Fill Out a Valid Njeda Certified Payroll Template

When delving into the realm of public works projects in New Jersey, understanding the Njeda Certified Payroll form becomes indispensable. This document is not just another piece of paperwork; it is a vital tool used to ensure that workers on public projects are paid prevailing wages, as mandated by law. Its meticulous completion and submission are crucial for compliance, serving as a transparent record that details the wages paid to each worker, their classifications, hours worked, and any deductions made. This becomes especially important in safeguarding workers' rights and ensuring fair labor practices are upheld. Moreover, its significance extends beyond the workers—it assists contractors and subcontractors in maintaining proper records and staying aligned with New Jersey's labor laws. By mastering the nuances of the Njeda Certified Payroll form, employers can avoid potential legal pitfalls and contribute to a more equitable workplace environment.

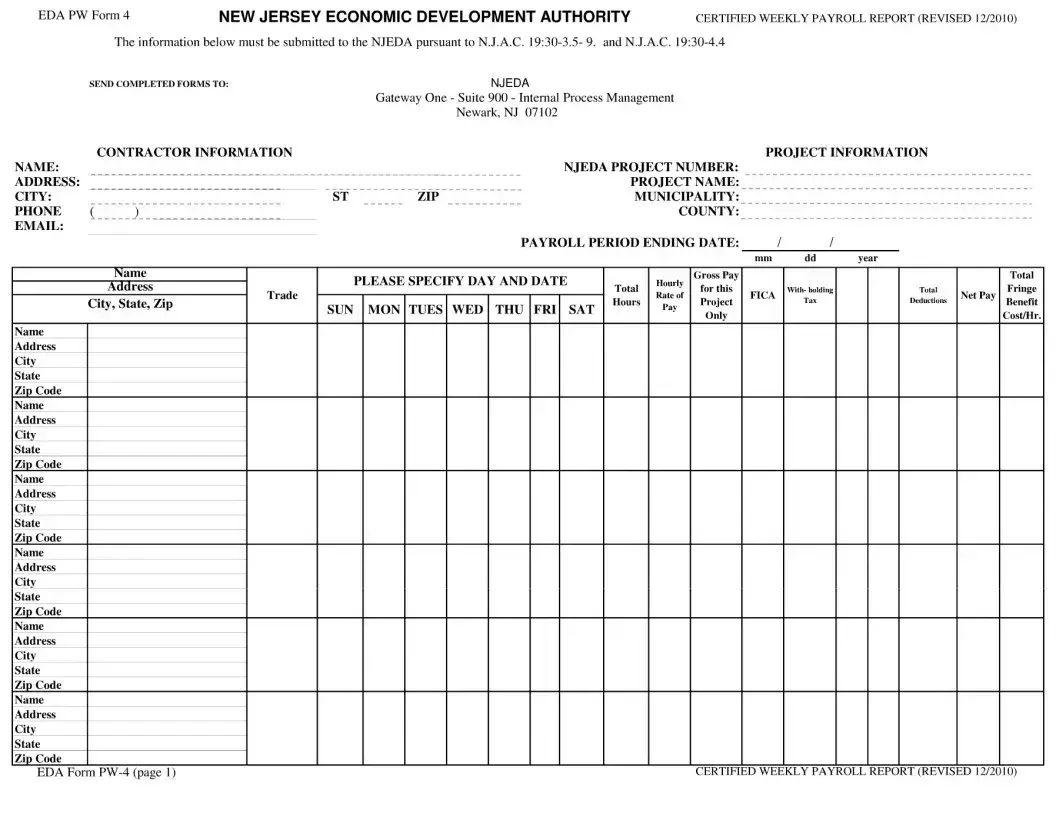

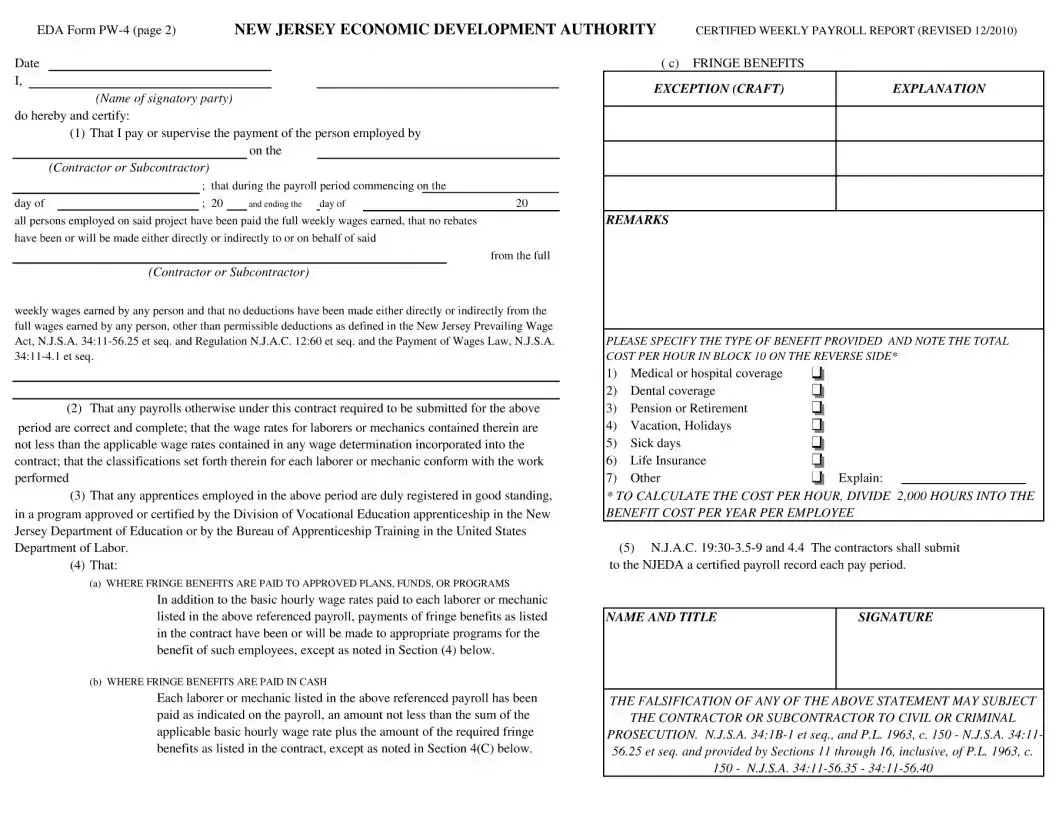

Sample - Njeda Certified Payroll Form

Document Specifications

| Fact Number | Description |

|---|---|

| 1 | The New Jersey Economic Development Authority (NJEDA) Certified Payroll form is used to document wage compliance for certain state-funded construction projects. |

| 2 | It ensures that workers are paid prevailing wages as required by the New Jersey Prevailing Wage Act (NJPWA). |

| 3 | Contractors and subcontractors must complete the form for each pay period and submit it to the overseeing public body. |

| 4 | The form requires detailed employee information, including names, classifications, hours worked, and wages paid. |

| 5 | It also necessitates declarations regarding fringe benefits and any deductions made from workers' pay. |

| 6 | Failure to accurately complete the NJEDA Certified Payroll form or comply with prevailing wage laws can result in significant fines and penalties. |

| 7 | This form is a key tool in upholding labor standards and protecting workers' rights on state-aided construction projects. |

Detailed Steps for Using Njeda Certified Payroll

Filling out the NJEDA Certified Payroll form is a critical step for contractors and subcontractors working on New Jersey Economic Development Authority (NJEDA) projects to ensure compliance with labor regulations. This process helps document and verify that workers are paid appropriate wages as required by law. The form seeks detailed information about the workweek, employee wages, benefits, and hours worked, among other data. By correctly completing this form, businesses affirm their commitment to fair labor practices and enable the NJEDA to maintain the integrity of its projects.

Steps to Complete the NJEDA Certified Payroll Form

- Begin by downloading the latest version of the NJEDA Certified Payroll form from the New Jersey Economic Development Authority's official website to ensure you have the most current form.

