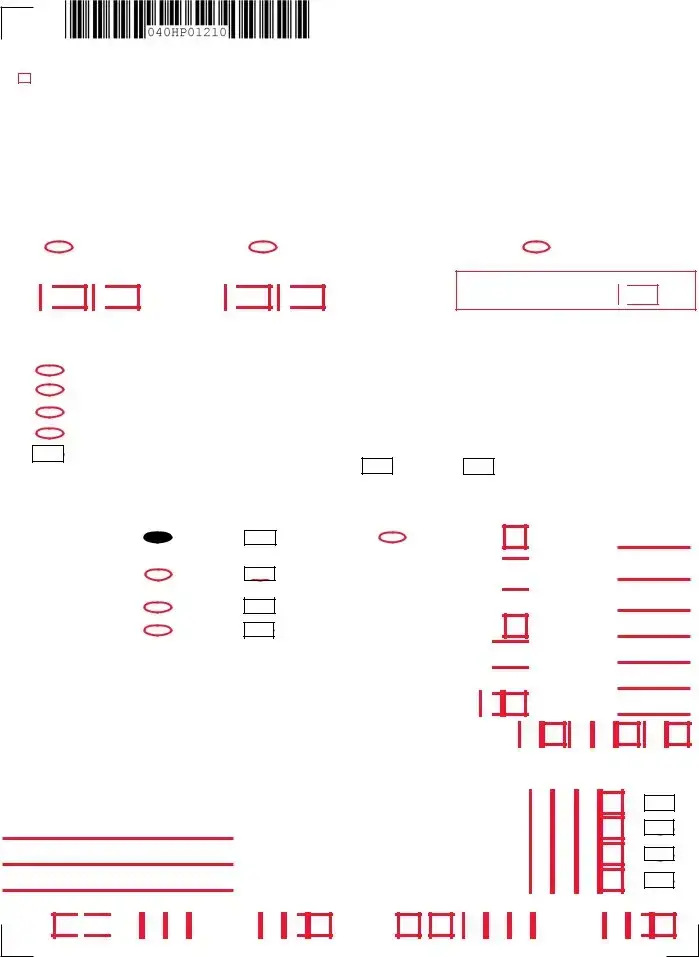

Fill Out a Valid Nj1040 Template

The process of navigating through tax responsibilities comes with its inherent complexities and the need for accuracy and completeness, making the NJ1040 form a critical document for New Jersey residents. This extensive form serves as the New Jersey Resident Income Tax Return, which was specifically designed for the 2020 tax year, embodying various sections that require meticulous attention to detail. From personal information, such as Social Security Numbers and addresses, to intricate financial data about income, tax exemptions, deductions, and credits, every part must be filled with precision. The form also accommodates various filing statuses and provides space for reporting dependents, which is crucial for calculating the owing or refundable state income tax accurately. Additionally, the NJ1040 form prompts taxpayers to engage in charitable giving through contributions to designated funds, furthering societal benefit alongside their tax reporting obligations. It is designed not only to comply with state tax regulations but to assist in the detailed accounting of a taxpayer's fiscal year, guiding through earnings, potential tax exclusions, and deductions with the aim of ensuring every New Jersey resident meets their tax responsibilities while optimizing their financial standing.

Sample - Nj1040 Form

For Privacy Act Notification, See Instructions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey Resident |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Return |

|||||

5R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Affix preprinted label below ONLY if the information is correct. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

