait to pay until you file your annual taxes. This misconception could lead to penalties. The ST-50 form is for quarterly returns, meaning you need to file and pay by the deadline for each quarter to avoid late fees.

There's no way to confirm your filing. The form includes a section for a confirmation number once your return is filed. Keeping this number ensures you have a record of your filing, offering peace of mind and proof of compliance.

Understanding these key points can make handling the New Jersey Sales Tax ST-50 form a smoother process, helping to ensure accurate filing and payment. Always check the latest guidelines and rates when preparing your tax returns.

Key takeaways

Filling out the NJ Sales Tax ST-50 form correctly is crucial for businesses operating in New Jersey. Here are four key takeaways about completing and using this form:

- Exclusive Online Usage: The ST-50 can only be filed online. This digital requirement streamlines the process and ensures timely and accurate submission of your sales and use tax returns. Make sure to have internet access and be comfortable with online submissions.

- Record Keeping: After filing your ST-50 form, it is essential to print the confirmation page. This document serves as a record of your submission and might be necessary for future reference, audits, or clarifications with the New Jersey Division of Taxation.

- Understanding the Components: The worksheet outlines several crucial figures, including gross receipts, exemptions, sales and use tax due, penalties, and the final amount owed. Completing each line accurately requires a good understanding of your sales activities and the applicable tax rates for the period in question.

- Payment Methods: The form accommodates payment via e-check or EFT debit but does not accept funds from banks outside the United States. Credit card payments are also accepted with an additional convenience fee. It is important to choose a payment method that suits your business operations while keeping in mind the potential extra costs.

Remember, the tax rate you apply depends on the specific quarter you are filing for, with rates having varied historically. Always verify the current tax rate before filing. Correctly reporting and calculating your sales and use tax is not only a legal obligation but also a crucial aspect of your business's financial health.

Popular PDF Documents

Nj Dmv Registration - Serves as an introductory step for NJ public service employees towards securing their retirement by enrolling in pension plans.

Tax Clearance Certificate Nj - The lack of expedited services for form C-9600 reinforces the need for meticulous planning and adherence to submission timelines.

Nj Reg - Out-of-state corporations operating in New Jersey are required to complete the NJ-REG form for state compliance.