- Enter the project or contract number and the week ending date for the payroll period at the top of the form to accurately identify the specific timeframe the payroll information covers.

- Fill out the contractor or subcontractor information section. This includes the name, address, and contact details of the company submitting the payroll form.

- List each employee who worked during the specified week, including their name, address, and social security number or individual taxpayer identification number. Make sure to respect employee privacy and handle this information securely.

- Document the classification of work performed by each employee. This should match the job titles or labor categories predefined in the project agreement or contract.

- Enter the hours worked by each employee for the week, broken down by type of work. Include regular hours, overtime hours, and any other applicable categories.

- Record the rate of pay for each type of work performed by the employee. If different rates apply for different types of work or overtime, specify these rates clearly.

- Specify any deductions made from each employee's wages, including taxes, insurance, and other permissible deductions, alongside the purpose of each deduction.

- Indicate the net wages paid to each employee for the week after all deductions have been applied. This ensures transparency in how wages are calculated and disbursed.

- Provide information on fringe benefits paid directly to employees or to a plan, fund, or program on behalf of employees. Detail the type of benefits and the amounts contributed.

- Review the completed form for accuracy and completeness. It is important to ensure that all information is correct to the best of your knowledge to avoid penalties or delays.

- Sign and date the certification section at the end of the form. This is a legal affirmation that the information provided is accurate and complies with the relevant labor laws and regulations.

- Submit the completed NJEDA Certified Payroll form as directed by the project documentation or contract. This may involve sending it to a specific department, agency, or individual within the NJEDA or via an online submission portal if available.

After the form has been submitted, it's processed by the NJEDA or its designated reviewer. This step includes verifying the accuracy of the information, ensuring compliance with wage regulations, and addressing any discrepancies. Prompt and accurate submission of the NJEDA Certified Payroll form supports fair labor practices and contributes to the smooth operation of development projects within New Jersey, benefiting workers, contractors, and the community at large.

Learn More on Njeda Certified Payroll

What is the NJEDA Certified Payroll Form?

The NJEDA Certified Payroll Form is a document designed for employers to report wages paid to employees on projects financed by the New Jersey Economic Development Authority (NJEDA). This form helps ensure compliance with state labor laws, particularly those related to minimum wage and prevailing wage rates. It's a crucial tool for transparency and accountability in projects supported by public funds.

Who needs to fill out the NJEDA Certified Payroll Form?

All contractors and subcontractors working on NJEDA-funded projects must accurately complete the NJEDA Certified Payroll Form. It's required for any project part of the NJEDA's financial assistance programs, aiming to maintain fair labor practices and standards across the board. This requirement safeguards workers' rights and promotes a level playing field for all contracting entities.

How often should the NJEDA Certified Payroll Form be submitted?

Submission frequency for the NJEDA Certified Payroll Form aligns with the regular payroll periods of the contractor or subcontractor. It's typically expected that the form is submitted weekly, ensuring timely and consistent reporting of wages, hours worked, and other pertinent employment details. Regular submissions help in monitoring compliance and addressing any discrepancies promptly.

What information is required on the NJEDA Certified Payroll Form?

The NJEDA Certified Payroll Form requests detailed information to verify compliance with wage regulations, including:

- The names and individual identifying information of all employees engaged in the project.

- The classification or nature of work performed by each employee.

- The number of hours worked each day, including the start and end times, by all employees.

- The rate of pay, including any fringe benefits, if applicable.

- Gross wages, deductions, and net wages paid for the reporting period.

This comprehensive data collection supports the enforcement of fair wage laws and helps in the oversight of state-funded projects.

Are there penalties for not complying with the NJEDA Certified Payroll requirements?

Yes, there are significant penalties for failing to comply with the NJEDA Certified Payroll requirements. Non-compliance can result in:

- Fines and penalties imposed on the employer, which can escalate for repeated offenses.

- Possible suspension or debarment from future NJEDA projects, affecting the contractor's eligibility for future work on state-funded projects.

- Legal action, including lawsuits for unpaid wages, if it's found that employees were not compensated according to the prevailing wage laws.