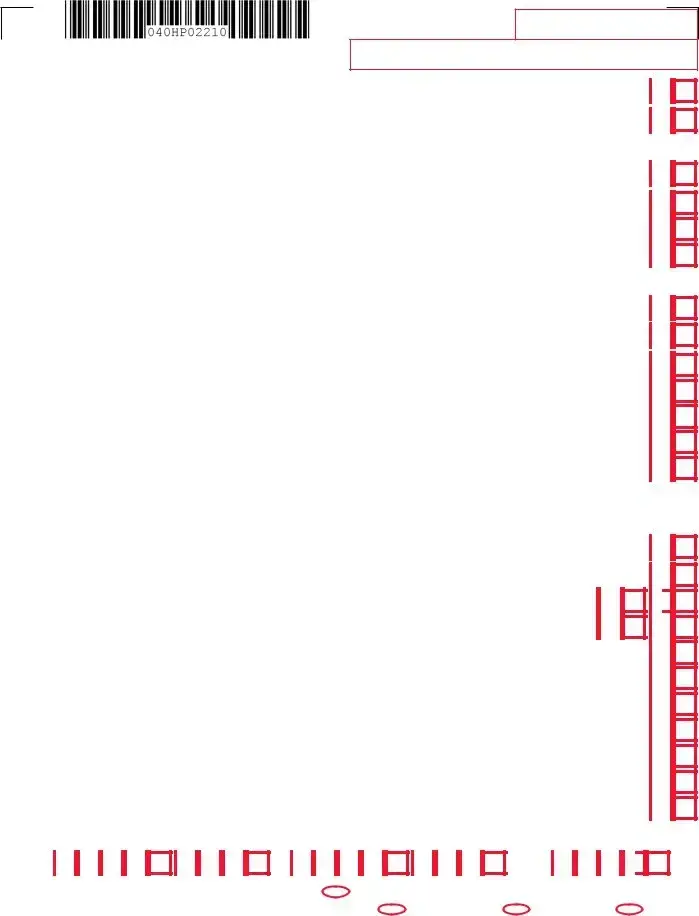

Your Social Security Number (required) |

|

|

|

|

Last Name, First Name, Initial (Joint Filers enter first name and middle initial of each. Enter |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

spouse’s/CU partner’s last name ONLY if different.) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Spouse’s/CU Partner’s SSN (if filing jointly) |

|

Home Address (Number and Street, including apartment number) |

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

County/Municipality Code (See Table page 50) |

|

City, Town, Post Office |

|

State |

ZIP Code |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Fill in |

|

|

|

if federal extension filed. |

|

Fill in |

|

|

if the address above is a foreign address. |

Fill in |

|

|

if your address has changed. |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From: M M / D

M / D  D / 2 1 To: M

D / 2 1 To: M M / D

M / D  D / 2 1

D / 2 1

Fiscal year filers only:

Enter month of your year end

M M

M

2022

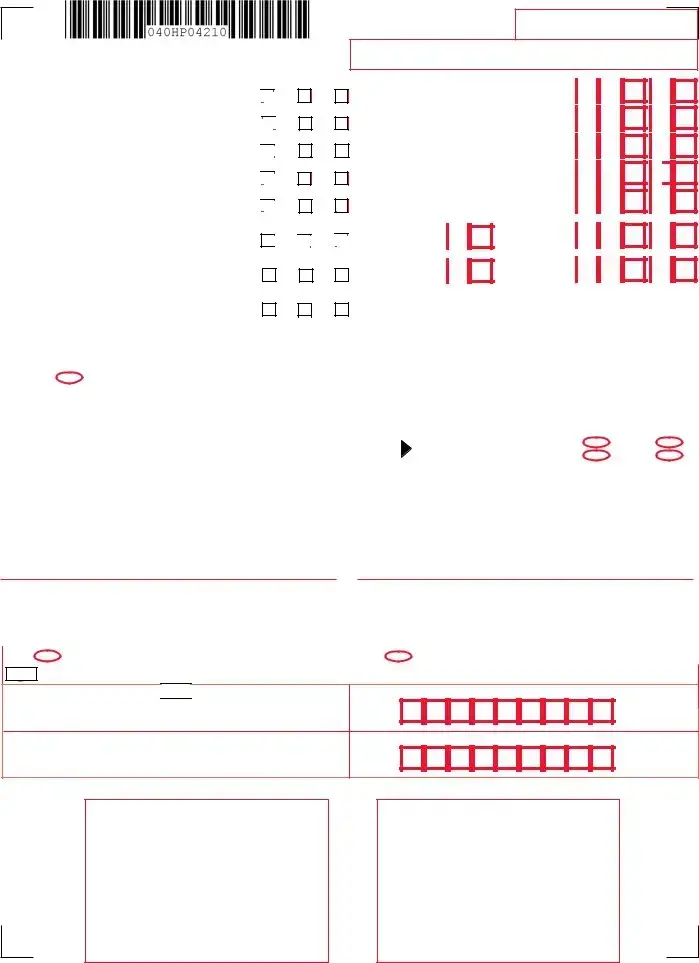

Filing Status

Fill in only one.

