Fill Out a Valid Nj W4 Wt Template

The Form NJ-W4-WT is an essential document for employees in New Jersey, governing the amount of state income tax withheld from their paychecks. It captures critical information including social security number, name, address, and filing status which directly impacts withholding rates. Employees can specify their number of allowances, any additional amounts they wish to have deducted, and even claim exemption from withholding under certain conditions, making this form critical for accurate tax withholding. Its importance extends to helping employees avoid underpayment or overpayment of taxes. With detailed instructions for completing each line and a specific wage chart designed to assist those with higher incomes or multiple sources of income, the NJ-W4-WT form is designed to accommodate various financial situations. Additionally, the form includes provisions for exemptions based on income thresholds, according to filing status, and requires annual renewal for those claiming exempt status. Understanding and accurately completing this form is crucial for New Jersey employees to ensure correct tax deductions and compliance with state tax laws.

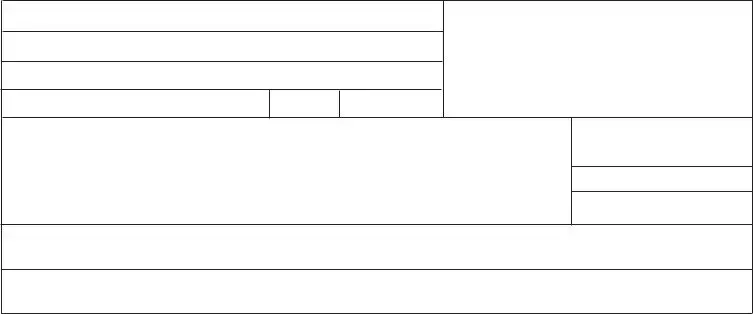

Sample - Nj W4 Wt Form

Form

State of New Jersey - Division of Taxation

Employee’s Withholding Allowance Certificate

1.SS# Name

Address City

State

Zip

2.Filing Status: (Check only one box)

1. Single

Single

2. Married Joint

Married Joint

3. Married Separate

Married Separate

4. Head of Household

Head of Household

5. Qualifying Widow(er)

Qualifying Widow(er)

3. |

If you have chosen to use the chart from instruction A, enter the appropriate letter here |

3. |

4. |

Total number of allowances you are claiming (see instructions) |

4. |

5.Additional amount you want deducted from each pay . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. $

6.I claim exemption from withholding of NJ Gross Income Tax and I certify that I have met the

conditions in the instructions of the

7.Under penalties of perjury, I certify that I am entitled to the number of withholding allowances claimed on this certificate or entitled to claim exempt status.

Employee’s Signature |

Date |

|

|

Employer’s Name and Address |

Employer Identification Number |

BASIC INSTRUCTIONS

Line 1 Enter your name, address, and social security number in the spaces provided.

Line 2 Check the box that indicates your filing status. If you checked Box 1 (Single) or Box 3 (Married Separate) you will be withheld at Rate A. NOTE: If you have checked Box 2 (Married Joint), Box 4 (Head of Household), or Box 5 (Qualifying Widow(er)) and either your

spouse works or you have more than one job or more than one source of income and the combined total of all wages is greater than $50,000, see instruction A below. If you do not complete Line 3, you will be withheld at Rate B.

Line 3 If you have chosen to use the wage chart below, enter the appropriate letter.

Line 4 Enter the number of allowances you are claiming. Entering a number on this line will decrease the amount of withholding and could result in an underpayment on your return.

Line 5 Enter the amount of additional withholdings you want deducted from each pay.

Line 6 Enter “EXEMPT” to indicate that you are exempt from New Jersey Gross Income Tax Withholdings, if you meet one of the following conditions:

•Your filing status is SINGLE or MARRIED SEPARATE and your wages plus your taxable

•Your filing status is MARRIED JOINT, and your wages combined with your spouse’s wages plus your taxable nonwage income will be $20,000 or less for the current year.

•Your filing status is HEAD OF HOUSEHOLD or QUALIFYING WIDOW(ER) and your wages plus your taxable nonwage income will be $20,000 or less for the current year.