Adhering to the NJEDA Certified Payroll requirements is not only a matter of legal compliance but also an ethical commitment to fair labor practices.

Common mistakes

Not Double-Checking for Accuracy: One of the most frequent mistakes is simply entering incorrect information. Whether it's a misspelled name, wrong classification of work, or inaccurate hours worked, even small errors can cause big headaches. It's always a good idea to proofread the form before submitting.

Forgetting to Sign and Date: It might seem like a no-brainer, but in the haste to submit paperwork, many forget to sign and date the form. This oversight can invalidate the entire document, necessitating a do-over.

Omitting Worker Classification: Each worker must be classified according to the type of work they perform. Failing to list or incorrectly listing a worker's classification can lead to issues with compliance and payment rates.

Incorrectly Reporting Hours Worked: Misreporting the hours worked, whether by mistake or misunderstanding, can affect payroll accuracy. It's crucial to accurately report all regular and overtime hours worked.

Leaving Blank Fields: All required fields on the form must be filled in. Leaving a field blank can result in processing delays. If a section doesn’t apply, consider noting it as "N/A" or "None" to show it wasn’t simply overlooked.

Using Incorrect Pay Rates: Pay rates must align with the prevailing wage for the job classification in that specific area. Using outdated or inaccurate pay rates can lead to underpayment or overpayment issues.

Failure to Report Fringe Benefits: If applicable, fringe benefits must be reported on the form. Neglecting to include this information can misrepresent the total compensation of employees.

Not Updating the Form for Corrections: If errors are made, it’s important to correct them promptly. However, some forget to update the NJEDA Certified Payroll form with these corrections, leading to inconsistencies and potential compliance issues.

Let's drill down a bit deeper into how these errors can be mitigated:

Always review the completed form at least once for typos, inaccuracies, or omissions.

Ensure that all workers are correctly classified and all pay rates are up-to-date and accurate according to the latest wage determinations.

Both the preparer and the authorized signer need to check that all sections are duly signed and dated.

Do not leave blanks; instead, use "N/A" or "None" to indicate that you have reviewed the section and determined it does not apply.

By avoiding these common pitfalls, you can help ensure your NJEDA Certified Payroll submissions are accurate and complete, thereby streamlining your project's administrative workflow.

Documents used along the form

When managing payroll for projects, especially those requiring adherence to specific labor laws and regulations, the New Jersey Economic Development Authority (NJEDA) Certified Payroll form is a pivotal document. However, to provide a comprehensive overview of compliance and labor costs, a suite of supplementary forms and documents are often utilized alongside it. These additional forms enable employers to ensure accuracy, facilitate audits, and foster transparency in reporting. Below is a digest of key forms and documents that are commonly used in conjunction with the NJEDA Certified Payroll form to meet regulatory and administrative requirements effectively.

- Employee Information Form: Gathers personal and employment details from each worker, critical for payroll processing and compliance reporting.

- Statement of Compliance: An attestation by the employer ensuring that the wages paid to employees meet or exceed those required by law, often mandated alongside the certified payroll submission.

- Timesheets: Records the daily hours worked by each employee, providing the foundational data required for preparing the certified payroll.

- Project Contracts: Highlight specific labor standards and wage requirements for a project, informing the preparation of the certified payroll to ensure adherence to agreed-upon rates and conditions.

- Change Orders: Document any alterations to the original project scope, including adjustments in labor hours or costs, crucial for accurate payroll reporting and compliance.

- Work Classification Reports: Define the different roles or classifications involved in a project and the corresponding wage rates, essential for certifying that employees are paid according to their job classifications.

- Daily Work Reports: Detail the work performed each day, by whom, and for how long, supporting the timesheets and providing an audit trail for verifying labor charges.

- Prevailing Wage Determination: Issued by the Department of Labor, specifies the minimum wage rates for different types of labor and trades on public work projects, serving as a benchmark for certified payroll compliance.

- Subcontractor Compliance Forms: Collect compliance information from subcontractors, ensuring that all tiers of contractors on a project adhere to prevailing wage laws and project-specific labor standards.