1. |

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

Married/CU Couple, filing joint return |

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3. |

|

Married/CU Partner, filing separate return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

4. |

|

Head of Household |

Enter spouse’s/CU partner’s SSN |

||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5.

Qualifying Widow(er)/Surviving CU Partner

Indicate the year of your spouse’s/CU partner’s death:

2019 or

2020

Exemptions

Fill in the ovals that apply. You must enter a total in the boxes to the right and complete the calculation.

6. |

Regular |

|

|

Self |

||

|

|

|

||||

7. |

Senior 65+ (Born |

|

|

Self |

||

|

|

|||||

|

in 1956 or earlier) |

|

|

|||

|

|

|

|

|||

8. |

Blind/Disabled |

|

|

|

Self |

|

|

|

|

||||

|

|

|

|

|

|

|

9. Veteran |

|

|

|

Self |

||

|

|

|

||||

Spouse/ |

|

Domestic |

|

||

CU Partner |

|

Partner |

|

Spouse/CU Partner ..........................................

Spouse/CU Partner ..........................................

Spouse/CU Partner ...........................................

x $1,000 |

= |

|

x $1,000 |

= |

|

x |

$1,000 |

= |

x |

$6,000 = |

|

10.Qualified Dependent Children ...........................................................................................................

11.Other Dependents .............................................................................................................................

12.Dependents Attending Colleges (See instructions) ...........................................................................

x $1,500 |

= |

|

x |

$1,500 |

= |

x |

$1,000 |

= |

13. Total Exemption Amount (Add totals from the lines at 6 through 12) |

13. |

||||||||||||||||||

14. Dependent Information. Provide the following information for each dependent. |

|

|

|

|

|

|

|

|

|

||||||||||

Last Name, First Name, Middle Initial |

|

Social Security Number |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

,

Birth Year

.

No Health Insurance

Division

use

1

2

2

3

3

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

6 |

|

|

|

|||

|

|

|

|

|

|

|

|

4 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

7

Page 2

Your Social Security Number

Name(s) as shown on Form

15. |

Wages, salaries, tips, and other employee compensation (State wages from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Box 16 of enclosed |

15. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||

16a. |

Taxable interest income (Enclose federal Schedule B if over $1,500) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

16a. |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

16b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) Do not include on line 16a |

16b. |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Dividends |

17. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

18. |

Net profits from business (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Enclose federal Schedule C) |

18. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

19. |

Net gains or income from disposition of property (Schedule |

19. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

20a. |

Taxable pension, annuity, and IRA distributions/withdrawals (See instructions) |

20a. |

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20b. |

Excludable pension, annuity, and IRA distributions/withdrawals |

20b. |

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

21. |

Distributive Share of Partnership Income (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

(Enclose Schedule |

21. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

22. |

Net pro rata share of S Corporation Income (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

(Enclose Schedule |

22. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

23. |

Net gains or income from rents, royalties, patents, and copyrights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Schedule |

23. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. |

Net gambling winnings (See instructions) |

24. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. |

Alimony and separate maintenance payments received |

25. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

Other (Enclose documents) (See instructions) |

26. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27. |

Total Income (Add lines 15, 16a, 17 through 20a, and 21 through 26) |

27. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||

28a. |

Pension/Retirement Exclusion (See instructions) |

28a. |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

28b. |

Other Retirement Income Exclusion (See Worksheet D and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

instructions pages |

28b. |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

28c. |

Total Exclusion Amount (Add lines 28a and 28b) |

|

|

|

|

|

|

|

|

|

|

28c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||

29. |

New Jersey Gross Income (Subtract line 28c from line 27) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(See instructions) |

29. |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||||

30. |

Exemption Amount (Enter amount from line 13. |

|

|

|

|

|

30. |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

31. |

Medical Expenses (See Worksheet F and instructions) |

|

|

|

|

|

31. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

32. |

Alimony and separate maintenance payments (See instructions) |

|

|

|

|

|

32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

33. |

Qualified Conservation Contribution |

|

|

|

|

|

33. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

34. |

Health Enterprise Zone Deduction |

|

|

|

|

|

34. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

35. |

Alternative Business Calculation Adjustment (Schedule |

|

|

|

|

|

35. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

36. |

Organ/Bone Marrow Donation Deduction (See instructions) |

|

|

|

|

|

36. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

37. |

Total Exemptions and Deductions (Add lines 30 through 36) |

|

|

|

|

|

37. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

38. |

Taxable Income (Subtract line 37 from line 29) |

38. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|||||||||

39a. |

Total Property Taxes (18% of Rent) Paid (See instructions page 24) ... |

39a. |

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

39b. Block

.