Your exemption is good for ONE year only. You must complete and submit a form each year certifying you have no New Jersey Gross Income Tax liability and claim exemption from withholding. If you have questions about eligibility, filing status, withholding rates, etc. when completing this form, call the Division of Taxation’s Customer Service Center at

Instruction A - Wage Chart

This chart is designed to increase withholdings on your wages if these wages will be taxed at a higher rate due to inclusion of other wages or income on your

HOW TO USE THE CHART

1)Find the amount of your wages in the

2)Find the amount of the total for all other wages (including your spouse’s wages) along the top row.

3)Follow along the row that contains your wages until you come to the column that contains the other wages.

4)This meeting point indicates the Withholding Table that best reflects your income situation.

5)If you have chosen this method, enter the “letter” of the withholding rate table on line 3 of the

NOTE: If your income situation substantially increases (or decreases) in the future, you should resubmit a revised

THIS FORM MAY BE REPRODUCED

WAGE CHART

Total of All |

0 |

10,001 |

20,001 |

30,001 |

40,001 |

50,001 |

60,001 |

70,001 |

80,001 |

OVER |

||

Other Wages |

10,000 |

20,000 |

30,000 |

40,000 |

50,000 |

60,000 |

70,000 |

80,000 |

90,000 |

90,000 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

B |

B |

B |

B |

B |

B |

B |

B |

B |

B |

|

|

10,000 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,001 |

B |

B |

B |

B |

C |

C |

C |

C |

C |

C |

|

|

20,000 |

||||||||||

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

20,001 |

B |

B |

B |

A |

A |

D |

D |

D |

D |

D |

|

O |

|

30,000 |

||||||||||

U |

30,001 |

B |

B |

A |

A |

A |

A |

A |

E |

E |

E |

|

R |

|

40,000 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

40,001 |

B |

C |

A |

A |

A |

A |

A |

E |

E |

E |

|

|

|

|||||||||||

|

|

50,000 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

W |

50,001 |

B |

C |

D |

A |

A |

A |

E |

E |

E |

E |

|

A |

|

60,000 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

60,001 |

|

|

|

|

|

|

|

|

|

|

|

G |

B |

C |

D |

A |

A |

E |

E |

E |

E |

E |

||

E |

|

70,000 |

||||||||||

|

70,001 |

|

|

|

|

|

|

|

|

|

|

|

S |

80,000 |

B |

C |

D |

E |

E |

E |

E |

E |

E |

E |

|

|

|

80,001 |

|

|

|

|

|

|

|

|

|

|

|

|

90,000 |

B |

C |

D |

E |

E |

E |

E |

E |

E |

E |

|

|

over |

|

|

|

|

|

|

|

|

|

|

|

|

90,000 |

B |

C |

D |

E |

E |

E |

E |

E |

E |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specifications

| Fact Name | Description |

|---|---|

| Form Identification | Form NJ-W4-WT (4-02, R-9) |

| Form Issuer | State of New Jersey - Division of Taxation |

| Primary Purpose | Employee’s Withholding Allowance Certificate |

| Filing Status Options | Single, Married Joint, Married Separate, Head of Household, Qualifying Widow(er) |

| Adjustment for Multiple Jobs/Spouses Working | Wage chart usage recommended for combined wages over $50,000 |

| Withholding Rate Options | Rate A for Single or Married Separate; Rate B by default or if conditions apply |

| Exemption Claims | Conditions based on filing status and taxable income thresholds |

| Exemption Validity | Valid for one year, requires annual certification |

| Additional Withholding Requests | Allows specifying extra deduction amounts per pay |

| Contact Information for Queries | Division of Taxation’s Customer Service Center at 609-292-6400 |

| Governing Laws | New Jersey Gross Income Tax Act |

Detailed Steps for Using Nj W4 Wt

Filling out the NJ W4 WT form is a crucial step for employees in New Jersey to ensure that their employer withholds the correct amount of state income tax from their paychecks. Proper completion of this form can help avoid owing a large amount of taxes at the end of the year or receiving a large refund. Follow these simple steps to accurately complete your NJ W4 WT form.