These documents together form a comprehensive framework for labor compliance and reporting. They not only reinforce the integrity of the Certified Pay me the Roll process but also provide employers, project managers, and auditors with the tools necessary to maintain accountability and transparency. Utilizing these documents effectively can help in navigating the complexities of labor compliance, ensuring that all workers are paid fairly and in accordance with the law.

Similar forms

The NJEDA Certified Payroll form shares similarities with the Federal WH-347 Payroll Form, widely used by contractors and subcontractors working on federal construction contracts. Both documents require detailed employee payroll information, including hours worked, wage rates, deductions, and the net wages paid for each week of work on a project. This information helps ensure compliance with the Davis-Bacon Act, which mandates the payment of prevailing wages on public works projects.

Another document akin to the NJEDA Certified Payroll form is the State Prevailing Wage Report. Various states have their own versions that contractors must complete when working on state-funded construction projects. Like the NJEDA form, these reports collect data on the wages paid to workers, categorizing it by trade and job classification to monitor adherence to state-specific prevailing wage laws and regulations.

The Employee Wage Deduction Authorization Form is also comparable to the NJEDA Certified Payroll form. This form documents any deductions from an employee's wages, such as for uniforms, tools, or benefits, with the employee's consent. Although its primary focus is on deductions rather than comprehensive payroll reporting, it similarly ensures transparency and compliance with labor laws regarding permissible wage deductions.

Similarly, the IRS Form W-2, the Wage and Tax Statement, shares objectives with the NJEDA Certified Payroll form. The W-2 form provides an annual summary of wages paid and taxes withheld for each employee, serving as a key document for tax compliance. While the scope is broader and serves a different regulatory purpose, both forms play crucial roles in reporting accurate wage information and supporting legal compliance.

The Project Work Hours Report, often used by project managers, also parallels the NJEDA Certified Payroll form. This report tracks the total hours worked by employees on a project, which is essential for monitoring project costs and productivity. Though it may not include detailed wage data, its function in labor reporting and management intersects with the objectives of the NJEDA form.

Comparable to the NJEDA Certified Payroll form is the Employee Time Sheet. This document records the daily hours an employee works, which is foundational for preparing payroll. Like the NJEDA form, time sheets ensure that employees are paid for all the hours they work, providing a record to reconcile wages paid with hours worked, albeit in a more abbreviated format.

Lastly, the Union Reporting Form, required by some labor unions, resembles the NJEDA Certified Payroll form in its goal of tracking and reporting wages and hours worked by union members. These forms help ensure that contractors comply with collective bargaining agreements, much like the NJEDA form’s role in enforcing prevailing wage laws. Although serving different audiences—the union versus a government agency—their core function of safeguarding worker rights through detailed payroll reporting aligns them closely.

Dos and Don'ts

Filling out the NJEDA Certified Payroll form requires careful attention to detail and a thorough understanding of the requirements. Here are key dos and don'ts to keep in mind:

- Do ensure that you have all necessary information about your employees before you begin completing the form. This includes their full names, addresses, social security numbers, job classifications, hours worked, and rates of pay.

- Do double-check the accuracy of the information you input. Errors can lead to delays and potential penalties.

- Do use the most current version of the form. Regulatory requirements can change, and using an outdated form may mean your submission is rejected.

- Do list each employee's work classification clearly. Accurate classification is crucial for compliance with labor standards.

- Do ensure that all hours worked and rates of pay are reported accurately and in accordance with applicable laws. This includes paying and reporting the correct prevailing wage rates.

- Do not leave any fields blank. If a section does not apply, enter "N/A" or "none" to indicate this. Blank fields can raise red flags and delay processing.

- Do not estimate hours worked or rates of pay. Use actual figures to ensure compliance and prevent discrepancies.

- Do not forget to sign and date the form. Unsigned forms are considered incomplete and will not be processed.

- Do not ignore instructions or supporting document requirements. Submitting the form without the required supporting documents can result in rejection.

Misconceptions

The NJEDA Certified Payroll form plays a crucial role in ensuring that workers on certain projects are paid prevailing wages in compliance with state regulations. However, there are some common misunderstandings surrounding this form that merit clarification. By addressing these misconceptions, employers and employees alike can better understand their obligations and rights.