Lot

.

Qualifier

39c. County/Municipality Code |

|

|

|

|

|

|

|

Fill in |

|

if you completed Worksheet G. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

39d. Indicate your residency status during 2021 (fill in only one oval) |

|

|

Homeowner |

|

Tenant |

|

Both |

|||||||||||

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3

Your Social Security Number

Name(s) as shown on Form

40. |

.......................................................Property Tax Deduction (From Worksheet H) (See instructions) |

|

|

|

|

|

|

|

40. |

|

|

|

||||||||

41. |

New Jersey Taxable Income (Subtract line 40 from line 38) |

41. |

|

|

|

|

|

, |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|||||||||||||

42. |

Tax on amount on line 41 (Tax Table page 52) |

Enter Code |

|

|

42. |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

||||||||||||||

43. |

Credit For Income Taxes Paid to Other Jurisdictions |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

(Enclose Schedule |

|

|

|

|

|

43. |

|

|

|

|

|

||||||||

44. |

Balance of Tax (Subtract line 43 from line 42) |

|

|

|

|

|

44. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

45. |

Sheltered Workshop Tax Credit |

|

|

|

|

|

45. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

46. |

Gold |

|

|

|

|

|

|

|

|

|

|

|

|

46. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Star Family Counseling Credit (See instructions) |

|

|

|

|

|

|

|

|

|

|

||||||||||

47. |

Credit for Employer of Organ/Bone Marrow Donor (See instructions) |

|

|

|

|

|

47. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

48. |

Total Credits (Add lines 45 through 47) |

|

|

|

|

|

48. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

49. |

Balance of Tax After Credits (Subtract line 48 from line 44) If zero or less, make no entry |

49. |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

||||||||||||||||

50. |

Use Tax Due on Internet, |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

(See instructions) If no Use Tax, enter 0.00 |

|

|

|

|

|

50. |

|

|

|

|

|

||||||||

51. |

Interest on Underpayment of Estimated Tax |

|

|

|

|

|

51. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Fill in |

|

|

if Form |

|

|

|

|

|

|

|

|

|

|

|

|

||||

52. |

....................................................................Shared Responsibility Payment (See instructions) |

|

|

|

|

|

52. |

|

|

|

|

|

||||||||

|

REQUIRED Enclose Schedule HCC and fill in |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

53. |

..................................................................................Total Tax Due (Add lines 49 through 52) |

|

|

|

|

|

53. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

54. |

Total NJ Income Tax Withheld (Enclose Forms |

54. |

|

|

|

|

, |

|

|

|

||||||||||

55. |

Property Tax Credit (See instructions page 23) |

|

|

|

|

|

|

|

55 |

|||||||||||

56. |

New Jersey Estimated Tax Payments/Credit from 2020 tax return |

|

|

|

56. |

|

|

|

|

, |

|

|

|

|||||||

57. |

New Jersey Earned Income Tax Credit (See instructions) |

|

|

|

|

|

|

|

57. |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

Fill in |

|

|

if you had the IRS calculate your federal earned income credit |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Fill in |

|

|

if you are a CU couple claiming the NJ Earned Income Tax Credit |

|

|

|

|

|

|

|

|

|

|||||

58. |

Excess New Jersey UI/WF/SWF Withheld (Enclose Form |

|

|

|

58. |

|

|

|||||||||||||

59. |

Excess New Jersey Disability Insurance Withheld (Enclose Form |

............... |

|

59. |

|

|

||||||||||||||

|

|

|

|

|||||||||||||||||

|

|

|

|

|||||||||||||||||

60. |

Excess New Jersey Family Leave Insurance Withheld (Enclose Form |

........ 60. |

|

|

||||||||||||||||

61. |

Wounded Warrior Caregivers Credit (See instructions) |

|

|

|

|

|

|

|

61. |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

62. |

|

|

|

62. |

|

|

|

|

, |

|

|

|

||||||||

63. |

Child and Dependent Care Credit (See instructions) |

|

|

|

|

|

|

|

63. |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

Fill in |

|

if you are a CU couple claiming the Child and Dependent Care Credit |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