- Personal Information: Start by entering your full name, address, city, state, and zip code in the respective fields provided. Make sure to also include your Social Security Number (SSN) without any errors.

- Filing Status: Determine your filing status and check the appropriate box. Remember, your filing status affects your withholding rate. If you're unsure, refer back to the criteria listed for each status to make the right choice.

- Withholding Rate Option: If you decide to use the wage chart in instruction A to determine your withholding rate, enter the appropriate letter that corresponds to your situation in the space provided for line 3.

- Claiming Allowances: Enter the total number of allowances you are claiming on line 4. Keep in mind, claiming fewer allowances means more tax will be withheld, potentially leading to a larger refund, while claiming more allowances reduces the amount withheld, increasing your take-home pay but possibly resulting in tax owed at year's end.

- Additional Withholdings: If you wish to have an additional specific amount withheld from each paycheck, specify this amount in dollars on line 5.

- Claiming Exemption: If you meet the conditions for exemption from withholding (your income is below a certain threshold), enter “EXEMPT” on line 6. Be sure only to claim this if you genuinely meet the exemption conditions as outlined above.

- Signature and Date: Sign and date the form to certify that the information provided is accurate. Remember, signing also means you’re aware that you’re responsible for the correctness of the allowances claimed.

- Employer Information: Provide your employer’s name and address along with their Employer Identification Number (EIN).

After completing these steps, submit the form to your employer. It's also wise to keep a copy for your records. Should your income situation change significantly, remember to update your NJ W4 WT form accordingly. This ensures your withholdings are always as accurate as possible, helping you manage your finances better throughout the year.

Learn More on Nj W4 Wt

What is the Form NJ-W4-WT?

The Form NJ-W4-WT, issued by the State of New Jersey Division of Taxation, is an Employee’s Withholding Allowance Certificate. Its primary function is for New Jersey employees to inform their employers how much state income tax to withhold from their paychecks. This form plays a crucial role in ensuring that the amount of New Jersey Gross Income Tax withheld from an employee's pay is accurate, potentially avoiding the need for large payments or refunds when filing an annual tax return.

How do I determine my filing status on the NJ-W4-WT form?

Your filing status on the NJ-W4-WT form corresponds to your current situation, selected among five options: Single, Married Joint, Married Separate, Head of Household, and Qualifying Widow(er). Each status affects the withholding rate differently, due to different tax brackets and allowances. For instance, single filers or those married but filing separately fall under 'Rate A' withholding rates, generally higher due to lower allowances. Conversely, those married and filing jointly, head of households, or qualifying widow(er)s, particularly when combined income exceeds $50,000, should use Instruction A's wage chart to ascertain the correct withholding rate, which might involve higher allowances and possibly lower withholding rates.

What is the wage chart and how do I use it?

The wage chart provided in the NJ-W4-WT form instructions aims to help certain filers—specifically, those married filing jointly, head of household, or qualifying widow(er)s—if the combined taxable income exceeds $50,000. To use this chart:

- Locate your wage amount in the left-hand column.

- Find the total for all other wages, including your spouse's, along the top row.

- Follow the row and column to where they intersect, finding the withholding table letter that applies to your situation.

- If using this method, enter the letter on Line 3 of the NJ-W4.

Can I claim exemption from New Jersey Gross Income Tax withholding?

Yes, in certain situations, you can claim exemption from New Jersey Gross Income Tax withholding by entering "EXEMPT" on Line 6 of the NJ-W4-WT form. Eligibility for this exemption depends on your filing status and whether your (and if applicable, your spouse's) wage plus taxable non-wage income will not exceed specific thresholds within the tax year. These thresholds are $10,000 for single filers or married filing separately, and $20,000 for married filing jointly, head of household, or qualifying widow(er), but this exemption needs to be claimed annually by submitting a new form certifying no New Jersey Gross Income Tax liability.

What should I do if my financial situation changes during the year?