- Misconception 1: The NJEDA Certified Payroll form is only for construction projects. While it's commonly associated with construction, the requirement to submit a NJEDA Certified Payroll form extends beyond to any project funded by or associated with the New Jersey Economic Development Authority that requires the payment of prevailing wages. This includes renovations, maintenance work, and other types of projects.

- Misconception 2: Small businesses are exempt from submitting the NJEDA Certified Payroll form. The size of a business does not exempt it from the requirement to submit certified payroll records. Any contractor or subcontractor working on a relevant project, regardless of their business size, must comply with this mandate.

- Misconception 3: Only the direct contractor needs to submit the form. This is not accurate. Both direct contractors and all levels of subcontractors are required to submit NJEDA Certified Payroll forms if they are working on a pertinent project. Each entity involved in the project must report their payroll to ensure full compliance with prevailing wage laws.

- Misconception 4: If you pay more than the prevailing wage, you don't need to submit the form. Paying wages above the prevailing rate does not exempt an employer from the requirement to submit certified payroll. The purpose of the form is not only to verify that workers are paid at least the prevailing wage but also to maintain transparency and accountability in public works projects.

- Misconception 5: Digital submissions are not allowed for the NJEDA Certified Payroll form. This misbelief could significantly hinder efficiency. In reality, digital submission is not only permitted but also encouraged for its efficiency and ease of storage and retrieval. The NJEDA provides a platform for the electronic submission of these forms, streamlining the process for contractors and subcontractors.

- Misconception 6: Certified Payroll forms are only to be submitted when the project is completed. Rather than a single submission at the end, the NJEDA Certified Payroll form must be submitted on a regular basis throughout the duration of the project. This is usually weekly, ensuring continuous compliance and allowing for timely identification and correction of any discrepancies.

Addressing these misconceptions helps in fostering a transparent and compliant working environment for all parties involved in NJEDA-related projects. By understanding the correct processes and requirements, contractors and workers can ensure that legal standards are met, promoting fair labor practices across industries.

Key takeaways

When dealing with the NJEDA Certified Payroll form, ensuring accuracy and compliance is key to a smooth process. Here are some key takeaways that will help guide you through filling out and using this form effectively:

Understanding the Purpose: The NJEDA Certified Payroll form is designed to ensure workers on public projects are paid prevailing wages as per state labor laws. It's a tool for transparency and fairness in employment practices.

Accuracy is Essential: Every piece of information provided on the form must be accurate and truthful. Errors or omissions can lead to delays or legal consequences.

Personal Information: Start by filling out personal information accurately. This includes the worker’s full name, address, and Social Security Number or Taxpayer Identification Number.

Classification of Work: Clearly indicate the classification of work performed by each worker. This determines the prevailing wage rate applicable.

Work Hours and Wages: Report the hours worked and the wages paid to each worker accurately. Include overtime hours separately, as they are typically subject to different wage rates.

Benefit Contributions: If applicable, detail any contributions made to benefits on behalf of the worker, such as health insurance, pension, or vacation funds. These contributions are part of meeting the prevailing wage requirements.

Signatures Matter: The form must be signed and dated by an authorized representative of the contractor. This attests to the truthfulness and accuracy of the information provided.

Regular Submission: The NJEDA Certified Payroll form must be submitted on a regular basis, typically weekly, for the duration of the project. Timeliness ensures compliance and helps avoid penalties.

Record Keeping: Contractors are required to keep a copy of all certified payroll records for a specified period, often three years. These records must be available for inspection by authorized authorities.

Following these guidelines will help in successfully navigating through the complexities of compliance with New Jersey’s labor laws. Understanding the requirements and maintaining accurate records is crucial for any contractor working on public projects in New Jersey.

Popular PDF Documents

Nj Dmv Registration - An organized method for New Jersey employees to declare their pension fund choice and supply necessary personal and employment details.

How Long Does It Take to Get Dea License for Np - Requires information on any past surrendering, revocation, or denial of a controlled drug registration for thorough vetting.