64. |

Total Withholdings, Credits, and Payments (Add lines 54 through 63) |

|

|

|

64. |

|

|

|

|

, |

|

|

|

|||||||

65. |

If line 64 is less than line 53, you have tax due. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Subtract line 64 from line 53 and enter the amount you owe |

|

|

|

65. |

|

|

|

|

, |

|

|

|

|||||||

|

If you owe tax, you can still make a donation on lines 68 through 75. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

66. |

If the total on line 64 is more than line 53, you have an overpayment. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Subtract line 53 from line 64 and enter the overpayment |

|

|

|

66. |

|

|

|

|

, |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

67. |

.Amount from line 66 you want to credit to your 2022 tax |

|

|

|

67. |

|

|

|

|

, |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|||

Page 4

Your Social Security Number

Name(s) as shown on Form

68.Contribution to N.J.

Endangered Wildlife Fund ......................................

69.Contribution to N.J. Children’s Trust

Fund To Prevent Child Abuse.................................

70.Contribution to N.J. Vietnam

Veterans’ Memorial Fund........................................

71.Contribution to N.J. Breast

Cancer Research Fund ..........................................

72.Contribution to U.S.S. New Jersey

Educational Museum Fund.....................................

$10 |

$20 |

Other |

68. |

$10 |

$20 |

Other |

69. |

$10 |

$20 |

Other |

70. |

$10 |

$20 |

Other |

71. |

$10 |

$20 |

Other |

72. |

.

.

.

.

.

73.Other Designated Contribution

(See instructions) ...................................................

$10

$10  $20

$20  Other

Other

Enter Code

73.

.

74. Other Designated Contribution |

|

|

|

(See instructions) |

$10 |

$20 |

Other |

Enter Code

74.

.

75. |

Other Designated Contribution |

|

|

|

|

|

Enter Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(See instructions) |

$10 |

$20 |

Other |

|

|

|

|

|

|

75. |

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|||||||||

76. |

Total Adjustments to Tax Due/Overpayment amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(Add lines 67 through 75) |

|

|

76. |

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|||||

77. |

Balance due (If line 65 is more than zero, add line 65 and line 76) |

................................. |

77. |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|||||||||

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

Fill in |

if paying by |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

78. |

Refund amount (If line 66 is more than zero, subtract line 76 from line 66) |

78. |

|

|

|

|

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Gubernatorial Elections Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Do you want to designate $1 to the Gubernatorial Elections Fund? |

|

|

You |

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

No |

|

|

||||||||||||||||

|

If joint return, does your spouse want to designate $1? |

|

|

|

|

Spouse/CU Partner |

Yes |

|

|

|

|

|

No |

|

|

||||||||||||||||||||||

|

This does not reduce your refund or increase your balance due. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature

Under penalties of perjury, I declare that I have examined this Income Tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

Your Signature |

|

Date |

|

Spouse’s/CU Partner’s Signature (required if filing jointly) |

Date |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver’s License Number (Voluntary) (See instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill in |

|

if death certificate is enclosed. |

|

|

|

|

Fill in |

|

|

|

if you do not want a paper form next year. |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I authorize the Division of Taxation to discuss my return and enclosures with my preparer (below).

Paid Preparer’s Signature (Fill in  if

if

Federal Identification Number

Firm’s Name

Firm’s Federal Employer Identification Number

Keep a copy of this return and all supporting documents for your records.