If there's a substantial increase or decrease in your income or if there are significant changes in your personal circumstances affecting your tax situation (such as marriage, divorce, or a child's birth), it's advisable to submit a revised NJ-W4-WT to your employer. Failing to update your withholding allowances can lead to under or over-withholding of state taxes, which might result in either a tax due or a large refund when you file your New Jersey Gross Income Tax return.

Where can I get help if I have questions about completing the NJ-W4-WT?

If you have questions about how to complete the NJ-W4-WT form or about your specific tax situation, you can contact the New Jersey Division of Taxation’s Customer Service Center by calling 609-292-6400. They can provide guidance on filing status, withholding rates, and other aspects of the form. Additionally, consulting with a tax professional can provide personalized advice tailored to your individual circumstances.

Common mistakes

Not correctly indicating their filing status is a common mistake. The form clearly provides options such as Single, Married Joint, Married Separate, Head of Household, and Qualifying Widow(er). This choice impacts the withholding rate, so selecting the wrong status could result in incorrect tax withholdings.

Another frequent error occurs with Line 3, regarding the wage chart from Instruction A. Some taxpayers fail to enter the appropriate letter after using the wage chart, which is designed to adjust withholdings based on combined income levels. This oversight can lead to under- or over-withholding of taxes.

Incorrectly calculating the total number of allowances on Line 4 is also common. Each allowance reduces the amount withheld from each paycheck. Overestimating allowances could result in owing taxes at the end of the year, while underestimating could mean less take-home pay throughout the year.

Not accurately reporting an exemption from withholding on Line 6 is another mistake. This line should only be filled out if the taxpayer meets specific conditions making them exempt from withholding. Incorrectly claiming exemption can lead to underpayment of taxes and possible penalties.

In summary, when filling out the NJ-W4-WT form:

- Ensure the correct filing status is checked.

- Use the wage chart if applicable and enter the resulting letter on Line 3.

- Accurately calculate and enter the total number of allowances on Line 4.

- Only claim exemption from withholding on Line 6 if eligible.

By avoiding these errors, individuals can help ensure the right amount of taxes are withheld, potentially avoiding unwanted surprises during tax season.

Documents used along the form

When employees complete the Form NJ-W4-WT, they often need to consider additional paperwork to ensure their tax situation is properly addressed. This documentation helps in accurately determining tax withholding amounts to avoid underpayment or overpayment of taxes. Below is a list of forms and documents commonly used alongside Form NJ-W4-WT that help employees and employers navigate through the specifics of tax withholding requirements.

- Form W-2 (Wage and Tax Statement): This form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It is used by the employee to file federal and state taxes.

- Form W-4 (Employee's Withholding Certificate): A federal form that helps employers determine the correct amount of federal income tax to withhold from employees' paychecks. While the NJ-W4-WT is for New Jersey state taxes, the Form W-4 is for federal taxes.

- Form NJ-1040 (New Jersey Resident Income Tax Return): Used by residents to file their annual state tax return. Information from Form NJ-W4-WT can affect the calculations on this return.

- Form NJ-165 (Employee's Certificate of Non-residence in New Jersey): For employees who live in another state but work in New Jersey, this form exempts them from New Jersey withholdings.

- Pay Stubs: While not an official form, reviewing recent pay stubs can help employees make accurate withholding decisions by providing current year-to-date earnings and tax withholding amounts.

Together, these forms create a comprehensive approach to handling an employee's tax obligations accurately. They address both the federal and state aspects of tax withholding and ensure that employees provide all necessary information to their employers. This suite of documents supports the aim of achieving the correct amount of tax withheld, minimizing the likelihood of significant balances due or large refunds when filing annual tax returns. Employers play a crucial role in this process by maintaining accurate records and providing timely and clear instructions to their employees on these matters.

Similar forms

The Form W-4 is a Federal Employee's Withholding Certificate that holds similarities with the NJ-W4-WT, primarily in its function of determining the amount of federal income tax to withhold from an employee's paycheck. Like the NJ-W4-WT, employees fill out Form W-4 to declare their filing status and any other circumstances that might affect their tax withholding, such as marriage, number of dependents, or additional income. Both forms allow for additional amounts to be withheld at the employee's request and offer a guideline for claiming exemption from withholding if certain conditions are met.