Tax Due Address

Enclose payment along with the

State of New Jersey

Division of Taxation

Revenue Processing Center – Payments PO Box 111

Trenton, NJ

Include Social Security number and make check or money order payable to:

State of New Jersey – TGI

You can also make a payment on our website:

nj.gov/taxation

Refund or No Tax Due Address

Use the labels provided with the envelope and mail to: State of New Jersey

Division of Taxation

Revenue Processing Center – Refunds PO Box 555

Trenton, NJ

Document Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The NJ-1040 form is used for filing New Jersey resident income tax returns. |

| Filing Status Options | Options include Single, Married/CU Couple filing jointly, Married/CU Partner filing separately, Head of Household, and Qualifying Widow(er)/Surviving CU Partner. |

| Exemptions | Categories include Regular, Senior 65+, Blind/Disabled, and Veteran exemptions, along with Qualified Dependent Children and Other Dependents. |

| Income Reporting | Includes wages, taxable and tax-exempt interest, dividends, net profits from business, and several other income types. |

| Deductions and Exclusions | Offers deductions for medical expenses, alimony payments, and specific retiree income exclusion. |

| Credits | Includes credits for taxes paid to other jurisdictions, child and dependent care, and others aimed at specific New Jersey taxes. |

| Contributions | Allows taxpayers to contribute to funds supporting wildlife, child abuse prevention, veterans, breast cancer research, and education. |

| Payment and Refund Methods | Provides options for direct refunds, balance due payments, and charitable contributions directly from the tax refund or due amount. |

| Governing Law(s) | Governed under New Jersey State Law, primarily under New Jersey Taxation law governing income tax filings for residents. |

Detailed Steps for Using Nj1040

Filling out the NJ-1040 form, the New Jersey Resident Income Tax Return, is a crucial step for residents to comply with state tax laws. This form is used to report income, calculate taxes owed, and determine eligibility for refunds or deductions. The process can seem daunting at first, but breaking it down into manageable steps can simplify the task. Below are the steps needed to accurately complete the NJ-1040 form.

- Start by affixing your preprinted label in the designated area if the information it contains is correct. If you do not have a preprinted label or the information is incorrect, manually enter your Social Security Number, name, and if filing jointly, your spouse’s/CU partner’s details.

- Enter your complete home address, including apartment number if applicable, and if you have a different mailing address, be sure to fill in the section for that as well.

- If you are a part-year resident, provide the months and days you were a resident of New Jersey during the year 2020.

- Select your filing status by filling in the oval next to the option that applies to you.

- Under the exemptions section, fill in ovals that apply and calculate the total exemption amount.

- Provide dependent information as required, including each dependent’s social security number and birth year.

- Enter your wages, salaries, tips, and other compensation in the designated area.

- Report taxable and tax-exempt interest income, dividends, and net profits from business in their respective lines.

- Detail your income from pensions, annuities, IRA withdrawals, and any distributive share of partnership income.

- Add and report your total income, then subtract any allowed deductions to arrive at your taxable income.

- Calculate your New Jersey tax base by subtracting any property tax deductions and enter your New Jersey taxable income.

- Apply the appropriate tax rates based on the tax tables to find out the amount of taxes you owe or the refund due to you.

- Fill in any credits, deductions, or additional taxes owed such as use tax, estimated tax penalties, or contributions to designated funds.

- Sign and date the form. If filing jointly, your spouse or CU partner must also sign and date the form.

- Review the payment or refund instructions and choose the appropriate address for mailing your completed NJ-1040 form, depending on whether you have a balance due or are expecting a refund.

Filling out the NJ-1040 form accurately is essential to ensure you are in compliance with New Jersey tax laws and to avoid potential penalties or delays in processing your return. Remember to keep a copy of the completed form and all related documents for your records. This can assist in future tax preparations or in the event that any questions arise regarding your submitted tax return.

Learn More on Nj1040

What is the NJ-1040 form?

The NJ-1040 is an income tax return form specifically for residents of New Jersey. It's used to report income earned during the year to the New Jersey Division of Taxation. This form includes several sections such as income, exemptions, deductions, and calculates both the tax owed and refunds due to the taxpayer.

Who needs to file the NJ-1040 form?

Any New Jersey resident who has earned income within the tax year is required to file an NJ-1040 form. This includes both full-year and part-year residents. Full-year residents have lived in New Jersey for the entire tax year, while part-year residents have lived in New Jersey for only a portion of the year. Certain thresholds based on income level, filing status, and age might exempt some individuals from filing.

What information do I need to fill out the NJ-1040 form?

To accurately complete the NJ-1040 form, you'll need:

- Your Social Security Number and, if filing jointly, your spouse's/CU partner's Social Security Number

- Detailed income information, including wages, salaries, dividends, and any other income earned during the year

- Information about any deductions you're eligible for, such as medical expenses, alimony payments, or property taxes paid

- Documentation for any tax credits you're claiming

It's also helpful to have your previous year's tax return as a guide.

Can I file my NJ-1040 form electronically?

Yes, the New Jersey Division of Taxation encourages taxpayers to file electronically as it speeds up the processing time and can lead to faster refunds. Residents can file electronically through NJWebFile or through a software provider certified by the state. Electronic filing is safe, secure, and ensures that the state receives your tax return immediately.

What should I do if I need more time to file my NJ-1040?

If you need more time to file your NJ-1040 form, you can request a six-month extension. However, it's important to note that this extension applies only to the filing of the form and not to any tax payment due. You are still required to estimate and pay any taxes owed by the original deadline to avoid potential penalties and interest charges. To request an extension, you must fill out the form NJ-630 and submit it by the original due date of the tax return.

Common mistakes

When filing the NJ-1040 New Jersey Resident Income Tax Return, it's crucial to approach the task carefully to avoid common pitfalls. Many people make mistakes that can lead to processing delays, underpayment, or overpayment of taxes. Here are eight common mistakes:

- Incorrect Social Security Numbers: Entering an incorrect Social Security Number for yourself, your spouse, or dependents can cause significant issues with your tax return.

- Filing Status Errors: Choosing the wrong filing status is a common mistake. It's important to select the correct option that matches your marital and family situation.

- Ignoring Part-Year Resident Information: For those who moved to or from New Jersey during the tax year, failing to accurately report the months you were a resident can affect your tax liability.

- Miscalculating Exemptions and Deductions: Incorrectly calculating exemption amounts or forgetting to include eligible deductions can lead to an inaccurate tax return.

- Income Misreporting: Not reporting all sources of income, including wages, interest, dividends, or capital gains, can result in underpayment of taxes and possible penalties.

- Omitting Tax Credits: Many filers overlook eligible tax credits such as the Earned Income Tax Credit or property tax credit, which can reduce the amount owed or increase a refund.

- Misusing Schedules and Attachments: Failing to include required schedules or documentation for specific income types or deductions can delay processing.

- Incorrect Payment Information: When due a refund or making a tax payment, entering incorrect banking information for direct deposits or electronic payments can delay or misdirect funds.

Avoiding these common errors can streamline the tax filing process and ensure an accurate tax return.

Documents used along the form

When preparing and filing the NJ-1040 form, which is the New Jersey Resident Income Tax Return, taxpayers often need to include additional forms and documents to provide a complete picture of their financial situation for the tax year. These documents ensure accurate reporting of income, tax deductions, and credits, aligning with the state's taxation requirements. Here's a brief overview of some commonly used forms and documents alongside the NJ-1040 form.

- W-2 Forms: These are Wage and Tax Statements provided by employers, detailing the income earned and taxes withheld during the tax year.

- 1099 Forms: These documents report various types of income other than wages, such as independent contractor income (1099-NEC), interest and dividends (1099-INT, 1099-DIV), government payments (1099-G), and retirement distributions (1099-R).

- Schedule B: Used for reporting interest and dividend income in more detail if the total amount received exceeds a certain threshold.

- Schedule NJ-BUS-1: For reporting net profits from a business, this schedule is utilized to detail the income and expenses from business activities.

- Schedule NJ-DOP: This form is for reporting gains from the disposition of property, used when calculating income from sales or exchanges of real estate and other properties.

- NJ-2450: Employees who believe they have excess New Jersey Unemployment Insurance/Healthcare/Workforce (UI/HF/SWF) contributions withheld must complete this form.Schedule NJ-COJ: Used for crediting income taxes paid to other jurisdictions, this schedule is necessary for residents who have income taxed by both New Jersey and another state.

- NJ-2210: For taxpayers who underpaid estimated tax payments throughout the year, this form helps calculate any penalty owed for underpayment.

- Schedule HCC: Required if claiming the Health Coverage Continuation Program, this schedule works alongside other health insurance deduction claims.

Beyond these forms, taxpayers might need to attach additional schedules or documents based on specific circumstances or to claim certain credits and deductions. Every document serves to clarify or substantiate information reported on the NJ-1040, ensuring that taxpayers meet their legal obligations while optimizing their tax situation. Always refer to the current year's tax instructions to determine the exact requirements for filing, as tax laws and form requirements can change from year to year.