The W-2 form, while distinct in purpose from the NJ-W4-WT, is related in the broader context of employment tax documentation. The W-2 is issued by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. Though not used by employees to claim withholding allowances, the information provided on a W-2 could influence how an individual completes their NJ-W4-WT or similar forms in subsequent years, reflecting changes in income or tax status that might affect withholding needs.

The state equivalent forms in other states, such as the California Form DE-4 or New York IT-2104, serve the same primary purpose as the NJ-W4-WT by allowing employees to specify the amount of state income tax to be withheld from their paychecks. These forms consider state-specific tax regulations and rates, with sections for personal information, filing status, number of allowances, and additional withholding amounts. Although the line items and instructions may vary, the core objective of helping employees tailor their tax withholdings to their personal financial situation remains consistent across these state forms.

The IRS Form 1040-ES, Estimated Tax for Individuals, while not directly related to withholding allowances or employment, is relevant for individuals who have income not subject to withholding. This form allows taxpayers to calculate and pay estimated taxes on a quarterly basis. The reason for its similarity to the NJ-W4-WT lies in its objective of tax planning and ensuring the right amount of tax is paid throughout the year to avoid underpayment penalties, echoing the preventative measures employees take when adjusting withholdings on their NJ-W4-WT.

The Form 1099 is a series of documents that report various types of income other than wages, salaries, and tips. Comparatively, while the NJ-W4-WT deals directly with employment income, individuals who receive forms 1099 might need to adjust the withholdings on their W-4 or NJ-W4-WT forms to account for additional tax liabilities not covered by regular employment withholding. This interaction underscores a broader tax planning strategy, emphasizing the interconnectedness of various tax documents.

The Earned Income Tax Credit (EITC) form, or Schedule EIC, is used to claim a federal tax credit for low- to moderate-income working individuals and families, particularly those with children. The link between the NJ-W4-WT and Schedule EIC is indirect but important; changes in income and tax liability identified on the NJ-W4-WT can affect eligibility for the EITC. Therefore, accurate completion of withholding forms can play a crucial role in maximizing the benefits for which taxpayers are eligible.

Overall, these documents, including the NJ-W4-WT, are integral components of the tax and income reporting ecosystem, each serving unique yet interconnected roles. They collectively contribute to an individual's comprehensive tax planning and compliance strategy, emphasizing the importance of accurate and timely information submission to tax authorities.

Dos and Don'ts

When filling out the NJ W4 WT form, it is crucial to strike a balance between accuracy and legality. Here is a distilled guide on what you should and shouldn't do to streamline the process:

Do:- Double-check your personal information: Ensure that your name, address, and social security number are correctly filled out to match your legal documents.

- Select the correct filing status: Your choice should reflect your current marital and tax filing status, as this affects your withholding rate.

- Use the wage chart accurately if needed: If your situation calls for it, carefully find and input the appropriate letter from the wage chart to ensure correct withholding.

- Be realistic about allowances: Claiming allowances reduces how much is withheld from your paycheck for taxes, so be truthful to avoid owing taxes at year-end.

- Declare additional withholding if necessary: If you have other income sources or anticipate a higher tax liability, use Line 5 to specify any extra amount you wish deducted.

- Claim exemption correctly: Only write "EXEMPT" if you truly meet the conditions outlined, to avoid penalties for underpayment of tax.

- Sign and date the form: Your signature certifies that the information is accurate to the best of your knowledge, under penalties of perjury.

- Guess your filing status: Incorrectly selecting your filing status can lead to insufficient withholding and potential tax liabilities.

- Forget to use the wage chart when required: Overlooking this step, if applicable, may result in incorrect withholdings and a tax bill later.

- Underestimate your allowances: Claiming too few allowances could lead to over-withholding, unnecessarily reducing your take-home pay.

- Ignore additional income: Not accounting for extra income on Line 5 can result in under-withholding and a possible owed balance to the IRS.

- Claim exempt without eligibility: Incorrectly claiming exempt status can lead to tax penalties and interest on the owed taxes.

- Overlook the annual requirement for claiming exempt: Remember, the exemption claim is only valid for one year, and a new form must be submitted each year if applicable.

- Submit without a signature: An unsigned form may be considered invalid, leading to incorrect withholdings or a lack of compliance with tax laws.

Adhering to these guidelines ensures that your NJ W4 WT form is filled out accurately and legally, safeguarding against potential issues with tax withholdings. It’s always wise to consult with a tax professional or reach out to the New Jersey Division of Taxation if you find yourself unsure about any part of the process.

Misconceptions

When it comes to filling out tax forms, misconceptions can lead to mistakes, and the New Jersey W4 WT (NJ-W4) form is no exception. Here are six common misunderstandings about this form:

- Exemption applies indefinitely: Many believe once you declare yourself exempt on the NJ-W4, you don’t have to worry about it anymore. However, exemptions are valid for only one year. You need to file a new form each year if you still meet the exemption criteria.

- Married filing jointly always benefits: There's a notion that choosing the "Married Joint" option always results in less tax withheld. This isn’t always the case, especially if both spouses work or have multiple jobs since the combined income may push you into a higher tax bracket, increasing withholding.

- More allowances mean more take-home pay: While it's true that claiming more allowances can increase your immediate take-home pay, it might also lead to underpayment of taxes and a possible tax bill at year’s end. It's crucial to claim the correct number of allowances based on your specific situation.

- The form only affects state taxes: While the NJ-W4 directly impacts the calculation of New Jersey state income tax withholding, it doesn’t exist in isolation. Changes can affect your overall tax burden, including how it aligns with federal tax liabilities.

- Single filers don’t need to worry about the wage chart: The wage chart provided in the instructions is often overlooked by single filers or those married but filing separately, under the false assumption it’s not designed for them. However, single filers should consider using the wage chart if they have multiple jobs or other sources of income that could push them into a higher tax bracket.

- Everyone should claim the same number of allowances each year: Your financial and personal situation can change from one year to the next. A common mistake is carrying over the same number of allowances year after year without reviewing current circumstances. Annual review of your NJ-W4 ensures that withholdings accurately reflect your current situation.

Understanding the nuances of the NJ-W4 can help you navigate the complexities of state tax withholdings more effectively, ensuring you neither underpay nor overpay your taxes through the course of the year.

Key takeaways

When completing the NJ W4 WT form, it's essential to accurately provide your social security number, name, and address to ensure proper processing and tax withholding.

Selecting the correct filing status on the form directly affects withholding rates and is crucial for accurate tax deductions from your wages.

For individuals with more complex income situations, such as multiple jobs or a working spouse, choosing the appropriate letter from the wage chart (Instruction A) and entering it on Line 3 is necessary to ensure the correct withholding rate is applied.

The total number of allowances claimed influences the amount of tax withheld from your paycheck. Claiming more allowances can decrease the amount withheld, potentially leading to underpayment of taxes.

Additional withholdings can be specified on Line 5 if you wish to have more taxes taken out of your paychecks beyond the calculated amount based on allowances and filing status.

Claiming exemption from withholding is only applicable if you meet specific income conditions related to your filing status. This exemption must be certified annually by completing and submitting this form.

Ensuring the form is signed under the penalties of perjury attests that the information provided is accurate and that you are entitled to the number of allowances or exempt status claimed.

For married couples filing jointly, heads of households, or qualifying widow(er)s with combined incomes over $50,000, using the provided wage chart can help adjust withholdings to better match tax obligations.

Any significant change in income, either an increase or decrease, warrants submitting a revised NJ W4 WT form to your employer to adjust withholding taxes accordingly.

The NJ Division of Taxation’s Customer Service Center is available for questions or clarifications needed when filling out the form to ensure correct completion and submission.

Popular PDF Documents

Tax Waiver Form Nj - This form specifically aids in releasing New Jersey bank accounts, stocks in NJ corporations, brokerage accounts, and investment bonds.

What Are the 6 Points of Id in Nj - As part of a suite of services and forms provided by the MVC, it exemplifies New Jersey's integrated approach to vehicle management and owner responsibilities.