Similar forms

The NJ-1040 form, used for New Jersey Resident Income Tax Return filings, bears similarities to other tax documents used by individuals both at the federal and state levels, providing a unique intersection of financial reporting, tax assessment, and personal information disclosure. One document resembling the NJ-1040 is the IRS Form 1040, the U.S. Individual Income Tax Return. Both forms serve as the primary annual income tax return filed by residents, detailing earnings, calculating allowable deductions, and determining the amount of tax owed or refund due. They collect taxpayer identification, dependents, income from various sources, adjustments to income, tax credits, and direct contributions to designated funds.

The IRS Schedule B is akin to portions of the NJ-1040 that inquire about interest and dividend income. Required when a taxpayer receives amounts above a certain threshold, Schedule B lists the sources and amounts of interest and dividends, similar to the NJ-1040's request for taxable interest income and dividends, assisting in ensuring all income is accurately reported for tax purposes.

Another analogous document is the Schedule C, relating to the NJ-1040's section on net profits from business. Sole proprietors and single-member LLCs use Schedule C to report the profit or loss from a business, paralleling the NJ-1040's approach to documenting income or losses from business operations. Both schedules require detailed financial reporting of revenues, expenses, and net income, contributing to the individual’s total taxable income.

IRS Form 2210, Underpayment of Estimated Tax by Individuals, similarly corresponds with sections of the NJ-1040 associated with underpayment of estimated tax. Both documents address situations where the taxpayer hasn’t paid enough tax through withholding or estimated tax payments, calculating penalties due for the underpayment, ensuring taxpayers meet their tax responsibilities throughout the year.

State-specific tax credits forms, like the NJ-1040’s Schedule NJ-COJ for Credit for Income Taxes Paid to Other Jurisdictions, have parallels in other states’ tax forms where residents must report and claim credit for taxes paid to other states. This prevents double taxation on the same income, ensuring fair treatment of taxpayers who earn income across state lines.

The Federal Schedule K-1 (Form 1065), reporting share of income, deductions, credits, etc., from partnerships, S-corporations, or trusts, aligns with the NJ-1040's reporting requirements for distributive share of partnership income and S Corporation income. These sections of both the federal and state forms ensure that income from these diverse sources is accurately reported and taxed at the individual level.

The IRS W-2 form, detailing wages and taxes withheld by employers, is directly referenced and required in tandem with the NJ-1040 for reporting wages, salaries, tips, and other employee compensation. The direct use of information from Form W-2 ensures the accurate transfer of employment income data onto the tax return, facilitating an accurate assessment of income tax liability.

Finally, Form NJ-1040-V, a payment voucher for submitting payment alongside the NJ-1040, shares a purpose with the federal IRS Form 1040-V used for similar reasons. Both vouchers accompany tax payments when filings are not conducted electronically, specifying essential information such as the taxpayer's name, Social Security number, and the amount of tax being paid, ensuring correct application of the payment to the taxpayer's account.

Dos and Don'ts

Filling out the NJ-1040 form for your New Jersey Resident Income Tax Return? Here's a quick guide to help you navigate the do's and don'ts, ensuring a smoother process:

- Do double-check your Social Security Number (SSN) and any other identification details. A simple typo can lead to processing delays or issues with your return.

- Don't leave any required fields blank. If a particular section does not apply to you, make sure to enter "0" or "N/A" to indicate that it has been reviewed but is not applicable.

- Do use the correct filing status that applies to your situation. This affects your tax calculation, so choose wisely whether you're filing singly, jointly with a spouse, or in another status.

- Don't guess your income or deductions. Refer to your W-2 forms, 1099 forms, and other financial documents to report your income and deductions accurately.

- Do include all relevant schedules and additional forms if you have specific types of income, deductions, or credits. These are essential for providing a complete picture of your financial situation.

- Don't forget to sign and date your return. Both you and your spouse (if filing jointly) need to sign. An unsigned return is like submitting an incomplete application—it won’t be processed.

- Do review the entire form once it's been filled out to ensure no errors have been made and that all pertinent information is included.

- Don't neglect to keep copies of your tax return and all supporting documents. These are crucial for your records and may be needed for future reference.